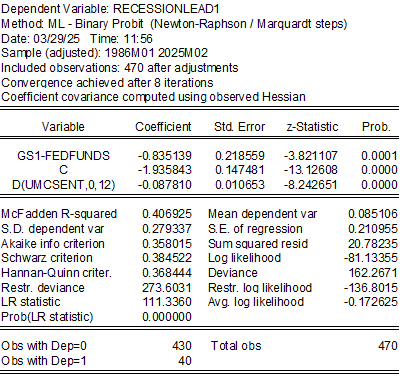

I run a probit regression of a NBER peak-to-trough recession dummy on contemporaneous Michigan sentiment (FRED variable UMCSENT, and final reading for March) and the 1yr-Fed funds spread (the last is per Miller (2019) who shows this spread has he highest AUROC of spreads at one month horizon).

The pseudo-R2 is pretty high, but to be expected for doing a near-contemporaneous prediction of recession.

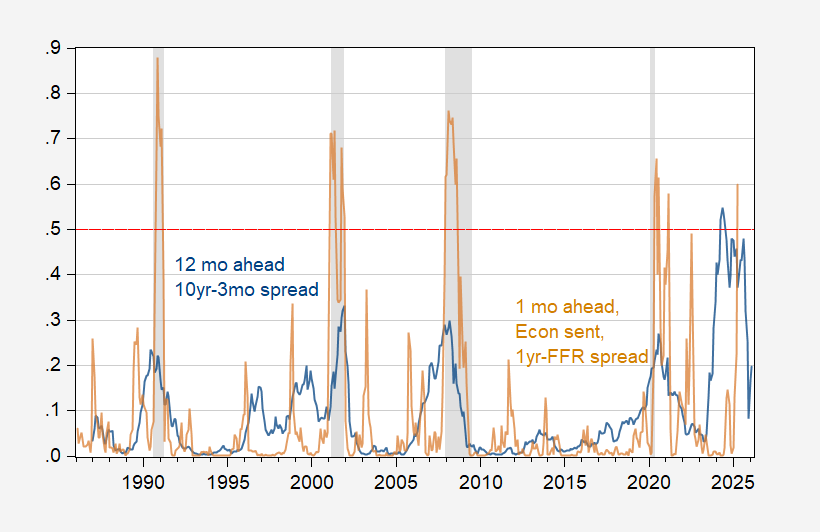

And here’s the estimated recession probability, extended to 2025M03, assuming no recession has occurred as of February 2025.

Figure 2: One month ahead estimated recession probability using y/y change in Michigan consumer sentiment and one year Treasury-Fed Funds spread. March spread based on Michigan final reading and yields/rates through 28 March. NBER defined peak-to-trough recession dates shaded gray. Horizontal red dashed line at 50% threshold. Source: U.Michigan, Treasury, Federal Reserve, NBER and author’s calculations.

The likelihood for April is 60% (using the final U.Michigan reading and interest rates through the 28th). Note that using a 50% threshold, there are no false positives (using a 45%, one would find a false positive in 2022.

