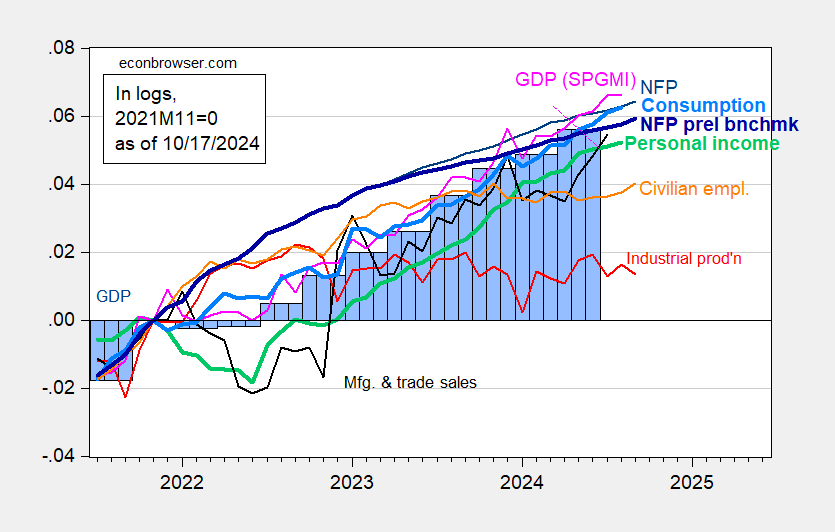

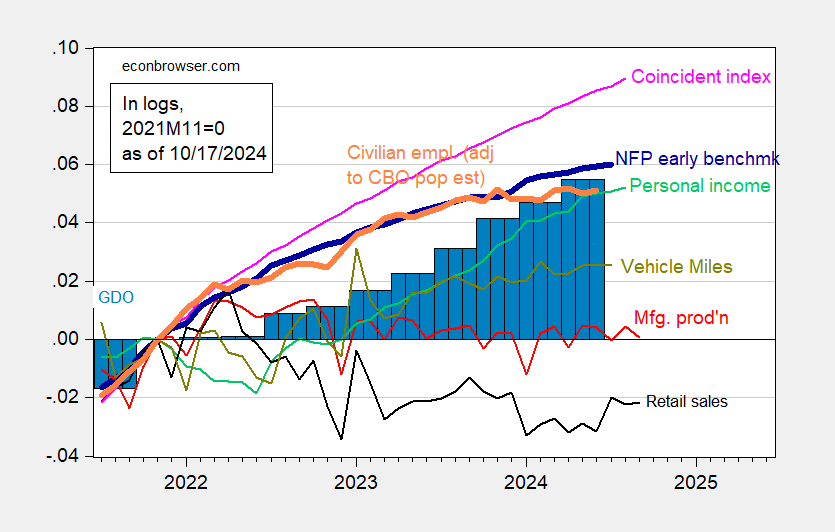

Industrial and manufacturing production below consensus (-0.3% m/m vs -0.1%, -0.4% vs -0.1%, respectively), while retail sales and core retail sales above consensus (+0.4% m/m vs +0.3%, +0.5% vs +0.1%, respectively). Here’s the resulting two pictures, first one for those indicators followed by the NBER BCDC, and the second one alternatives.

Figure 1: Nonfarm Payroll (NFP) employment from CES (blue), implied NFP from preliminary benchmark (bold blue), civilian employment (orange), industrial production (red), personal income excluding current transfers in Ch.2017$ (bold light green), manufacturing and trade sales in Ch.2017$ (black), consumption in Ch.2017$ (light blue), and monthly GDP in Ch.2017$ (pink), GDP (blue bars), all log normalized to 2021M11=0. Source: BLS via FRED, Federal Reserve, BEA 2024Q2 3rd release/annual update, S&P Global Market Insights (nee Macroeconomic Advisers, IHS Markit) (10/1/2024 release), and author’s calculations.

Figure 2: Nonfarm Payroll early benchmark (NFP) (bold blue), civilian employment adjusted using CBO immigration estimates through mid-2024 (orange), manufacturing production (red), personal income excluding current transfers in Ch.2017$ (light green), retail sales in 1999M12$ (black), vehicle miles traveled (chartreuse), and coincident index (pink), GDO (blue bars), all log normalized to 2021M11=0. Early benchmark is official NFP adjusted by ratio of early benchmark sum-of-states to CES sum of states. Source: Philadelphia Fed, Federal Reserve via FRED, BEA 2024Q2 third release/annual update, and author’s calculations.

Industrial production (which includes mining and utilities as well as manufacturing) is the only index which looks obviously in decline in September. Real retails sales are flat.

