Mark Sobel at OMFIF discusses the likelihood of an new Plaza Accord to depreciate the dollar. Given one would need Euro area and Chinese agreement, the assessed likelihood is low

A Mar-a-Lago Accord also would be inconsistent with Europe’s cyclical situation. A devalued dollar would be tantamount to a stronger euro. That could be achieved by higher ECB interest rates and/or fiscal expansion in key European nations. But the ECB is now cutting rates given weak European economies and key countries such as Italy and France lack fiscal space.

G3 foreign exchange market jawboning and interventions, absent changes in fundamentals, are largely ineffective. Of course, exchange rates are driven by the entire balance of payments, often reflecting interest rate differentials, and thus it is almost impossible to foresee how capital flows and exchange rates might respond to any accord.

Would China agree to an accord?

Trump’s ‘devaluation’ rhetoric is heavily aimed at China. China was not a party to the Plaza Accord but it would need to be central to a Mar-a-Lago Accord.

…

A weakening renminbi poses conundrums for Chinese authorities. The renminbi is already falling against the dollar, towards 7.3 currently, reflecting in large measure general dollar strength and anticipation of tariffs (Figure 1). But sharp depreciation against the dollar runs the risk of spawning a massive one-way capital outflow as happened in 2015-16, an experience China doesn’t want to see replicated. The authorities might have some temptation, however, to let the renminbi fall in a restrained manner to offset the impact of tariffs and send Trump a message.

This article spurred me to examine the US effective exchange rate, measured using (the conventionally used) CPI and unit labor costs (the latter more relevant for evaluating “competitiveness” — see discussion here).

Figure 1: CPI deflated trade weighted value of US dollar (blue), and ULC deflated value of US dollar(tan), both in logs 2000Q1=0. NBER defined peak-to-trough recession dates shaded gray. CPI series is Fed goods trade weighted series spliced to goods and services trade weighted series at 2006M01. 2024Q4 observation is for October-November. Source: Federal Reserve Board, and OECD, both via FRED, NBER, and author’s calculations.

So on both CPI deflated and ULC deflated (“competitiveness”) terms, the dollar is indeed not as strong as it was in the mid-1980’s. So why the Trumpian fixation on the exchange rate? Are exchange rates inessential to the trade balance? I’d say no, having been the contributor to many papers on the elasticities approach to trade flows (see here and here). However, I’d also say that at the medium run, private saving relative to investment, and public saving (i.e., the budget balance) are going to be key determinants of the current account and indirectly then the trade balance (as in the IMF’s earlier Macroeconomic Balance approach underlying CGER, and Chinn and Prasad (2003), and various Chinn-Ito papers [1] [2] [3] [4]).

The Trumpian idea of forcing a depreciation of the dollar will then likely have little medium term effect on the trade balance in the absence of somehow adjusting macroeconomic balances (admittedly, throwing the US economy into a recession would tank investment, (S-I) would increase and ceteris paribus the current account improve).

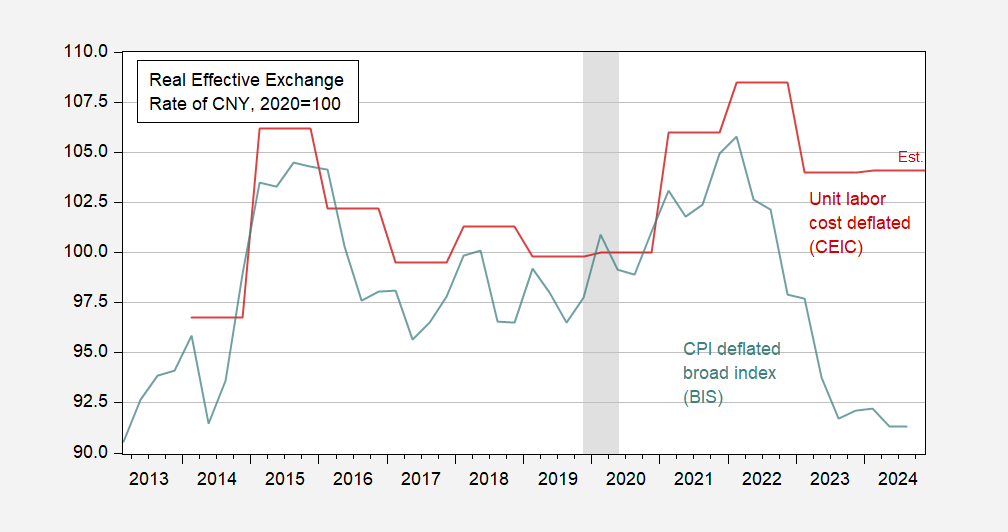

On the point that China is unlikely to let it’s currency appreciate against the US dollar, it’s interesting to inspect not only the CPI deflated yuan (as Sobel does), but also the ULC deflated yuan (this took some hunting around):

Figure 2: [graph changed 12/13/2024] CPI deflated value of Chinese yuan (red), ULC deflated value of Chinese yuan (blue), 2020=100. ULC is economywide. 2024 observation is forecast. Source: BIS via FRED, CEIC.

