With apologies to Kramer’s boss in Seinfeld. From Oren Cass’s “Trump’s Most Misunderstood Policy Proposal: Economists aren’t telling the whole truth about tariffs,” The Atlantic:

Their first mistake is to consider only the costs of tariffs, and not the benefits. Traditionally, an economist assessing a proposed market intervention begins by searching for a market failure, typically an “externality,” in need of correction. Pollution is the quintessential illustration. A factory owner will not consider the widespread harms of dumping pollutants in a river when deciding how much to spend on pollution controls. A policy that forces him to pay for polluting will correct this market failure—colloquially by “making it his problem.” It imposes a cost on the polluter in the pursuit of benefits for everyone else.

Tariffs address a different externality. The basic premise is that domestic production has value beyond what market prices reflect. A corporation deciding whether to close a factory in Ohio and relocate manufacturing to China, or a consumer deciding whether to stop buying a made-in-America brand in favor of cheaper imports, will probably not consider the broader importance of making things in America. To the individual actor, the logical choice is to do whatever saves the most money. But those individual decisions add up to collective economic, political, and societal harms. To the extent that tariffs combat those harms, they accordingly bring collective benefits.

I dunno. I’m not the trade specialist in my forthcoming textbook with Doug Irwin (Cambridge University Press), but I’m pretty sure I talked about to my intro to trade course about transfers, dead weight loss on production and consumption sides, and what the infant industry argument was. I think I also talked about learning-by-doing, and long run impacts. Checking back, why yes I did: see on tariff transfers to Treasury, DWL here, on infant industry etc., here. (In fact, the fact that Mr. Trump keeps on talking about all the tariff revenue the Treasury would get to replace lost revenue for getting rid of income taxes means that we cannot in general be ignoring the transfers from consumers to Treasury.)

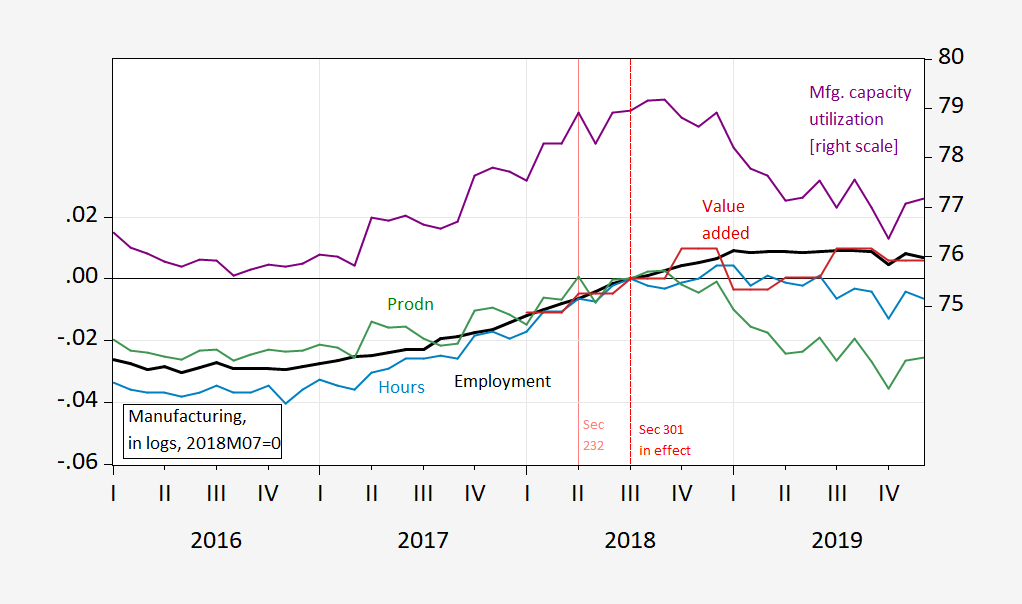

It all comes down to empirics, then, if we’re talking about effects. And here we know what happened to indicators of activity in the wake of the 2018-20 trade war, at least to manufacturing.

Figure 1: Manufacturing employment (bold black, left scale), hours (light blue, left scale), production (green, left scale), valued added (red, left scale), all in logs 2018M07=0; and capacity utilization (purple, right scale). Source: BLS, Federal Reserve, BEA via FRED, and author’s calculations.

