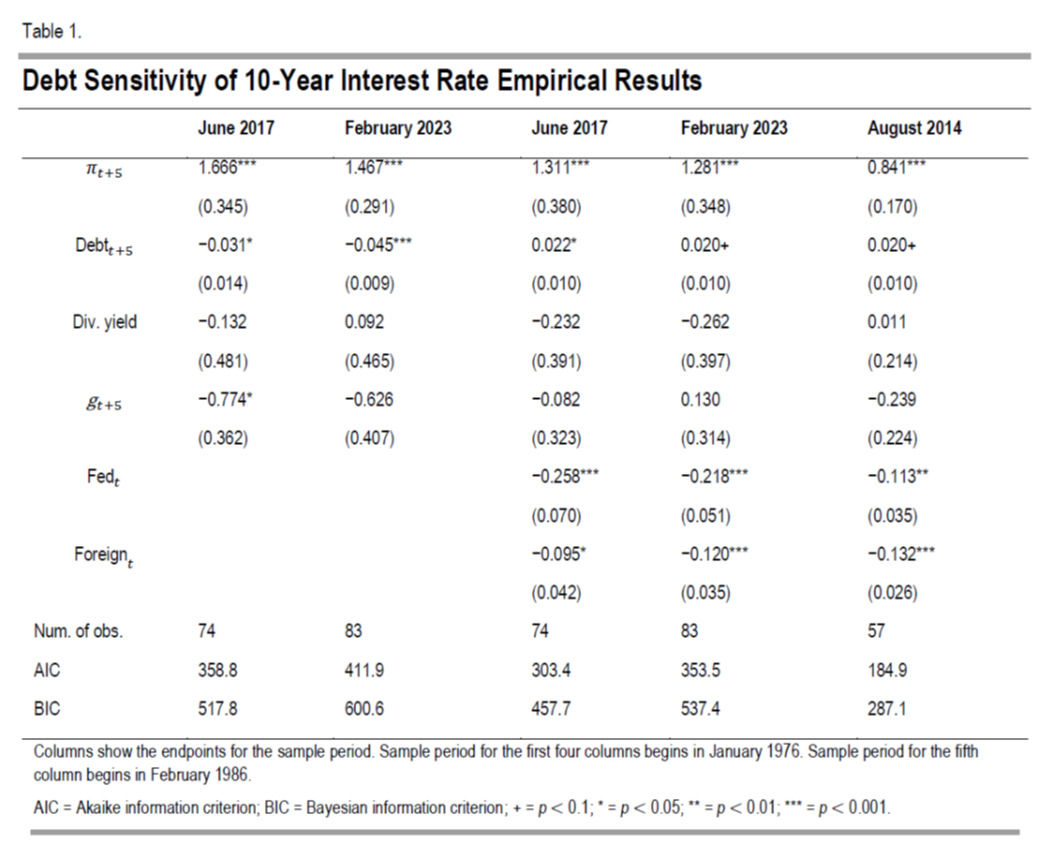

From CBO, a working paper by Andre R. Neveu (FDIC) and Jeffrey Schafer (CBO) on the debt sensitivity of the interest rate (DSIR):

Source: Neveu and Schafer (2024).

Each percentage point of increase in debt-to-GDP results in 2 bps increase in yields.

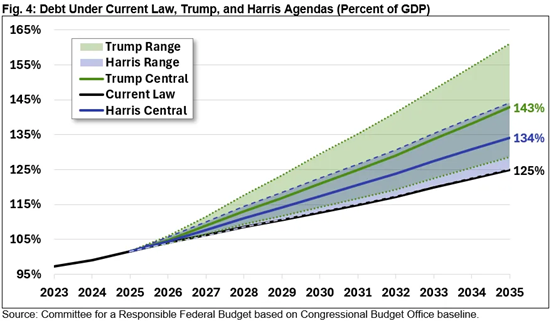

This parameter of interest given the possibility of a fast upward trajectory in debt-to-GDP, as shown here:

Source: CRFB, Oct 28, 2024.

Of course, 2bps per ppt could be low or high. This is somewhat smaller than the estimates we found (Chinn and Frankel, 2004) in data up to 2002.

Maybe Trump will break all his promises, and debt proceeds at baseline. Or maybe he and the Congress will cut Social Security and Medicare benefits (dubious he’d raise taxes on high earners). But I’m guessing he’ll just tank the economy by raising tariffs, expanding deportations, and elevating policy uncertainty, while extending the TCJA further blowing a hole in the budget.

Elizabeth Bowen was probably the fist person to utter “The stupid person’s idea of the clever person.” She said it about Aldous Huxley. Huxley may be the cleverest person ever to be described this way.

