As of yesterday COB:

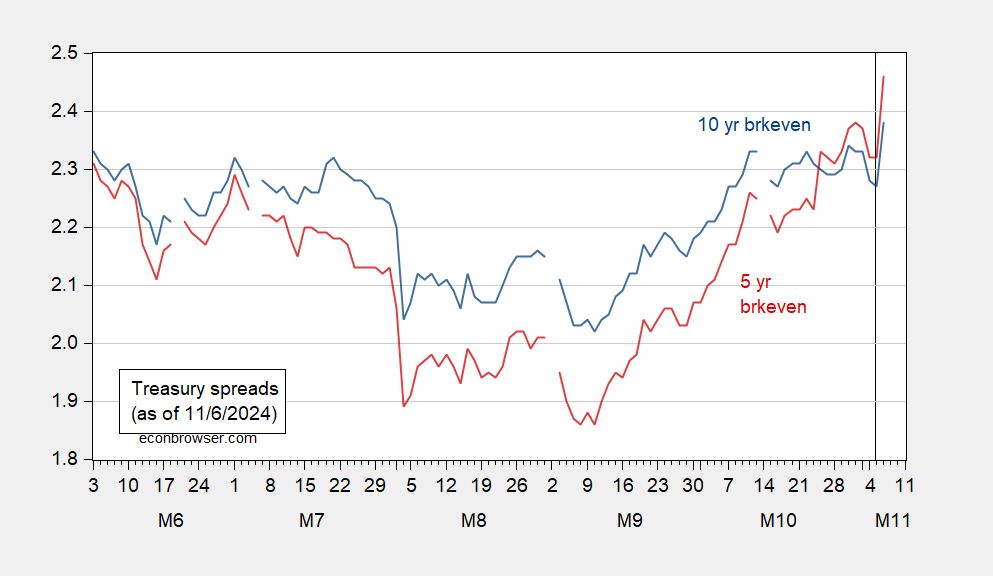

Figure 1: Ten year breakeven (blue), five year breakeven (red), in %. Source: Treasury via FRED.

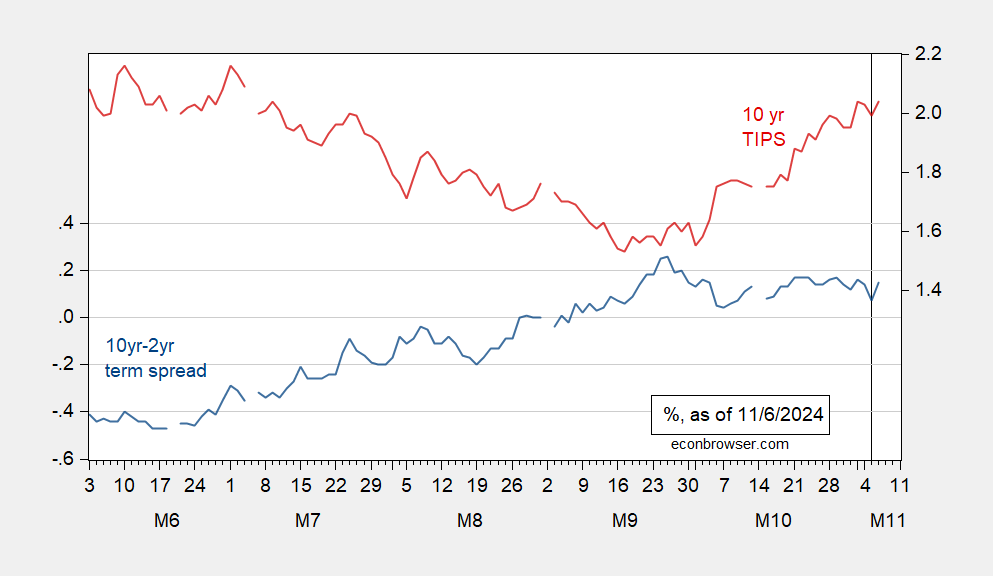

Figure 2: 10yr-2yr Treasury term spread (blue, left scale), ten year TIPS yield (red, right scale), in %. Source: Treasury via FRED.

Inflation expectations (at least a proxy) are up, as expected. However, term spreads are relatively unchanged from before the election. In an earlier time, I might’ve thought this was indicating not much change in perceived growth rate of GDP, but now not so sure.

Twenty-five basis points.

Futures currently price in nearly 100% odds of another 25 bp cut in November, roughly 2/3 odds of yet another 25 in December.

The Fed typically avoids handicapping fiscal, immigration and trade future policy in making its own policy decisions, so through December, the election should have little influence.

Futures have adjusted to anticipate a somewhat higher funds rate at mid-2025 compared to one week and one month ago, consistent with expectations of increased inflation risk from Trump’s policy intentions.

Trump has certainly increased the risk of inflation.

