Remember when GDP contracted under Biden but Dems said that wasn’t a recession? What will they say now that Trump is president? ATL Fed’s GDP nowcast for Q1 just plunged from 2.3% to -1.5% as everyone begins to realize our “growth” has just been debt-fueled gov’t spending

Well, I don’t recall many mainstream economists declaring a recession. I certainly didn’t, for two reasons. First, as any sentient economist knows, recessions are not declared by the NBER’s Business Cycle Dating Committee solely on the basis of two consecutive quarters of GDP growth, but rather personal income ex-transfers, employment and other indicators. Second, most macroeconomists were aware (unlike Dr. Antoni) of the anomalous gold imports driving the negative GDP growth nowcast — here’s my 3/3 commentary. My assessment from 3/4:

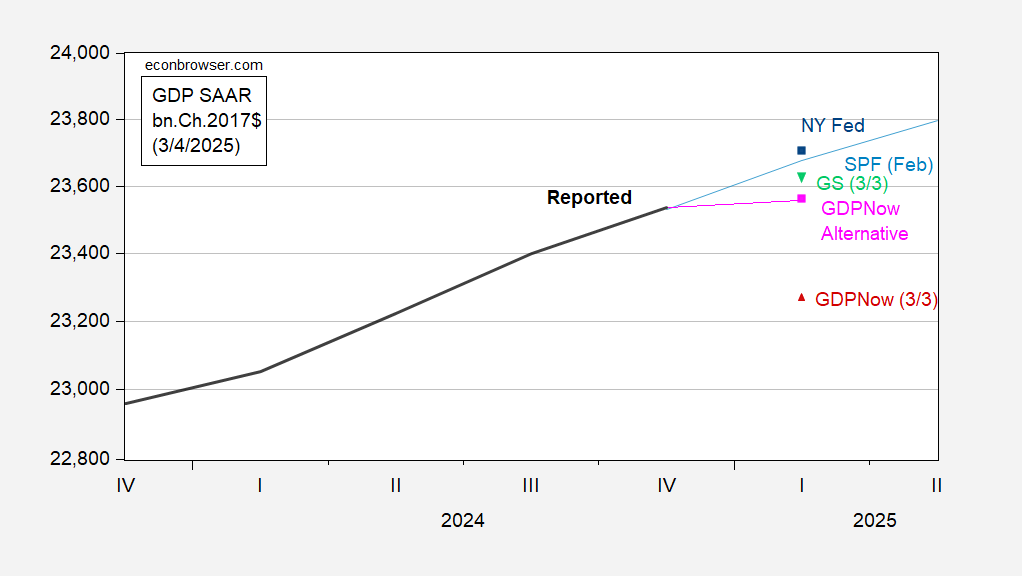

Figure 1: GDP as reported 2nd release (bold black), February median SPF (light blue line), NY Fed (2/28) (blue square), GS (3/3) (green inverted triangle), GDPNow (3/3) (red triangle), and GDPNow adjusted to omit import effect of 2/28 (pink square), all in bn.Ch.2017$, SAAR. Source: BEA 2nd release, NY Fed, Atlanta Fed, Philadelphia Fed, Goldman Sachs, and author’s calculations.

