Personal income growth at +0.8% m/m vs +0.4% Bloomberg consensus, while consumption growth is +0.4% m/m vs 0.5% consensus. GDPNow adjusted for gold imports now at -0.5% q/q annualized. Michigan final expectations for March down 52.6 vs 54.2 consensus.

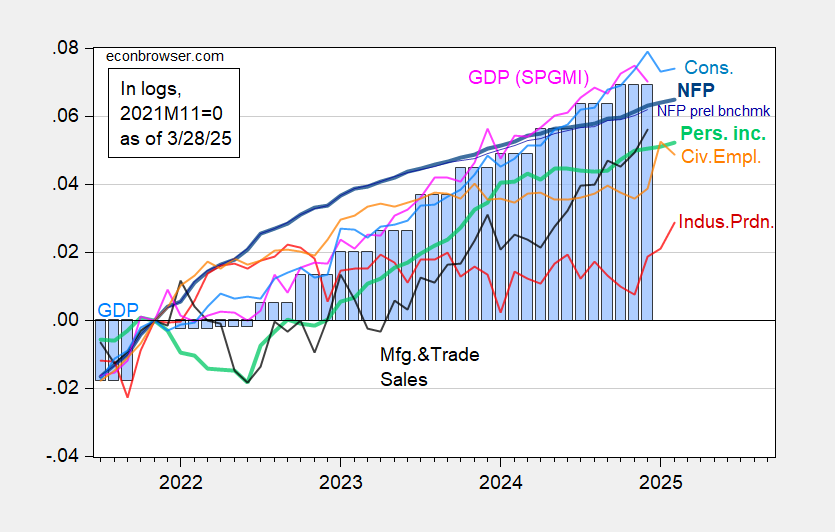

Figure 1: Nonfarm Payroll incl benchmark revision employment from CES (bold blue), implied NFP from preliminary benchmark through December (thin blue), civilian employment as reported (orange), industrial production (red), personal income excluding current transfers in Ch.2017$ (bold light green), manufacturing and trade sales in Ch.2017$ (black), consumption in Ch.2017$ (light blue), and monthly GDP in Ch.2017$ (pink), GDP (blue bars), all log normalized to 2021M11=0. Source: BLS via FRED, Federal Reserve, BEA 2024Q4 advance release, S&P Global Market Insights (nee Macroeconomic Advisers, IHS Markit) (3/3/2025 release), and author’s calculations.

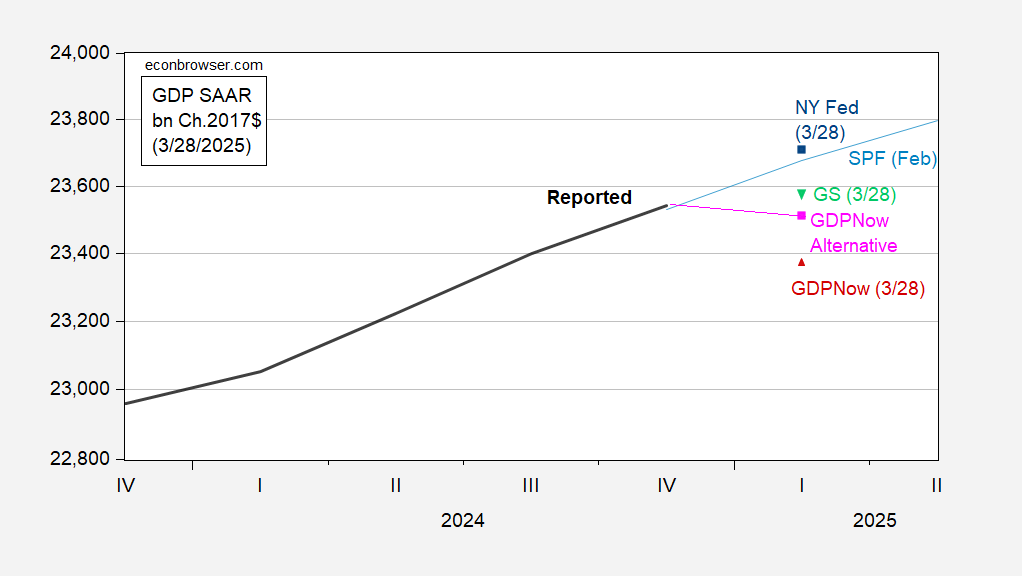

Consumption numbers shift downward the nowcasts.

