This Thursday 4:30 CT at UW:

Description:

The pace of China’s economic growth since 1978 is unprecedented. The national security strategy of the United States calls for maintaining a durable competitive edge over China.

While US officials now like to characterize the goal of economic policy toward China as derisking, the proliferation of tariffs on Chinese goods and an ever widening net of export controls suggests the mix is evolving toward decoupling. The costs and risks of this strategy for the United States are likely to be substantial. China is a large market for many leading US technology firms. If sales of these firms are increasingly curtailed by export controls, how will these firms sustain the R&D expenditures required to sustain their technological lead? More generally what are the implications if the United States curtails economic exchange with what remains the world’s fastest growing large economy?

Biography:

Nicholas R. Lardy, called “everybody’s guru on China” by the National Journal, is a nonresident senior fellow at the Peterson Institute for International Economics. He joined the Institute in March 2003 from the Brookings Institution, where he was a senior fellow from 1995 until 2003. He was the director of the Henry M. Jackson School of International Studies at the University of Washington from 1991 to 1995. From 1997 through the spring of 2000, he was also the Frederick Frank Adjunct Professor of International Trade and Finance at the Yale University School of Management. He is author, coauthor, or editor of numerous books, including The State Strikes Back: The End of Economic Reforms in China? (2019), Markets over Mao: The Rise of Private Business in China (2014), Sustaining China’s Economic Growth after the Global Financial Crisis (2012), The Future of China’s Exchange Rate Policy (2009), China’s Rise: Challenges and Opportunities (2008), Debating China’s Exchange Rate Policy (2008), and China: The Balance Sheet—What the World Needs to Know Now about the Emerging Superpower (2006). Lardy is a member of the Council on Foreign Relations and of the editorial boards of Asia Policy and the China Review.

University of Wisconsin-Madison sponsors of this event:

- Center for East Asian Studies

- Center for Research on the Wisconsin Economy

- East Asian Legal Studies Center

- Robert M. La Follette School of Public Affairs

- Tommy G. Thompson Center on Public Leadership

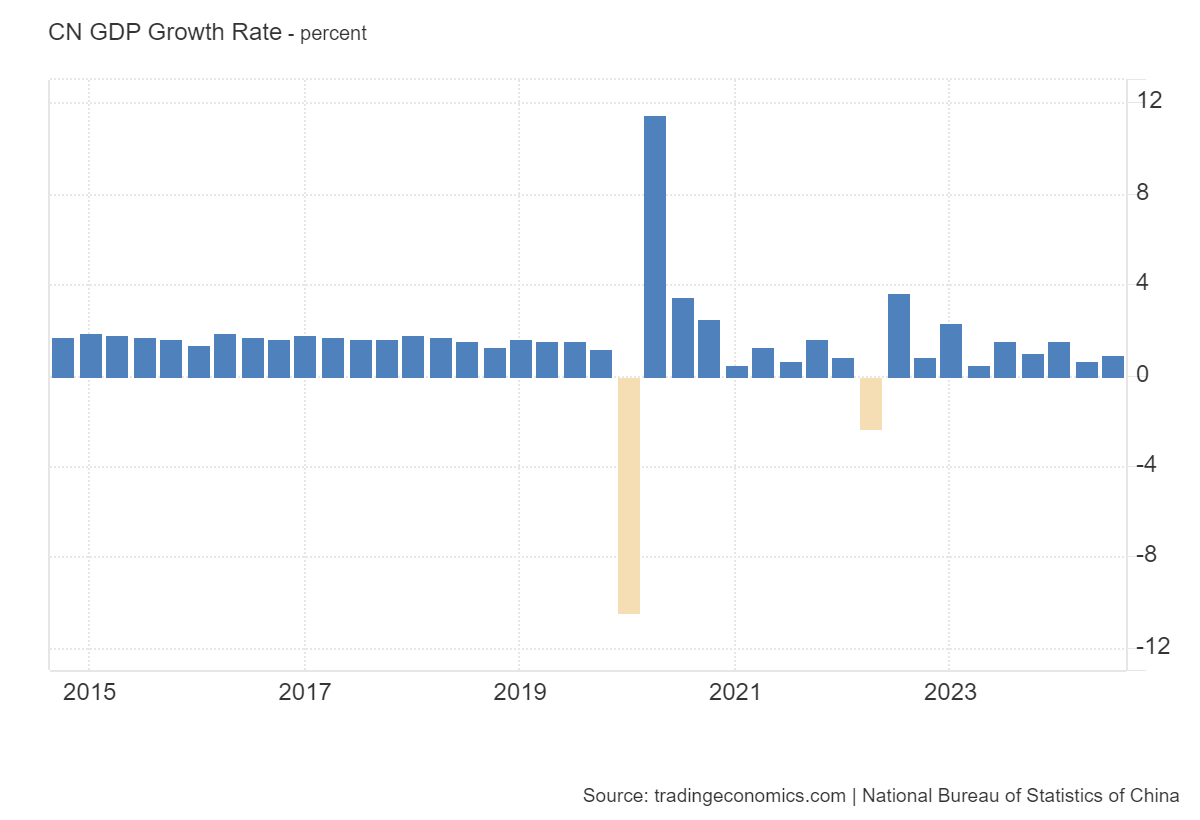

China GDP growth through Q3:

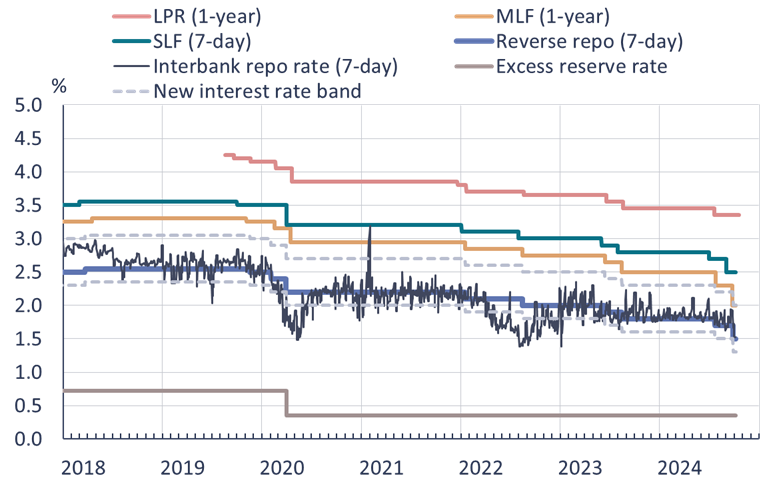

BOFIT reviews the recent stimulus measures:

My impression is that the failure of the CCP to roll out greater fiscal stimulus means that one shouldn’t expect a big cyclical rebound (and certainly none of the measures announced or even contemplated the factors affecting the secular trend, including increasingly statist policies in pursuit of other goals). To wit, from Natixis today:

• Two major developments have followed the Third Plenum in July. First, a series of economic data releases indicated that the plenum had done nothing to improve the country’s short-term outlook. Second, a series of stimulus measures were announced over a two-week period, that have so far failed to reinvigorate the economy.

• The government is unlikely to enact the reforms necessary to support consumption due to high public debt and limited fiscal capacity, as doing so would require cutting subsidies central to the country’s industrial policy. This would contradict Xi Jinping’s focus on innovation.

• The People’s Bank of China may need to continue interventions in both the sovereign bond market and the stock market, though this could reduce foreign investor interest in Chinese financial markets.

• The government’s stimulus measures so far have largely been aimed at stabilizing asset prices rather than addressing the deeper issues of demand and overcapacity.

I don’t think Lardy necessarily agrees with this viewpoint (nor the lagging consumption story in general), which is why it’s a good idea to listen!

Looks like a fun one. I probably won’t be getting drinks until Friday, so I can probably watch this one while still in my “right mind” (such as my “right mind” is in my case). Appreciate the “heads up” because I enjoy most of these a lot.

We (I) lack data needed for some of the basic calculations needed to assess China’s capacity to expand its stimulus. Some, buy not all.

g>r 4.6%>2.4%

https://fred.stlouisfed.org/graph/?g=1wHHY

That’s for the 3-month rate, but g>r is true for all investment-graderates out to 5 years.

So China can use fiscal stimulus to foster growth.

