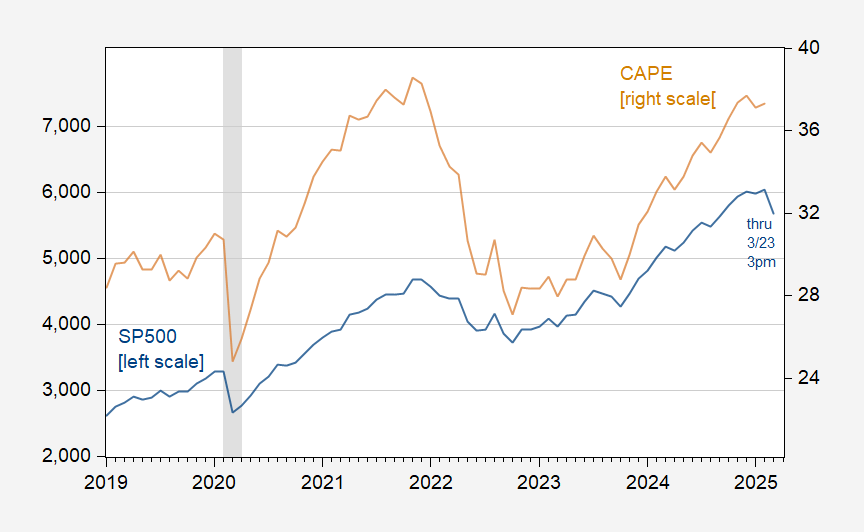

As attributed to Paul Samuelson. So, with trepidation, I show the SP500 and CAPE over the last half decade:

Figure 1: SP500 (blue, left scale), CAPE (tan, right scale). NBER defined peak-to-trough recession dates shaded gray. Source: Shiller, NBER.

Even including todays rebound, the SP500 looks like a substantial decline.

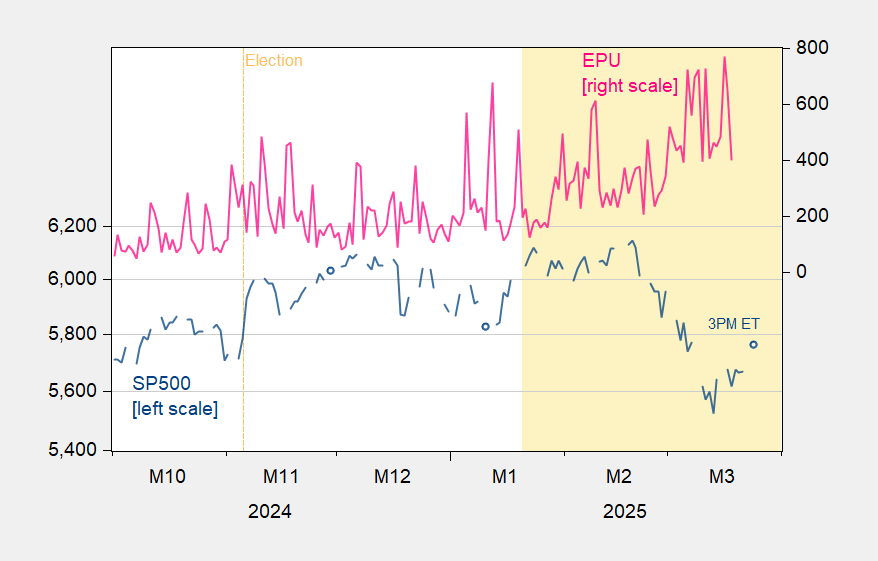

And what are movements in the SP500 associated with (in addition to interest rates, VIX):

Figure 2: SP500 close (blue, left log scale), EPU (pink, right scale). Source: FRED, policyuncertainty.com.

The mid-expansion decline in stocks was in response to higher interest rates – the whole risk-adjusted equilibration of asset returns thing. We have already marveled at the economy’s resilience to contractionary monetary policy and the accompanying loss of wealth.