Figure 2: GDP (black), GDPNow of 3/28 (red triangle), GDPNow adjusted for gold imports (pink square), NY Fed of 3/28 (blue square), Goldman Sachs of 3/28 (inverted green triangle), February Survey of Professional Forecasters (light blue), all in billion Ch.2017$ SAAR. Source: BEA, Atlanta Fed, Philadelphia Fed, NY Fed, Goldman Sachs and authors calculations.

Kalshi registers 0.5% q/q AR in Q1, as of 3/28, around GS at 0.6%.

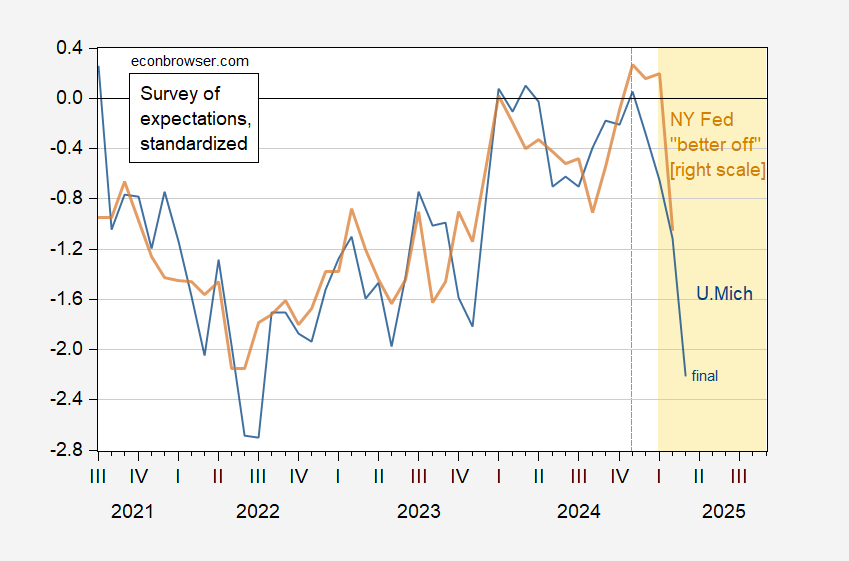

Expectations have fallen further in the final March numbers.

Figure 3: U.Michigan expectations index (blue), and NY “better off” aggregate (tan), both demeaned and standardized (2013M06-2025M02). Source: U.Michigan, NY Fed, and author’s calculations.

A decline in stock indices and term spreads is to be expected.

I thought it would be fun to see how MSN Pilot would answer Professor Chinn’s question.

1. Precautionary Savings: Individuals might be saving more due to uncertainty about the future, such as concerns about job security or economic downturns. This behavior is common during periods of economic instability.

2.Debt Repayment: Higher income might be directed towards paying off existing debts rather than spending on goods and services.

3. Changes in Consumer Preferences: There could be a shift in preferences, where people prioritize saving or investing over immediate consumption.

4. Inflationary Pressures: If prices are rising faster than income, consumers might cut back on spending despite having higher earnings.

5. Income Distribution: If the rise in income is concentrated among higher-income individuals, it might not lead to proportional increases in consumption, as wealthier individuals tend to save a larger share of their income.

Yes to #5 in particular!

See below.

6. Individuals who because of their dislike and dismay of Trump and his ilk vow that over the next 4 years to minimize their participation in the Trump economy. (I fall into this category. I am 70 plus, retired, with no debt, live in flyover country and my retirement is such that I am still saving money. I don’t plan on spending money on diddly squat that I don’t have to.)

We don’t get monthly data on spending at various income levels – not that I know of. Nor do we get income gains at various income levels. So it’s impossible to tell yet whether either income gains or spending were concentrated at some income level.

I have an idea I like based on income levels, but I can’t make it work, based on the information I have. The idea is that maybe richies, took a breather. The can do that because their spending is vastly above subsistence. Their spending is also very little constrained by short-term income swings, so the rise in income in February wouldn’t mean much to their spending, even if they were its beneficiaries. So far, so good – richies could be the source of the Q1 spending slump.

Why would they be the source? Many richies live on borrowed money – odd, but true – so what happened to their ability to borrow in January and February? They borrow against assets, so asset values matter. Here’s the problem with my story: equity values were in pretty good shape until late February, and housing values remain in good shape.

The only impediment to borrowing in early Q1 was that interest rates had bounced at the end of last year and didn’t really start to slide until late February. Rates had been higher earlier in the period when richies were already driving consumption gains, but maybe a rise in borrowing costs put them off?