A glance at the chart will show that the gap between g and r has narrowed substantially. We also know that lots of investments in China don’t provide returns equal to the growth rate of nominal GDP. So a cavalier conclusion that g>r so all is right with China would not be wise.

I mentioned that I lack data for some basic analysis. I don’t know of a source for Chinese spending multiiers. New fiscal expansion should take spending multiiers into account. I don’t know of a source for potential GDP estimates. Fiscal multipliers are higher when there is an output gap.

Debt/GDP is available, but don’t know of a source for interest payments as a share of GDP. The World Bank provides data for the public sector, but private debt is a bigger problem for China. Just can’t tell how big.

Absent this basic background information, figuring out whether China’s prospects are good or bad, whether more stimulus is a good idea, what kind of stimulus is likely to work best, is hard to do. So it’s also hard to know whether Lardy’s optimism of the pessimism of someone like Pettis is more credible.

Lardy’s recent statements, as Menzie suggests, are pretty hopeful as regards China’s outlook. A question I’d like answered is whether Lardy has a good forecasting record as regards China. Lardy has been publishing on China for a long time, through much of the period of China’s world-beating growth. That can bias a fella’s perceptions. I’m curious about Lardy’s forecasting record, especially during the Xi period.

The U.S. experience is that going big on fiscal expansion works to lift an economy back toward full capacity. China isn’t the U.S., but Japan’s experience also suggests going big is the right approach to a big output gap. The U.S. borrows in dollars, Japan in yen, China in yuan – the budget constrain is pretty flexible in such cases.

@ Macroduck Same paper, slightly different time frames. I guess this data is slightly “dated/old” but arguably not old in the sense the data is hard to amalgamate and capture.

https://www.econstor.eu/bitstream/10419/212913/1/bofit-dp2019-005.pdf

https://www.sciencedirect.com/science/article/abs/pii/S0261560621001327

I would be pretty shocked if Michael Pettis doesn’t have some ideas on what the multiplier number would actually be and also shocked if he hasn’t commented on it at one point of time or another, but I’ve had a gruesome end of the day here and am too lazy to hunt Pettis’s thoughts down.

“They won’t do it the way the US or the EU did it during the pandemic. They’ve discussed introducing what in the US a few years ago was called a ‹cash for clunkers› scheme, in which people get a subsidy to sell their old car and buy a new one. In China, they’ve discussed doing a similar scheme not just for cars but also for household appliances. The question of course is how big these subsidies will be, and if there will be a multiplier effect to consumption. I don’t think there will be a multiplier effect at all.”

https://themarket.ch/interview/michael-pettis-the-world-cannot-absorb-the-overproduction-of-china-ld.11630 <<——Late July of '24

An environmentally disastrous policy. Was for the U.S. Would be for China.

Just about everywhere, economic a and environmental policies are soloed apart from each other. Big mistake.

Very logical. I assume Pettis agrees with you. As far as Pettis’s specific best solution in an imperfect world, his answer is very roughly the following:

“That is probably why Guizhou was the first province to effectively go bankrupt. But, here’s the weird thing: The second most valuable company in China, after ICBC, is Moutai. It sells premium liquor. And who owns Moutai? The government of Guizhou. Why do they need to own a liquor company? Why not sell it and use the proceeds to lower the debt? Everybody knows why. Because the dividends from Moutai pay for much of the functioning of the government and for the relationship between local banks, local businesses, and the local government. That makes it very difficult to force local governments to pay for the transfers needed to pay down debt and boost local consumption. But ultimately it is the best solution: local governments should sell or transfer the assets they own to pay for China’s economic adjustment costs.”

“This overcapacity idea is that you shouldn’t produce more than you can sell domestically. If that was carried to an extreme, that would mean no trade globally. Everybody would just produce what they consume at home,” Lardy told Xinhua in an interview Thursday.

https://english.news.cn/20240421/2b8882da727c428da82c13c42e6c69fe/c.html

I realize that journalistic recitation of complex ideas can make a mess. That said, Lardy iseems to have engaged in some pretty serious question begging in that quote. Yes, IF overcapacity arguments are predicated only on producing no more than what the domestic market demands, then you’ve written off comparative advantage.

