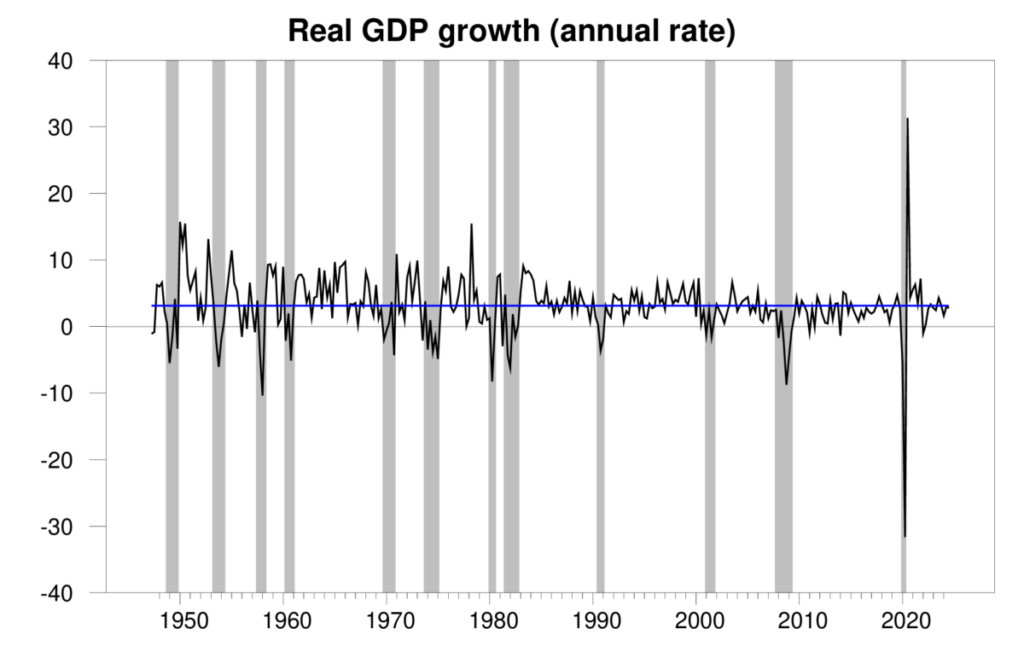

The Bureau of Economic Analysis announced today that seasonally adjusted U.S. real GDP grew at a 2.8% annual rate in the third quarter. That’s close to the long-run historical average of 3.1%. With inflation coming down, I think we now can declare that the Fed has achieved the admirable but difficult objective of a “soft landing” — bringing inflation down without tipping the U.S. into recession.

Quarterly real GDP growth at an annual rate, 1947:Q2-2024:Q3, with the historical average (3.1%) in blue. Calculated as 400 times the difference in the natural log of real GDP from the previous quarter.

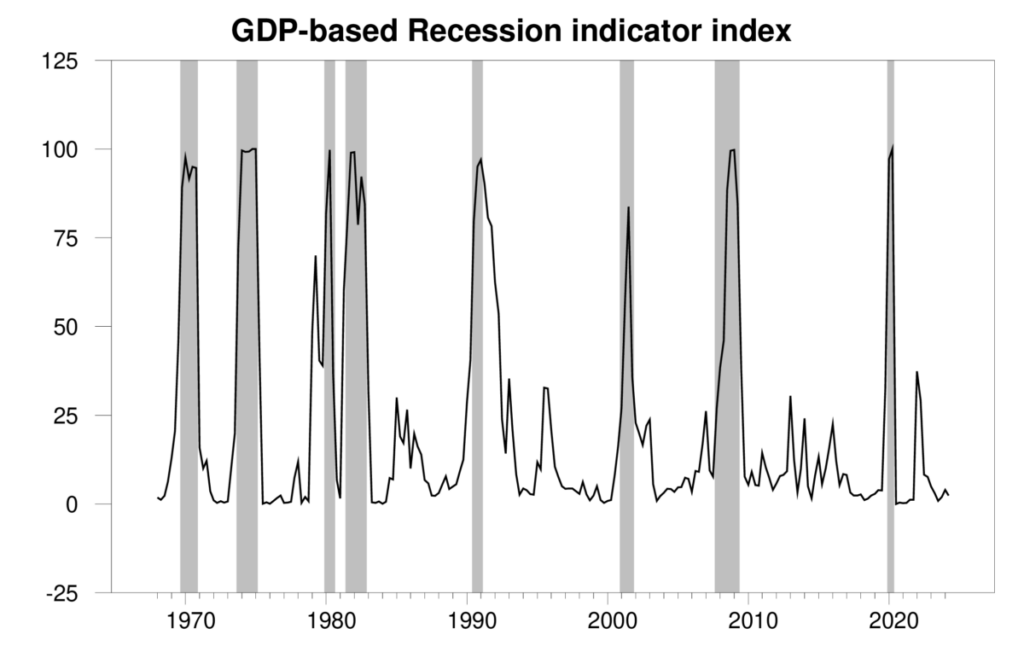

The new numbers put the Econbrowser recession indicator index at 2.4%. That’s quite a low number, and signals an unambiguous continuation of the economic expansion that began in 2020:Q3.

