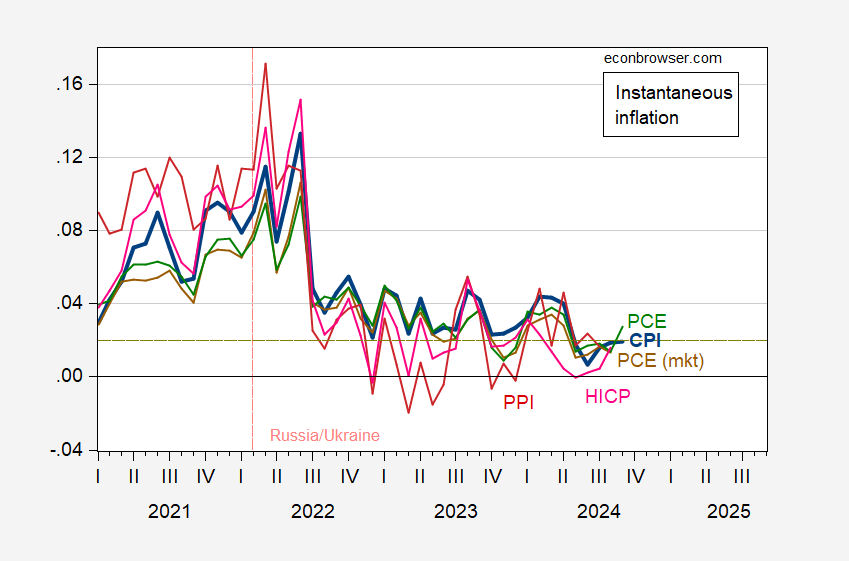

CPI m/m at 0.2% vs. 0.1% consensus [correction 7:15pm CT MDC] (Core 0.3% vs. 0.2% consensus). Here are snapshots of instantaneous inflation rates for September headline, core, supercore, and services supercore CPI, headline and core PPI and HICP and headline and core PCE deflator for August.

Figure 1: Instantaneous inflation for CPI (bold blue), PCE deflator (green), PCE deflator – market based pries (brown), HICP (scarlet), PPI (red), per Eeckhout (2023), T=12, a=4. September observation based on PCE nowcasts from Cleveland Fed as of 10/10/2024. Horizontal chartreuse dashed line at 2% PCE inflation target (for CPI should be about 2.5%). Source: BLS, BEA, Eurostat via FRED, Cleveland Fed, and author’s calculations.

Note that the September observation for the PCE deflator is based on the September nowcast from the Cleveland Fed, as of today, and taking into account the CPI release.

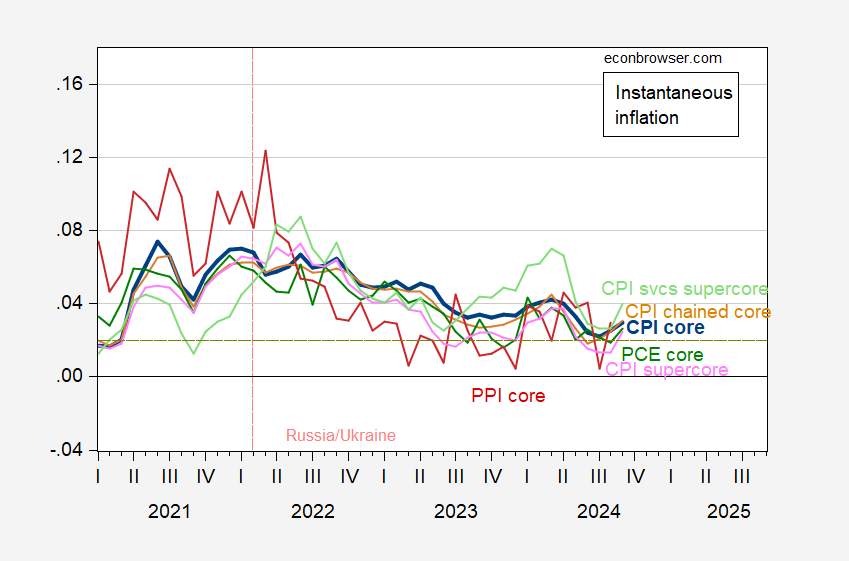

I plot below core measures, using the same vertical scale to retain comparability.

Figure 2: Instantaneous inflation for core CPI (blue), chained core CPI (tan), supercore CPI (pink), services supercore (light green), PPI core (red), and PCE core (green), per Eeckhout (2023), T=12, a=4. September observation based on PCE core nowcasts from Cleveland Fed as of 10/10/2024. Horizontal chartreuse dashed line at 2% PCE inflation target (for CPI should be about 2.5%). Source: BLS, BEA, Pawel Skrzypczynski, Cleveland Fed, and author’s calculations.

