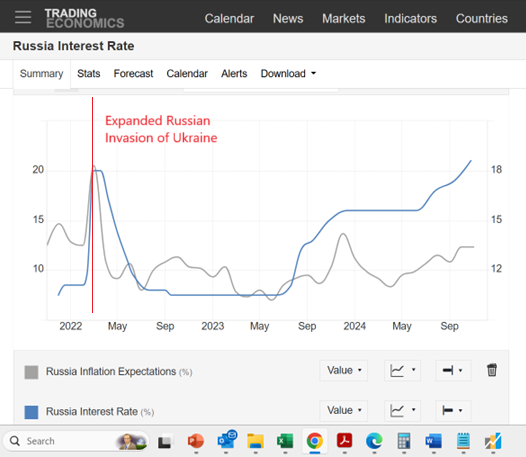

Locking up the butter in Russia (CNN). Official inflation in October was 0.8% m/m (annualize that and it’s about 10%. That’s the official inflation rate. The ex post rate is around 11% then.

Taking the CBR’s expected inflation rate of 13.4% at face value, this implies a 7.6% ex ante real rate. With the policy rate expected to rise to 23% at December’s meeting, this would imply 9.6% ex ante real rates assuming expected inflation remains constant.

There is an interesting question of whether we can take the CPI numbers coming out of the Rosstat at face value. A recent report by the Stockholm Institute of Transition Economics observes:

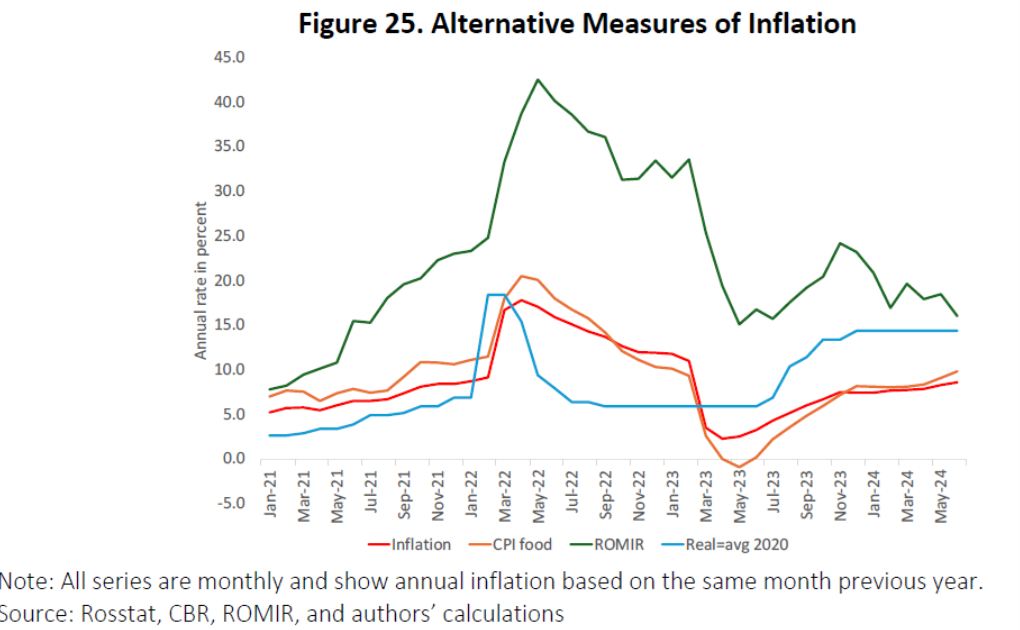

…the credibility of the official inflation numbers put out by Rosstat. Figure 25 shows some alternative measures of inflation that suggest that the official numbers may seriously understate the inflation households face. The first alternative measure is the fastmoving consumer goods (FMCG) index produced by the independent Russian public opinion monitoring service ROMIR.25 The FMCG mostly includes food and cosmetics and ROMIR estimates that the share of FMCG in total household expenditures is around 50 percent. Their index produces consistently higher inflation rates than both total CPI and the food CPI index produced by Rosstat. In May of 2022 their inflation measure peaked at over 40 percent at an annual rate. It has since come down significantly but has remained at around twice the rates published by Rosstat. In June 2024, which is the latest month currently available, the ROMIR inflation rate is at 16 percent versus 8-10 percent for the CPI and food CPI inflation by Rosstat. In contrast to ROMIR, Rosstat traditionally considers the share of food in the Russian CPI basket to be 38 percent, which Milov (2022) argues is too low and leads to an underestimation of inflation. Secondly, Rosstat observes prices for goods which consumers do in fact buy. It is likely that many Russian households have started to buy cheaper substitute goods due to the sanctions and budget constraints and that such substitution effects will not be reflected in CPI.

