A reminder:

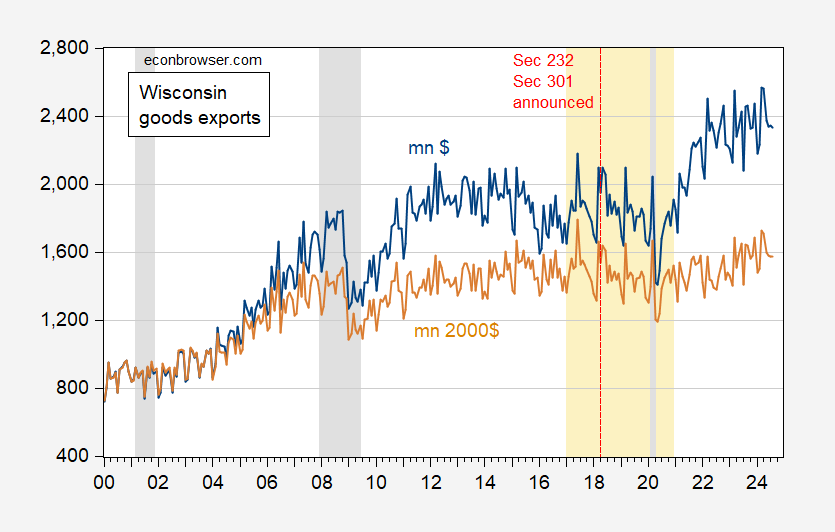

Figure 1: Wisconsin exports of goods in millions $ (blue), in millions of 2000$ (tan), n.s.a. Wisconsin exports deflated by US export price index, 2000=100. NBER defined peak-to-trough recession dates shaded gray. Trump administration shaded orange. Red dashed line at announcement of Section 232, 301 actions. Source: Census, BLS via FRED, NBER, and author’s calculations.

US exports during the trade war, shown here.

Real exports for the U.S.:

https://fred.stlouisfed.org/graph/?g=1vnq3

Growth stalled under Trump. Exports collapsed during Covid, then resumed growth and reached new highs under Biden.

Stalled is a polite term. From 2018Q2 to 2020Q1, real exports fell.

Glad you noted real exports as a recent Tweet from fake PhD EJ Antoni reads:

Trade deficit plunged 10.8% in Aug as imports dropped $3.2 billion from Jul and exports rose; about 1/3 of the drop in imports was just crude prices falling, but we’re also seeing American consumer hit a wall, i.e., importing far fewer luxury automobiles

Got that, the fall in the trade balance was due to people importing fewer BMWs! What are rich people to do? Antoni I guess had to write that exports rose but he could not tell his moronic readers how much of the trade balance improvement was from rising real exports. MAGA!

https://www.iea.org/reports/renewables-2024/executive-summary

Global renewables growth set to outpace current government goals for 2030

Global renewable capacity is expected to grow by 2.7 times by 2030, surpassing countries’ current ambitions by nearly 25%, but it still falls short of tripling. Climate and energy security policies in nearly 140 countries have played a crucial role in making renewables cost-competitive with fossil-fired power plants. This is unlocking new demand from the private sector and households, while industrial policies that encourage local manufacturing of solar panels and wind turbines are fostering domestic markets. However, this is not quite sufficient to reach the goal of tripling renewable energy capacity worldwide established by nearly 200 countries at the COP28 climate summit.

The good news is that renewable with energy storage is becoming cheeper than even the most efficient hydrocarbon based electricity production. So for new production, few will choose to build fossil fuel plants. Market forces will do their thing. What may happen soon is what we saw with coal fired plants over a decade ago. It will become impossible to get financing for building any more natural gas plants. I would not put my money into a bond backed by the asset of a natural gas plant.

The cost for electricity produced at NG plants are the sum of fuel (NG) cost + maintenance + bond payments (for building the facility). For alternative energy it’s, maintenance + bond payments. Investors have to look at what happens to a NG plant when its total cost exceeds market price for electricity. Eventually they will default on their bonds. The asset is then sold for cents on the dollar and production continue until the next major maintenance event – but original bond holder lose most of their money. Smart money will soon begin fleeing financing of NG plants, and that will be the end of building any more of them.