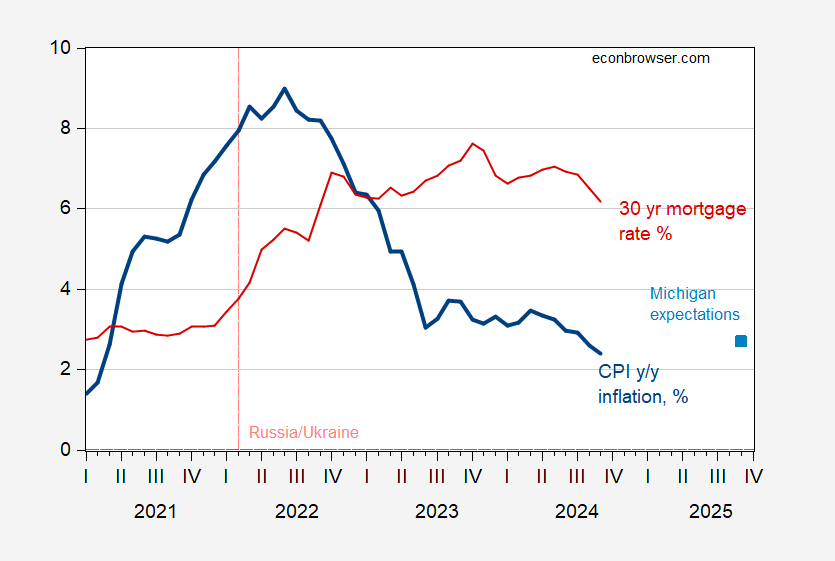

Note that the CPI is usually thought of as a cost of living index. Recently, Bolhuis et al. (2024) have argued that interest rates and house prices enter into people’s perceptions of the cost-of-living better than the owner equivalent measure used since 1983. Note that both CPI headline (year-on-year) inflation and mortgage rates have been declining in recent months.

Figure 3: CPI headline inflation (y/y) (blue), expected inflation rate for September 2025 from Michigan survey (light blue square), 30 year mortgage rate (red), all in %. Source: BLS, Freddie Mac, University of Michigan via FRED.

See more on the CPI release by Jan Groen here.

It is these days standard practice to report whether economic data turn out lower, higher or as forecasters expect, right alongside the numbers themselves. The spin is typically that a datum is good or bad because it is better or worse than forecasters expected.

Having made tens of thousands of forecasts for clients, I just want to say, short-term forecasts have nothing to do with human welfare. Forecasts matters to financial market participants because financial markets price in expectations and react to actual data in relation to that expectation.

Unless you are part of that business, the actual number is all that matters. Maybe even the actual number doesn’t matter.

The trend in inflation remains lower. Monetary policy remains contractionary. The Social Security COLA is set for the next 12 months.

I’m not saying we shouldn’t look at forecasts and forecasting errors, but the habit of featuring the forecasting miss in the headline and first sentence of news reports misses the point, and the (limited) purpose, of short-term forecasting. The fact of a forecast differing from reality is not that the data point is good or bad, but that the forecast was wrong.

Off topic – Trump foreign policy advisor calls for napalming UN peace keepers:

https://www.thejournal.ie/al-aquidi-drops-advisor-over-tweet-to-drop-napalm-over-irish-peacekeepers-6511393-Oct2024/

I never cared much for those other peace keepers, anyhow.

“Matthew RJ Brodsky had previously advised Trump administration’s Middle East peace team and the White House’s Palestinian-Israeli peace team. On Sunday, he posted to X, saying: “Israel should carpet bomb the Irish area and drop napalm over it”.

Hey I’m Irish. Oh well – I always thought wanted me dead.

https://www.matthewrjbrodsky.com/about/

Your boy Matthew RJ Brodsky proudly notes he is a Heritage guy. BTW – that Twitter account is now suspended.

Just to be clear, Brodsky’s position is that UN peace keepers in Lebanon who refused to follow orders given by Israel, should be burned to death. UN peace keepers largely perform their peace-keeping function by holding ground between belligerent forces so that belligerents can’t kill each other. That’s what Irish UNIFIL soldiers are doing. On Lebanese sovereign territory, not Israeli territory. Brodsky wants to burn Irish soldiers to death for doing exactly what they are intended to do, for refusing to come with Israel’s orders in a place where Israel has no sovereign right to give such orders.

Brodsky is one of “the best people” Trump hires to help him make decisions.

“Recently, Bolhuis et al. (2024) have argued that interest rates enter into people’s perceptions of the cost-of-living better than the owner equivalent measure used since 1983.”

So they propose a new CPI index that incorporates interest rates. Great! Whenever inflation is too high, the Fed just needs to lower rates to zero and poof, the measured inflation in the new index goes down. Likewise if the economy is depressed and there is deflation, they just have to raise interest rates and poof, the measured inflation in the new index goes up.

Oh, well. There’s a dangerous positive feedback tendency in measuring inflation this way.

It’s time to raise taxes, not cut them

https://jabberwocking.com/its-time-to-raise-taxes-not-cut-them/

“So forget all the tax breaks. What we need to do is return to the tax rates we had in the late 1990s—which was a pretty prosperous time, as I recall.”

Kevin Drum plots what tax revenues would have been over the 2000 to 2024 had we not had all those Republican driven tax cuts. An $850 billion in revenues for 2024 alone. Anyone remotely concerned about the deficit would be endorsing Drum’s idea. But we know the Trumpian trolls here will not.