The vast right-wing conspiracy provides a lucrative career path for people who appear clever to stupid people. There’s Cass and Antoni and their ilk, many of the “scholars” at Hudson and Cato (though Cato is sometimes more ideogical than dishonest) and so forth. There is every talking head on Faux. It is that ability, the ability to ape intelligent discussion, that makes these lightweights employable.

This travesty won’t go away, because it’s not a bug for the vast right-wing conspiracy; it’s a necessary element in their work. Heck, Donald Luskin has been at it since 2003, and he was hardly the first. Limbaugh was first out of the sewer after the fairness doctrine was overturned in 1987. Heck, Jack Kemp did pretty well pretending to know more than he did. These aren’t just vain idiots pretending to be smart. They are vain middle-brows providing a smokescreen for a right-wing agenda that can’t survive prolonged contact with facts.

The guys with the money need a particular type of pseudo-intellectual muddling every issue, the type that says what they’retold to say. Stupid peoples’ idea of clever people sold the Reagan revolution, the Bush war and both Trump campaigns. They sold Putin’s agenda to the rank-and-file right in the U.S. They sold every tax cut since the budget was last in balance. Truly, a magic formula.

“Greatest living U.S. president” is up for grabs today. The long-standing holder of the title has resigned from the field.

One of the big network evening news programs offered up the view that Carter’s presidency was unsuccessful, but gave him credit for a successful “post-presidency”. Half right, half stupid conventional wisdom. Carter was a one-term president, but measured by his accomplishments in that term, he was a great success.

One source for half-baked histories of Carter’s presidency is that Reagan took credit for Carter’s policy actions, starting with deregulation. The Airline Deregulation Act, the Motor Carrier Act (trucking deregulation), the Staggers Rail Act (introducing competition into rail freight) and the Telecommunications Act (long distance telephone deregulation) all resulted from Carter’s efforts:

https://www.theregreview.org/2023/03/06/dudley-jimmy-carter-the-great-deregulator/

Reaganites claim credit not only for deregulation, but also for the collapse of the U.S.S.R. It was, however, Carter who supported the Mujahideen in driving Soviet forces out of Afghanistan. Oil prices and Gorbachev did most of the rest. Not much credit left for Reagan.

Carter presided over the worst period of U.S. inflation, but he didn’t cause it. If any presidents are to blame for that inflation, they are Nixon and Johnson. Carter appointed Volcker, a Republican, to the Fed, and Volcker’s Fed broke inflation. Carter’s deregulation efforts were also aimed at ending inflation.

And let’s not forget that Ed Meese was responsible for Iran holding hostages until the end of Carter’s presidency, and the Meese did it to get Reagan elected. The Iran-Contra affair began with a Reagan backer urging Iran to hold U.S. diplomats, U.S. citizens, captive for partisan political gain.

Carter did not break unions, didn’t weaken environmental regulation and didn’t run up a massive budget deficit. He did try to impose higher taxes on the oil industry, but Congress, already in the pocket of Big Oil, blocked new taxes on oil. The neo-liberal agenda was unheard of during Carter’s presidency. His accomplishments were so great that his successor had to claim credit for them in order to have much of a legacy of his own.

Carter is exactly the president we need today. Honest, intelligent, focused on policy over politics. Sadly, there is no one like him on the scene today.

OK, one last thing. During Carter’s presidency, labor compensation amounted to between 56.% percent of GDP and 57.7%, nearly the highest ever. In the latest full-year reading, for 2023, labor compensation was just 51.7% of GDP. With the end of Carter’s presidency came a turn away from equitable income distribution.

Like Biden (and Harris), Carter was voted out of office because of inflation that wasn’t his fault. Unlike Biden, Carter was also voted out because of the side effects of a fight against inflation that was of his own choosing.

Biden will be discussed in a similar vein to carter. He dealt with inflation that came from trump era. He created good policy that will take time to affect, and trump will steal his credit. He was a good man who acted honorably. Alas, the modern world does not want that kind of man. Does not stand out on tiktok.

Fyi, tiktok has been banned by abbott in texas. Abbott is becoming a little dictator in texas. The rest of the country should wake up and take notice of the undemocratic actions in texas these days.

Oops! Forgot Carter’s Nobel Peace Prize. Peace between Egypt and Israel could have been a foundation for a wider peace in the region, but kind like turning our backs on the Mujahideen, we couldn’t be bothered to do the tricky business of foreign affairs after the immediate crisis had passed.

Why would one not use time period “t”, where “t+5” is indicated and “t-5” when “t” is shown, so as to use actual data perhaps as an additional test model?

