Since the incoming administration has indicated the deportations will start on day one, I thought it of use to consider the sectoral impacts of a policy of mass deportation (aside from macro based ones as discussed here).

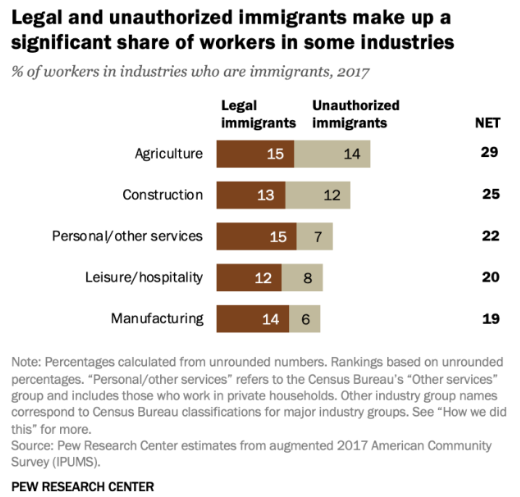

First, I consider two graphs from Pew that Torsten Slok/Apollo has recently sent out.

Note the relatively more substantial shares of unauthorized workers in agriculture and construction overall. Within agriculture, consider the shares in food production/food processing.

Second, two observations. If the Trump administration really wants to do something about grocery prices and housing affordability (I must confess I am dubious they care at all about these things), then a policy of mass deportation of unauthorized workers will certainly work against those goals. (If the administration were to proceed on denaturalization as proposed in Project 2025 pp. 143-44, well heck, I have no idea what would happen, quantitatively).

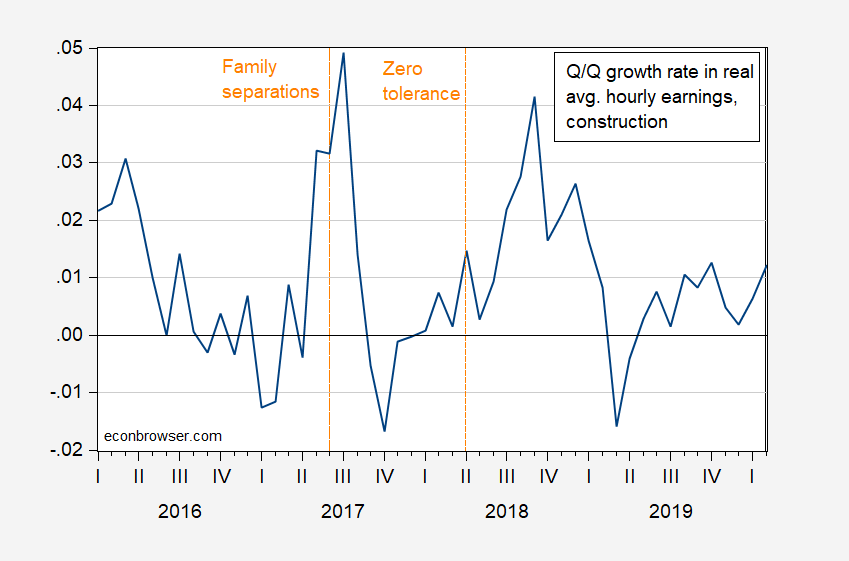

First, think construction costs. A big input is labor (and others include imported products like lumber — so I’m not even considering tariffs). Here’s the evolution of real wages for construction:

Figure 1: Quarter-on-Quarter CPI deflated wage growth in construction, annualized (blue). Source: BLS via FRED, and author’s calculations.

Hence, housing construction costs will jump up in real terms.

