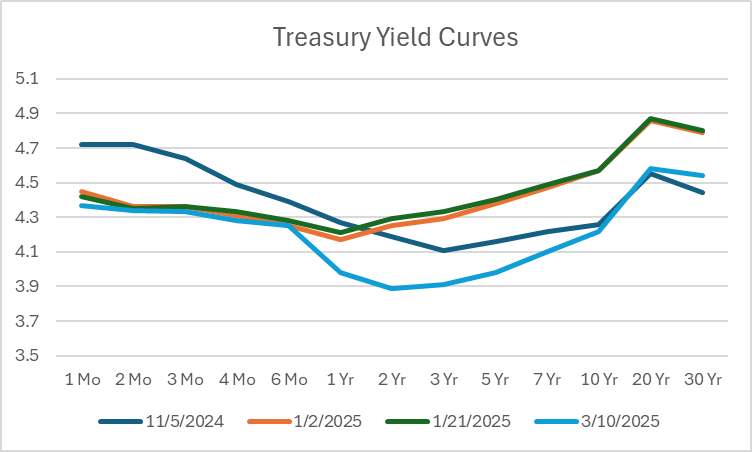

From 1/21/2025 to 3/10/2025, the 2 year constant maturity yield fell by 40 bps.

Figure 1: Yield curves as of 11/5/2024 (blue), as of 1/2 /2025 (tan), as of 1/21/2025 (green), as of 3/10/2025 (light blue). Source: Treasury.

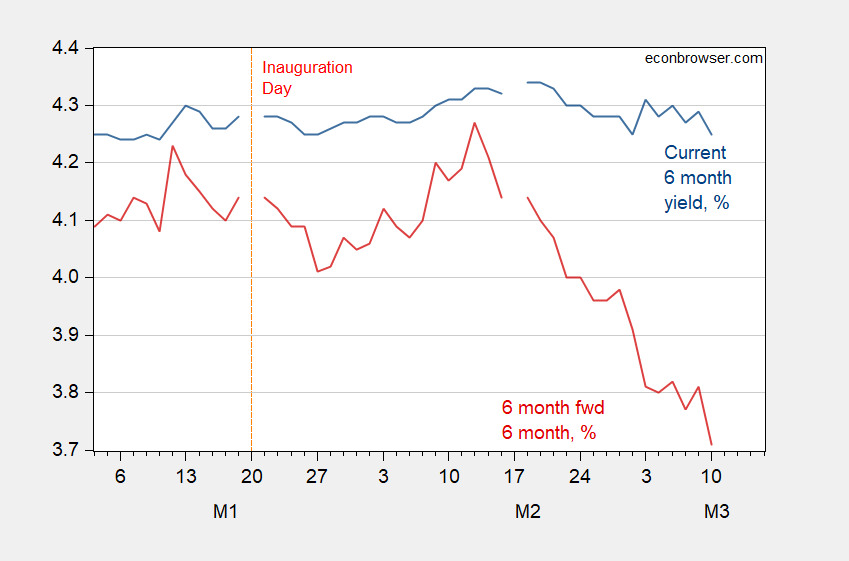

Using the pure expectations hypothesis of the term structure (i.e., no term premia at 6 months and 12 months maturities), the 6 month yield expected 6 months ahead has fallen by about 43 bps since Inauguration day, and 66 bps since 2/12. Here’s a time series graph:

Figure 2: Six month constant maturity yield (blue), and six month forward six months (red), %. Source: Treasury and author’s calculations.

Addendum:

Miller (2019) shows that at the 6 month horizon, the maximal AUROC pure term spread model (1984-2018) is provided by the 5yr-FedFunds spread. Here’s my updated probit based forecast (1967-2024M08), assuming no recession through 2025M02.

Figure 3: Five year-Fed funds spread, % (black, left scale), spread on 3/10/2025 close (black square), estimated probability of recession (teal, right scale). Source: Treasury, Federal Reserve Board via FRED, author’s calculations.

The regression has a pseudo-R2 of 29%.

Off topic – Making America Great Again, one bankrupt elder at a time:

https://www.ssa.gov/news/press/releases/2025/#2025-03-07-a

The Social Security Administration had a longstanding policy of withholding 50% of monthly payments from those whom it had previously overpaid, until the overpayment was recouped. That practice led to some dire results for recipients. Last year, the monthly withholding amount was cut to 10%. As of March 27, withholding on all new overpayments will amount to 100% of monthly checks. Past overpayment will continue to face 10% withholding.

How Medicare premia will be paid, I cannot say. Premia for simple Medicare, whether the legitimate version or slimey “Advantage” policies, are withheld from SS checks, and I don’t know if another mechanism for payment exists. Medicare recipients have paid into the system with every W2 paycheck they’ve received, so are owed access to the system.

This is another gleeful jab at the helpless by some idiot(s) unfamiliar with the ins and outs of the system they’re screwing up. Sociopathy? Psychopathy? Both?

Recipients of overpayment are not “cheaters”. The SSA made the mistake, and the SSA can make itself whole quite easily over time without being evil in the process.

I assume that when the first round of $0 payments go out, Congress will hear about it. At least those who continue to listen to constituents will.

The modal priced-in estimate for the year-end funds rate is now 75 basis points lower than the current rate, vs 25 bps lower a month ago.

https://www.cmegroup.com/fr/markets/interest-rates/cme-fedwatch-tool.html

even if you think an inverted yield curve will contract the econmy when it is not caused by central bank tightening you are ignoring you totally wilful lax fiscal policy.

Trump will make fiscal policy more expansionary not less thanks to those terrible tax cuts!

I disagree. Fiscal contraction of 1.5 trillion is coming. The tax cuts have little multiple ability. While Harris had a 1.1 trillion fiscal contraction with less destructive counterparties. Biggest draw down since WwIi

I am amazed 350 billion end of business transfers from the Covid packages ending is not being discussed more. Corporations have been using that to cook investors for 3 years now. It also bloated the budget deficit.

you have to look at the structural deficit not the overall deficit to gauge if it is expansionary or contractionary.

It is a common error in argumentation to say things like “you are ignoring you totally wilful lax fiscal policy.” You simply cannot know that on the evidence presented. The way to deal with that ignorance is to ask “Have you considered the effect of a large tax cut?”

Discretionary fiscal policy is generally recognized as a slow tool for addressing shocks. Congress makes fiscal policy on a formal schedule, and often falls behind that schedule, as is the case now. A tax cut might arrive just in time to offset the effects of policy uncertainty, but might not.

Also, see Menzie’s latest post; the economic drag from uncertainty can be quite large. In keeping with my own suggestion: Have you considered whether a tax cut of as-yet unknown size and timing will be adequate to fully offset the drag on economic activity caused by this administrations policy flailing?

Oh, and let’s not forget that tariffs amount to an increase in taxes. The felon-in-chief has recognized that by saying he intends to replace taxes with tariffs. We don’t know how large the tax increase from tariffs will be, but the evidence presented in earlier posts on this blog suggest the tax increase from tariffs could be quite large.

Have you considered the implications of increased policy uncertainty and a large change in the incidence of taxes which may result in an overall tax cut, tax increase, or no change in tax revenues? (See? “Have you considered…?”)