Flags will be at half staff for 30 days for a former President, including Trump’s inauguration. He’s going to be so angry but it will be a fitting signal for the start of his administration.

This is according to a proclamation signed by Eisenhower back in 1954. Of course that doesn’t prohibit Trump from reversing it on his first day, because that’s just the sort of person he is.

Remember when Trump ordered flags to be raised a day after McCain died and only lowered them again for the funeral after blistering criticism from both Republicans and Democrats.

Deportations are already happening. Deportations are a federal system thing, just not Federal government. All 3 levels were heavily deporting in 2024. I think as more updated data comes, it will surprise many people.

Tariffs will burst the US consumer credit bubble and micro bubbles like students loans and agriculture. a inverse of 2008. Nominal GDP still has never come back to precovid path levels. My guess a spike of inflation followed by a sharp disinflation in 2026 as the economy contracts. The trade warriors, desperate to rebuild the unrebuildable fall by the way side and voting ranks by 2026. The pain of realizing economic growth is over essentially and especially industrial growth has been long dead, will cause voting turnout to collapse. Its long overdue. The dollar dies as “the” world reserve currency and instead becomes a world reserve currency. The loss of wealth of the billionaires will be epic. Yet unsettling as they are still far richer than everybody else. Anti-crypto legislation starts popping up. Note, people are noticing the drain of energy it provides in a world heading towards a refining/transportation crisis as cheap sweat oil runs out.

Predictions are fun. The mechanisms by which you expect your predictions to come to pass are more interesting. What ya got?

By the way, our host has posted a good bit on the dollar’s role as a reserve currency. Might want to rub your ideas up against his.

Off topic: Occasionally, this blog carries discussion of monopsony power and its effect on wages. There are two new studies of the impact of Walmart on local incomes. Both find that, contrary to the claims of Walmart and the some members of the economics profession, Wal-Mart’s low prices don’t offset the impact of low Wal-Mart wages. First up, “Monopsony Power and Poverty: The Consequences of Walmart Supercenter Openings”

Here’s the abstract:

“Prior research suggests that Walmart Supercenters exert substantial power over the low-wage labor market, though the consequences of Supercenter openings on household incomes and public finances are less clear. This study uses restricted-access Panel Study of Income Dynamics data from 1970 to 2019 to study how Walmart Supercenter openings affect poverty, tax liabilities, and receipt of income transfers. Using a stacked difference-in-differences approach, we find that the opening of a Supercenter leads to a 2 percentage point (16%) increase in poverty. This increase is channeled through declining annual earnings and persists for 10 years following the Supercenter’s entry. Increases in poverty are particularly strong for younger and less-educated adults, and for adults with pre-treatment incomes below the national median. Moreover, Walmart Supercenter openings lead to a $200 (or 16%) per household per year increase in government income transfers received, and a $920 (or 5%) per household per year decrease in tax revenues.”

https://www.iza.org/publications/dp/17323/monopsony-power-and-poverty-the-consequences-of-walmart-supercenter-openings

Here’s another:

Walmart Supercenters and Monopsony Power: How a Large, Low-Wage Employer Impacts Local Labor Marke

Here’s the Abstract:

“This paper considers the extent and impact of monopsony power exercised by Walmart Supercenters. I focus on Walmart as it has long been the largest private-sector employer in the U.S., and as it pays very low wages. Previous research into the firm’s labor market impact has yielded incongruous results, with little consensus on how to address identification concerns regarding endogeneity of store entry. A more recent literature has also demonstrated that widely-used estimators are often subject to numerous sources of bias when units are treated at different times. I address these identification concerns by adopting a stacked-in-event-time synthetic control approach to estimate average county-level labor market effects of the Walmart Supercenter roll-out across the U.S. Crucially, I construct the pools of synthetic control donor counties from novel observations of counties where Walmart tried to open a Supercenter but was blocked by local efforts. I find Supercenter entry caused significant reductions in local aggregate employment and earnings. Retail employment concentration grew, as retail employment initially jumped up before reverting to pre-entry levels. In counties with a Supercenter, subsequent exogenous minimum wage increases led to significant growth in aggregate and retail employment. These results run counter to predictions for competitive labor markets, and indicateWalmart Supercenters gradually accumulated and exercised monopsony power in their local markets for labor, with negative consequences for workers.”

https://equitablegrowth.org/working-papers/walmart-supercenters-and-monopsony-power-how-a-large-low-wage-employer-impacts-local-labor-markets/

Both studies find that Walmart has a significant effect in lowering real incomes. Both studies are written by economists, and economists, we’re told, don’t care about income distribution…well, what do you know?!?!