GDP-based recession indicator index. The plotted value for each date is based solely on the GDP numbers that were publicly available as of one quarter after the indicated date, with 2024:Q2 the last date shown on the graph. Shaded regions represent the NBER’s dates for recessions, which dates were not used in any way in constructing the index.

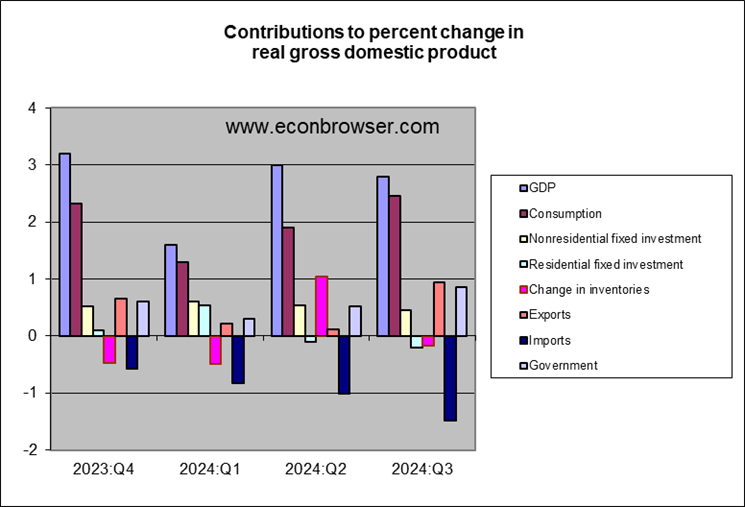

GDP growth was led by strong spending by consumers, who seem to be regaining confidence as employment growth continues strong. Third-quarter GDP was also boosted by a big increase in government spending associated with military assistance to Israel and Ukraine. A surge in imports, which are subtracted from GDP, held GDP growth back. Slower new home construction also subtracted from GDP growth, but not to the degree that we’d see if the Fed had engineered a big housing crunch.

Markets also breathed a sigh of relief this week that the military conflict in the Middle East does not look (for now) as if it’s going to lead to a big disruption in oil production or shipping. All this is enough to bring a smile back to the face of our Little Econ Watcher.

For now.

Soft landing, job well done. Do you think we achieve the soft landing without the 0.5% rate cut? or with a 0.25% rate cut? or do you believe we get a soft landing with the fed holding steady? how important, or unimportant, was that last action by the fed?

I don’t know who’s going to win the election. And whoever wins, I’m not sure which of their proposals they could get Congress (and the courts) to approve. So I’m not factoring in any assumption about policy in 2025. Just calling it like I see the situation on the ground right now.

Mortgage rates are back where they were before the September Fed rate cut, so I don’t think you can claim that made a huge difference. A key question is whether inflation remains stable. Again, looks OK to me for now, but we’ll see what comes next.

fair point about mortgage rates returning to previous levels. in this case, the fed tried to error on the side of monetary easing. if it works, it gives ammo to those who argue against austerity approaches to the economy.

in the big picture, if you don’t want to crash the economy, then don’t keep monetary policy tight. i think the fed is willing to live with more inflation if it must.

I will add, unemployment rate is up about 0.5% from its recent low. even with the rate at historically low values, such a move probably reinforces that the rate cuts were appropriate at this time.

at any rate, hopeful the country sustains a soft landing. not sure why anybody would be hoping for a different outcome.

Biggest surprise to me about this was consumer spending holding up. I really thought things would slow down towards the end of the year. Going to be interesting to see how Christmas sales go, but this certainly implies nothing too bad.

The plane is on the runway but the Fed is still at full throttle and in danger of running off the end and crashing.

They need to cut rates quickly. You can’t say they’ve landed when they are way above the neutral rate.

so you are in the camp of a cut was needed. and from what I infer, it was the 0.5% cut. what are your thoughts on how the economy would have proceeded if it had been a 0.25% cut? and what will your predicted outcome be if the next meetings provides a 0.5% cut, 0.25% cut or not cut at all? I think we get 0.25% cut, and continue on soft landing course. however, I would personally prefer another 0.5% cut to refinance a mortgage.

Powell has repeatedly said: “Monetary policy affects economic activity with long and variable lags.”

Today 2.1% PCE is at effectively at their official target. Assuming that Powell is correct about the lag (opinions are 6 to 12 months), the Fed is already behind the curve.