See also this assessment of job losses, here.

So, if Mr. Cass wants to talk about welfare, I’d love to see his calculations of welfare loss to consumers, welfare gains to producers, and transfers to Treasury in short run and long run. He’d have to specify the value of the externalities associated with manufacturing, among other things. I suspect he has little idea of the quantities involved.

And this guy is running the think tank that’s going to provide the ideas for Trump 2.0?

Here is what this fellow is trying to say I guess:

https://americancompass.org/a-new-conservative-think-tank-challenges-market-fundamentalism/

A New Conservative Think Tank Challenges ‘Market Fundamentalism’

Huh – a rightwing version of Marxism?

“Tariffs address a different externality. The basic premise is that domestic production has value beyond what market prices reflect. A corporation deciding whether to close a factory in Ohio and relocate manufacturing to China, or a consumer deciding whether to stop buying a made-in-America brand in favor of cheaper imports, will probably not consider the broader importance of making things in America.”

Externality is not the right term here. Adjustment costs maybe. But this excuse for protectionism is as old as it gets and in general it is quite fallacious. Your list is the right way to think about these things but this MAGA nutcase cannot articulate basic economics as he indeed has no economic training at all.

Even if he did – consider the mess Trump gave us in 2018. Of course back then Trump relied on WILBUR Ross and the likes of Larry Kudlow and Stephen Moore aka a pack of Village Idiots. Based on his speeches of late – his economic team is even dumber.

“Which brings us back to washers and dryers. If we extend the data a bit further, through the end of 2019, the higher prices completely vanish. (They spike again in 2020, after the pandemic begins wreaking havoc upon global supply chains.) This could be because Samsung and LG brought U.S.-based factories online after the tariffs took effect, expanding domestic supply.”

Not that I do not trust Cass here (actually I think he’s lying about a lot of things but hey) but could someone who knows how to access the data he (ab)used in his tweet check his spin here?

The multinationals will look at “cost of production” + “cost of transportation from site of production to site of sale” and do whatever they can to minimize that combined cost. Their sale price is based on “how much can we get away with charging” – the total cost is just a price floor not a ceiling. The tariffs on end products becomes an addition to the cost of transportation for foreign production sites. Covid increased the shipping cost about 10 fold for a while. So both of those changed the price floor for foreign production. However, the tariffs on raw material (metals) increased the cost of production in the US. So total cost has increased, but there is always the option of keeping sales prices stable (temporarily) by cutting profits. It will take a long time to fully sort itself out – but my guess is higher prices in the end.

Since Cass was a little weak with his sourcing of data on that claim that washing machine price increases in 2018 completely reversed themselves, this is the best I could find:

https://www.in2013dollars.com/Laundry-equipment/price-inflation#:~:text=According%20to%20the%20U.S.%20Bureau%20of

Prices for Laundry Equipment, 1977-2024

Price Inflation for Laundry equipment since 1977: Consumer Price Index, U.S. Bureau of Labor Statistics is a useful graph.

What I see is a huge increase in 2018 and a small decrease the next year. Followed by a modest increase, a huge increase, etc.

Now if Cass thinks he has a point here – he either failed to be clear about the data or more likely flat out lied.

Thanks for that link. It does seem to fit with a trend of falling prices being reversed by a sharp jump in prices in 2018, after Trumps tariffs began. That also coincided with higher profits https://www.nytimes.com/2019/04/21/business/trump-tariffs-washing-machines.html – so the manufacturers took advantage of the reduced competition. A small fall in prices the year after was then followed by Covid price jumps. The tariffs expired in 2023 and prices fell again.

Good observations. The 2006 merger of Maytag and Whirlpool comes to mind. Some of us worried about the market concentration aspect but defenders of the merger said something about foreign competition. Which of course those stupid Trump tariffs took away – and as you noted firms jacked up profits reaping monopoly profits.

