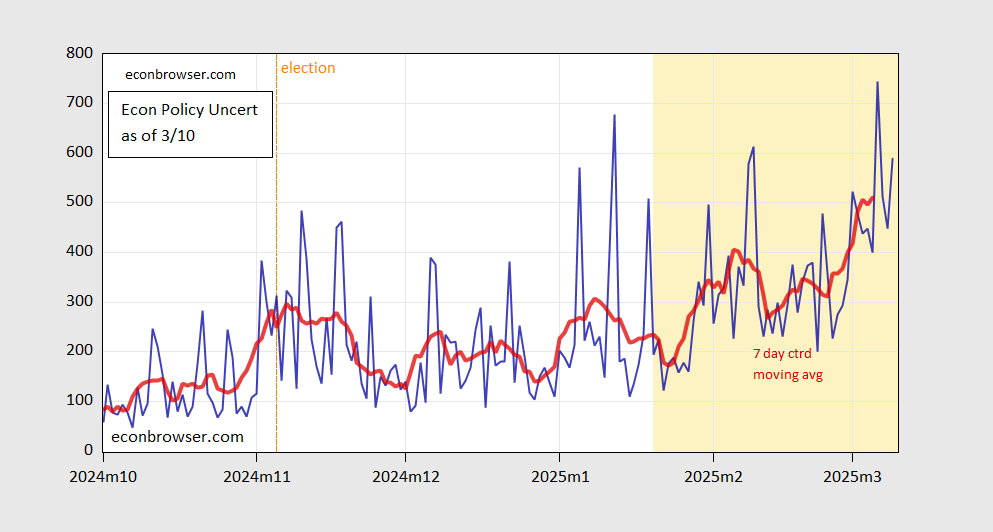

Uncertainty from text analysis, and from consumer surveys:

First economic policy uncertainty:

Figure 1: EPU (blue), and 7 day centered moving average (red). Source: policyuncertainty.com and author’s calculations.

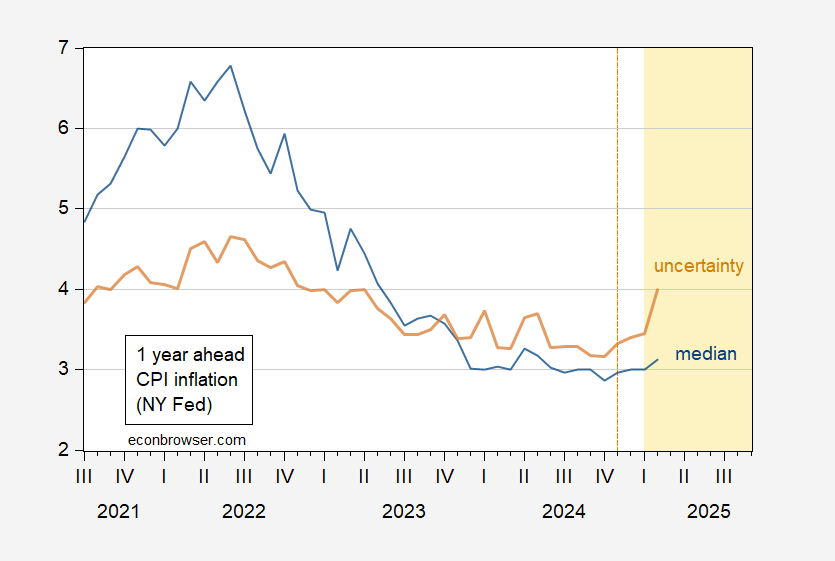

Next, consider the newly released NY Fed measures of 1 year ahead expected inflation, and uncertainty.

Figure 2: Median one year ahead inflation (blue), and associated uncertainty (brown). Source: NY Fed.