Not a great story, but while job growth continues, it’s hard to tell a story in which regular folk abruptly slow their spending. Too much of regular folks’ spending is either basic needs or is programmed – dance lessons, Netflix, Friday date night for mom and dad. Regular folks change spending habits slowly and reluctantly.

For what it’s worth, goods spending was particularly weak in January, but services spending weakness has been more persistent:

https://fred.stlouisfed.org/graph/?g=1G1Fd

Don’t know why. Maybe restaurants?:

https://fred.stlouisfed.org/graph/?g=1G1JG

Spending on services has historically continued to rise right on through recessions, except for severe ones like 2007-09. It is spending on goods that takes the hit.

Despite the storm and drang I am reading at most places, I am not overly concerned about the decline in spending in January and February. That’s because the *exact same thing* happened one year ago: after a sharp increase in December, spending fell back in January and February. And PCE inflation did the same thing: rising more sharply from December through March, giving rise to a lot of recession worries, after which it went back to sleep.

So until proven otherwise I think this is yet another example of unresolved seasonality due to the COVID years.

BTW, there are at least two decent weekly measures of consumer spending: Redbook (retail) and OpenTable (restaurants). I won’t bother with the links, I’m sure they will be easy to find. Both have been doing just fine YoY at the moment.

interest rates did not drop throughout the end of last year and first quarter of this year like many had predicted mid year of 2024. I think wealthier households are holding back on spending because the cash is still earning well over 4% interest right now. the expectation had been that rates would fall by now or later in the year. in think until we get clarity on the fall, spending from the wealthier side may be moderated. if rates drop another 1% or more, then spending will resume. I am sitting on plenty of cash that am happy not to deploy at this point in time. because who knows what the nincompoops in the White House will screw up next! and I do have a couple of spending projects which will gobble up quite a bit of cash. new car and new windows for the house. may hold off on the car purchase if the tariff and EV tax break are not clarified, however.

Claudia is out with her latest read on FOMC thinking:

https://www.investing.com/analysis/stagflationary-risks-will-slow-the-fed-down-200658838

The highlight is a stagflation “whiff” in the latest FOMC communications, but not full stagflation. (“Whiff” as in “brief stench”, not a swing-and-a-miss.)

What I liked most about her piece is the assessment of forecast risks among FOMC members. Uncertainty is elevated, but not off the charts. Notably, though, “uncertainty” is all one way – toward stagflation. The risks to GDP are all on the downside, risks to unemployment and inflation all to the upside. That combination is at its greatest extreme in the history of the FOMC’s Summary of Economic Projections.

So the FOMC, behind the scenes, should be thinking through its policy options for stagflation. We know what Volcker did. Is squeezing out inflation, no matter the cost, appropriate today? We have a far more financialized economy and a far larger stock of public debt than in Volcker’s day. Think what would happen if the FOMC released a “damn the torpedoes” policy statement about bringing inflation down.

“Think what would happen if the FOMC released a “damn the torpedoes” policy statement about bringing inflation down.”

trump is relying on a drop in the interest rates to further his agenda. he will not tolerate increased rates, which would set up a battle with the fed. I do not believe fed leadership is willing to confront trump on this issue, no matter what they say. they will be bullied by trump.

at the end of the day, trump cannot tank the economy with doge cuts, cut taxes and revenues, and still end up with high interest rates. he can lie about inflation, but not interest rates. so he needs to make sure the fed has rates that are not high. it will be a disaster for him otherwise..

Ya know how the felon-in-chief occasionally tries to claim that either tariffs or deportations are necessary to keep fentanyl out? Turns out, egg smuggling is the real reason. Massive egg smuggling:

https://www.npr.org/2025/03/28/nx-s1-5342554/eggs-border-seizures-fentanyl?

Just a couple of observations:

• Vehicle sales took a dip in January but have ticked upward in February (seasonally adjusted annual rate) and remain roughly at 2024 levels. https://fred.stlouisfed.org/series/TOTALSA

• Existing home sales recovered from the 2024 low and are close to one-year ago levels (seasonally adjusted annual rate) https://fred.stlouisfed.org/series/EXHOSLUSM495S

As for the infamous egg prices, it is still a supply issue for a couple of reasons (one of which is being investigated by the DOJ) and explained nicely here which also gives some historical context for the last time prices spiked during the Obama Administration. https://www.cnet.com/home/kitchen-and-household/why-are-eggs-still-overpriced-one-economist-gave-us-an-analysis/

However, buying eggs and buying homes and vehicles involve somewhat different decisions. My daughter-in-law, who is a realtor, seems quite busy right now. Apparently, Heisenberg’s principle isn’t quite strong enough yet. Regardless, I’d say #2 on AS’ list could be influencing purchase patterns. Unlike the Federal government, consumers can’t print more money.

https://www.newyorkfed.org/microeconomics/hhdc.html

While considering Brucie’s latest contribution, let’s review his prior one, regarding a Washington Post article reported that cuts to the IRS budget could lead to up to half a trillion dollar reduction in tax revenue did to tax evasion:

– Brucie said that’s just tax avoidance, which is legal. Wrong. The article made clear that tax evasion, which is a crime, is the concern. Right there in the article, but Brucie claimed otherwise.

