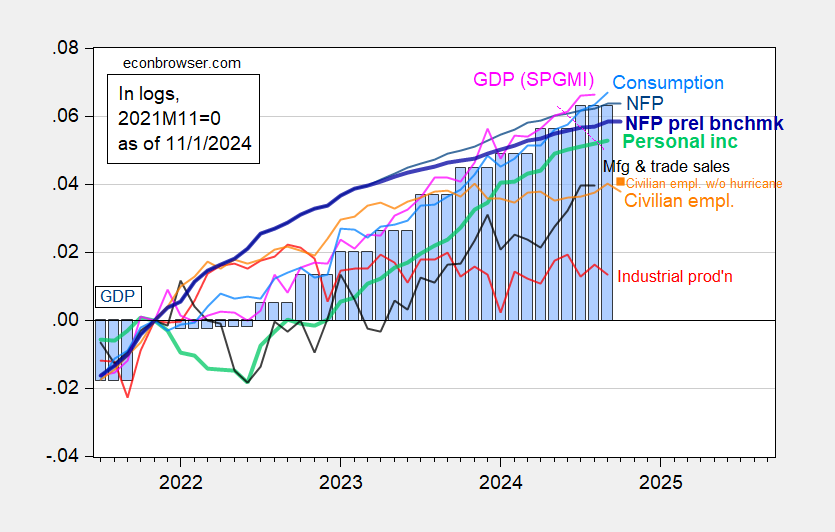

Employment for October and monthly GDP for September, in the set of variables followed by the NBER’s BCDC:

Figure 1: Nonfarm Payroll (NFP) employment from CES (blue), implied NFP from preliminary benchmark (bold blue), civilian employment (orange), civilian employment adding number of workers indicating unemployed due to weather (orange square), industrial production (red), personal income excluding current transfers in Ch.2017$ (bold light green), manufacturing and trade sales in Ch.2017$ (black), consumption in Ch.2017$ (light blue), and monthly GDP in Ch.2017$ (pink), GDP (blue bars), all log normalized to 2021M11=0. Source: BLS via FRED, Federal Reserve, BEA 2024Q3 1st release, S&P Global Market Insights (nee Macroeconomic Advisers, IHS Markit) (11/1/2024 release), and author’s calculations.

Note that adding in 41K for the strikes will not change the path much for reported NFP; however adding in 460K for the decrease d employment due to bad weather makes the household survey series (civilian employment, see orange square) look less daunting.

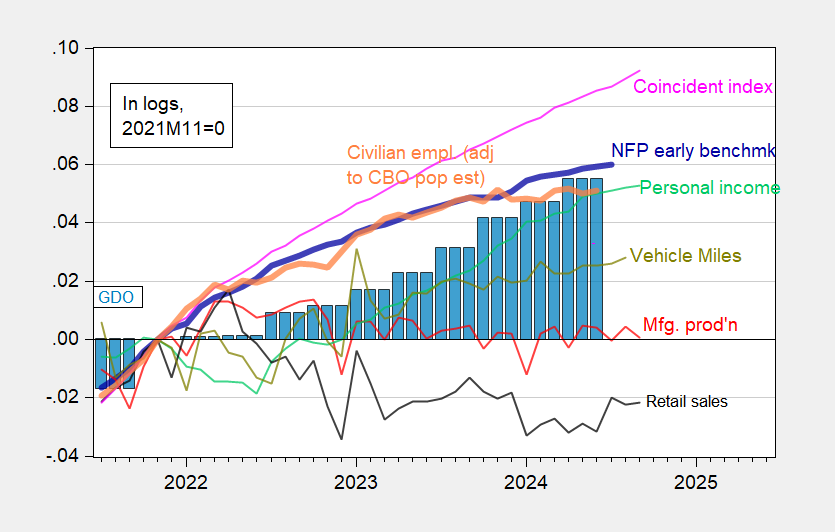

Available alternative indicators are generally up, including the coincident index for September, and vehicle miles traveled (VMT) for August.

Figure 2: Nonfarm Payroll early benchmark (NFP) (bold blue), civilian employment adjusted using CBO immigration estimates through mid-2024 (orange), manufacturing production (red), personal income excluding current transfers in Ch.2017$ (light green), retail sales in 1999M12$ (black), vehicle miles traveled (VMT) (chartreuse), and coincident index (pink), GDO (blue bars), all log normalized to 2021M11=0. Early benchmark is official NFP adjusted by ratio of early benchmark sum-of-states to CES sum of states. Source: Philadelphia Fed, Federal Reserve via FRED, BEA 2024Q2 third release/annual update, and author’s calculations.