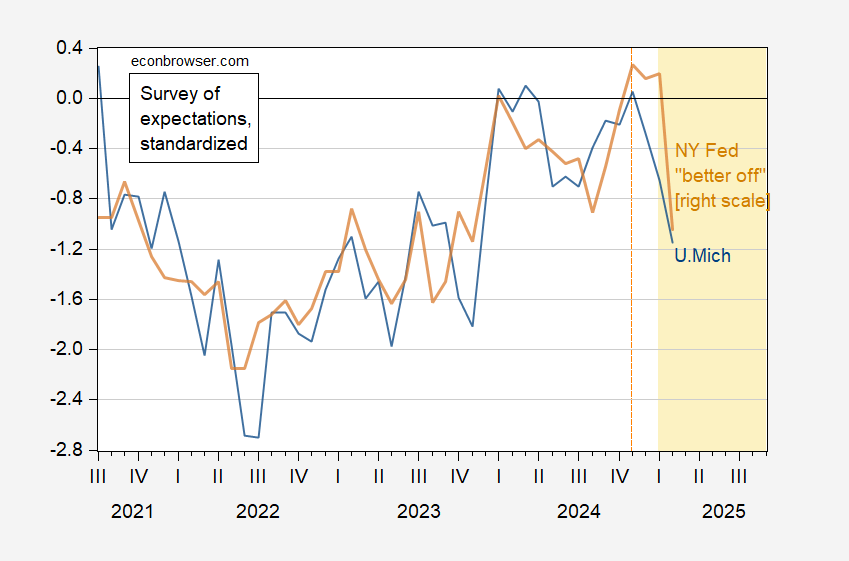

Third, even more interesting is how the “better off” a year ahead number (sum of much better off and somewhat better off) has evolved, vs. U.Michigan economic sentiment and Conference Board confidence.

Figure 3: U. .Michigan survey median future expectations (blue, left scale), and NY Fed survey “better off in a year” (brown, right scale), both demeaned and divided by standard deviation 2013-2025. Source: U.Mich. via FRED, NY Fed, and author’s calculations.

Exactly so. The world does work more or less as it should, most of the time.

My concern is that financial stresses show up “Gradually, then suddenly”. The EPU index measures talk, not risk premia. Most convention financial stress indices (KC and St. Louis Fed, OFR) which run off of prices, are low, though some are headed up. By the time risk premia begin to generally show an increase, it is likely to be “suddenly”.

Sad news today. Kevin Drum has died after a decade long battle with myeloma.

Kevin was one of the smartest and most skilled civilian translators of complicated economic data for the general public. He will be missed.

I never found anyone like him on the internet. I learned more about more varied stuff from him than anyone else, by far.

May he Rest in Peace.

Sorry to lose him.

Another sad passing:

https://www.bulwer-lytton.com/

R.I.P. Bulwer-Lytton Contest. You will be missed.

I didn’t know about Drum when I wrote about Bulwer-Lytton. No disrespect intended.

No problem. I assumed as much.

Kevin kept blogging right up to the end. One of his last postings:

“Fading fast. Pneumonia worse. Ventilator next. Not looking good. Take care of Donald Trump for me.”

I guess now we will have to take care of Trump for him.

Rick stryker, is the trump recession part of the plan? Or is it simply an added bonus in his attempts to destroy America? Just for the record, rick is a strong proponent of trump and his current actions and outcomes. He will defend trump unapologetically.

Elon Musk today: “10% of federal expenditures” are due to people having fake Social Security numbers, claiming it is “half a trillion dollars.”

How is it that people say Musk is smart? This doesn’t even make sense.

He keeps making up claims of massive fraud but so far hasn’t documented a single case.

He’s learning from his boss. Also, federal government quasi-emoyees are not supervised by the SEC; Musk is basking in the glow.

They have yet to show a single case of a >125 year old person getting a check. Trump was bawling off large numbers of extremely old people listed in the social security databases – but never stated that those people have been receiving any money lately. These computer “geniuses” went in and found records of everybody that had ever been listed in social security since its beginning.

Data from the NY Fed’s survey of consumer expectations for February were released today:

https://www.newyorkfed.org/microeconomics/sce#/

As usual, there are some oddities.

Income and spending expectations were modestly better than in January, on par with all of Q4. At the same time, debt delinquency expectations are the highest since 2020, expectation for higher unemployment jumped up and expectations for household finances deteriorated. So, earn and spend more, but worse employment and finances. Notably, the biggest rise in expectations for spending and income was among the least numerate respondents.

There’s a particular oddity regarding expectations for the increase in government debt. Just about every category of respondent, by region, income and education, expects a slower pace of government debt growth than in January, and the average expectation fell to the lowest rate since mid-2017. (Where in the heck are these people getting their news?) The only group to anticipate higher debt in February than in recent months is those below the age of 40. The largest drop in expectations for debt increase was among less numerate respondents.