The Chinese are trying to spur growth in their economy, in part by spurring net exports. Appreciation works against this.

By the way, if indeed the Trump administration plans to slap a 60% tariff on China, just remember the standard deviation of the month-on-month change in the CNY/USD exchange rate (2018-2024) has been about 1.3% (not annualized). At the possible cost of capital flight, the Chinese could allow substantial yuan depreciation, although as Sobel notes, a more “managed” depreciation might be implemented.

At a minimum, don’t expect a grand plan to arrange euro and yuan appreciation.

“…private saving relative to investment, and public saving (i.e., the budget balance) are going to be key determinants of the current account…”

In other words, Trump is attempting to bully other countries into undoing some of the effect if his desired fiscal policy. They pay for our dogma.

Menzie, your “here and here” links are missing.

Please, please, please don’t let it be called the “Mar-el-Lago accord”.

It’s probably only fair to note that the French budget “crisis” is partly the result of a formal rule which puts France at risk of not getting ECB help if needed, rather than actual default risk or “market vigilante” concerns. The French deficit is similar to the U.S. deficit, as a share of GPD, and the U.S. may be headed for worse:

https://fred.stlouisfed.org/graph/?g=1C6oF

Both issue debt in their own currency. The French budget isn’t some crazy tilt-a-whirl spinning out of control.

My point is that, while Trump is pursuing a particular dogma and trying to shove the cost onto our trading partners, Europe is pursuing a (rather Germanic) dogma of its own. Just ask the Greeks.

I think it would be a mistake to engage in a Rube Goldberg currency mechanism as a buffer against Trump’s fiscal misdeeds. That doesn’t mean Europe’s fixation on budget ratios should be ignored.

deary me why of why is devaluation mixed up with depreciation

The former a government can do. the latter it cannot.

It seems to me that all of Trump’s bluster will lead U.S. trading partners to seek more reliable partners elsewhere – just like it did last time – leading to decrease in U.S. GDP. https://global.chinadaily.com.cn/a/202408/22/WS66c69619a31060630b9245c5.html

Of course with more tax cuts for wealthy – we can expect stock buybacks and an increase in stock prices. And with a cut in regulations we can expect an increase in some speculative asset – had someone from Texas telling me the other day that I should invest in Crypto-Coin ETFs – Wasn’t there a run up in prices in these Crypto-Coins in the first Trump admin?

(Menzie – now that Krugman has retired from writing a NY Times column – perhaps you could offer to write some balanced economic analysis for them?)

“The dollar soared in the early 1980s on the back of Federal Reserve Chair Paul Volcker’s monetary tightening to wring inflation out of the economy and President Ronald Reagan’s expansive fiscal deficits on the heels of tax cuts and increased defence spending. US interest rates and the dollar soared. The dollar came off its highs in early 1985 and the Plaza Accord later that year gave it an extra push. That push involved G5 country commitments to take fundamental actions in support of desired currency movements, including the US getting its fiscal house in order and others boosting domestic demand. It involved agreements to intervene in currency markets.”

Nice description of the St. Reagan years. Reagan had charlatans as advisors until Martin Feldstein et al. stepped in and did their best to undo the Reagan fiscal fiasco which cause national savings to fell. Trump has created a similar fiscal fiasco and the clowns he listens to are worse than the Reagan charlatans.

You may have noticed that the current generation of Republicans no longer has much use for Reagan, not even the imaginary Reagan who never raised taxes and brought down the Soviet Union single-handedly. Republicans have a new demi-god, more in the image of Nixon than a Reagan, but without the knowledge base.

my biggest disappointment is that those Reagan republicans have had multiple opportunities to rid the party of trump. but they chose not to do so. they still voted for trump. lack of a spine? pragmatists? fear? not sure why. but the party of Reagan is effectively dead at this point.