The past two years of raising interest rates hurt alternatives because the initial investment is bigger (so bond payments are a bigger part of production cost). But that will reverse with falling interest rates.

https://www.economicstrategygroup.org/publication/strain_protectionism/

Protectionism is Failing and Wrongheaded: An Evaluation of the Post-2017 Shift toward Trade Wars and Industrial Policy

AEI’s Michael Strain is no fan of the Trump trade war.

Trump is leading Harris by a lot in one measure!

PolitiFact bias: 201 Trump ‘Pants on Fire,’ zero for Harris

https://www.msn.com/en-us/news/politics/politifact-bias-201-trump-pants-on-fire-zero-for-harris/ar-AA1rYRQp?ocid=msedgntp&pc=U531&cvid=c9f54677eaef44969824cba53879e704&ei=16

Wait, wait – this story says PolitiFact must be biased if Trump lies a lot but Harris does not? Oh – this is the rightwing Washington Examiner which has never ranked high in the integrity department. Hey fellows – your guy lies all the time. Get used to it!

Two MAGA Republicans who are too stupid for words:

Hurricane Milton Threatens Florida Districts Whose Lawmakers Reject Climate Action

As the storm heads toward their districts, Reps. Greg Steube and Byron Donalds are pushing legislation calling the climate crisis a “false emergency”

https://www.rollingstone.com/politics/politics-features/hurricane-milton-florida-byron-donalds-greg-steube-climate-1235129603/

As a hurricane intensified by hot ocean water now threatens to destroy the Tampa Bay region, Florida Republicans bankrolled by the fossil fuel industry are pushing legislation that would bar the president from declaring a climate emergency. Reps. Greg Steube and Byron Donalds, both Republicans who have together received more than $175,000 from oil and gas interests over their relatively short careers, co-sponsored the House version of the bill last year, which frames the climate crisis as a “false emergency.” Steube represents Sarasota and Charlotte counties, both south of Tampa, and Donalds represents much of Florida’s Lee County — all areas under evacuation orders as of Tuesday. Neither Steube nor Donalds returned The Lever’s requests for comment on Tuesday. Both lawmakers co-sponsored the legislation alongside 17 other Republicans, including several that represent the Gulf Coast region threatened by climate-intensified hurricanes: Reps. Randy Weber (R-Texas), Brian Babin (R-Texas), and Clay Higgins (R-La.). So far this election cycle, these three representatives have received more than $190,000 from the oil and gas industry. Mississippi Sen. Roger Wicker (R) — who has received more than $1.2 million from oil and gas interests since 1993 — is co-sponsoring the Senate version of the bill. The bill’s backers claim that declaring a climate emergency — which could enable the government to end offshore drilling, accelerate clean energy production, and take other bold action — would weaken national security and jeopardize valuable fossil fuel interests. “President Biden and his radical administration are working around the clock to destroy American-made reliable energy sources,” said Rep. August Pfluger (R-Texas), author of the House bill, in a June 2023 news release. A similar bill was introduced in the Senate in April 2022, where it was co-sponsored by Sen. Rick Scott (R-Fla.), who received almost $242,000 from oil and gas interests that year. The legislation died in Congress.

No one is destroying reliable energy sources but Steube and Donalds are doing their best to destroy the lives of the people they serve.

https://www.msn.com/en-us/news/politics/why-ron-desantis-allegedly-dodged-kamala-harris-hurricane-relief-calls/ar-AA1s12SJ?ocid=msedgdhp&pc=U531&cvid=c8d69e59c2124cafa01b66170c80f54c&ei=13

Why Ron DeSantis allegedly dodged Kamala Harris’ hurricane relief calls

As the governor of Florida one would think DeSantis would appreciate the help of FEMA. But no – DeSantis is one partisan piece of trash.

s

https://www.bls.gov/news.release/cpi.nr0.htm

Consumer Price Index Summary

Inflation remains low. Of course the spin machine is searching for some product price that rose a lot in order to let EJ Antoni tweet it out!

