Today we are pleased to present a guest contribution by James Cabral (University of Toronto) and Walter Steingress (University of Wisconsin). The views expressed are solely those of the authors, and do not necessarily represent the institutions they are associated with.

In recent years, many advanced economies have seen an increase in immigration, sparking discussions about its economic impacts, particularly on housing and rent prices. This short note presents a summary of our recent paper (Cabral and Steingress, 2024) on the effect of immigration on local house and rent prices in the United States.

1. Impact Channels:

There are various channels through which immigration can affect local house and rent prices.

- New immigrants arriving in the US need housing and thereby increase demand, which puts upward pressure on shelter prices.

- The magnitude of this demand shock will depend on the skill composition of immigrants as more educated immigrants tend to have higher incomes and can afford more expensive homes compared to less educated immigrants.

- The magnitude of this demand shock will depend on the underlying supply conditions of the local housing market. If immigrants arrive in a housing market where supply can expand, the impact on shelter prices will be muted relative to a housing market where it is more difficult to add homes.

2. Empirical Analysis:

Our empirical analysis is based on detailed county-level data for the period 1985—2019. To ensure a causal association between immigration and shelter prices, we employ a shift-share instrument based on the ancestry composition of residents in each US county following Terry et al (2023). This instrument leverages the composition of residents’ ancestry as well as the timing and size of the national inflow of immigrants from a country of origin matched to ancestry to predict current immigrant flows to a given county in the United States.

3. Main Findings:

- Immigration inflows equal to 1% of a county’s population are associated with a 3.5% increase in median housing prices and a 2.0% increase in rents.

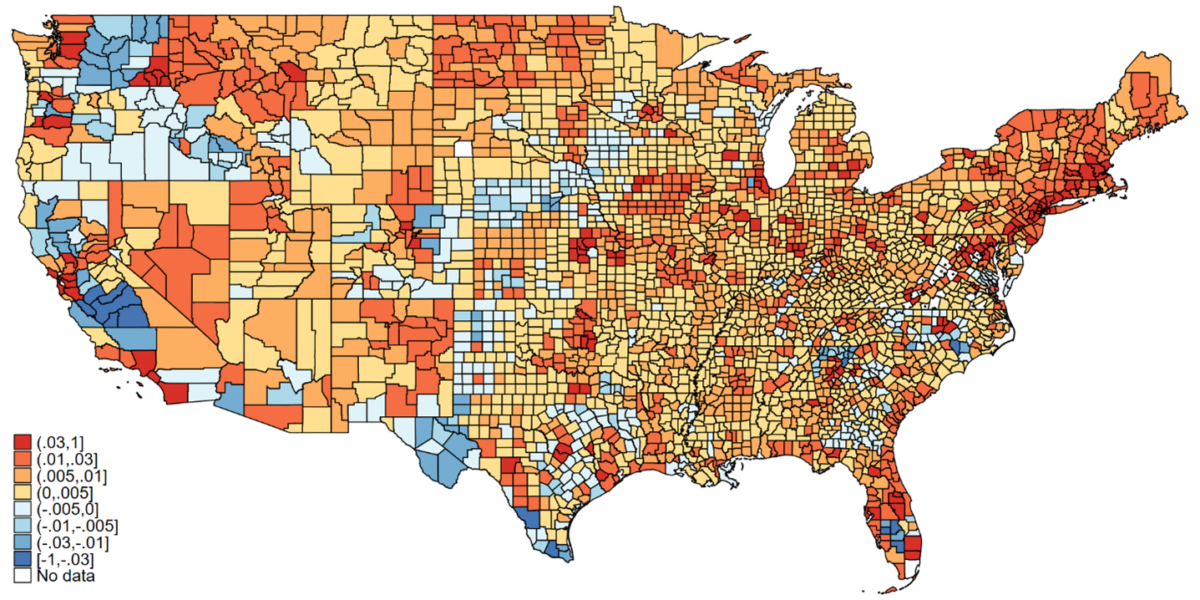

- The impact varies significantly based on immigrants’ relative education levels and local housing supply conditions (see Figure 1).

- In the county with the most restrictive issuance of building permits receiving immigrants with the highest level of education, an immigrant inflow of 1 percent of the county’s population would increase shelter prices by 6-8%.

- In the county with the least restrictive issuance of building permits and the lowest level of education of immigrants, an immigrant inflow of 1 percent of the county’s population would reduce shelter prices by 0-2% relative to a county that received no immigrants.

Figure 1: Distribution of Estimated House Price Impact

Notes: The figure plots the average estimated impact of new immigrants across the sample period obtained from the estimates presented in column (3) of Table 2 in Cabral and Steingress (2024).

