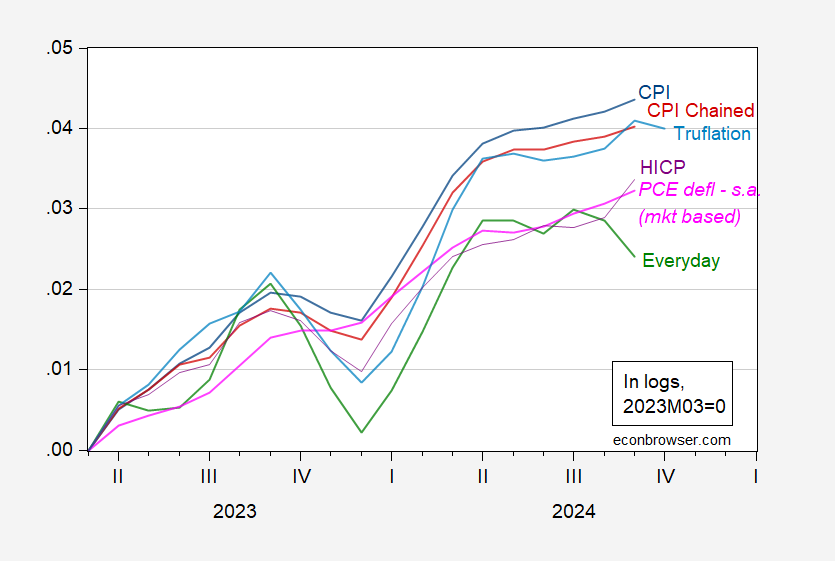

Versus 2.4% for the CPI (in logs). Lots of people think the government’s statistics understates the true inflation rate. It used to be John Williams at ShadowStats. Now it’s EJ Antoni at Heritage Foundation (who touts the use of Primerica’s everyday price index). But the American Institute for Economic Research’s “Everyday Price Index” (EPI) says otherwise (over the past year and a half).

Figure 1: CPI (blue), chained CPI (red), HICP (purple), EPI (green), Truflation (light blue), all not seasonally adjusted, and PCE deflator – market facing, seasonally adjusted (pink), all in logs 2023M03=0. Truflation index measured at last day of month. Source: BLS, European Commission via FRED, Truflation, AIER.

AIER’s EPI tries to tabulate, like it says, every day expenses, taking out prices of those goods and services that are postponable. Truflation taps into big data to produce high frequency estimates of the cost of living (documentation here).

While awaiting out mutual fate, let’s keep score on one of our so-called public intellectuals:

https://www.dailymail.co.uk/debate/article-14008015/NIALL-FERGUSON-Kamala-Harris-poses-greater-threat-democracy-home-abroad-Donald-Trump.html

Ferguson claims Harris is a greater threat to democracy than Trump because some people on her side of politics have radical ideas and “who’s to say” if Harris might adopt those ideas, while Trump himself has radical ideas that he wants to adopt, but probably won’t succeed.

That’s what a top-tier education and a career at top-flight institutions has led to. Nobody should listen to Ferguson ever again.

Voters reporting choosing Trump for two reasons: inflation and immigration. I would also add interest rates here, which are a kind of inflation in the price of money.

Why inflation and high interest rates? Clearly, the Fed overstimulated the economy with incorrect monetary policy. The Administration pushed through a too large spending program, apparently leading to higher structural deficits. I think — but don’t know (I’d like to see a post) — that higher interest rates are largely attributable to weakness in the Chinese economy, ie, the surplus savings are lower. These savings pushed down interest rates, the primary cause of the GFC. With China, it appears, out of the game, huge US budget deficits must be financed closer to home, hence, 7% mortgage rates. That is, we are seeing actual crowding out of private investment, which had been masked for almost 20 years due to China’s fantastic savings rate. So goes the hypothesis. It certainly deserves a post.

In any event, all of these are linked to the difference between a recession and a suppression, now writ large in the results of the election.

“Clearly, the Fed overstimulated the economy with incorrect monetary policy.”

Clearly? Then why has most of the rest if the world also suffered inflation, right along with the U.S? We’ve been over this many times – a supply shock was a prominent cause of inflation. Willfully ignoring the global nature of inflation and the obvious effect of Covid on supply is dishonest. We always catch you when you engage in dishonesty, yet you seem utterly unable to stop.

i would like steven to address this point. how did the fed introduce high inflation throughout the rest of the globe? please provide a detailed explanation of this mechanism. otherwise this is an unsubstantiated argument, steven.

” I think — but don’t know (I’d like to see a post) — that higher interest rates are largely attributable to weakness in the Chinese economy, ie, the surplus savings are lower.”

I have provided you the tools to do this analysis yourself. I’ve provided them repeatedly. Still, you prefer to guess:

https://fred.stlouisfed.org/graph/?g=1z6QW

Nominal yields are the sum of the cost of money, an inflation premium and term premium. In this construction, anything other than the cost of money and the inflation premium ends up in term premium. So the effect of overseas demand for Treasury debt ends up in term premium. Look at the picture – since 2018, term premium and the inflation premium account for about 50 basis points in the 150 bp rise in ten-year yields. Term premium alonge accounts for about 15 bps. China’s influence accounts for some part of 15 bps, no more than 10% of the total rise in nominal ten-year yields.

