Overtaken By Events:

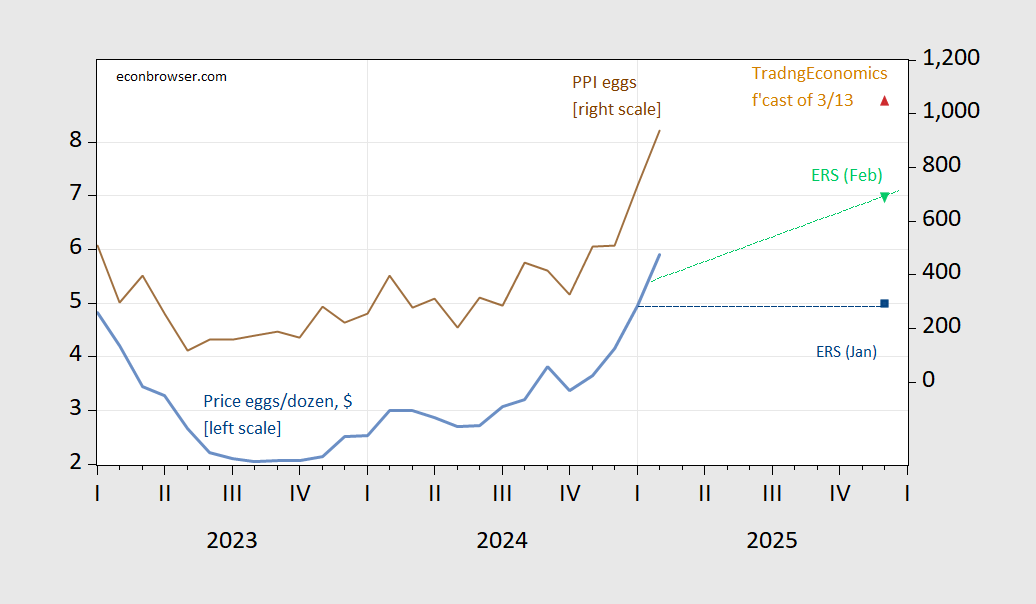

Figure 1: Price of dozen large AA eggs, $ (blue, left scale), ERS forecast of January (blue square), ERS forecast of February (inverted light green triangle, left scale), PPI for eggs (brown, right scale), TradineEconomics forecast of 3/13 implied PPI for end-2025 (tan triangle, right scale). Source: BLS, ERS, TradingEconomics accessed 3/13, and author’s calculations.

TradingEconomics 3/12 prices are down 37% since March 4th peak (discussion here), but apparently forecasts are for a return to higher prices.

Off topic – EU ESG:

https://commission.europa.eu/business-economy-euro/doing-business-eu/sustainability-due-diligence-responsible-business/corporate-sustainability-due-diligence_en

The European Commission adopted new environmental, social, and governance standards last July. The standards apply to all firms above a certain size operating in EU territory, including U.S. firms.

I hadn’t seen much grousing about these standards in the U.S. but The Hill now has an opinion piece from a Heartland Institute guy entitled “A radical European law could devastate the U.S. economy”. Leave it to Heartland to predict devastation of the U.S. economy from standards which, until feverish right-wing backlash, had already been adopted by many firms in the U.S. “Poor us! We’re sooooo fragile!”

Anyhow, this is just the sort of thing to end up as part of the felon-in-chief’s tariff argument. We are, after all, no longer going to enforce the law against bribery in foreign business dealings, nor laws against workplace discrimination. Why should our trading partners get to make their own decisions about ethics? Look forward to it.

Correction day for the S&P500.

Over 200 of the 500 component shares had already fallen at least 10% from their 52-week high as of Monday, so no big surprise the index has, too. How often do 10% drops lead to 20% drops (corrections lead to bear markets)? Seems like about 25% of the time:

https://seekingalpha.com/news/4420416-heres-how-often-sp-500-corrections-turn-into-bear-markets

Of the 48 corrections since WWII, this one is the 5th fastest. Turns out, though, that a rapid decline of 10% doesn’t necessarily lead to a decline of 20%.