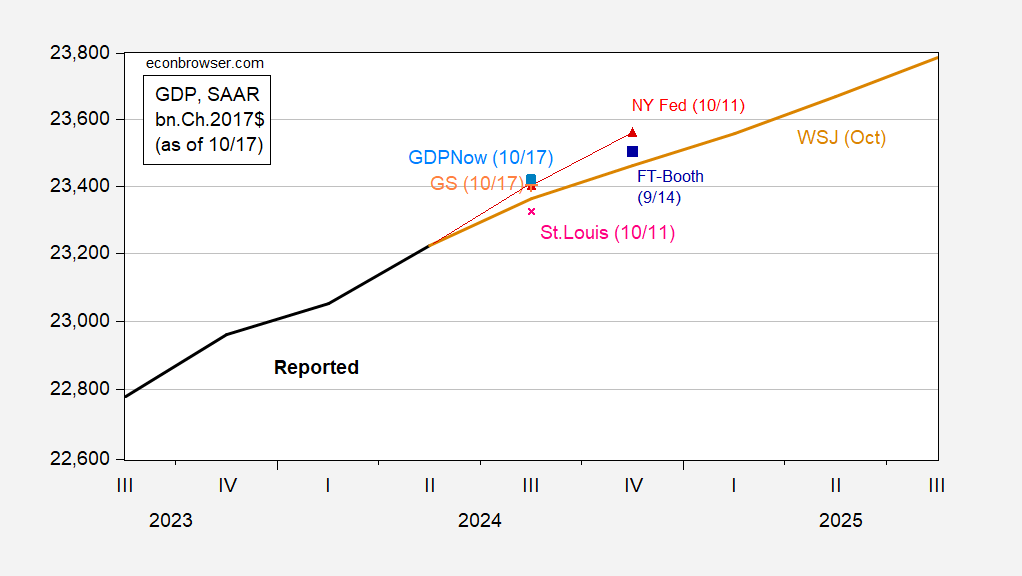

Q3 GDPNow is moved up from 3.2% q/q AR on 10/9 to 3.4% as of today. Combined with GS tracking and WSJ October survey, we have the following picture.

Figure 3: GDP (bold black), WSJ October survey mean (tan), GDPNow as of 10/17 (light blue square), NY Fed nowcast as of 10/11 (red triangles), St Louis Fed news nowcast as of 10/11 (pink x), Goldman Sachs tracking as of 10/17 (green +), FT-Booth as of 9/14 iterated off of 3rd release (blue square), all in bn.Ch.2017$ SAAR. Levels calculated by iterating growth rate on levels of GDP, except for Survey of Professional Forecasters. Source: BEA 2024Q2 3rd release, Atlanta Fed, NY Fed, Philadelphia Fed, WSJ October survey, and author’s calculations.

As noted in yesterday’s post, nowcasts (except St. Louis) appear to be outpacing the most recent survey, from WSJ.

The Lewis-Mertens-Stock WEI for data available as of 10/12 is at 2.0%, down from 2.22% for data through 10/5. The Baumeister, Leiva-Leon, Sims WECI is at -0.21, which translates to 1.78% if trend growth is 2%.

It is hard to see a recession in the currently available data as of September.

Catherine Rampell steps into the ring with nutjob Kevin O’Leary over the Trump tariffs!

‘I’m doing real business in China!’ Fed-up ‘Shark Tank’ star duels economics columnist

https://www.msn.com/en-us/money/markets/i-m-doing-real-business-in-china-fed-up-shark-tank-star-duels-economics-columnist/ar-AA1spjtr?ocid=msedgdhp&pc=U531&cvid=d6dd921223b84636b78f61ae92900693&ei=12

Businessman Kevin O’Leary squared off against Washington Post columnist Catherine Rampell on “NewsNight” after Rampell asked why Trump continues to propose levying tariffs on other nations including China. In response, O’Leary accused China of “screwing” his 45 businesses for more than three decades — and said he “likes the idea of going to war with China with tariffs to change behavior.” As Rampell shot back that the tariffs didn’t change the Chinese government’s behavior, O’Leary insisted it was “weak leadership” from President Joe Biden and the Clintons who wanted to “democratize” the country. “It’s time to raise tariffs on China to 400 percent,” he declared. As Rampell pointed out Trump already raised tariffs on the country, he insisted, “Not enough.” As Rampell said studies show U.S. companies and consumers bore the costs of those moves, a fed-up O’Leary proclaimed: “I love the academic study. I’m doing real business in China! I’m actually doing business there. I’m actually working there. There’s no academics in my companies.”

And we thought Trump at the Chicago Economic Club was crazy!

Retail sales ex-auto, up 0.5% vs up 0.4% for overall retail sales.

Motor vehicle.production -1.5%

Looks like motor vehicles were a drag on both reports. I kinda think Helene had something to do with that. Reports so far in October suggest supply problems are going to limit auto production in October, too – Helene again.

Auto demand is probably going to get a lift from Helene, with insurance a mediating factor. Lost inventory and production against replacement demand will probably mean higher prices.

Could be that hurricanes also boosted consumer demand aside from autos.