– Brucie blamed Democrats, saying they should have done something when they were in power. In fact, Democrats did do something; they had increased the IRS budget. The IRS brings in many dollars of revenue for every new dollar in its budget. That’s the underlying point of the entire issue. Brucie got it wrong, trying to deflect blame onto Democrats, as he often does.

– Brucie then claimed that tax cheating is widespread in the population, when the very source that Brucie cited indicated that 85% of the population pays their taxes on time.

– Oddest of all, Brucie wanted uds to know that black people cheat on their taxes, too, as if tax cheating is a racial issue. (If your only tool is a hammer, every problem is a nail. If your every thought involves racism…)

Anyhow, I figure if Brucie was so eager to distract us from the fact that cutting the IRS budget is likely to massively boost the deficit that he engaged in dishonesty and race-baiting to do so, we might want to be sceptical about his other claims. Like when he tells us egg prices rose during the Obama administration – once again trying to deflect blame onto Democrats. Obama isn’t in charge now. And the “historical context” is that egg prices jumped a heckofalot more lately than they did under Obama.

Or everything is dandy in housing because Brucie’s daughter-in-law is busy? There’s a daughter-in-law rule in economics? No, but let’s consider Brucie’s point that home sales are about the same as a year ago; home sales were depressed a year ago, so “about the same” is not good:

https://tradingeconomics.com/united-states/existing-home-sales

Same old Brucie – unreliable, deceptive, misinformed, biased.

Macro, are you really just pgl or are you just enamored of him and his juvenile retorts? Such adolescent remarks. Surely you have something of value to respond., Wait, maybe you don’t.

Regardless, I’ve provided some links for this post and you can say they are irrelevant, but you should have some actual reasoning to say that. Playing 3rd grade debate with names is hardly convincing. As for my personal observation of the local real estate market, take it or leave it. Your imprimatur means nothing to me.

I seem to remember Menzie making a statement to the effect that it seemed like some people were cheering on a recession. You seem to be one.

The only function of economic forecasting is to make astrology look respectable.

”

”

John Kenneth Galbraith

Bruce Hall: I thought a recession was coming during the Biden administration. I presented probit estimates indicating a high likelihood of recession. As of March 2025, spreads, as well as the change in Michigan sentiment is suggestive of a recession. I think saying there’s an increased likelihood of recession in the last two months — a view shared by many non-affiliated economists — is hardly cheering on a recession.

Perhaps I didn’t remember correctly, but during the Biden Administration when there were ongoing discussions about whether or not there had been a recession or there was a recession on the way, you had made an observation that it seemed some people were cheering on a recession. My comments was that it seemed some people were doing that now. It wasn’t pointed at you. Sorry if it seemed that way.

Despite the relatively high level of revolving debt and concern about Trump’s policies, so far personal consumption doesn’t seem to be significantly affected.

https://fred.stlouisfed.org/series/PCEC96

https://fred.stlouisfed.org/series/CCLACBW027SBOG

Still, household debt as a percent of disposable income, while rising, isn’t back to pre-pandemic levels so there seems to be some cushion for the consumer-driven economy.

https://fred.stlouisfed.org/series/TDSP

Trump’s import tariffs (which I think of a import consumption taxes) will, no doubt, push some prices higher. How much depends on how much the exporters are willing to reduce their prices to offset some of the tariffs to keep market share. Trump is playing a game of chicken with his “reciprocal” tariffs. I guess we’ll see who blinks first. He says he wants more investment in the US and I’m presuming he means both US companies and foreign companies and that’s part/most of the reason he is pushing tariffs. I’m not sure if that will draw or push away FDI, but he does want US companies to “repatriate” production. Turning around a long term trend may be difficult or impossible.

https://fredblog.stlouisfed.org/2024/10/the-decline-in-the-us-international-investment-position/

But, then, as Macroduck would say, I don’t have a clue what I’m talking about.