4. Overall Impact:

Armed with the estimated effects of immigrants on shelter prices and observed immigration flows, we can calculate the model implied contribution of immigration to observed changes in US shelter prices.

- The overall impact of immigration on shelter price growth is minimal, contributing less than 2 percent to the increase. The primary reason is that immigration only accounts for a small fraction of local population changes.

- When we apply our estimates to within-US population shifts and account for changes in counties’ educational composition, our model can explain 59% of the observed change in local house prices and 47% of the observed change in rent prices.

5. Conclusion:

Our analysis suggests that immigration to the United States has a significant but varied impact on local shelter prices, depending on local conditions and immigrant characteristics. The influx of immigrants serves as a useful tool to identify causal effects of population movements on shelter prices, providing insights into how both national and international population movements affect the local housing market. Overall, our results suggest that the main culprit of shelter price growth in the United States is within-country population movement across US counties.

This post written by James Cabral and Walter Steingress.

‘In the county with the most restrictive issuance of building permits receiving immigrants with the highest level of education, an immigrant inflow of 1 percent of the county’s population would increase shelter prices by 6-8%.’

San Francisco and New York City come to mind. Of course the immigrants in question are those that employers want to move here and nothing to do with Donald Trump’s “garbage can”.

This paper focuses on the demand side. It would be nice to see an analysis that also consider how immigrants might be contributing to the supply side as in construction labor.

Fact check: How Trump’s TV ads deceive viewers with misleadingly edited quotes

https://www.msn.com/en-us/news/politics/fact-check-how-trump-s-tv-ads-deceive-viewers-with-misleadingly-edited-quotes/ar-AA1sWxeJ?ocid=msedgdhp&pc=U531&cvid=59c4d8771f634c8b9b05fa95bc7ce373&ei=12

If you watched any of these Trump attack ads, you could have written this article. Yea – the dishonesty is disgusting. But here’s my question – why hasn’t the Harris campaign been more aggressive at countering these blatant lies? Oh wait – our lame press has decided not to point out the many vile and racist lies coming from Team Trump. After all – our stupid press is saying it was Harris and not John Kelly that called Trump a fascist. Got it.

There’s pretty good evidence that mentioning a lie in order to rebut that lie is counterproductive. The repetition of the lie sticks better than the rebuttal.

If you accept that repeating the lie is bad, you want to counter it without repeating it. Trump is weird. Trump is a fascist. Trump is a felon. Trump is a liar. Trump is a rapist. Trump is a tax cheat. Trump is a serial bankrupt. Trump is an insurrectionist. Trump doesn’t pay his workers. Jared K. should be investigated for violating the foreign agents act. Trump is Putin’s lapdog. Trump is a serial adulterer. Trump isn’t very intelligent. Trump is senile. Trump is unhinged.

See? Never once repeated Trump’s lies.

Building permit policy is only one factor limiting the availability of new dwellings, but I suspect it is closely correlated with some others. Densely populated areas generally have more restrictive permitting rules than sparsely populated areas. That’s my guess, anyhow.

That doesn’t mean rationalizing permitting rules wouldn’t do some good in boosting available housing and limiting prices. Just that permitting rules are mostly a necessary response to dense population. It’s population density, reflected in tight permitting rules, which drives housing costs.

Dense population also tends to mean higher average wages, and higher wages are part of the mechanism leading to higher housing costs. Point being that while building permits work as an independant variable, we might not want to conclude that permitting rules are the ultimate cause of high housing costs, any more than we should conclude that immigration is.

Consider Tennessee. A low cost of doing business, including low wages, has led to a rapid increase in job growth. Housing costs were relatively low outside Nashville, prior to the jobs boom, but have risen rapidly in response. Tennessee doesn’t have particularly tough permitting rules overall, and has a good bit of open land, but that hasn’t stopped above-average increases in housing costs. Just watch what happens to real estate where new, gigantic chip-making faculties are being constructed in Arizona.

This is not intended as a criticism of the authors’ work, which seems quite useful. Rather, these are just some ideas about how to read the results.

Trump is a convicted felon, rapist, serial liar, fraudster and deranged lunatic who has become incoherent in conversation. Trump would be ineligible to enter the united states if trump immigration policy were to be enacted. He is ineligible to vote in most conservative states due to his felony conviction. He cannot hold a state job in texas due to his fraud conviction. He was impeached twice and unworthy of consideration for president.

The Heritage Foundation is the gift that keeps on giving!

