From the IMF (9/27/2024):

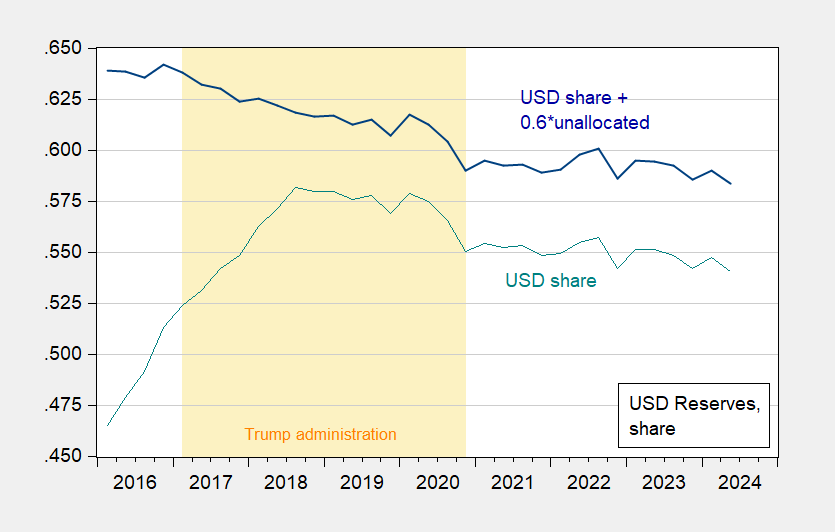

Figure 1: USD share of total reserves as reported (light blue), and USD share plus 60% of unallocated share (bold blue). Source: IMF, COFER, and author’s calculations.

While this reduction might seems precipitous, it’s interesting to note the faster shift was during the Trump administration. In any case, some context is useful.

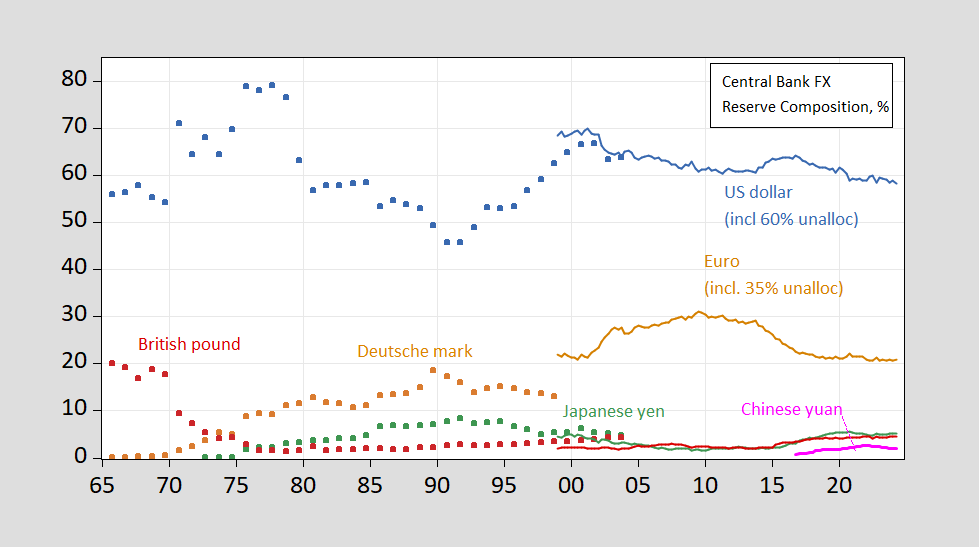

Figure 2: Share of foreign exchange reserves held by central banks, in USD (blue), EUR (orange), DEM (tan squares), JPY (green), GBP (sky blue), Swiss francs (purple), CNY (red). For 1999 data onward, estimates based on COFER data, and apportionment of unallocated reserves, described in text. Source: Chinn and Frankel (2007), IMF COFER accessed 10/1/2024, and author’s estimates.

The decrease from 2022Q3 can be accounted for by the decrease in the value of the US dollar (remember the shares are calculated using currency values evaluated using market exchange rates). So, a bit premature to worry about the end of the dollar’s reserve currency hegemony.

For more on fx reserve holdings, from a central bank by central bank perspective, see Chinn et al. (2024), discussed here.

The sweet, reasonable deceit of J.D. Vance

https://jabberwocking.com/the-sweet-reasonable-deceit-of-j-d-vance/

If you are looking for a list of JD Vance’s many lies with some actual fact checking – Kevin Drum has an interesting list.

ADP: Private Sector Jobs Bounce Back in September, Beating Forecasts

https://www.msn.com/en-us/money/markets/adp-private-sector-jobs-bounce-back-in-september-beating-forecasts/ar-AA1rAvDb?ocid=BingNewsSerp

Private employers added a better-than-expected 143,000 jobs in September in a bounceback from sluggish summer hiring, payroll firm ADP said on Wednesday. The gains were broad-based with only the information technology showing a slight decrease. Increases occurred both at mid-sized and large employers. The leisure and hospitality sector led the way with a gain of 34,000 jobs, followed by construction with a 34,000 increase. Analysts had expected the September report would show an improvement from the upwardly revised 103,000 jobs added in August but had forecast an increase of about 120,000 jobs.