Thanks for the NYTimes piece written by Mark Perry who happens to be a conservative economics as opposed to this Cass Clown and Bruce Hall who I guess are conservative nitwits. Some excellent discussion including this:

Research to be released on Monday by the economists Aaron Flaaen, of the Fed, and Ali Hortacsu and Felix Tintelnot, of Chicago, estimates that consumers bore between 125% and 225% of the costs of the washing machine tariffs. The authors calculate that the tariffs brought in $82 million to the United States Treasury, while raising consumer prices by $1.5 billion. …The goal of all those moves [tariffs] was to push production….to America. The study authors credit Mr. Trump’s tariffs with 200 new jobs at Whirlpool’s plant in Clyde, Ohio, and a further 1,600 jobs for a Samsung factory in South Carolina and an LG factory in Tennessee. That’s 1,800 new jobs, at the cost—net of tariff revenues—of just under $1.5 billion for American consumers. Or, as the authors calculate, $817,000 per job.

Trump wants us to believe that China pays all of the tariff but it seems consumers are paying 100% of the tariff and a lot more.

What’s behind recent false claims about immigrants and crime in the US?

https://www.msn.com/en-us/news/world/what-s-behind-recent-false-claims-about-immigrants-and-crime-in-the-us/ar-AA1rqb8E?ocid=msedgdhp&pc=U531&cvid=ff88a15008ce4b6080524d3475764427&ei=7

An interesting discussion that includes the host of racist lies Trump is making and how the facts note how much Trump is lying.

He is trying to find excuses for a pretty poor economic policy that institute across the board heavy tariffs. Pathetic to see a former “small government” and “free trade” advocacy organization bend itself into weird contortions in order to support the fever dreams of Orange Jesus.

The idea of tariffs as a substitute for taxes on the rich is absurd. You can imagine what happens if all countries/trading zones add a huge 100% tariff on imports. That will close down almost all trade, except for a few raw materials that are not commonly available. Those “essential imports” would either be exempt or not produce that much money. The tariff import tax has no chance of producing enough money to run our government, no matter how you cut it. Either it’s too small to have a big effect on imports and budgets, or it’s big enough to substantially reduce imports, but then cuts off its own revenue stream.

The products no longer imported will instead be made domestically, and that will create new jobs. However, jobs are also lost because export industries will face the same high tariffs in foreign countries – and lose their export business. Whether a country has a net gain, or loss, of jobs, is hard to predict. However, a lot of people will have to change jobs as some factories close and others open. What is certain, is that prices will go up – and not just to fund that transition. The reason a product is made in a foreign country is that even with the added shipping cost, it’s cheaper than what is made domestically. The domestic product will be more expensive, because of higher production cost – and possibly also because of less (or no) competition. The cost of making products that require special (in demand) skills, will have an extra cost addition in the form of higher labor cost (salaries). That will be good for those with unique skills and bad for those having to pay for it. The extreme scenario is hyperinflation – if too many jobs are created relative to available workers.

In essence the import tax “kill trade” policies will take the making of a product from a place in the world where it is created the most cost/efficiently, to places where it is produced less cost/efficiently. There are specific cases of products where that can be justified, but as a general policy, it’s just stupid.

What Trump is really looking for is a mega grift. He want all trade to be dependent on him doing country to country negotiations at a product by product level. So washing machines imported from Sweden can avoid the tariffs, IF they can cut a deal with Trump. His willingness to do so will depend on how many nights the delegation spend at the Trump resort hotel, how many Trump watches they bought, and whether they have removed their tariffs on Ivanka’s fashion products.

Cass has written quite a few articles about economics and economic policy for “The Atlantic”, as well as for “The National Review”. (Uh huh…) His work history is split between Bain and Right-wing policy shops. It should probably be mentioned that he does not have a degree in economics. Nor does he have a law degree, though he attended law school.

So a non-economist with right-wing affiliations has mischaracterized the economic critique of tariffs. Quelle surprise. Non-economists of every stripe routinely “discover” that economists “don’t realize” all kinds of things that are either not true or included in standard economics texts. Right-wing chatterers routinely lie about the state of the world. Cass checks both boxes.

Sad thing is, “The Atlantic” published this common-as-dirt kind of mischaracterization. Things must be pretty bad over there.

Think I’ll have a look at some of this joker’s other articles for “The Atlantic” to see if they are similarly full of crap.

After a bike ride. Rain as stopped – must ride

“A corporation deciding whether to close a factory in Ohio and relocate manufacturing to China, or a consumer deciding whether to stop buying a made-in-America brand in favor of cheaper imports, will probably not consider the broader importance of making things in America. To the individual actor, the logical choice is to do whatever saves the most money. But those individual decisions add up to collective economic, political, and societal harms. To the extent that tariffs combat those harms, they accordingly bring collective benefits.”

