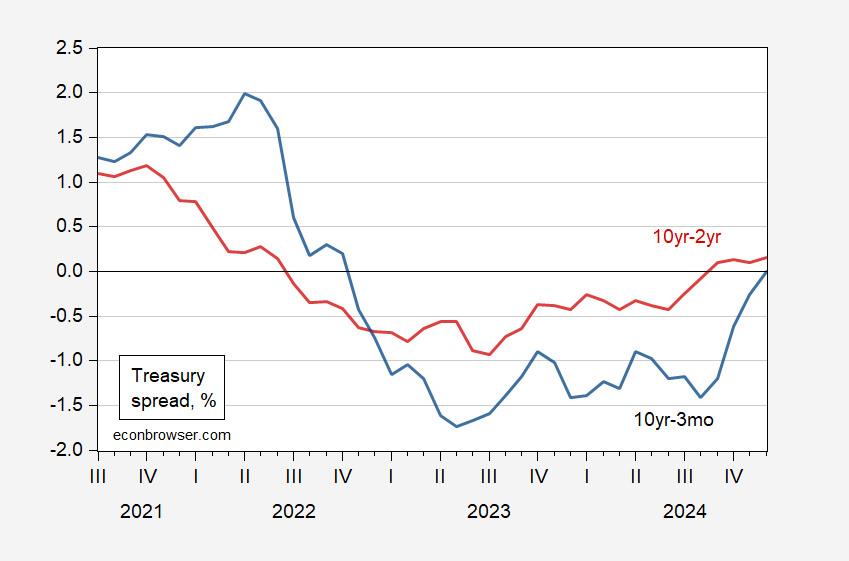

With December 31 data, here’s the picture of term spreads:

Figure 1: 10yr-3mo Treasury spread (blue), 10yr-2yr Treasury spread (red), both in %. Source: Federal Reserve via FRED, author’s calculations.

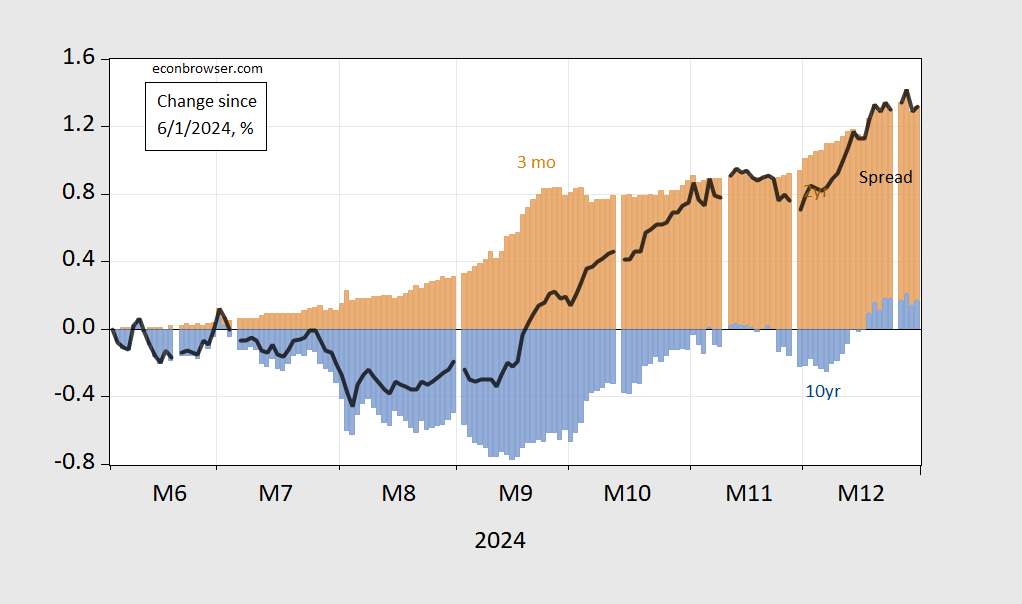

Bull or bear steepening in the 10yr-3mo? Here’s daily data:

Figure 2: Change since June 1, 2024 in 10yr-3mo term spread (bold black), contribution to change from 10 year yield (blue bars), from 3 month yield (tan), all in percentage points. Source: Treasury via FRED, and author’s calculations.

It’s the case that the majority of the disinversion since June 1st is due to the short rate falling, not the long rate rising.

Using a specification incorporating the 3 month change in the spread, a probit model implies 61% probability of recession in 2025M04, compared to 31% using a spread only…

Gasoline prices in my vicinity have been very strange the last two days, one of the stations I can usually count on as being one of the cheaper ones was $2.59 today. This just after getting gas for $2.41 yesterday (different, semi-dependable station), and a station sometimes on the high end price-wise was at $2.43. Weird.