These days, the decline in stocks is not, mathematically, driven by an increase in returns by lowering stock prices. Instead, expected returns have fallen, so prices have fallen in response. In fact, the drop in market interest rates means that stock prices don’t have to fall quite as far to maintain equivalence between returns on debt and equity.

Setting aside the questionable record of stocks as a recession predictor, what else is there to learn from the drop in equity prices? The wealth effect is reduced, and it is the wealthy who have been driving consumer demand most strongly since the labor market cooled off. Capital investment is likely to weaken in response to the decline in expected returns. Between the wealth effect and weaker capital investment, two of the components of GDP are looking shakey.

So we don’t need to look only at the binary question of recession in order to use stocks to assess the economic outlook.

Yes of course, the stock market is too volatile to the downside. But it’s in the Index of Leading Indicators for a good reason. If it keeps making new highs, with the – ahem – notable exception of 1929, you are not having a recession.

Almost always, more or less coincident with the onset of recession, the stock market is down YoY. If you pair it with initial claims YoY, specifically whether the 4 week average is higher by 10% or more YoY, you get a very easy and near flawless indicator.

FRED no longer has permission to post historical stock market data, but I believe this simple indicator has been flawless since at least the turn of the Millennium. And it is based on fundamentals, with one side measuring the production side of the economy, and the other the consumption (jobs and wages) part.

FRED still carries the NASDAQ back to the mid-1970s and yep, your rule still works:

https://fred.stlouisfed.org/graph/?g=1FGVE

I stopped before Covid because it smashes everything down so you can’t tell what’s going on.

Here’s the same picture, but just for the period of the Covid-era expansion:

https://fred.stlouisfed.org/graph/?g=1FGY2

No recession now, nor in Antoni’s “bag of hammers” recession.

Thanks.

“He wrote Economics: an Introductory Analysis in 1948, a text which was regularly revised and continued to stay in common use, going through 17 editions.

In the 1961, seventh edition of his text, Samuelson noted that, at that time, the U.S.S.R. had a gross national product (GNP) which was approximately half that of the U.S. According to Alex Tabarrok, Samuelson projected that, because of higher levels of investment driving faster economic growth, Soviet GNP would outpace that of the United States, perhaps as soon as 1984, but no later than 1997.”

https://www.thevintagenews.com/2018/08/23/soviet-gnp/

This falls directly in line with:

https://www.goodreads.com/quotes/261863-it-s-tough-to-make-predictions-especially-about-the-future

Samuelson wrote millions of words about economics, and made who knows how many predictions. I’m not clear on why you think this bit about Soviet growth is relevant here. Please enlighten us.

By the way, the idea that the Soviet economy would grow larger than the U.S. economy was entirely conventional during the third quarter of the 20th century. Heck, the CIA expected the Soviet Union to outgrow the U.S. Right-wingers like to crow about Samuelson, while neglecting to mention that many right-wing economists agreed with him.

Perhaps the most prominent economists to realize that Soviet growth could not keep pace with the U.S., much less catch up and surpass the U.S., was Walt Rostow, advisor to Kennedy and Johnson. I mean, if we’re keeping score, then let’s keep score. If you’re just parroting right-wing spin meant to dirty up Samuelson’s reputation, well, same old Brucie.

S&P 500 is about 20% overvalued based on median CAPE and dividend yields. A rudimentary Fed Model (differential between earnings yield and 10 year yield) predicts exactly the same thing.

On the other hand, real S&P earnings have not started to drop yet as of last week, which almost always accompanies a correction. So I think the Wile E Coyote moment will last a few more months, at least until Q1 earnings start coming in.

used to be a musk fan, but as I learn more about him my opinion continues to deteriorate. just read an interesting article by will lockett (who’m I have read vary rarely, but have seen before). everybody praises musk and space x. but space x has exploded 7 major rockets in its quest to get large payload starship into orbit. it has not yet done so, and its supposed deadline to get this done has swished on past us. and currently it has announced that its payload will now only be half of what was predicted, because its components cannot handle the original payload forces. seven blown up starships, and still not a single success. now musk claims genius and is this beacon of efficiency change. and very critical of nasa. well 50 YEARS AGO, nasa put the equivalent of starship into orbit and on the moon. and they did it without blowing up a single Saturn rocket. Elon, you are no nasa. and it makes you wonder who is actually willing to sit in that starship commanders seat, while Elon cuts corners to save cash at your explosive expense? so anybody who is buying the Elon doge genius malarkey needs to consider whether they would sit in that rocket seat, considering the preponderance of failure so far achieved Elon. Elon cannot seem to accomplish what nasa did 50 years ago with slide rules and digital calculators. food for thought.