Guess who has been publishing their trash at the Epoch Times?

https://www.theepochtimes.com/business/us-in-recession-since-2022-after-inflation-adjustments-new-research-shows-5738353

US in Recession Since 2022 After Inflation Adjustments, New Research Shows

Undercounting inflation since 2019 has resulted in overstating economic growth, economists say.

New research by a pair of prominent economists suggests that the U.S. economy has been in a recession for the last two years after inflation adjustments are taken into account. According to Bureau of Labor Statistics data, cumulative inflation since 2019 has totaled nearly 25 percent.

But inflation figures have been understated by nearly half, resulting in cumulative growth to be “overstated by roughly 15%,” say economists EJ Antoni and Peter St. Onge. “Moreover, these adjustments indicate that the American economy has actually been in recession since 2022,” they wrote in a new study published in Brownstone Journal.

We all know about Antoni’s dishonest tirades. And there’s Bruce Hall’s favorite troll Peter St. Onge! Prominent economists? Seriously? Two lying turds is more like it!

The original “study” was published by The Brownstine Group, which is a major source of Covid conspiracy theories and anti-vaccination hockum.

Jeffrey Tucker, of the Great Barrington Declaration, founded Brownstone. Tucker is an advocate of child labor and under-aged smoking, among many other things.

Financial Backers of Brownstone include:

Morgan Stanley Global Impact Funding Trust

Fidelity Investments Charitable Gift Fund

The Bluebell Foundation (which has funded other anti-vaxxers)

John and Barbara Crary (who fund a number of anti-vax efforts)

The Woodhouse Foundation (which also contributes to Koch family-affiliated organizations)

https://www.importantcontext.news/p/who-is-funding-the-brownstone-institute

So it looks like Brownstone is firmly nestled in the echo chamber.

The Epoch Times is “a far-right international multi-language newspaper and media company affiliated with the Falun Gong new religious movement…”

The Epoch Times is a major contributor of funding to Trump’s campaign.

https://en.m.wikipedia.org/wiki/The_Epoch_Times

So not necessarily inside the echo chamber, but certainly adjacent to it.

Sometmes, I just can’t help myself. Off topic – liquidity worries and the Fed’s asset portfolio:

Back in 2019, the Fed lowered the funds rate and offered liquidity facilities because of a tightening if financial conditions. Bit of an emergecy. There is always difficulty in the short term in knowing whether market wobbles are the result of temporary circumstances or persistent ones. Fed folk initially took signs of stress in 2019 as temporary, then got the message that they were persistent.

Heres a picture of SOFR over the past year:

https://fred.stlouisfed.org/graph/?g=1vuSN

Notice the two big recent wobbles. The first, the big drop, is a reflection of the Fed rate cut. The second, a big spike, happened at the turn of the quarter. There are routinely little spikes in SOFR at the turn of the quarter – overnight lenders want to lend less, overnight borrowers want to borrow more.

The latest spike was huge in terms of end-of-quarter spread widening, but proved transitory. Why huge, if transitory?

One theory is that the market has arrived at its lowest comfortable level of reserves (LCLOR):

https://www.ft.com/content/b7597b71-8764-4093-bf0f-b6df6ad3c307

The issue raised is whether the Fed ought to stop shrinking its asset portfolio. The latest FOMC minutes, from the mid-September meeting state that “the [reserve] manager concluded that reserves appeared to remain abundant.”

That was before the latest SOFR spike. It is reasonable to suspect that Fed insiders are now discussing whether LCLOR has been reached. If so, the Fed not only should stop shedding reserves, but begun adding reserves to reflect growth in the economy and in financial turn-over.

This is not a political issue nor a social policy issue. This is, for now, purely a market issue. But it has the potential to screw up the real economy by disrupting financial markets – typical liquidity stuff. Important decisions need to be made, certainly before the end of the year, when liquidity will be a good bit tighter than at the turn of the quarter.

I used to have arguments with Rosser about this. I think it’s an equity problem, if you consider reserves and individual bank assets as equity. Labeling it liquidity is a cop-out in my book. Next time you skip a payment on your house mortgage tell the bank it’s a liquidity problem and let me know how that goes. Rosser told me he got free vacations to speak at bankers’ association symposiums, so obviously he must have been right.