Cass wants to talk about some town in Ohio? OK – let’s talk about Springfield, Ohio. International Harvester was a major employer until 2011 when this corporation abandoned the town. JD Vance is trying to claim the arrival of immigrants is what trashed the Springfield economy but that event predated their arrival by a decade. Springfield decided to rebound from the departure of their major employer and part of this recovery is due to the arrival of hard working immigrants. But no – Trump and Vance would forcibly deport the immigrant for the crime of being good black citizens.

So Mr. Cass – why don’t you write about the “collective economic, political, and societal harms” that will be caused by the Trump-Vance racism? Oh – that is also part of your Project 2025 agenda. Never mind.

“To the individual actor, the logical choice is to do whatever saves the most money. But those individual decisions add up to collective economic, political, and societal harms. To the extent that tariffs combat those harms, they accordingly bring collective benefits.”

The same arguments are made for mandating EVs, banning natural gas appliances, and spending billions of taxpayer dollars on a high-cost energy infrastructure.

Bruce Hall: Why, yes. Mr. Cass knows the definition of an externality. Now, he has to show that manufacturing has an externality. We know burning fossil fuels has an externality.

Man, you are dumb.

We know burning fossil fuels has an externality.

I sent you a book with the hope that you might read it and gain some new perspective, but….

Bruce Hall: Oh, you sent that book. Thank you for sending it. I’ve read Dr. Curry’s material before, just FYI.

Hey Brucie – do we need to buy you a book. As in a basic microeconomic textbook. You clearly have no clue what youo are babbling about.

…… And we thought Bruce had no heart.

That’s going to make good starter for a campfire. A cigarette lighter, smear the back and front cover with Vaseline and Menzie doesn’t have to rub twigs together, he’s all set for a 12 hour bonfire. Let’s just hope Curry doesn’t have some kind of wicca thing where when she deletes posts she feels embarrassed about Menzie’s campfire will be inexplicably extinguished.

Same arguments? Not that you ever understood the concept of externalities. No worries – neither does Cass.

Come on Brucie – please stop embarrassing your family with your incessant stupidity.

How much time do you have to spend looking in the mirror and telling yourself you really know as much as you think you know?

There is the argument that economic interdependence is the best course of action both economically and politically. This obviously begs the question: after 40-some years of economic interdependence with China, why has the political situation deteriorated? Why would the leftist Biden Administration seek to expand tariffs against Chinese products? And with that deterioration and possibly some future proxy conflicts, is there a long-term cost/danger (externality) to the US for dependence on China for many critical raw materials, finished goods, and medical precursors that is being ignored? Dealing with China is not like dealing with European nations.

My God – you have no idea what the topic is do you? Come Brucie – try learning some basic economics for a change. BTW using words like “economic interdependence” in this context may sound smart to your fellow two year olds like Steven Koptis and his “suppression” nonsense but has nothing to do with externalities. As our host originally note – you are incredibly dumb.

“Dealing with China is not like dealing with European nations.”

Like the EU has never subsidized production on certain key goods? Bruce – you are a know nothing moron and nothing more. Quit writing such gibberish as your mother is beyond being embarrassed.

pgl,

I like to think that you could benefit from some reading about economic interdependence.

https://www.cnbc.com/2020/09/29/5-charts-show-how-the-us-and-chinese-economies-depend-on-each-other.html

https://image.cnbcfm.com/api/v1/image/106716660-1600998709511-Value_added_source_US.png?v=1601358023&ffmt=webp&vtcrop=y

https://image.cnbcfm.com/api/v1/image/106716656-1600998704068-Value_added_source_China.png?v=1600998503&ffmt=webp&vtcrop=y

It’s not that large scale trading is inherently bad… it’s generally good between countries. But the negatives of depending on a nation that could well be your military adversary would certainly outweigh any dollar savings in toys and EVs. I know that concern doesn’t resonate with you, but apparently it does with Biden-Harris.

