Industrial production -0.9% vs. +0.1% consensus (m/m).Here are some key indicators followed by the NBER’s BCDC, plus monthly GDP.

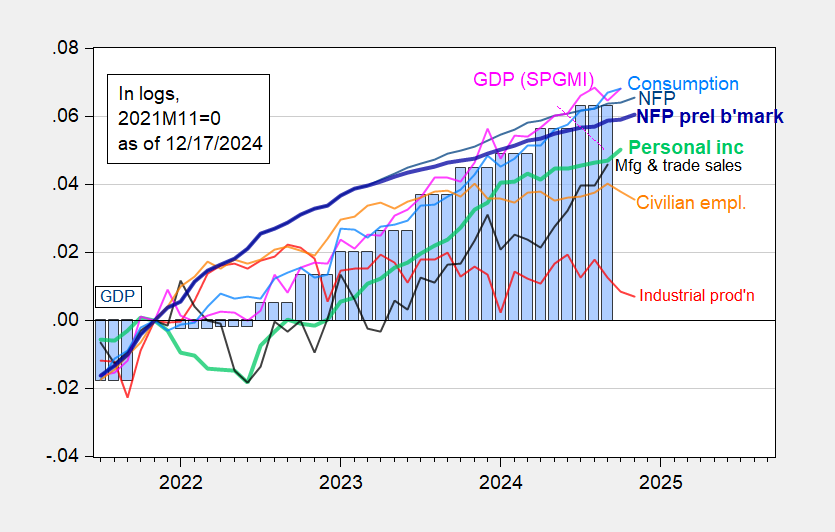

Figure 1: Nonfarm Payroll (NFP) employment from CES (blue), implied NFP from preliminary benchmark (bold blue), civilian employment (orange), industrial production (red), personal income excluding current transfers in Ch.2017$ (bold light green), manufacturing and trade sales in Ch.2017$ (black), consumption in Ch.2017$ (light blue), and monthly GDP in Ch.2017$ (pink), GDP (blue bars), all log normalized to 2021M11=0. Source: BLS via FRED, Federal Reserve, BEA 2024Q3 2nd release, S&P Global Market Insights (nee Macroeconomic Advisers, IHS Markit) (12/2/2024 release), and author’s calculations.

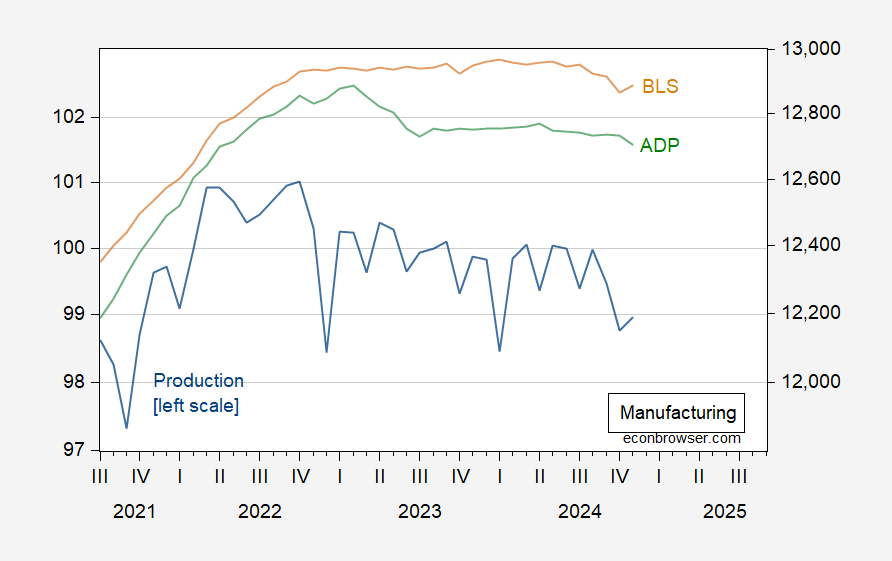

Manufacturing recovered somewhat, but still below consensus (+0.2% vs. +0.5%consensus (m/m)).

Figure 2: Manufacturing production (blue, left log scale), manufacturing employment from BLS, 000’s (tan, right log scale), manufacturing employment from ADP-Stanford Digital Economy Lab, 000’s (green, right log scale), all s.a. Source: Federal Reserve, BLS, ADP all via FRED.

Core retail sales were also below consensus (+0.2% vs. +0.4% m/m), while total retail sales slightly above (+0.7% vs. +0.6% m/m).

Hardly accelerating growth, but too early to declare recession, given increases in employment and personal income in November.

The Philadelphia Fed’s preliminary benchmark, released last week, indicated a SA decline of -0.1% jobs in Q2 of this year:

https://www.philadelphiafed.org/-/media/frbp/assets/surveys-and-data/benchmark-revisions/2024/early-benchmark-2024-q2-report.pdf?la=en

So employment may be substantially weaker than indicated by nonfarm payrolls.

OTOH, measures of real sales and consumption look quite strong for the past six months. And YoY initial jobless claims are only slightly higher than one year ago.

Production is negative (but not as negative as the non-recessions of 2015-16 and 2018-19), and employment has been weakening, but there is no recession now.

Not sure it’s still true, but there have been periods in which strong auto sales often accompanied lackluster non-auto sales. It seemed to be a problem of too little time, rather than shoppers actually pulling in their horns.

The fact that non-auto sales were tepid in a holiday shopping month is notable. It’s hard to find a pattern suggesting holiday shopping strength or weakness – recreational goods up strongly, clothing down, electronics up slightly.