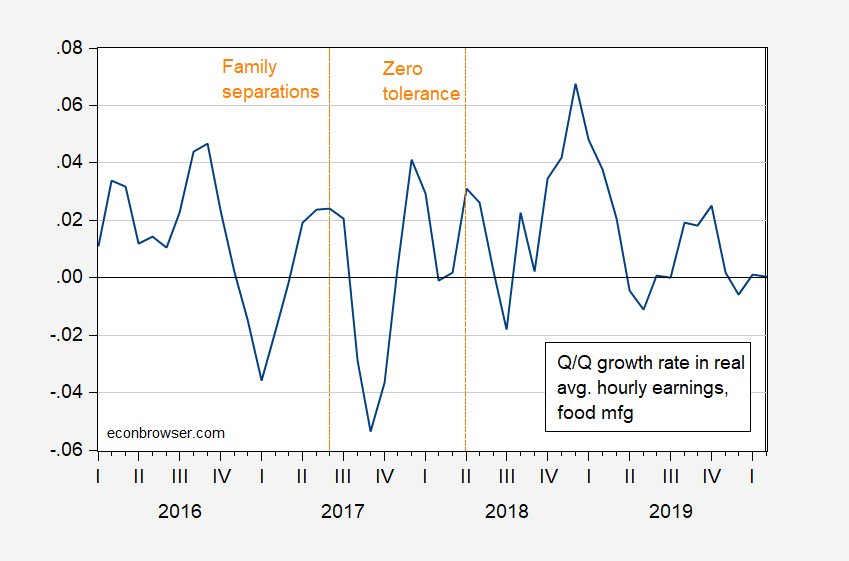

Figure 2: Quarter-on-Quarter CPI deflated wage growth in food manufacturing, annualized (blue). Source: BLS via FRED, and author’s calculations.

This is not the wage in agriculture in terms of produce collection. It’s in food processing (think processing chicken). Prices are not going to be going down because of higher wages.

So we know what a little bit of elevated deportations and limited authorized immigration can do. A much more ambitious program to achieve the Trump administration’s ultimate solution — even if only partway — would likely have larger effects.

Note that given the blended nature of many immigrant households (some authorized, some not), mass deportation could also impact the number of authorized immigrants working in these sectors.

In the medium term, we’ll have a number of measures to look at to assess the effect of immigration enforcement across sectors. Financial filings, price and wage trends and so on.

Immediately, financial market measures are more readily available. Stock performance, CDS spreads – the usual. This is pretty much always the case – hard data takes longer than market data. The performance of financial indicators is an indirect measure; a bunch of people make their best guess about what’s happening. There’s also an element of a Keynesian beauty contest.

And yes, absolutely, comparing performance across firms and sectors is a good way of teasing apart the effects of individual policies from each other and from general economic conditions.

Off topic – financial risks and politics in the Eurozone:

The ECB’s latest Financial Stability Review reads about as you’d expect. Concern has shifted from too much inflation to too little growth. This is reflects EMU/ECB sort of thinking, given that poor growth has been a problem since before Russia’s renewed invasion of Ukraine. The combination of fixed budget rules and a single mandate for the ECB – price stability, but not growth – leaves growth as an official afterthought. Here’s the link:

https://www.ecb.europa.eu/press/financial-stability-publications/fsr/html/index.en.html

The financial press is tossing “fiscal crisis” into coverage of this report, but here’s what Greek rates look like:

https://fred.stlouisfed.org/graph/?g=1BxIq

Ground zero in the last Eurozone financial crisis is looking OK. In fact, it’s France that’s being singled out this time. The review cites “elevated debt levels and high budget deficits” and budget uncertainty resulting from recent “election outcomes…notably in France”.

France has a new parliament, and new governments are meant to come up with new solutions, but budgets are initially the legacy of the last government – just ask Biden or Starmer. Here’s more on the French budget situation:

https://www.politico.eu/article/france-budget-eurozone-michel-barnier-spending-cuts-tax-increases/

Maybe the notion of “crisis” has more to do with tension between governmental levels and compliance with rules than with market dislocation. Maybe the Liz Truss episode next door is fresh in mind.

In a sense, we – rich countries – are all in the same boat. A recession induced by a supply shock, met by fiscal expansion and subsequently by tight monetary policy, has led to a big run-up in debt service costs for many governments. Developed economies, with their soft budget constraints, are nearly all facing this problem.

The more common case of demand or financial shocks causing recession typically leads to a lengthy period of low interest rates; the current pattern is unusual in many ways, including the sudden rise in debt service due to high interest rates. Wrapping official minds around unusual circumstances takes time.