If, on the other hand, we see evidence of government subsidies to export industries, then Lardy has misrepresented the actual argument – not the sort of thing you want to see from public intellectuals. It’s more of a trade lawyer argument, and that’s bad.

Off topic – when half the country’s voters (give of take a margin of error) think Trump should be president, we can’t have too many reminders of how venal, ignorant, imbalanced, immoral, criminal, vindictive, fatuous, dishonest and downright embarrassing the man is:

https://newrepublic.com/article/187252/trump-100-worst-things-list-2015-2024

https://newrepublic.com/article/187252/trump-100-worst-things-list-2015-2024

Robert Reich is also out with a YT video listing the ten (sic) worst things Trump did while president. I won’t link, but it’s easy to find.

And let’s not forget this venerable effort:

https://www.washingtonpost.com/politics/2021/01/24/trumps-false-or-misleading-claims-total-30573-over-four-years/

Trump’s 39,578 lies. That’s just in public, while president.

Nobody does it like the Orange Man.

Obama is giving a speech in Wisconsin. His close reminded us that his team had a plan for a pandemic which they gave to Trump. Trump got rid of it which was a large part of the incompetence Trump’s team displayed in 2020. Obama provided one estimate of the damage. We had around 1 million deaths which could have been 60% less had we had a competent White House. So yea – Donald Trump’s incompetence led to the death of 600,000 Americans. Heck of a job Donnie!

‘Trump’s false or misleading claims total 30,573 over 4 years’

That’s all? Trump is running second to Bruce Hall.

https://fred.stlouisfed.org/series/USGOVT

All Employees, Government

The latest Trumpian spin from fake PhD EJ Antoni is the suggestion that we desperately need to cut government employment. He was not saying this under Trump when this employment rose by over half a million from the time Trump became President and beginning the pandemic. Yes it has risen of late but the Biden years has seen employment rose by another half million.

So in typical Heritage fashion, higher government employment under Trump is good, good but under Biden it is MARXISM!

The polls are so all over the map which is why I have stayed away from all this noise. However, this one caught my eye:

October 2024 Tracking National Poll: Harris 49%, Trump 48%

October 18th, 2024

https://emersoncollegepolling.com/october-2024-tracking-national-poll-harris-49-trump-48/

OK, let’s look behind the headline:

A majority of voters (80%) say they made up their minds about which candidate to support over a month ago, while 11% made up their minds in the last month, 6% made up their minds in the past week, and 3% still have not made up their mind. “Voters who made their decision on who to support over a month ago break for Trump, 52% to 48%, while voters who made up their mind in the last month or week break for Harris, 60% to 36%,” Kimball said. “The three percent of voters who said they could still change their mind currently favor Harris, 48% to 43%.”

Take that for what it is worth but Harris-Walz know there is more work to do. Now Donald keeps saying she is lazy but then Donald cancels another meeting to take a nap.

If Trump loses, his shares tank, busuness opportunities that come to him in anticipation of his return to power dry up and he spends lots of time in court. He still faces the need to come up with hu dreds of billions to make court-ordered payments. The PAC paying his legal bills is already down to a handful of millions. And Elon will stop calling to chat.

Meanwhile, it has been pointed out that within the margin of error of our endless polls is the possibility of a Democratic sweep or a Republican sweep of all the swing states, plus maybe one or two more, and a sweep in Congress. Rapist tax cheat or life-long civil servant, adoptive mother?

The poll calibration issue is an interesting one. Once the votes are tallied, I suspect Trump’s performance relative to Republican senate candidates will be examined to sort out the issue you raise.

Fingers crossed, you’re right.

@ Macroduck You don’t “necessarily” strike me as a religious guy. I like both you and Menzie so much, but neither of you strike me as religious guys. You both love tangible facts, I’m not going to ask you to “pray to Jesus”, not going to ask you or Menzie that,. Can we imagine we all three of us have had good/great/happy times at various times of our lives??? Can you ask whoever made those happy times for us, can we ask/pray that they/”he”/ God” will help this nice lady, who is better than the Orange man” can win in two weeks?? I think IF WE PRAY the man in the sky, will grant us that.

Your friend, UNcle Moses,