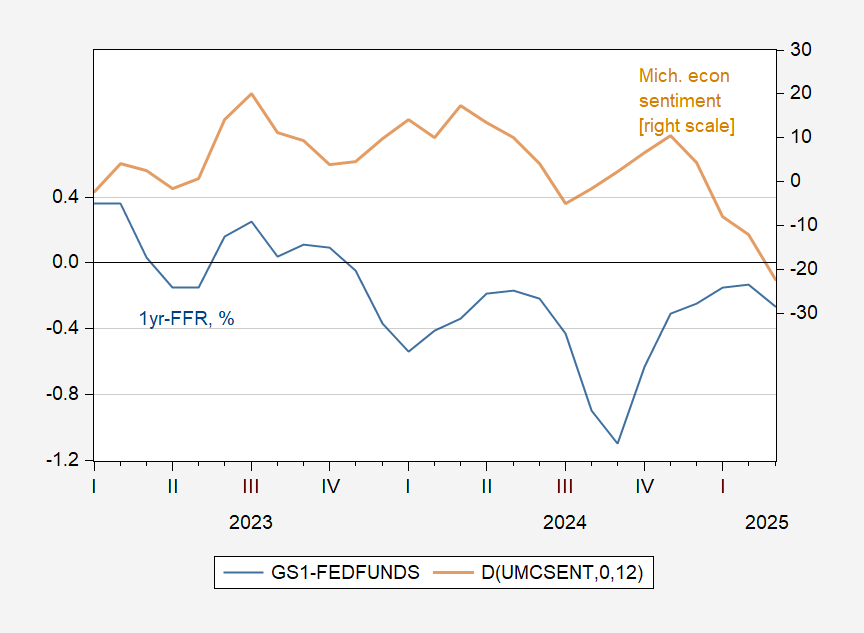

Looking at the determinants makes one understand why the estimated recession likelihood is high.

Figure 2: One year Treasury – Fed funds spread, % (blue, left scale), and Year-on-Year change in U.MIchigan economic sentiment (brown, right scale). Source: FRED, U.Michigan, and author’s calculations.

The 1yr-FFR spread has deepened its inversion, and the Michigan sentiment index has experienced a large and quick decline.

That being said, aside from consumption, there’s been little sign of a recession in contemporaneous, hard-data indicators.

There’s a discussion with Bernstein on Krugman’s blog, during which they discuss the shift toward more negative coverage of the economy over time. This shift, they speculate, could account for some of the decline in consumer sentiment, relative to economic performance.

Increased negatively In economic reporting may be partly a reflection of the faux news phenomenon, so goes right along with the recent partisan divide in sentiment. Of course, press negativity may provide its own negative increment.

So maybe, if consumer sentiment has become more negative for any level of economic , we should be cautious using historic relationships between thr two to assess economic performance.

That applies to consumer sentiment levels. I can’t see any reason a sharp change in sentiment wouldn’t mean what it has always meant – things are going wrong in the economy.

I have been looking at the leading indicators as shown on the Conference Board’s website, https://www.conference-board.org/topics/us-leading-indicators.

The most negative shown index is the ISM New Orders index for the latest six-month period at -0.69 value.

Using Professor Hamiton’s cycle model as shown on Econbrowser, I found that since about 2022Q3, the index has oscillated about the approximate value of -0.11. This is a much lower oscillation value compared to prior periods back to 1985. For prior periods back to 1985 the oscillation value was around zero between recessions.

Professor Hamilton’s model seems quite remarkable in identifying cycles.

Weakness in new orders suggests that clients – retailers, wholesalers and other producers – expect demand weakness. If they’re right, then heightened recession expectations aren’t just a headline; they are affecting business behavior.

The export orders index, on the other hand, is doing fine. Maybe a tariff effect is at work, masking recession concerns, but on the face of it, this suggests worry about weak demand is more a domestic U.S. concern than a concern among our trading partners.

Economist Peter Navarro on Fox News today: “The message is that tariffs are tax cuts.”

He could have added:

“War is peace”

“Freedom is slavery”

“Ignorance is strength”

What the heck happened to break that man’s brain?

When one of those guys says “the message is…” you know what’s happening. They are telling the ditto-heads what to say. Expect Bruce Hall to tell us now that tariffs are tax cuts.

Spokespeople from both parties do this “the message is” stuff. I find it off-putting. I sounds like an admission either that they think we’re too dumb to understand what “the message” is, or that we’re sheep, waiting to be told what to think. You don’t find that in Lincoln’s speeches, not Washington’s not Roosevelt’s. Icky stuff.

I thought at the time of Hegseth’s nomination that his wife was a better choice for…well, for almost anything. Even so, there’s no excuse for this:

https://www.theguardian.com/us-news/2025/mar/29/pete-hegseth-wife-jennifer-foreign-defense-official-meetings

Even if his wife has clearance, she doesn’t have a need to know. Limiting the number of people who know secrets is just good security hygiene.

If Hegseth needs his wife’s opinion, then let her do the job.

Which wife? He’s had a bunch of them.

I assume that his wife is a necessary presence to throttle his drinking to a deniable level.

Maybe she follows him to secret meetings because “secret meetings” are how the two of them ended up together; you know, while he was married to wife #2.