Off topic – who won the Veep debate? Depends on who you ask:

https://nomoremister.blogspot.com/2024/10/no-jd-vance-did-not-win-last-nights.html?m=1

Yeah, sure, Democrats think Walz won, Republicans think Vance did. Who’d have guessed? More interesting is that media professionals mostly told us that Vance won the debate, while regular voters thought it was a toss-up. Undecided voters, who are the big fish at this point?:

“Perhaps more importantly, Walz won over independents, with 58 percent of them saying that he was the winner as opposed to 42 percent for Vance—but these people were also more likely to say they didn’t even watch the debate.”

The press has spent decades normalizing the dishonesty of the right, over a decade normalizing the criminality of Trump, and in the process have made themselves suckers for guys like Vance.

We expect teachers to be good at teaching. Painters to be good at painting. What is it, exactly, that media professionals are supposed to be good at?

semi-related, Mr Setser:

https://www.cfr.org/blog/beijing-still-has-fiscal-space

https://www.cfr.org/blog/chinese-state-investors-do-not-seem-profit-higher-us-interest-rates

https://www.cfr.org/blog/imfs-latest-external-sector-report-misses-mark

https://www.cfr.org/blog/chinas-imaginary-trade-data

Lots of gems in these Setser blog posts: “As I have noted in the past, China’s data doesn’t agree with itself. One measure of the goods deficit is a lot bigger than another measure of the goods surplus.” is but one small example. Gee, Beijing officials “telling on themselves” with lies a five year old might try. Beijing never did that before…… the child with cookie crumbs all over his face and shirt saying “But Mom, I didn’t eat any cookies”. So consumed with gazing at their own navels, Beijing has zero perception of how see-through the lies are.

Menzie was quick out of the gate in identifying the Oren Cass as a bubble-headed nonsense monger:

https://econbrowser.com/archives/2024/09/its-almost-as-if-you-have-no-economics-training-at-all

Others are now waking up and arriving at similar conclusions.

Brad Delong in response to the Cass article:

“For as long as I can remember—but more so under editors Kelly and Goldberg—the Atlantic Monthly has had a habit of sometimes publishing bullshit misinformation, often right-wing, on important topics that are in my wheelhouse, and then doubling down and refusing to publish well-motivated, well-written, & convincing rebuttals.”

https://braddelong.substack.com/p/crosspost-kimberly-clausing-piie

The whole post is worth reading. Delong suggests that The Atlantic pretends to intellectual aspirations, but is really in the business of shit-stirring. But no real intellectuals allowed, because that would make obvious that people like Cass aren’t worth the space The Atlantic provides them. Too embarrassing.

Kimberly Clausing and Maurice Obstfeld:

“Oren Cass’s shallow and selective defense of Donald Trump’s trade policy in The Atlantic misrepresents what economists know about tariffs.”

“…an assessment of tariffs as a policy tool must answer three questions:

• How costly are tariffs?

• Would they deliver the desired benefits?

• Would other policy tools be more effective than tariffs?

Our brief answers are:

• Very.

• Negligibly or no.

• Yes.

https://www.piie.com/blogs/realtime-economics/2024/what-populists-dont-understand-about-tariffs-economists-do

Clausing and Obstfeld are also worth reading in full, for those interested in what real economic thinking looks like.

Thanks to Menzie for leading the charge.

To restore dollar dominance we obviously need to re-create all of the economic and socio-political conditions of the mid 1970’s. It will take a Golden Man to return us to a Golden Era.

Returning to an era before shipping containers would also be great. Imagine all the jobs for stalwart men unloading great ships by hand!

Excellent point. We are endlessly told that political leaders will make decisions about reserves that will sink the dollar. That’s not what the record showx. Odds are, economic developments will continue to determine reserve currency status.

Consider the Euro. Whole bunch of countries joined their currencies into a single currency. One declared intention of creating that single currency was to reduce the dollar’s reserve status. Figure 2 shows that the Dmark, alone, was held in reserves almost as much as the Euro upon its creation, and the share of the Euro is now pretty much where it was at its creation. That’s the case even though a handful of additional countries have adopted the Euro since its inception.

Politicians propose. Economies dispose.

Further to the same point –

While the dollar accounts for just under 60% of reserve holdings, it is one side of over 80% of foreign exchange transactions:

https://www.bis.org/statistics/rpfx22_fx.htm

As long as the dollar dominates FX trade, the “exorbitant privilege” of reserve dominance is likely to continue, too.

There are lots of reasons for the high relative volume of dollar exchanges. One reason is that dollar trades are cheaper to execute than most others. You’d probably want to do Eur/Jpy trades direct, but a Cad/Jpy or Nzd/Jpy trade is often cheaper to do in two steps, going through the USD, than through a direct trade. USD transactions are really cheap. There is a lot of inertia in foreign exchange dominance.

You’re making an attack on Labor Unions?? What exactly is your Swahili language bitch here??