Top of my list:

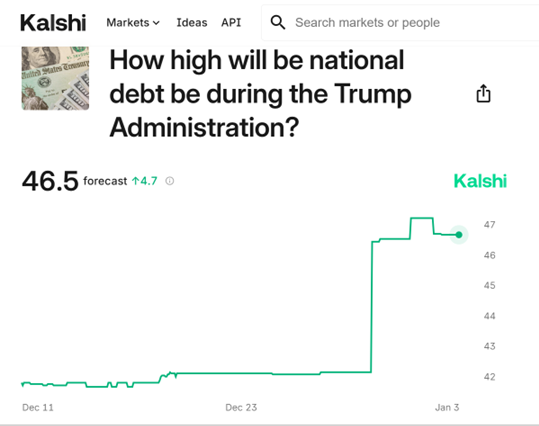

Source: Kalshi, accessed 1/3/2025.

Would this be bad news? Well, yes. But worse yet given the incoming administration. For proof, I have but one word: “bleach”.

Second:

Source: Kalshi, accessed 1/3/2025.

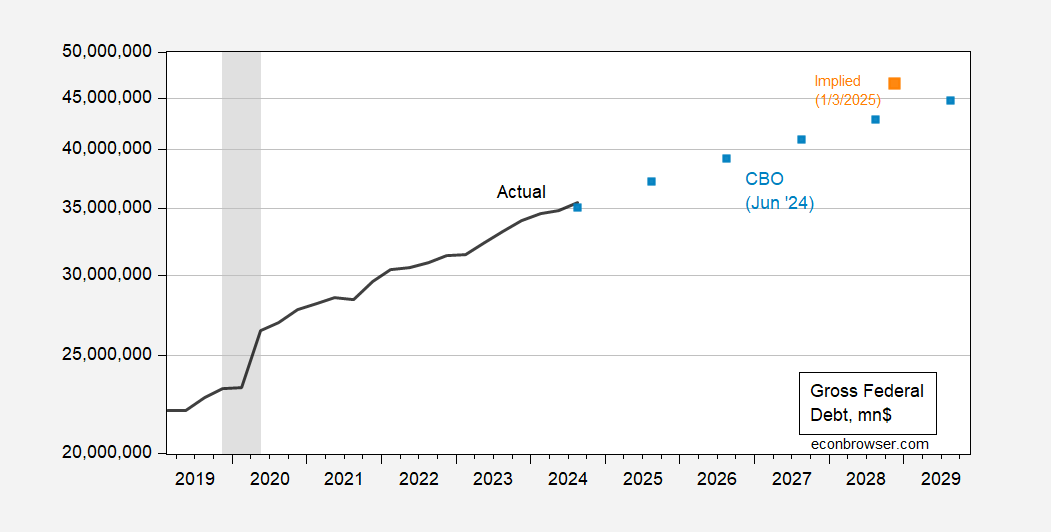

For comparison, the June 2024 CBO Economic Outlook update projected $42.9 trillion gross Federal debt by end of FY2028 (September 2028). That means bettors think Trump will raise deficits by about $3.5 trillion relative to baseline.

Figure 1: Gross Federal debt (black), CBO projection under current law (light blue squares), implied by Kalshi 1/3/2025 (orange square). NBER defined peak-to-trough recession dates. Source: Treasury via FRED, CBO, Kalshi 1/3/2025.

Remember, that’s over 4 years. A Bloomberg tabulation of Trump promises placed the cost at $11 trillion over ten years.

Both are definitely risks, but I think I would put the following geopolitical risk ahead of #2, and maybe even make it #1:

After Trump cuts off all aid to Ukraine, Putin overruns the country, and moves directly into Moldova, which drives millions of refugees into central and Western Europe, further inflaming right wing politics there and destabilizing those democracies. Next he directly threatens the Baltics. Trump says he won’t defend them, causing a further crisis.

As I said last week, Trump would have a meltdown over the half staff flags honoring Jimmy Carter.

The Narcissist in Chief today: “Because of the death of President Jimmy Carter, the flag may, for the first time ever during an Inauguration of a future President, be at half mast. Nobody want to see this, and no American can be happy about it.”

He’s mentally ill.

Oh, and don’t be surprised if Trump rescinds the flag order immediately as the first act after his inauguration. He will love the reality show optics of the flags rising on a new day of MAGA magnificence.

Financial disintermediation is always on my list. I could make up a list of possible financial shocks, but that’s not usually how disintermediation happens; surprise is part of the pattern for financial shocks. If the public knows that officials are standing by to patch up, say, French collateral problems, then French collateral is unlikely to be the problem. Italy’s banks didn’t collapse when they were the monster under the bed, but little Thailand kicked off the Asian financial crisis. When Lehman went down, most folks weren’t looking at repo trade as a big risk. Repo traders, in the other hand…

We can quibble over whether disintermediation is often the ultimate cause of a crisis, but finance is a magnifier and transmitter of risk, and I think that always qualifies for a list of risks.

Politico has rounded up 15 credentialed guessers to write about their favorite “black swan” for 2025. Epidemic is on the list. Iran shows up more than once. Not all of them are bad news:

https://www.politico.com/news/magazine/2025/01/03/15-unpredictable-scenarios-for-2025-00196309

Is it really a “black swan” if it ends up on Politico before the fact?