bruce, macroduck had something informative to say. he wrote it down. now maybe you don’t like that it was delivered with snark? but he corrected several items that you either intentionally (doubtful) or stoooopidly introduced into your argument. learn from the man, or remain a fool bruce. and if you don’t like that style of delivery, then improve the quality of your arguments. and that means remove the falsehoods and misinformation that you sprinkle into your comments. you seem to want the snark based upon the stooopidity of your comments.

and as I have stated before, I am in the market for a new car purchase. or I was. this uncertainty is inching me towards keeping my vehicle awhile longer. and Tesla is off the table. having just sold a house, I can tell you that the market is not very robust either. there is activity. but high rates are continued headwind. and economic uncertainty about the future will cause folks to pull back even more. because lower rates will not help pay your mortgage if you become unemployed. and doge cuts to places like fha are not helping matters one bit, either.

Well, baffling, if you are basing your vehicle purchase decisions based on not liking Trump or Musk (a former darling of the left for pushiing EVs), I guess that makes your sample of one more conclusive than my sample of one. I don’t know when you sold your home, but am guessing it was after the inflation run up and the Fed’s rate responses that did cause a market slowdown.

But it seems that with slightly lower current mortgage rates and the overall market adjusting (generally upward since Sept. 2024) to the reality that 2-3% mortgages are out of the question, that serious buyers are still out there (which is what my daughter-in-law has said).

https://fred.stlouisfed.org/series/MORTGAGE30US/

https://apnews.com/article/fed-federal-reserve-rates-trump-tariffs-inflation-prices-a9008f1bb081093cd149967e3e637c7b

https://fred.stlouisfed.org/series/EXHOSLUSM495S

“Well, baffling, if you are basing your vehicle purchase decisions based on not liking Trump or Musk (a former darling of the left for pushiing EVs),…”

bruce, i am basing my decision to purchase a new car on economic conditions and the current state of the companies producing autos. economic conditions are not great. i can still get a few more quality years out of the vehicle (2017 acura). don’t need a new one immediately, but would not mind exploring the new options. but tesla is now a HUGE question mark. resale value has been plummeting. refreshed model y is not that much of an improvement. tesla and musk are not passing on EV tax deduction very well. i make too much money to purchase and deduct. and unlike most other brands, tesla is not passing the tax deduction through lease capital reduction. so a tesla lease is expensive compared to other options to lease/buy. i can actually get equal or better deals with audi or MB on EV’s.

now add in the fact that as doge leader, musk is making many fundamental and perhaps fatal flaws in his execution. it makes you wonder if the same judgement is being applied at tesla? which is why i am looking to unload my tesla stock if we can get a rebound in price (although based on my current assessment, i should probably just dump it now).

the issue is not whether i like trump/musk or not (i don’t). the issue is their decision making and execution of actions has become very flawed. that will impact the future value of any purchase i make. right now, i am not interested in buying a mistake.

Brucie, Brucie, Brucie….

I have pointed out your SUBSTANTIVE errors, along with your rhetorical trickery. You keep wiggling around to avoid addressing either. You lied when you claimed the Washington Post article wasn’t about criminal tax evasion. You lied when you claimed tax evasion is widespread. You were pulling a disgusting trick when you brought up race.

As to you bringing up pgl, I can only guess he really got under you skin. Compare me to him all you want; it means I’m getting under your skin.

As long as you keep dragging cheap faux news talking points in here, as long as you keep trying to distract us from the real issues, as long as you keep lying, I’ll keep pointing it out.

Snarky One… (pgl fanboy),

did I lie? hmmm. Not so sure about that. In fact, I pointed out that the data in one report shows Black taxpayers evade proportionally twide (28.4%) their population percentage (incidence, not dollars) simply by not filing at all or underreporting (and provided the link below) and (sarcastically) said how racist the report was for pointing that out. But many people define evasion (not you of course) as not paying their “fair share” (whatever that is) because the wealthier have the legal means to avoid taxes (such as investment and depreciation) despite paying the preponderance of income taxes.

https://finmasters.com/tax-evasion-statistics/

Ironically, the biggest complaint is that Black taxpayers are audited too much.

https://law.stanford.edu/press/irs-disproportionately-audits-black-taxpayers/

“did I lie? hmmm. Not so sure about that.”

bruce, the fact that you cannot be sure about whether you lied or told the truth speaks volumes about you. unethical. immoral. immature. criminal? uneducated. ignorant. the list goes on and on.

the question becomes, when trump and musk gut your social security check, will you still support their efforts. or recognize your ignorance?