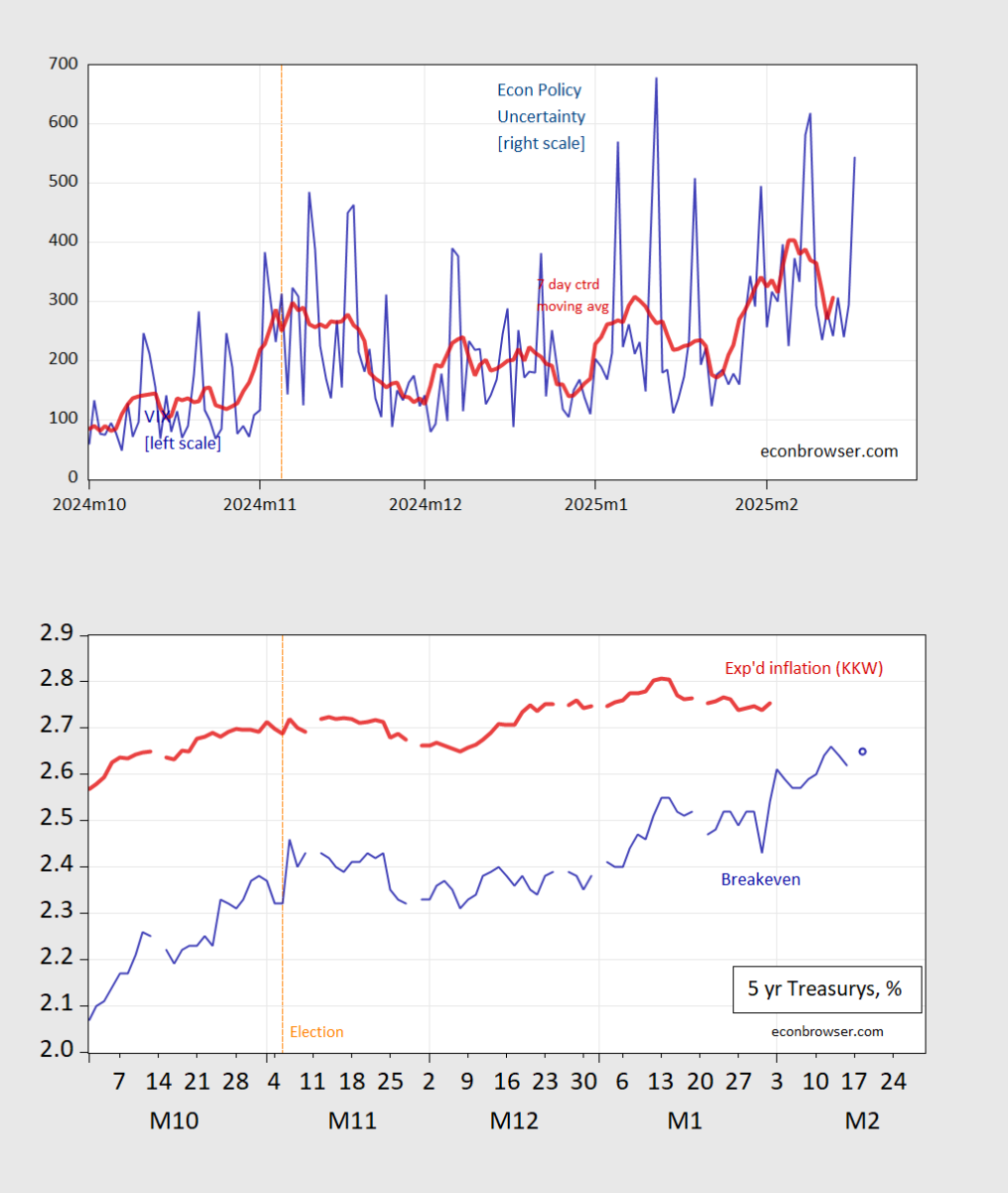

From election day, five year inflation breakeven up 33 bps; EPU up 231. What could go wrong?

Figure 1: Top graph – EPU (blue), 7 day centered moving average (red); bottom graph – five year Treasury-TIPS breakeven (blue), and KKW estimate of five year inflation (red), both in %. Source: policyuncertainty.com and Treasury via FRED and author’s calculations.

On a related topic, the U.S. is stepping up efforts to cut Iranian oil shipments to China:

https://www.reuters.com/business/energy/us-imposes-sanctions-individuals-tankers-shipping-iranian-oil-china-2025-02-06/

Reuters describes the effort as incremental, involving “a few individuals and tankers”. AP’s reporting includes unnamed firms in India, the UAE and China among targets of increased sanctions. Meanwhile, the felon-in-chief has declared his intention to cut Iranian oil shipments to China to zero, something he failed to do in his first term.

A good bit of electronic ink has been spilled speculating about how effective new sanctions can be and how China and Iran will respond. Most of this speculation pretends more insight than is actually provided – all pretty vague.

Recall that European countries have recently put more pressure on Russia’s shadow fleet of oil tankers. This, too, is not yet a big deal for global supply, but could become more important if Russia’s fleet can be contained.

Pipelines offer a longer-term solution for Russia and China (perhaps at some cost to Iran?). Both efforts, if successful, would keep oil off the market, raising prices, limit growth and boost demand for renewables and gas.

G7 is preparing to tighten (lower?) the price cap on Russian oil:

https://gcaptain.com/g-7-allies-weigh-tightening-russian-oil-price-cap/

The U.S. is attempting to keep Europe out of negotiations to end a European war, but is happy to allow G7 members to help pressure Russia to negotiate.

Looks like the felon-in-chief is a fan of all kinds of trade action, not just tariffs. Also, clearly, a fan of fossil fuels. Put ’em together and what have you got? Oil as a policy tool.

By the way, the leader of one of Russia’s biggest oil clients, India, has recently said that India is not neutral regarding Russia’s war on Ukraine – India is on the side of peace. To my knowledge, this is so far nothing but talk, but talk is better than silence.

Nothing personally, but G7 is irrelevant. There is nothing to negotiate and Trump is a kompromat. Russia is getting IOW’s now. Oil is diminished in importance.

Trade sanctions are hard work, and never do as much as the public wants, but they aren’t nothing. Dismissing them as irrelevant, diminished, or whatever, is defeatist. You do the work. You keep the pressure on. The increments add up.