The CEPR-EABCN is one arbiter of business cycle chronologies in the Euro Area. The latest announcement is from April 17, 2024. What do more recent indicators suggest (a partial survey)?

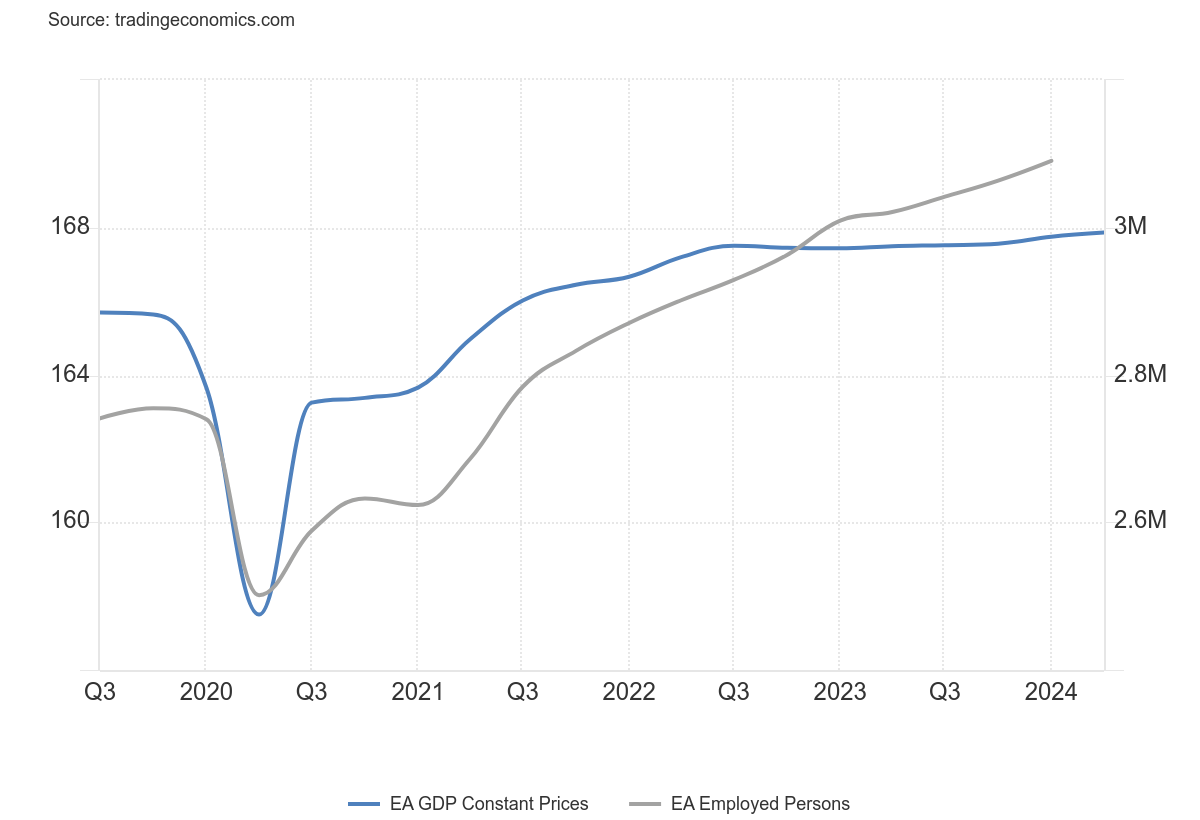

GDP and employment:

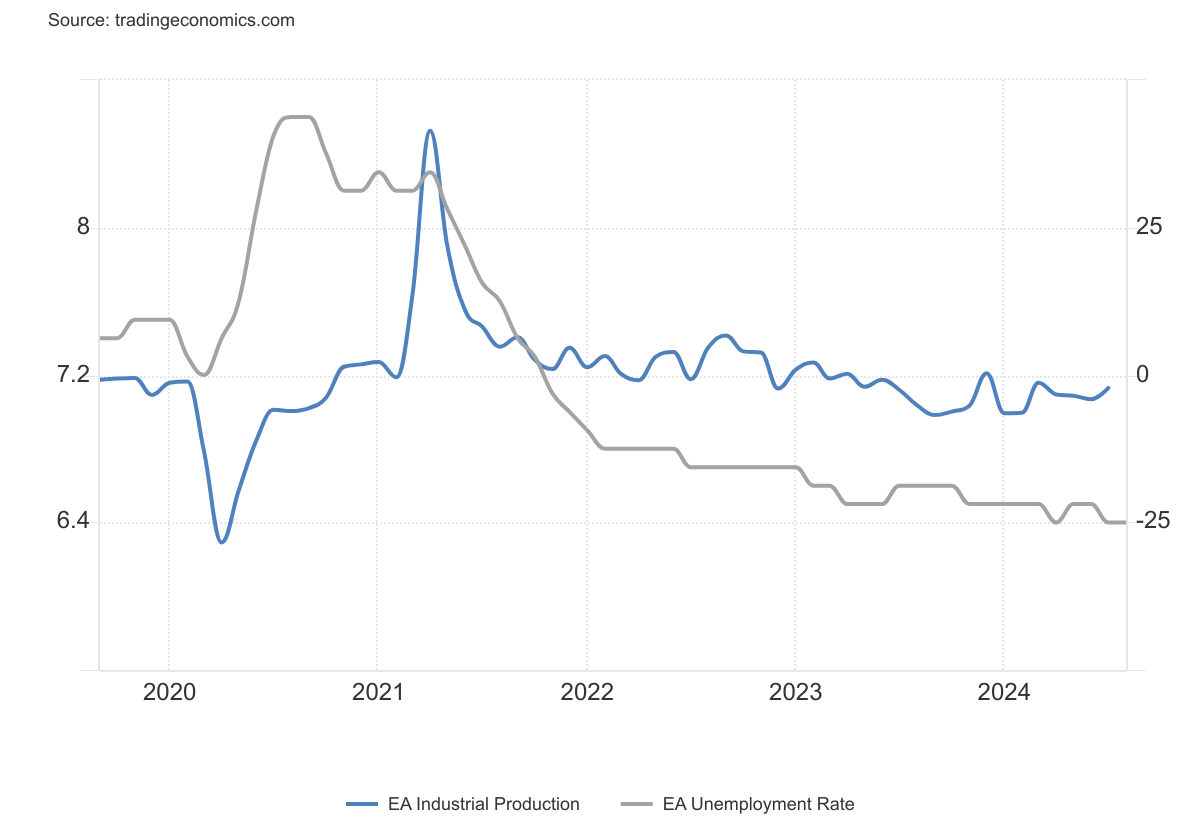

Industrial production and the unemployment rate:

With employment growing through Q1 and unemployment declining from 2023 onward, it’s hard to declare a recession in place — even taking into account the fact all these data will be revised over time.

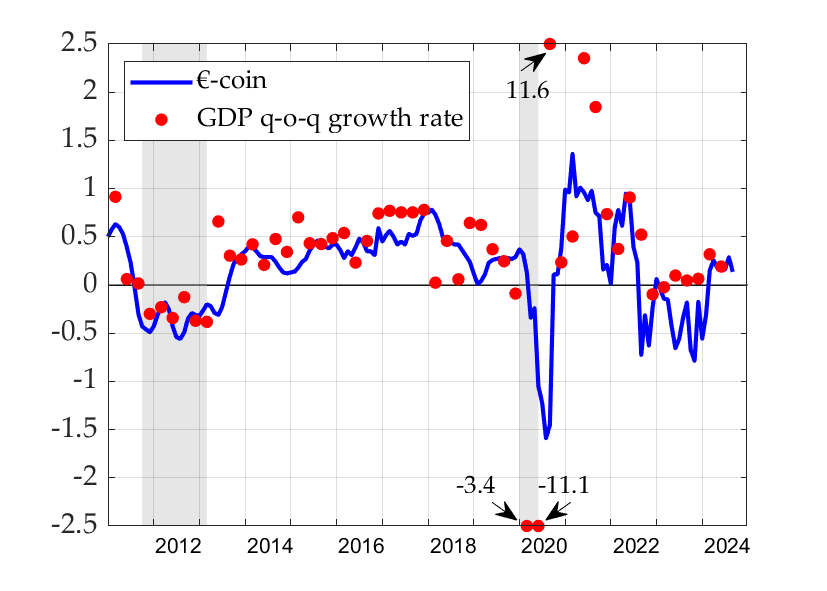

Nowcasts indicate near zero growth in Q3. First the Banca d’Italia/CEPR eurocoin is slightly positive as of September release (October 4), at 0.14% q/q (0.6% q/q AR).