Here’s Figure 25 from that study.

Source: Stockholm Institute for Transition Economics.

Figure 25 also provides an implied inflation rate if CBR was trying to hold the real policy rate at 2020 levels. Using that logic to construct an alternative expected inflation series makes sense if the natural rate (r*) doesn’t change. However, my guess is that given the large fiscal stimulus and loss of labor stock, r* probably has changed, so the blue line is particularly questionable in my mind.

In any case, a 21% policy rate combined with either 13.4% or 16% (10% official CPI plus 6 percentage points for mismeasurement) still yields a 5-7.6% real rate — pretty high.

A simple budget rule-of-thumb is that g>r means the government budget is sustainable, gg is bad news.

Let’s try again.

A simple budget rule-of-thumb is that g>r means the government budget is sustainable, gg is bad news.

Failed again. Must be a bad character.

You, or the keyboard? (Ha ha!)

By the way, the CNN article identifies the conscription-induced labor shortage, along with resource diversion to military production, as the source of inflation. The arrival of North Korean troops, to the extent it reduces domestic conscription, is a tiny effort at offsetting the labor shortage. Same with the Wagner Groups’ enlistment of foreign nationals. Russia could use a great big gob of immigrant labor, but difficulty feeding, housing and paying them could prove an impediment to recruitment.

Another problem is the xenophobia rampant in Russia – the right wing base supporting the war is very concerned about “others”.

The xenophobia there is even more corrosive than that. The government is emptying out areas with less favored ethnicities by sending them to die in Ukraine. Ethnic Russians, especially those in Moscow and St. Petersburg, are currently being insulated from the reality of Putin’s war. They have economic problems, but they still have most things available to them and they aren’t in much physical danger. For now anyway.

Gaetz has withdrawn from consideration to be Attorney General. Trump’s effort to humiliate Congress has suffered a setback.

Next rapist.

in other news, gaetz replaces Rubio in the senate.

Bill the Diver on West Coast container traffic:

https://www.calculatedriskblog.com/2024/11/long-beach-port-traffic-surges-to.html?m=1

Highest number of inbound containers in history at the Port of Los Angeles, up 30% from a year ago.

So we’re getting hard data on an import surge. Bill thinks it’s an effort to front run tariffs; he’s not alone. So, imports will be a drag on Q4 GDP (Q3, too), while inventories will be a boost. These swings will be reversed once tariffs are imposed, if not before.

These swings, in themselves, don’t change the underlying pace of economic activity, they just move activity around. The drag on underlying activity comes as a result of higher costs, reduced supply and uncertainty, the first two of which depend on the level and coverage of tariffs. As baffling has pointed out, we don’t have a good grasp of future tariff policy – ya know, uncertainty.

Gaetz replacement, Pam Bondi, has her own closet of skeletons. She has long been a loyal Trump toadie. When multiple states formed a coalition to sue Trump University for fraud, Bondi as attorney general pulled Florida out after receiving a bribe payment to her re-election campaign from Trump. And it turns out the campaign contribution was paid from Trump’s charity foundation, which is illegal. Trump was ordered to pay $2 million for charity fraud, shut down his foundation and he and his kids banned from operating a charity.

this is not a skeleton. this is a suit to be worn proudly. you are under the impression that right and wrong mean something today. silly rabbit.

“Taking the CBR’s expected inflation rate of 13.4% at face value, this implies a 7.6% ex ante real rate. With the policy rate expected to rise to 23% at December’s meeting, this would imply 9.6% ex ante real rates assuming expected inflation remains constant.”

Not to beat a dead horse but Steven Koptis insists (for reasons only he gets I guess) that real rates in Russia cannot be greater than 2% so I presume inflation is expected to be 20%. Never mind the fact that a massive fiscal stimulus with tight money would tend to yield very high real interest rates!

“Butter, some meats, and onions are about 25% more expensive than a year ago, according to official data. Some supermarkets have taken to keeping butter in locked cabinets: Russian social media has shown stocks being stolen.”

This made me laugh for 3 reasons. One is that a lot of NYC stores lock up the razor blades. Why is beyond me but it makes shopping a real pain.

Also remember when JohnH used to tell us “guns and butter” applies to US military Keynesianism but not to Putin’s? It seems JohnH has found a new home over at Kevin Drum’s blog. And so far his comments are strangely well behaved.

Now Russian food prices rising by 25% per year. Of course Trump and Bruce Hall kept telling us that US food price inflation is much higher (even though it has been much lower).