Bruce Hall: Speaking for myself, I *do* worry about national security related issues of international trade and investment. I attended CFIUS meetings when I served in the USG. I had some sympathy for Trump’s early decision to sanction Chinese firm ZTE — before he reversed course after Trump org got a nice $500mn loan. On the other hand, I didn’t think our supply of steel & aluminum was a paramount reason for imposing tariffs on steel *on our allies* (remember Section 232 tariffs are for national security concerns).

On the other hand, I think I could make a case that semiconductor chips might be a national security concern, while not believing every thing we import (remember 10% tariffs on *everything*) is critical to national security.

“I like to think that you could benefit from some reading about economic interdependence.”

Did Brucie flunked preK reading. We all get economic interdependence dumba$$. But it was YOU who tried to equate it with externalities. My point was your equating two very different concepts was stupid as it gets. And Brucie still does not get it. BECAUSE? Brucie is STUPID.

Hey Brucie – when you finally graduate from preK and actually read an economic text book, maybe we will let you sit at the grown up table. In the meantime, SHUT UP and stop wasting our time.

My God – Bruce Hall could not bother to READ the intro bullet points from his own link on economic interdependence. OK Brucie boy, here they are:

President Donald Trump has repeatedly raised the possibility of divorcing the U.S. and Chinese economies.

But various data suggest that such a process may be challenging as the two economies have grown more connected over the years.

The U.S. and China have been major trading partners for years, and they rely on each other’s supply chain for input into goods and services consumed within their borders.

You support Trump’s insane trade wars but your OWN link indicates how effing stupid Trump (and you as his defender) really are.

DAMN IT Bruce – READ your own stuff for once in your pathetic link life. You might learn something (but I doubt it).

Something of value from Bruce’s economic interdependence link – not that Bruce will ever understand a word of this. But for the adults here:

‘Latest available estimates by the OECD showed that in 2015, foreign input accounted for 12.2% — or around $2.2 trillion — of total goods and services consumed in the U.S. China was the largest contributing country of that foreign input, the data showed. Some manufacturers within the U.S. were especially reliant on China for intermediate input or final products, said Fitch, citing the OECD data. Those include American producers of textiles, electronics, basic metals and machinery, the agency said.’

China replaced Mexico as the king of both contract manufacturing and processed trade when it was allowed in the WTO a generation ago. Mexican toll manufacturers were called maquiladoras and benefited a lot from free trade until China basically took over this game.

There are two basic forms of this. In the electronic sector, we often see US based multinationals doing the designs and having a Chinese affiliate do the production. iPhones are a twist as Apple relies on an independent firm call Foxconn. But same business model.

The other form are apparel companies like GAP or shoe companies like NIKE who hire third party contract manufacturers but use tax haven procurement companies who pay transfer pricing games just as companies in the electronic sector have their own twists to transfer pricing abuse.

Now readers of Brad Setser’s blog have probably seen him write on the transfer pricing twists. Of course an effective IRS could shut down the transfer pricing games generating more profit taxes for the US Treasury. But Trump wants these multinational tax cheats to pay less in profit taxes and not more. After all – he wants to stick it to the little guy with tariffs.

Nuance isn’t Bruce Hall’s strength.

“spending billions of taxpayer dollars on a high-cost energy infrastructure.”

yes bruce. that is like the state of texas spending $10 billion dollars on NEW nat gas generators to serves as backups. first, the last failure occurred because those gas backups that already existed froze. second, you are now spending $10 billion dollars on energy infrastructure that is only utilized less than 1% of the time. it is extremely wasteful and inefficient. but that is exactly what folks like you and the texas republicans have defined as good governance. you guys have the decision making skills of a baboon. you are not interested in good decision making, only prolonging the current misery.

The former President who basically ignored Puerto Rico after Maria in 2017 is trying to make political points off of Helene:

Trump drags Hurricane Helene into 2024 campaign

https://www.msn.com/en-us/news/politics/trump-drags-hurricane-helene-into-2024-campaign/ar-AA1rqxtE?ocid=msedgdhp&pc=U531&cvid=4af91f1ced9445db9861692491e2b03a&ei=12

“Former President Donald Trump is making Hurricane Helene into a campaign issue, planning a stop in storm-ravaged, battleground Georgia on Monday and criticizing the Biden administration’s response with just weeks left until the November election. During a rally in Erie, Pennsylvania, on Sunday, Trump accused President Joe Biden of “sleeping” at his beach house in Delaware and dragged Vice President Kamala Harris for holding fundraising events in California over the weekend “when big parts of our country have been devastated by that massive hurricane.” At least 84 people have been killed from Hurricane Helene, according to The Associated Press. The storm made landfall in Florida late Thursday, then moved into the interior Southeast, across the Southern Appalachians and into the Tennessee Valley. It caused millions of power outages and billions of dollars in property damage, with two electoral swing states — Georgia and North Carolina — among the most affected.”

