Ryan Cummings and Ernie Tedeschi have a very interesting article in BriefingBook today which casts new light on the disjuncture between measured sentiment and conventional macroeconomic indicators. Cummings and Tedeschi document how the move to online sampling has altered the characteristics of the University of Michigan Economic Sentiment series.

…we believe online respondents are resulting in the level of the overall sentiment and current conditions indices being meaningfully lower, making more recent UMich data points inconsistent with pre-April 2024 data points. Specifically, we use a simple statistical model to estimate that the effect of the methodological switch from phone to online is currently resulting in sentiment being 8.9 index points –or more than 11 percent–lower than it would be if interviews were still collected through the phone.

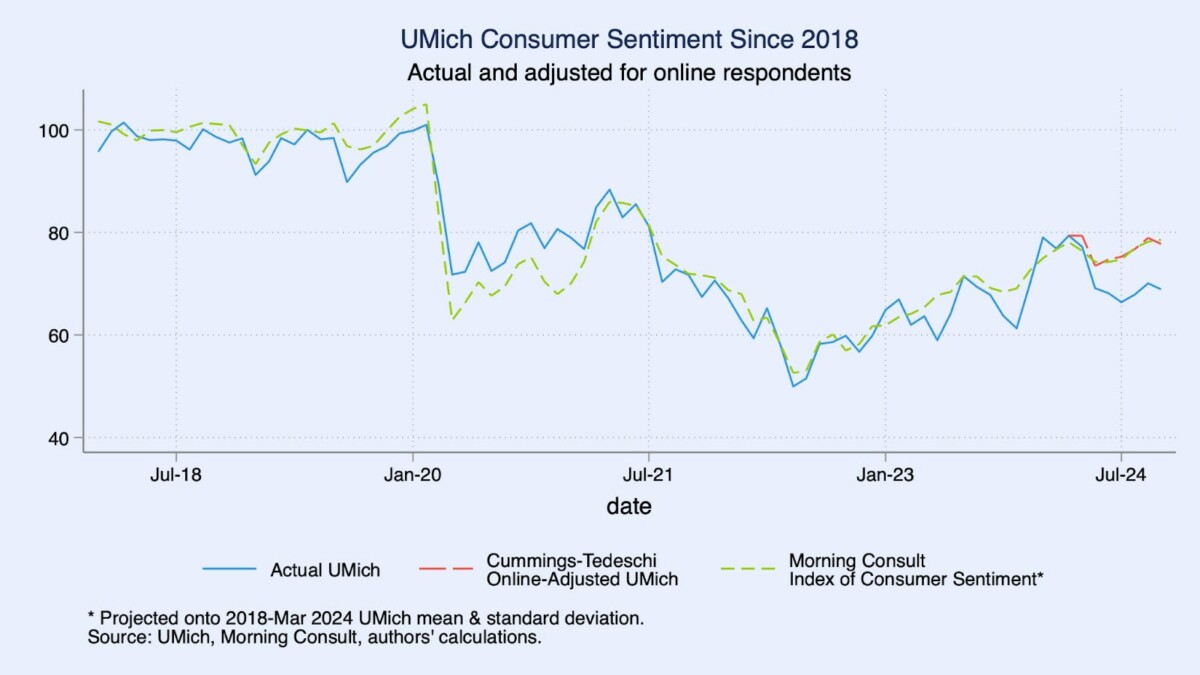

To demonstrate that the switch to online surveying has imparted a structural break in the UMich series, they compare against the Morning Consult series.

Source: Cummings and Tedeschi (2024).

The Morning Consult survey has been online, so it serves as a control. Hence, the key reason for the shift in measured sentiment.

A cursory look at the weighted age distribution of phone and online assignments suggests that, no, they were not random in practice. For example, online respondents were more likely to be older in those transition months, which might affect their sentiment responses. …

A more formal multilevel logit model–which measures the likelihood of an individual being in a certain age cohort after accounting for other demographic factors–confirms this difference. Respondents 65+ for example had a 52 percent chance of being in the online group in April-June, which is more than twice as likely as respondents 18-24, and this difference is statistically significant …

I don’t know how the greater presence of older respondents interacts with the partisan divide examined in this post (are Republican/lean Republican voters older than corresponding Democratic/lean Democratic respondents?)