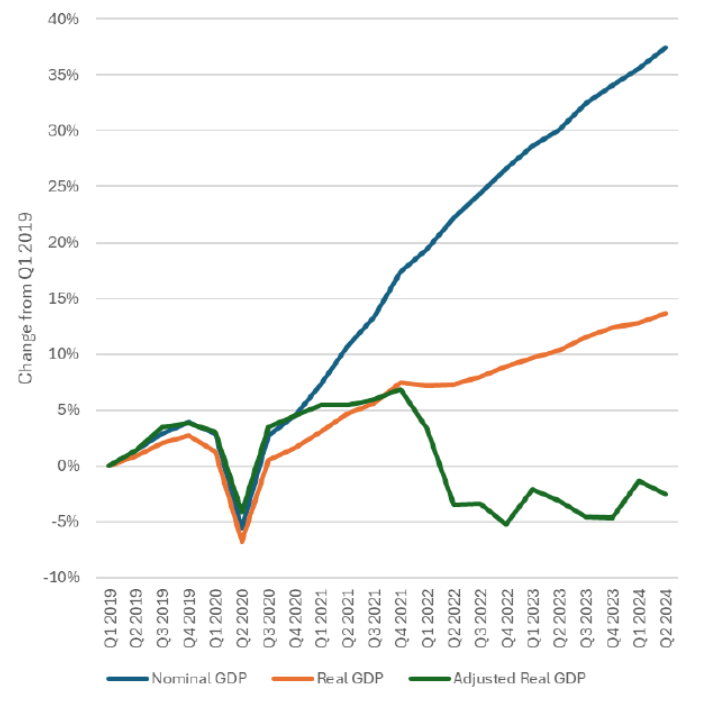

I must confess some confusion as to Dr. Antoni’s beliefs. As argued in this paper with Peter St. Onge, the US economy has been in recession since 2022. Recall this graph?

Source: Antoni and St. Onge (2024).

As far as I know, Dr. Antoni never declared the end to the recession which allegedly began in 2022. Hence, he should be happy to acknowledge the indication of recession in 2025Q1 as vindication.

As an aside, Dr. Antoni has never responded to any queries regarding the construction of the deflator that yields the green line in the figure above (I can’t replicate it — see here).

“Dr. Antoni has never responded to any queries …”

Some of us have challenged Antoni’s many lies over at his Twitter account and of course this weasel never responds.

It seems the Commerce Sec. has declared Trump’s tariffs are great even if they cause a recession. I’m sure Antoni will mansplain this to us.

EJ’s latest misunderstands the C$/US$ dollar which is around 1.45 rights now. But our favorite MAGA moron thinks C$30 billion = US$10. Yea – he does write the dumbest tweets!

It seems to me to be increasingly important to recognize that the aggregate numbers for the economy have a different value that they did a couple of decades ago; the reason is that the US, more and more, is becoming two nations in one geographical location. When you aggregate the educated, well paid, productive urban economies with the less educated, low earning, less productive rural areas you average two economies that are increasingly diverging. (This, by the way, is one of the reasons Trump is in the White House today).

For one of these sub-economies economic conditions have definitely been worsening for years; for the other they have not. I think we are now at a point where the big drivers for the “upper” economy have hit a stall point. The biggest driver has been tech. Companies like Apple, Microsoft, etc. are now treading water but the AI enthusiasm has masked that. True productivity increases from AI won’t come immediately (if at all) but rather in the second and third generation iterations – look to the history of personal computers to see that. Meanwhile there have been no quantum leaps in any other tech area, only slight development. The smart phone revolution is over; Microsoft’s move to corner the business computing market is hitting diminishing returns; NVidia’s growth is coming from competing companies that cannot all succeed; EV growth has stalled in countries excepting China.. Trump policies that inhibit trade and raise prices will likely trigger a quicker fall than has been typical.

Antoni might have a limited understanding of the debt dynamics of the U.S. economy. His claim that ‘our “growth” has just been debt-fueled gov’t spending’ misses a lot:

https://fred.stlouisfed.org/graph/?g=1Ev5X

Growth is fueled by debt – business, household and government debt. Antoni seems to think debt is bad, which is evidence in itself of a weak understanding. He singles out government debt as the source of growth – obviously an error of omission – without explaining why he thinks government debt is bad.

We do have a structural federal deficit – a deficit largely caused by tax cuts – with cyclical spikes resulting from both automatic stabilizers and legislative decisions to combat recession.

The obvious thing to advocate if one is honestly worried about government debt is the elimination of the structural deficit in a way that would strengthen automatic stabilizers. Higher income tax rates would do that. Dedicating some part of the revenue gained to counter-cyclical spending, such as unemployment benefits and anti-poverty stipends, would strengthen the effect.

Anyone who wrings their hands over government debt while advocating tax cuts is either dishonest or dense. Likewise, anyone who frets over recession but doesn’t advocate strengthening automatic stabilizers. It is a sign of how tainted with lies our public discourse has become that the simple facts of tax cuts leading to structural deficits and automatic stabilizers buffering the economy against cyclical swings are no longer part of that discourse.