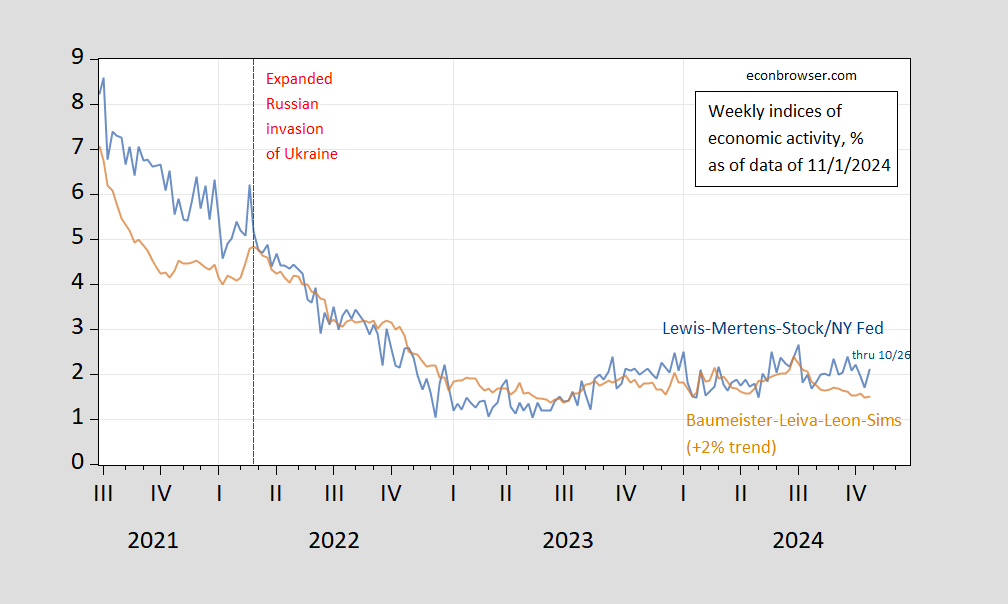

High frequency (weekly) indicators are mixed, with the Lewis-Mertens-Stock WEI at 2.1%, and the Baumeister-Leiva-Leon-Sims WECI at 1.5% (assuming trend is 2%).

Figure 3: Lewis-Mertens-Stock Weekly Economic Index (blue), and Baumeister-Leiva-Leon-Sims Weekly Economic Conditions Index for US plus 2% trend (tan), all y/y growth rate in %. Source: NY Fed via FRED, WECI, accessed 11/1/2024, and author’s calculations.

GDPNow for Q4 is at 2.3% today; NY Fed nowcast at 2.01%.

Off topic – UK markets and fiscal policy:

https://finance.yahoo.com/news/uk-bonds-fall-market-still-085854677.html

The Labour budget hasn’t been well received in fixed income markets. The issue, for now, is the expectation of fewer and slower rate cuts from the BOE. Bloomberg notes that the market response has been less severe than 2 years ago when the Truss government went all right-wing-ideology and arrogance in a mini-budget – with good reason, as there is a qualitative difference in the budgets. So far, tens and twos have added fewer than 30 basis point, as opposed to roughly 250 during the Truss episode.

Starmer inherited a bag of snakes from the Tories. His government faces some serious constraints. BOE easing will help, but the market response – 25 bps less in rate cuts – makes sense.

Off topic (again) – War Powers Act and Israel:

https://tlaib.house.gov/posts/tlaib-bush-lead-war-powers-letter-to-president-biden

The five signatories to the Congressional letter – Tliab, Bush, Carson, Lee and Omar – assert that “The Executive Branch cannot continue to ignore the law without Congressional intervention.”

That “intervention” would be a vote in the House to force removal of U.S. arms and personnel supporting Israel under the War Powers Act; any House member can force such a vote.

At one level, this is a mere gesture. With only 5 signatories, there is little evidence the vote could pass. The context is interesting, though. Just a couple of weeks after Biden demanded that aid to Gaza be resumed, Israel has almost completely blocked aid, banned UNRA from Gaza and started bulldozing UNRA facilities. The U.S. has so far done nothing in response to Israel’s failure to comply. And, of course, “undecided” voters in the Blue Wall states can still make it to the polls, but only just.

If you want your issue addressed, this is one way to go about it.