Never mind the fact that FEMA is already all over this. But back to the pathetic Orange Jesus:

‘The Trump campaign announced shortly after he left the stage at his rally that the former president planned to receive a briefing about Helene in Valdosta, Georgia, on Monday, and then distribute relief supplies and speak with reporters.’

I wonder if he will be tossing out paper towels again!

of course, he gets a good deal on those paper towels made in China. just dont tell anybody that

I’ve had a look at a couple of other articles by Mr. Cass at “The Atlantic”. Not stellar economic thinking, I have to say, but I suspect that’s not the point. Take “The Labor-Shortage Myth”, for instance:

https://www.theatlantic.com/ideas/archive/2023/06/labor-shortage-low-unemployment-inflation/674263/

As with the tariff article, Cass mistakes his own policy preference for some sort of higher good. His claim is that there cannot be a shortage of labor SO WE DON’T NEED AN OPEN ECONOMY. I have resorted to all caps here because that was also his preference in the tariff article. Cass doesn’t answer policy questions, he begs them.

Cass says firms ought to raise wages to meet their hiring needs, not agitate for more immigration. I’m all for higher wages, but once again, Cass skips the empirics. No thought to inflation, no thought to growth. No thought to distributional issues. He tells a little story which implicity insists that we should prefer one set of economic outcomes to another. He simply neglects to tell us that’s part of his story.

By the way, Cass pretends, just once, to take data seriously. He links to a FRED picture of inflation-adjusted hourly wages to assert that the gain over the last 50 years is just 1% and blames immigration. Take a look for yourself:

https://fred.stlouisfed.org/graph/?g=15H83

The picture shows a quarter century of decline, then a quarter century of rise. What does this have to do with immigration, you ask? Why did Cass pick end-points 50 years apart and ignore what happened in between? Good questions. If he had thought to look at changes in the labor force participation rate as women entered the job market in greater numbers (as an actual economist might), he might not jump to conclusions about immigration:

https://fred.stlouisfed.org/graph/?g=1ux3P

Here’s another: Why didn’t Cass look at total compensation instead of earnings? Real compensation is up more like 65% over the past 50 years:

https://fred.stlouisfed.org/series/RCPHBS

Enough of that mess. Let’s move on.

“How to Solve the Fixed-Costs Crisis”

https://www.theatlantic.com/ideas/archive/2020/03/create-taking-fund-compensate-businesses/608311/

Ummm…there was a crisis? I did a web search and the only reference I could find to “fixed cost crisis” was the article Cass wrote. Checked Wikipedia, too – no luck.

The point of the article was that closing businesses during Covid amounted to a “taking”. “Takings” are a right-wing shibboleth. A shibboleth isn’t the same thing as a crisis. No crisis here, just an opportunity to signal right-wing loyalty. Government did, in fact, provide lots of support to businesses during and after the Covid shutdown – just not the “Takings Fund” that Cass waved around.

Cass is looking like a more successful version of Antoni – successful in that Cass is published outside the echo chamber. That’s a shame, because the quality of his work is just as bad.

“The picture shows a quarter century of decline, then a quarter century of rise. What does this have to do with immigration, you ask? Why did Cass pick end-points 50 years apart and ignore what happened in between? Good questions.”

What I see in this graph is solid growth of real wages under Clinton and under Obama. Odd – I do not recall either one deporting millions of foreign born workers.

I also noticed how he cherry picked something from Glenn Hubbard which I bet misrepresented what Glenn was saying. Look – I’m no Hubbard fan but this Cass Clown does this a lot. Take a snippet from some longer discussion from other economists and then pretends that economist is either stupid or uncaring. That is the true mark of a troll.

“How to Solve the Fixed-Costs Crisis”

Gee this mental midget figures out that profits tend to fall when a business has an unexpected decline in sales. Stop the presses. No one ever said that before – well before 500 BC!

