GDP under Bloomberg consensus of 3.0% at 2.8% (GDPNow nails it); see Jim’s post yesterday. ADP private NFP change at 233K vs. Bloomberg consensus at 110K. Nominal personal income at consensus, consumption at 0.5% m/m vs. 0.4% consensus.

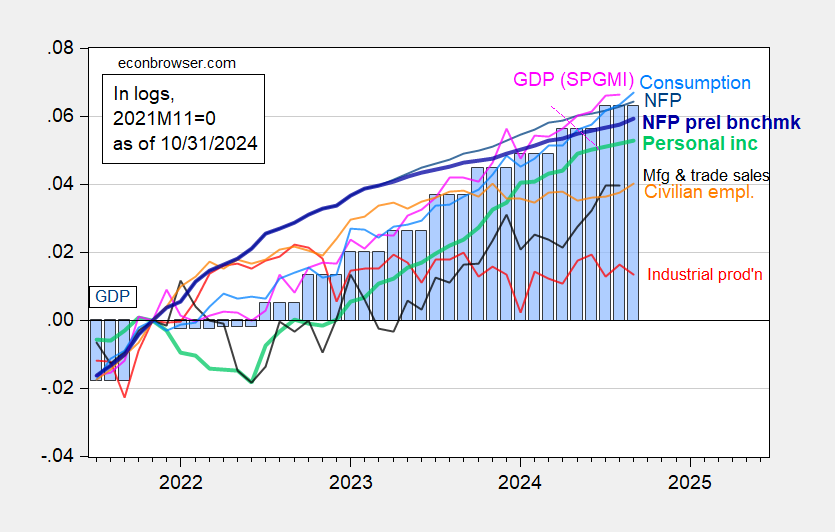

Figure 1: Nonfarm Payroll (NFP) employment from CES (blue), implied NFP from preliminary benchmark (bold blue), civilian employment (orange), industrial production (red), personal income excluding current transfers in Ch.2017$ (bold light green), manufacturing and trade sales in Ch.2017$ (black), consumption in Ch.2017$ (light blue), and monthly GDP in Ch.2017$ (pink), GDP (blue bars), all log normalized to 2021M11=0. Source: BLS via FRED, Federal Reserve, BEA 2024Q3 1st release, S&P Global Market Insights (nee Macroeconomic Advisers, IHS Markit) (10/1/2024 release), and author’s calculations.

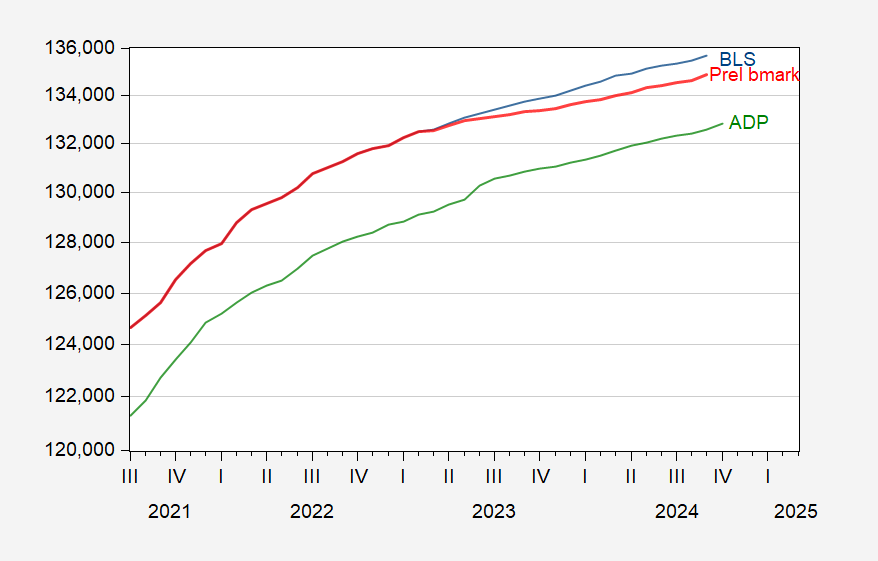

Yesterday, ADP released numbers on private nonfarm payroll employment.

Figure 2: Private nonfarm payroll employment from BLS (blue), implied preliminary benchmark revision of private NFP from BLS (red), and ADP-Stanford Digital Economy Lab private nonfarm payroll employment (green), all in 000’s. Source: BLS, ADP via FRED, and author’s calculations.

Recall, the ADP numbers are not based on a survey (so no issues about the firm birth-death model output, etc.).