Trump Delivers Historically Illiterate Lecture on Tariffs

https://www.msn.com/en-us/news/opinion/trump-delivers-historically-illiterate-lecture-on-tariffs/ar-AA1s3bj5?ocid=msedgdhp&pc=U531&cvid=33f90aa1256842068259c4d3bf03c736&ei=4

“In a speech to the Detroit Economic Club, Trump made a remarkable, error-strewn diatribe in favor of tariffs:”

Got that – before the Detroit Economic Club! But don’t worry – he insulted the city of Detroit as well!

https://digital.library.unt.edu/ark:/67531/metadc815472/m1/5/

U.S. Federal Government Revenues: 1790 to the Present Page: 5 of 18

Trump told the Detroit Economic Club that tariffs in 1890 raised an enormous amount of Federal revenues. I guess this moron does not know we also had excise taxes as well as tariffs back in 1890. And combined Federal revenues were only 3% of GDP. So I wonder how the heck Trump is going to pay for the Defense Department (3% of GDP) as well as other functions of government with an excise tax that is raising only 2% of GDP.

BTW – this moron also told us tariffs were not raised until 1932. No Donald – it was 1930. But I guess this is what Donald gets when he relies on people like Antoni and Kudlow for economic advice!

This story is over 2 months old, but I just caught it today, thought it was interesting and worth a share:

https://www.reuters.com/business/energy/drillers-emit-far-more-methane-than-us-estimates-aerial-survey-shows-2024-07-31/

Whenever the MethaneSAT numbers come out I will be very interested in reading them.

Good catch. A few related issues come to mind:

The Supreme Court has just declined to hear a challenge to Biden admin rules regulating methane release.

Climate change has occurred faster than had been anticipated by models. Maybe the models were OK, but the inputs were wrong. More methane means more warming.

Oil and coal extraction release methane. Fracking releases GOBS of methane. The U.S. fracks like almost no other country. We need to do something about fracking staring yesterday.

Trump’s ‘God Bless the USA’ Bible Was Made in China

The former president promises to bring back manufacturing from China while profiting off their goods

https://www.rollingstone.com/politics/politics-news/trump-god-bless-usa-bible-made-in-china-1235129694/

So would Trump put a huge tariff on his own bible?

Primerica Releases Inaugural Household Budget Index™ (HBI™) to Illustrate Purchasing Power of Middle-Income Families

New monthly index shows middle-income families are seeing increased spending power, yet still recovering from previous 18-months of high inflation

https://www.businesswire.com/news/home/20230822868176/en/Primerica-Releases-Inaugural-Household-Budget-Index%E2%84%A2-HBI%E2%84%A2-to-Illustrate-Purchasing-Power-of-Middle-Income-Families/

Has anyone else heard of this index? EJ Antoni must be desperate to find something that tells us real income is falling so he dug this up. Oh wait – it says the opposite of what EJ wants it to say. But I bet his MAGA fan base does not notice!

Here’s Primarica’s page on the new index:

https://www.primerica.com/public/household-budget-index.html

The idea is to narrow the basket of goods and services to necessary monthly expenses, rather than all expenses. No cars. No vacations. No movies. Food, fuel, health insurance and the like are included.

The page includes links to related articles, including one about people’s perceptions relative to reality. That is apparently part of the impetus for creating this index – to get a grip on why people feel they are doing well or badly financially. Seems a worthwhile effort.

My impression is that curious people accept that multiple measures are a good thing, because you learn more that way. Incurious people demand to know which measure is best, so they don’t have to bother thinking about alternatives. Lying liars go looking for measures which tell the story they want to tell and switch when it’s convenient.

‘Interpreting the HBI™ Chart

HBI™ = 100%: Households are neither better nor worse off today than they were in January 2019.

HBI™ > 100%: Households may have extra money left over at the end of the month that can be applied to things like entertainment, extra savings or debt reduction.’

So this is indexed to January 2019 and it is over 100 right now. Translation – households are better than off now than under Trump. Of course Antoni cannot just say that – can he?

Not a big fan of Talking Points Memo. Self-important, preachy and not useful as a news source. Sometimes, though, their preachiness is my preachiness:

https://talkingpointsmemo.com/cafe/how-mainstream-climate-science-endorsed-the-fantasy-of-a-global-warming-time-machine

Most of what we hear from governmental and big institutional climate pundits is based on an assumption that temporarily overshooting the 1.5 C target for warming is an OK idea. It isn’t. Not only does that assumption rely on carbon capture on a grand, unproven scale, but it gives too little thought to climate tipping points. Once the rainforest are gone, you don’t just plant new ones. Ice caps thousands of years in the making don’t pile back up because we belatedly cut back on greenhouse gas emissions.

Dumb idea, but pervasive.

Off-topic, Environment related

I still haven’t seen a date for when (an exact date) the first MethaneSAT data will be released. But I have signed up for email updates, so hopefully I will get that and pass it on to Menzie’s blog when it comes out.