And, remind me, weren’t there some increases in the cost of money?

https://fred.stlouisfed.org/graph/?g=1z75O

Seriously, you didn’t realize that the Fed drove up interest rates?

Steven Kopits Like a lot of voters, and especially MAGA voters, you are confusing a higher price level with higher inflation. High inflation was a thing of the past which led to a higher price level. But currently inflation is pretty much right on the Fed’s target. Inflation is the rate of change (i.e., the first derivative) of the price level. Now Trump is promising to lower the price level. That’s called deflation and would be much worse than the inflation we experienced in the wake of the pandemic. Trump’s supporters should be careful of what the wish for. A drop in the price level might sound attractive to naive and unsophisticated voters, but deflation would actually hurt his base more than the college educated Democratic base.

lot’s of people from a certain political persuasion were very much against any rate cuts on monday. are you folks still against rate cuts? or have you now decided that rate cuts are in order to recover from the biden economic disaster?

test

Are you testing us again?

So, the Fed.

Today’s meeting will avoid politics, because that’s what an independent central bank does; they’ll all talk about politics separately, outside the meeting. The rate decision won’t be any different than it would have been – baked in, as it were.

Mechanically, the rise in inflation expectations (see TIPS) and real yields cut in opposite directions with respect to realized inflation, but the rise in both represent expectations of a more inflationary environment. The outlook for monetary policy beyond this week has tightened substantially.

The dollar has strengthened in response to election results. That helps offset a small part of the inflationary cost of new tariffs. A stronger dollar will add to the real-side effect of tariffs in domestic growth – the growth outlook has dimmed.

Powell is out as of early 2026 and lobbying for Powell’s job is already underway. Trump’s preferences here are like his preferences in most jobs – he prizes loyalty over competence, crazy-ass notions over real knowledge. Let’s hope Senate Republicans get in his way, as they have in the past.

There is gradual turnover among Fed policy makers, often not driven by the length of appointments. We can expect Trump to replace some governors over the next 4 years. No Yellens. No Blinders. No Meyers.

The Fed has been through swings away from close attention to the Phillips curve and now back (I think) during Powell’s tenure. There is pretty serious structural change underway in the domestic and global economy, which should keep the Fed busy figuring out how best to do its job. Personnel is policy, so if we get bumptious dimwits on the Board, we can’t expect the Fed to keep up.

“Powell is out as of early 2026 and lobbying for Powell’s job is already underway.”

Keep in mind that Republicans are taking over the Senate which means that Trump will have his way with appointments — the Fed, Treasury, Attorney General, Defense, FCC, NLRB, CFPB, FTC and down the line. He will also push through another couple hundred Aileen Cannons who will be there for at least another 30 years and maybe another Supreme Court justice or two. They will want Thomas to cash in and go RVing and replacement him with someone they can count on for the next 30 years.

Mr Trump, some advice: don’t mess up a good thing.

Greg Ip (WSJ) says the economy is in good shape. It notes “quality growth”, by which he means a solid pace of output and employment growth, good productivity growth and low inflation. Nobody should need Ip to tell ’em that, but the Heritage boys are out there, so…

Most of the rest of the world isn’t doing as well, so maybe good U.S. performance isn’t just luck. Maybe U.S. policy has been good. If so, maybe you should be careful about imposing big changes.

Of course, pay-offs to supporters is utterly necessary. Go ahead and do whatever you want with crypto-currencies. Pigs get slaughtered – so what? Probably won’t stall the economy. Cut taxes? Bad, but not new, and we’ll survive. Richies love it, and you do, too.

But tossing out immigrants and imposing big tariffs, that’s just crazy. Overturning Obamacare and the Inflation Reduction Act? Highly destructive.

No politician keeps every promise. So do some of your bad ideas, but not all of ’em. Some are far worse than others.

But then, you can’t run again, so maybe you don’t care.

The main focus for Trump with regards to policy will be to do something “big” that he think will help put him in the history books (as the greatest President in the universe – ever). He will also continue to seek the adulation of his cult members. The grifting will be immense and the abuse of power for retribution will be substantially worse than during his first term (that is why Bezos kissed his ass in the last minute) – but that is small potatoes.

His unpredictability is based on a lack of ideology. It’s all about how he looks and is perceived – as a winner. The people behind him are certainly right wing extremists but he will drop them and their ideas, the minute they begin to tarnish his image or take the stage (as Bannon did). He is immensely ignorant because all he ever cared about was his image – and trying to understand things is too much work. But he is also cannot learn because he cannot admit that someone else knows more than him. The way he gets to a position is that he hears something from advisers, and if it sounds “smart” to him he adapts it as his own. However, it cannot cost him popularity.

It looks like he is likely to take some standard GOP Wall Street types as economic advisers so they will probably explain why raising the “border walls” and tariffs will be a really bad idea for the economy. His first term was quite light on blocking immigration and raising tariffs although those items were in his campaign. He conned his cult members with the border wall – which was popular with the morons but had no effect on border crossings. The tariffs were fairly minimal for all the thunder he created around them. Will he be able to con his cult members with similar bombastic, but grossly ineffective, populist performances again? If he gets called on it and his followers begin grumbling that he is ineffective or lied to them – he may get more real than he intended (rather than losing cult members).