Commentary: Inflation artificially pumps up the stock market

Opinion by Alexander Frei, The Heritage Foundation

https://www.msn.com/en-us/money/markets/commentary-inflation-artificially-pumps-up-the-stock-market/ar-AA1sTWI2?ocid=msedgdhp&pc=U531&cvid=7ad2d9bbc27d4e4889f28bae111b4eec&ei=21

mericans can readily see the effects of record-high inflation every time they shop. Prices have soared, from the grocery store to the gas pumps, and although inflation has cooled, families are still feeling the pinch. And the harm doesn’t end there: Inflation is also making stock markets appear stronger than they really are and cutting into returns for everyone, including those with retirement accounts. We seldom hear about that last point. When media outlets discuss the latest inflation rate, they typically highlight the average annual percentage change in the Consumer Price Index (CPI). The CPI is an index that tracks a basket of goods, including housing, food, energy, insurance, and more, measuring the average price increases of these items over time….Yet despite this negative sentiment, the stock market appears to be booming. On October 21, the Dow Jones and the S&P 500 hit all-time highs. However, these indexes alone don’t tell the full story. Inflation can distort how we perceive market gains. While it may appear that investments in the stock market are yielding record-breaking returns, these returns are more moderate once they’re adjusted for inflation….In short, inflation not only hurts consumers – it hurts investors (which includes most Americans). This hidden tax on savings and investments quietly eats away at real profits, leaving Americans with far less purchasing power than it appears on the surface. To estimate how this would affect someone who invested in the stock market in January 2021, you compare the Dow Jones Industrial Average with its inflation-adjusted counterpart. While the nominal stock market gains since 2021 show an increase of 39%, this growth shrinks to just 15% when adjusted for inflation. Inflation, often overlooked in stock market discussions, has a tangible impact on investment returns. Investors who focus solely on nominal gains without considering inflation may develop a false sense of optimism about their portfolio’s performance.

May I interrupt his little tirade by pointing out that economists have been aware of the difference between nominal returns and real returns for something like 107 years. Yes Irving Fisher published his Theory of Interest back in 1907. I guess the morons at Heritage never heard of this book but most economists have. Oh I did not let this clown finish:

‘This illusion of growth highlights the need for a sharper focus on controlling inflation. Reducing wasteful government spending and bringing down inflation is essential not only to preserve the real value of investments, but also to ensure that economic prosperity is felt across all levels of society.’

I guess you knew that was coming. Wasteful government spending? Is that like the waste of time from each and every Heritage rant?

Off topic – Goldman thinks equity returns are going to tank, averaging just 3% (nominal) over the next decade:

https://awealthofcommonsense.com/2024/10/3-stock-market-returns-for-the-next-decade/

The counter-argument is that returns that low occur only 9% of the time, so are unlikely. I don’t have access to Goldman’s argument, but I know that the counter-argument leaves out a good bit. Here’s the Shiller P/E:

https://www.multpl.com/shiller-pe

Pretty sure Shiller’s measure of P/E isn’t as high as it is now more than about 9% of the time. We’ve been through a period of extraordinarily low interest rates and may now be entering into a period of higher rates. It is reasonable to assume that we will see a period of correspondingly higher equity returns, but unless some productivity miracle occurs (an idea Ritholz seems to favor), then stock valuations need to decline, lowering total returns in the process.

The counter-counter-argument is that doom-sayers have told this Shiller story before. The counter-counter-counter-argument is the bursting of the NASDAQ bubble and 2022, when Shiller’s rules proved right.

OK – I bored you with the writing of Alexander Frei (not the soccer star) so here’s his pathetic little bio:

https://www.heritage.org/staff/alexander-frei

Alexander Frei is a Senior Research Associate at The Heritage Foundation’s Center for Data Analysis. His research focuses on Macroeconomic modeling, Climate modeling and applied Microeconometrics. Frei has written editorials published in The Daily Signal, The Epoch Times, and The BFD, as well as peer-reviewed research published in academic journals and presented at various academic conferences. His work has also been featured in Bay News 9, St Pete Catalyst and Tampa Free Press. Prior to joining Heritage, he worked as a Research Assistant in the economics department at Florida State University, assisting faculty members with research. He also worked with the UNC Charlotte Men’s Soccer team, providing analytics to the team. Alexander Frei holds a Bachelor of Science degree in Quantitative Economics and Econometrics from the University of South Florida, graduating summa cum laude, and a Master of Science degree in Economics from the University of North Carolina at Charlotte. Frei has completed three semesters of PhD-level coursework in Economics and Computer Science at Florida State University.

WHAT ‘peer-reviewed research published in academic journals’? They could not list even one such paper? Come on! And just a one and a half at FSU? Weak.

So a failed PhD student with no peer-reviewed publications. Sounds about right for a Senior Research Associate at The Heritage Foundation’s Center for “Data Analysis”.