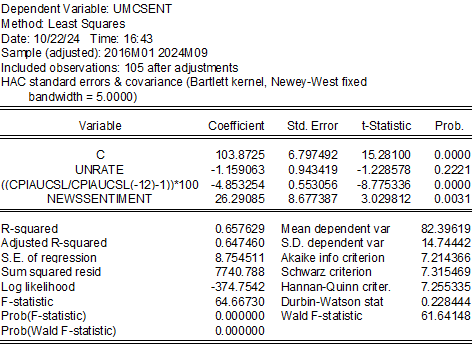

What I can say is that the adjusted Cummings-Tedeschi series exhibits less evidence of a structural break than the official UMichigan series, when using as regressors unemployment, y/y CPI inflation and the SF Fed news sentiment index.

Consider these two regressions, first with the official series, and the second with the Cummings-Tedeschi adjusted series:

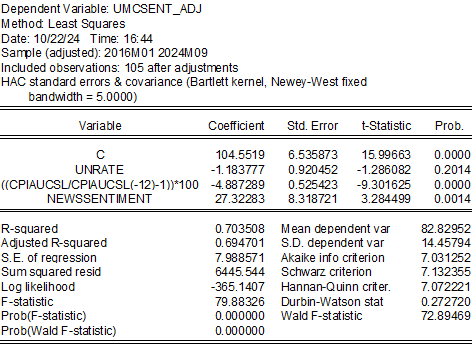

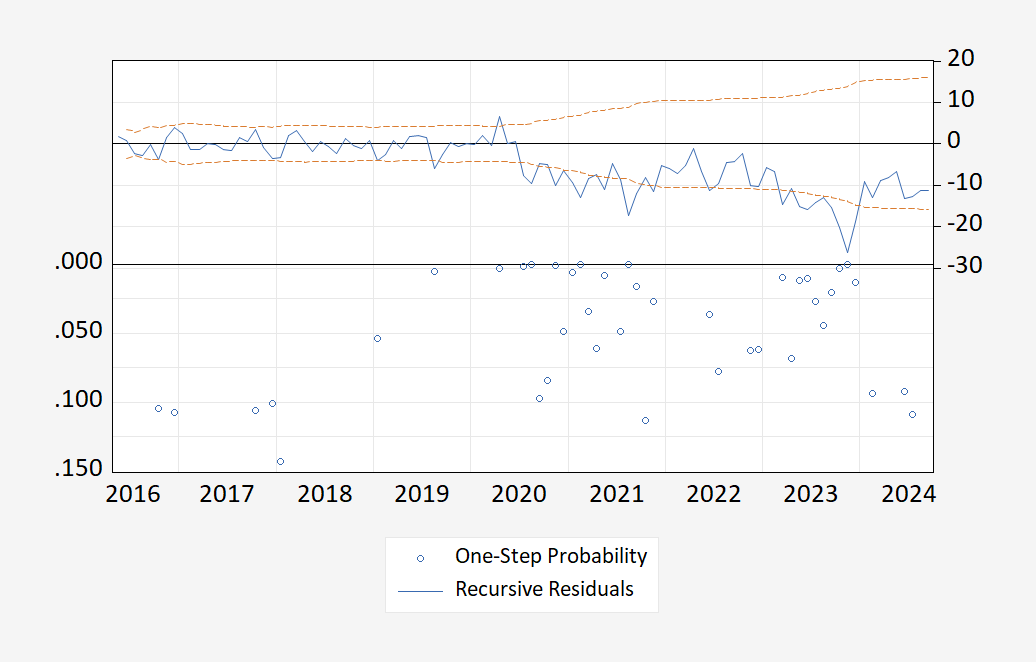

Now consider the respective recursive 1-step ahead Chow tests for stability.

Note that while both regressions exhibit instability around 2020 and 2023, the Cummings-Tedeschi adjusted series exhibits no structural break in 2024 around the switch to online polling.