Expectations of higher unemployment in February were led by those under-40, the college educated, those earning above $100,000 and Westerners.

Inflation expectations edged up slightly, with the same groups who most anticipate higher unemployment also most expecting higher inflation. Apparently, the stagflation story is getting traction in some quarters.

My two cents: The groups which most expect worse spending, income, employment and inflation outcomes also tend to vote Democratic and to be employed as journalists. The NY Fed doesn’t segregate by party affiliation, but we may be seeing another example of partisan bias in consumer expectations. Frankly, I’d put my money on the views of the well-educated, more numerate respondents, though how those jejune under-40s got so clever I can’t imagine.

I think they are hearing that government is laying off people and presume that will reduce government spending and debt. Sometimes the level of ignorance can be shocking for those of us who follow the news.

Salary cost for the 2 million federal employees are a minimal fraction of the total federal spending – so the “cutting” cost by firing people is just a cruel theater.

What’s curious about this picture?:

https://fred.stlouisfed.org/graph/?g=1EmEp

The VIX is moderately elevated, while corporate spreads are not. I admit to a bias in favor of fixed income metrics over equity metrics. With that on the table, let’s continue. Since the Covid oopsie, there has been a shift from higher spreads and lower VIX to lower spreads and higher VIX. For some reason, stock volatility has become more elevated, while other corporate risk metrics have not.

Even so, moderately elevated VIX vs dead low corporate spreads is hard to explain.

Unledd maybe corporate cash is the explanation?:

https://fred.stlouisfed.org/graph/?g=1EmFP

I’m not smart enough to know if the high level of corporate cash holdings explains the divergence between the VIX and corporate spreads, but I would point out that cash holdings are no longer rising.

Obviously, I’m looking for triggers for a sudden increase in financial ickiness. That has been my professional bread and butter, and I can’t help myself. Corporate cash is a buffer against a sudden market puke. Corporate cash seems to explain the divergence between equity and debt performance right now.

What’s missing from this analysis? Small business is. Small business formation has been a major factor in economic performance in the Covid era:

https://fred.stlouisfed.org/graph/?g=1EmH6

A look at recent FOMC minutes or small business surveys shows that small businesses are suffering from a lack of access to credit. We know that households are facing difficulties in meeting financial requirements, and households have been a major source of funding for small business in the Covid era. If households cut back on spending and small business formation stalls, I doubt all that corporate cash will save us.

“President Donald Trump shared his intent to purchase a Tesla on Tuesday to support Elon Musk”

[He’d better act soon because the price of steel and aluminum is going up fast..]

Trump is buying a Pity Tesla.

Residents of which state have bought more Teslas than residents of any other state? California, of course, 3X more than residents of Texas and Florida combined.

Residents of which state are more pissed off at Trump, Musk, and congressional Republicans who regularly threaten to withhold future disaster aid unless more water is sent to Bakersfield? California, of course.

Unless MAGAites suddenly fall in love with electric vehicles, where might Tesla sales tank severely? Anyone? Anyone? Bueller? Musk? Donald?

Uncertainty… perhaps. Or just basic pricing. From a month ago.

https://www.axios.com/2025/02/18/stocks-overvalued-research

Odd that you have commented here, when Menzie has already published a new post about the economic consequences of policy uncertainty, a post which makes obvious how policy uncertainty could lead to stock market decline.

Stocks have been overvalued for some time. So tell us, why would investors change their minds now? As demonstrated in the featured study, uncertainty has real economic consequences. Uncertainty is elevated, suggesting rising economic risks, and stocks have fallen just as one would expect.

The Vix is absolutely correlated with stock performance – negatively correlated. The Vix is colloquially known as “the fear index”. What is the most likely cause of fear among stock investors now which wasn’t present 2 months ago?

And let’s not ignore the point of the study; uncertainty is associated with bad economic outcomes. Menzie has drawn a perfectly reasonable connection to stocks – which you seem to want to dismiss – but the risk to the economy isn’t a matter of over-priced stocks. Inconvenient for your point, but let’s not dodge the issue.

So why, exactly, do you think uncertainty might not be to blame for the sharp drop in equity values? You think $4 trillion in value evaporated now, rather than 2 months ago, just at random? Or is this another of your efforts to defend the felon-in-chief?