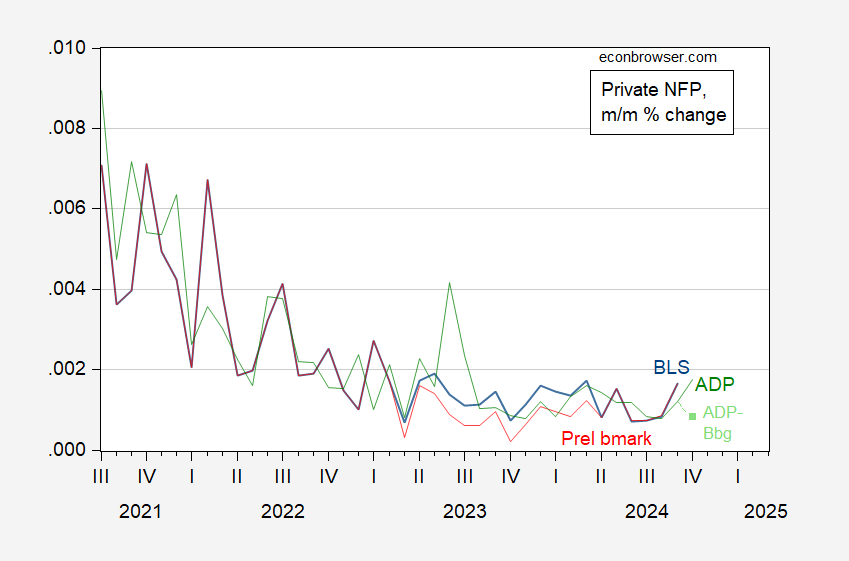

Figure 3: Month-on-Month growth rate of Private nonfarm payroll employment from BLS (blue), implied preliminary benchmark revision of private NFP from BLS (red), and ADP-Stanford Digital Economy Lab private nonfarm payroll employment (green), and Bloomberg consensus (light green square), all calculated using log differences. Source: BLS, ADP via FRED, Bloomberg, and author’s calculations.

Contra EJ Antoni, Kevin Hassett, Larry Kudlow, Peter Thiel, and Wilbur Ross these don’t look like recession numbers to me. However, we get October employment numbers tomorrow, as well as monthly GDP.

Y’all have probably already heard about fire being set to ballot boxes in Democratic precincts in Washington and Oregon earlier this week. Now, there are reports of machete-weilding teens intimidating voters in a Democratic precinct in Florida:

https://www.nbcnews.com/politics/2024-election/machete-wielding-teen-arrested-group-accused-intimidating-democrat-sup-rcna177981

And of a California landlord stealing ballots and using them to vote for Trump:

https://www.latintimes.com/california-landlord-fired-after-bragging-about-stealing-tenants-ballots-using-them-vote-trump-563709

And a one-time Republican candidate stealing ballots in Michigan::

https://www.indystar.com/story/news/crime/2024/10/29/former-5th-district-candidate-arrested-on-allegations-of-ballot-theft-larry-savage-jr-madison-county/75918036007/

Gotta watch out for those illegal immigrants trying to steal the election so they can eat more pets.

re: GDP under Bloomberg consensus of 3.0% at 2.8%

the first revision puts it a bit above that consensus…as per this morning’s, report, construction spending for all three months of the 3rd quarter was much higher than was indicated in the GDP report issued two days earlier…September’s spending was at a $2,148.8 billion annual rate, a modest 0.1% above the revised annualized August estimate of $2,146.0 billion….but the annualized August construction spending estimate was revised nearly 0.7% higher, from $2,131.9 billion to $2,146.0 billion, and the annual rate of construction spending for July was revised more than 0.4% higher, from $2,133.9 billion to $2,143.14 billion…

The BEA’s key source data and assumptions (xls) that accompanied the 3rd quarter GDP report indicates that they had estimated that September’s residential construction would increase by an annualized $1.7 billion from the previously published August figures, that nonresidential construction would decrease by an annualized $1.8 billion from last month’s report, and that September’s public construction would decrease by an annualized $0.7 billion from last month’s report….hence, the total of the figures used by the BEA for total September construction in the 3rd quarter GDP report were a net $0.8 billion lower than the previously published August figure…since this morning’s report indicates that September construction spending was up by $2.8 billion from an August figure that was revised $14.1 billion higher, that means that the net September construction figures used in the GDP report were a total of $17.7 billion too low…averaging that underestimation with the $14.1 billion upward revision to August construction spending and the $9.2 billion upward revision to July’s construction spending means the aggregate annualized nominal construction figures used in the 3rd quarter GDP report were roughly $13.7 billion too low, suggesting there will be an upward revision of about 0.24 percentage points to 3rd quarter GDP to account for what the construction spending report shows…(note: that could be off by a bit if there’s a large shift in the inflation adjustments among the revised constriction figures)