Depending on how he goes about boosting tariffs, it could happen pretty quickly. Tariffs can be increased under current law through administrative action. That action should include a period of study. Well, “should” may not go very far.

Deporting immigrants presents a manpower problem. Manpower problems, in a tight labor market, present a budget and pay-scale problem. I don’t have a feel for how long it would take to make a dent in the immigrant population. I can imagine immigrant workers becoming scarce before deportation begins.

Stephen Miller was blocked from doing the one thing he most wanted to do about immigration – punishing those who employ illegal immigrants. Everybody understand that if you required documents submitted by an app before you hire a person, and punished violators with +10K fines, there would be no jobs for illegal immigrants – and they would indeed all “self-deport”. There were people in the Trump administration who understood the consequences, and who blocked that – the only effective – way to end illegal immigration. The whole E-verify system is already set up and running. All they have to do is make it mandatory for all employers everywhere and increase penalties.

Walk through the produce department of any supermarket and ask yourself how deporting immigrants and raising tariffs will lower grocery prices, as Trump has promised. Almost everything in the produce department is either imported from (mostly) Latin America or picked by immigrant labor. Eight dollar a head lettuce anyone?

What many may not realize is that labor shortage may soon be developing in professional degrees. US graduate degree programs have traditionally been filled up with foreigners, mostly from China and India. Those individuals came here and paid big money to attend a university, and get an excellent education. However, their plans were always to stay in the country after graduation. From what I have heard the ability to stay and work at least a few years (to pay back the loans) – and to ease into permanent residency, have been curtailed. The result is that undergraduate and graduate programs have seen drastic reductions in number of applicants. Trump will not only empty the supermarkets – the pipelines of intellectual property will also be emptied. If we stop the pipeline that skim all the best talent from all over the world and settle them in the US – we will quickly lose our edge in everything.

Today’s press conference —

Reporter: Will you resign if Trump asks you to.

Powell: Nope

Reporter: Will you leave if Trump fires you.

Powell: Not permitted under law.

Well, it’s good to know at least one person is willing to push back against authoritarianism.

Powell’s term expires in May 2026. In the mean time, that doesn’t mean that Trump can’t pack the board with sycophants. He will have a Senate majority for appointments.

Powell Is about to get an education.

The law says that the president can remove a member of the Federal Reserve’s Board of Governors, which includes Jay Powell — quote — “for cause.”

“Cause” is whatever 5 or more members of the Supreme Court say it is. And we all know how scrupulously they follow rules of interpretation and precedent.

Trump has said he won’t remove Powell, or reappoint him. That could change, of course, but for now Powell is OK.

If you didn’t know anything at all about Powell, buy just went by his actions, he has *behaved* exactly like a GOPer would if they were trying to destroy a Democratic Administration. He raised rates sharply to extremely high “real” levels, and maintained them there, and then started lowering them just in time to assist a GOP Administration (cf. Greenspan, 1994).

from a timeline perspective, trump is not in a hurry to remove powell. trump is very aware of the inflation issue. he knows that if he implements all he wants now, he will need to deal with the ramifications of high inflation. better to let the fed counter his inflation policies for couple of years-it gives him a foil to rail against. then in the last couple of years, he can have a fed governor who implements his low rates and high inflation, which will juice the economy to become “the greatest economy ever”. somebody else will need to come in to clean up the mess later.

Yes, I was going to add ” ’cause he isn’t loyal to me” as sufficient. But at least Powell is speaking directly to Trump that he won’t be intimidated into going down without a fight.

Noteworthy that Fed Governor Michelle Bowman, a Trump appointee, who dissented from the rate cut in September, suddenly decides that rate cuts are okay today. Expect more of this as Trump fills the board with new members. Terms for four of the seven Fed board governors will expire during the Trump administration.

Off topic – partisan resistance to Trump’s authoritarian inclinations:

Some Republican elected officials have gotten in the habit of talking, and behaving, as if federal law only counts when a Republican is in the White House. Democrats have mostly not done that. I guess that’s the difference between “law and order” Republicans and Democrats, by whatever slur might be used.

Anyhow, Democrats have had time to prepare for a second Trump presidency, and a few seem to have some ideas about compliance.

“Pritzker said his administration has worked with the Democratic-led General Assembly to take “proactive steps” to shore up abortion rights and other laws that could draw scrutiny under a Trump White House. And he said Illinois would take action if the Trump administration were to circumvent government grants that were headed to Illinois. The governor said he’s had similar conversations with fellow Democratic governors around the country.”

More pointedly, Pritzker said “You come for my people, you come through me” with “my people” apparently meaning anyone in the State of Illinois.

https://www.politico.com/live-updates/2024/11/07/congress/jb-pritzker-trump-00188244

Republicans have long worked to erode respect for government, thereby making governance harder. Democrats, as a party, don’t seem ready to join them yet. But the spectacle, and the fact, of various levels of government battling each other over who’s in control – my authority can beat up your authority – can’t be good for our civil religion.