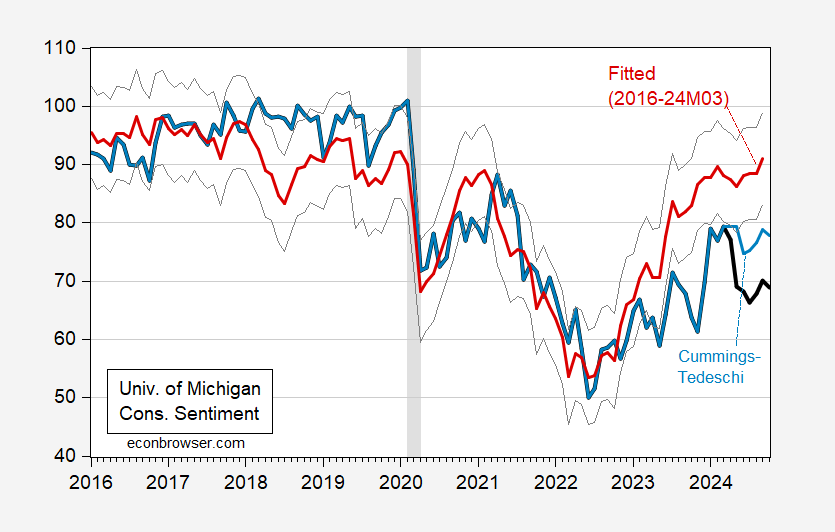

That being said, the switch in survey methods does not fully explain fully the gap between observables and sentiment. I estimate the regression over the 2016-2024M03 period, and predict out of sample for 2024M04-M10.

Figure 1: University of Michigan Consumer Sentiment (bold black), Cummings-Tedeschi adjusted series (light blue), fitted (red), +/- one standard error (gray lines). NBER defined peak-to-trough recession dates shaded gray. Source: U.Michigan via FRED, BriefingBook, NBER and author’s calculations.

So possibly less than half of the gap is accounted for by the change in survey methods.

File this under Trump’s fanboys will lie about everything:

Polymarket To Review User Base In Light Of Whales Betting Millions On Trump Election Win

https://www.msn.com/en-us/money/news/polymarket-to-review-user-base-in-light-of-whales-betting-millions-on-trump-election-win/ar-AA1sJxPg?ocid=msedgdhp&pc=U531&cvid=a591b3cd83dc424d97a671f1ed0884f9&ei=14

‘Blockchain based prediction market Polymarket is conducting a thorough review of its user base to ensure that large-scale bettors on the platform are based outside the United States, in compliance with its regulations.

What Happened: The platform, which prohibits U.S. users from trading, has experienced a significant increase in bets supporting Donald Trump’s chances of winning the upcoming presidential election.’

I wonder how much of this is secretly financed by Putin. And as I suggested before this may be a pump and dump scheme to get the stock price of Trump Media up.

The latest from Antoni:

https://x.com/RealEJAntoni/status/1848788162111541400/photo/1

He looks at M2 growth and thinks we must be seeing high inflation? Someone give this troll some meds!

https://www.military.com/daily-news/2024/10/16/military-voters-advocates-worry-votes-wont-count-amid-gop-election-challenges.html

There was an interesting article in the hardcopy AARP Bulletin (much more useful than their glossy magazine) that discussed rates of voting among 60+ seniors vs rates of voting among college age youngsters, but apparently you can’t access it online. I hunted around the house for it. I may have thrown it out after reading.

I think older tend to go for trump, mixture of reasons. Easier to frighten elderly over immigration etc. He’s getting rural and elderly and Dems need to be finding out the gap and how to narrow it. Although with 2 weeks left it’s most likely too little too late. Harris has been much smarter about getting the midwest vote, so at least in that sense she’s shown much more intelligence than Hillary did.

Another calibration issue.

We insist on looking into our collective mirrors, sentiment surveys and political polling, as well as the press relentlessly turning every story into a USAToday-style human-interest piece, but it doesn’t look like mirror-gazing is making us better informed.

We know that consumer mood survey results don’t correlate as well with consumer spending as in the past, nor does it match up with general economic conditions. We know that polling numbers have done a particularly bad job of forecasting recent election outcomes. At what point do we admit that some methods, some practitioners, are unreliable and so pay less attention to them?

Isn’t it like children paying jacks?? (am I showing my age?). Or adults playing the lottery. “21” at Vegas/Reno casinos?? We’re drawn to that thing with low odds but still give us that magical feeling the one time it’s right?? I don’t know. I was kind of fascinated by how after the one year 538 got it so right, since then they have been pretty bad, but people still “tune it” to 538.

*tune in