Cass’s writings serve one purpose – he makes Bruce Hall look smart by comparison!

I guess it’s politically contagious.

Trump implemented sweeping tariffs on about $300 billion of Chinese-made products when he was in office. President Joe Biden has kept those tariffs in place and, after the USTR finished a multiyear review earlier this year, decided to increase some of the rates on about $15 billion of Chinese imports.

https://www.cnn.com/2024/09/13/politics/china-tariffs-biden-trump/index.html

Maybe you are too stupid to notice two key things noted in your own link.

(1) Much of the sensible things your own link said directly contradict the blatant lies from your boy Trump. What’s the matter Brucie – did you once again not read your own link?

(2) Harris seems to be taking a more free market approach than even Biden. Now you may pretend you are for free trade but not once have you ever criticized Trump stupid trade war. How come little Brucie boy? Oh wait – that might suggest Harris is smarter on these things than your boy Trump. Or your boy Vance.

But please keep these stories that you have not read coming. It’s your only forte.

Well, I’m interested to know how you came to those conclusions from the article, especially about Harris’ economic expertise. Trump never lied about his intention regarding tariffs and was roundly panned by the Democrats who then kept his tariffs and then raised some. Whence Harris’ expertise and “free market” approach?

Here’s another link on that subject. It appears with regard to tariffs on Chinese goods that Biden and Harris are “always-Trumpers”.

https://time.com/7020042/trump-harris-china-explainer-trade-tariffs-taiwan-war-human-rights/

“I am not a protectionist Democrat,” Harris declared during a 2020 Democratic presidential primary debate. At the same time, she added: “We have to hold China accountable.” In the years since, the latter part has seemed to take precedence, as the current Administration has embraced protectionism—maintaining Trump’s tariffs on China and even adding to them.

While Trump’s allies, such as those behind the controversial Project 2025 conservative agenda, have proudly claimed “decoupling” from China as their goal, the Biden-Harris Administration has said that it prefers to pursue “de-risking.” But, according to South China Morning Post columnist Alex Lo, the new term, much like Harris’ broader approach to China, “just sounds less belligerent; the underlying hostility remains.”

“Trump never lied about his intention regarding tariffs”

Really Brucie? Trump says so many contradictions so I guess “lie” is too mild of a term for his incessant BS. Look dumba$$ – Trump lies 24/7 but you are so stupid you have no clue.

Oh gee – another worthless Bruce Hall link that Brucie didn’t read. OK – I will.

So many things here that directly contradict your boy Trump. I’ll offer just one:

“Trump doesn’t get the basics. He thinks his tariffs are paid for by China. Any beginning econ student at Iowa or Iowa State could tell you the American people are paying his tariffs,” then-candidate Joe Biden said in 2019.

Hey – Biden is right about this. Your moronic idol is not. But “decoupling”. And we thought Brucie believes in “economic independence”. As I figured – you have no clue what ANY of this means. DAMN!

Come on Brucie – Dr. Chinn has asked you to read a basic economic text. You haven’t. All I ask is that you read your OWN stupid links. I guess we are asking too much for a boy dumber than a retarded dog.

Checking with FRED it seems that the nominal value of US imports in 2024QII was the same as it was in 2022QII. But customs duties have fallen from around $108 billion per year to around $78 billion per year.

I say this for one simple reason. We have this MAGA moron little twit running around here claiming Biden has raised tariffs relative to the tariff rates under Trump’s stupid trade war. Now this little twit can’t back up his claims – heck his mommy still has to tie his shoe laces for him.

But it does seem we are collecting less in tariff revenues from the same volume of imports so the average tariff rate seems to have fallen.

It’s a laugh riot when MAGA morons discuss economics. We start off with some Trumpian nobody who wants to claim economists never discuss adjustment costs when it comes to trade issues even though this has been a hot issue for generations. And then this moron decides to equate externalities with adjustment costs, which I noted was just wrong.

But Bruce Hall decides to come to his rescue first with a claim that the use of fossil fuels does not involve negative externalities – a proposition so utterly absurd that even the most conservative economists reject it. OK – so little Brucie boy switches gears by saying he is concerned with “economic interdependence”, which even a two year old knows has nothing to do with the discussion.

This has become so dumb even little JD Vance won’t touch it!