Source: BdI.

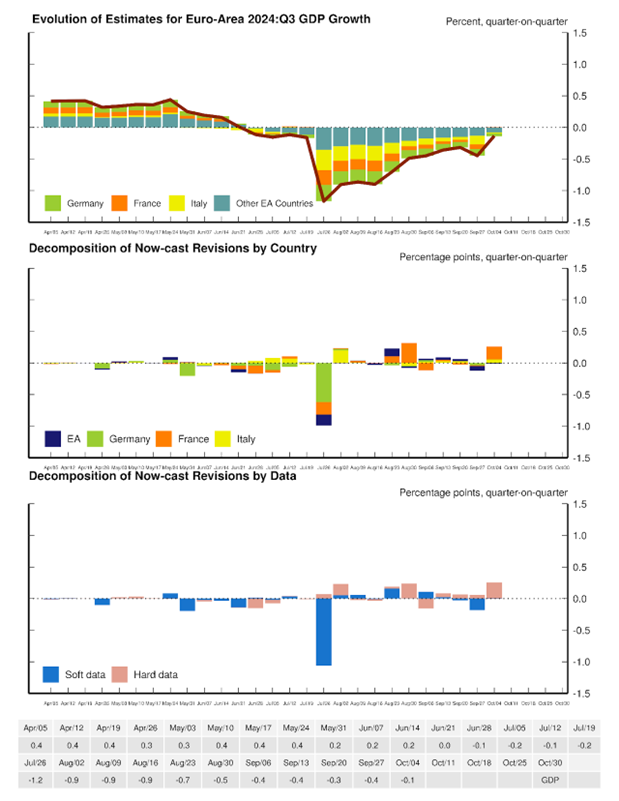

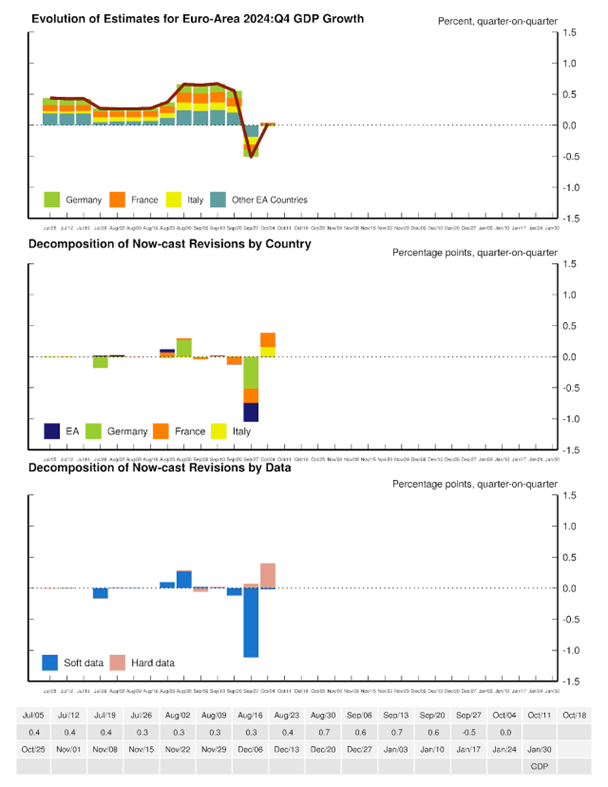

Nowcasts from several researchers originally/currently at the Federal Reserve Board (Cascaldi-Garcia et al., 2023)) show near zero growth in Q3 and Q4 (as of 4 October).

Source: Cascaldi-Garcia et al. (2023), accessed 10/7/2024.

Source: Cascaldi-Garcia et al. (2023), accessed 10/7/2024.

This nowcast indicates -0.4% and 0% q/q AR in Q3 and Q4 respectively.

Visualization of several euro area macro indicators here.

So while the U.S. is very likely experiencing reasonably good labor productivity growth, it looks like Europe is suffering declining productivity. “Looks like” because we see employment and unemployment in these figures, but not hours, and I’m too lazy to find the hours data.

Declining productivity, in itself, is kinda symptomatic of recession. Look for a sharp rise in productivity early in the expansion.