“Elon, you are no nasa.”

True. NASA and Boeing left two astronauts stranded for months in their version of Gilligan’s Island. Musk’s SpaceX has been developing revolutionary rockets and not afraid of early failures. Obviously, they’ve learned from the failures and now are uniquely positioned with reusable rockets and quick turn-around times… something NASA and Boeing can only dream about. The two astronauts said, “Elon, you are no nasa. Thank goodness.”

https://orbitaltoday.com/2025/03/24/spacex-450th-falcon-9-rocket-launch-sets-a-new-record/

I’m amused by those whose opinions of Musk have shifted 180º because he is now involved in trying to make government more efficient and less wasteful. Suddenly he is just a fraud. To them I say pick the reasons you hate Musk:

1) creating and popularizing Tesla EVs which were aligned with saving the planet by replacing fossil fuel vehicles.

2) creating and expanding Starlink satellite communications which were instrumental in restoring communications and internet to Ukraine.

3) creating and improving SpaceX which just brought back stranded astronauts when NASA and Boeing couldn’t get the job done

4) creating the Boring Company which has reduced the time and cost of tunnel infrastructure development.

5) creating and developing Neuralink that holds the promise of restoring autonomy to disabled people.

6) Volunteering his time and the expertise of his top software people to identify and eliminate the waste and inefficiency that has contributed to a $36 trillion national debt.

7) Being a legal immigrant.

Joe Biden had a visionary program: https://www.politico.com/news/2024/09/04/biden-broadband-program-swing-state-frustrations-00175845

Elon Musk already delivered in Ukraine. I’ll bet that $42 billion could provide a lot of Starlink rural high speed internet/communications in the US… and it wouldn’t involve years of laying cable through the wilderness. [#governmentefficiency]

Bruce Hall Musk’s problem isn’t that he isn’t smart enough; it’s that he thinks he’s the smartest guy in the room regardless of the subject. Musk obviously has a strong engineering mind with a lot of businessman energy. He’s been very successful at many of the things he’s tried. But he’s also been spectacularly unsuccessful in other things; e.g., marriage and interpersonal skills. You’ve really got to work at it to go through three wives in less than a decade. His intelligence matches his personality…quite lopsided. When it comes to government efficiency he’s simply way out of his depth. For example, as a businessman he’s likely to think that cutting costs is always efficient, but businessmen often don’t realize the difference between cost cutting and cost shifting. To them the effect on the private bottom line is the same. In government you have to be sensitive to the difference. He also has a cramped understanding of efficiency. There’s a difference between making the government more efficient (less inputs for the same output) and making the macroeconomy more efficient. Musk is focused on the former and seems oblivious when it comes to the latter. Firing government workers might or might not make the government more efficient, but if those workers are unable to find private sector jobs that yield a value of marginal product that is at least equal to the value of marginal product in their government jobs, then the macroeconomy is operating less efficiently. And it’s the macroeconomy that counts, not the government sector in isolation. That’s called suboptimization, something that in my personal experience is a common affliction among private sector managers. Musk also shares another trait common among megalomaniacs. When shown that he’s simply wrong on an objective fact (e.g., the age of SS retirees), he refuses to admit error. Instead, he doubles down and tries to retaliate against those who would dare to correct him. His ego is simply too fragile to accept the fact that he’s not omniscient. Then again, he shares that same trait with another megalomaniac.

Sorry, you are trying to sane-wash Elon by critiquing his efficiency skills. By discussing “efficiency” you are taking it at face value that Elon’s efforts have anything to do with efficiency. That’s just the cover story. The real aim is the total dismantling of anything that Elon disapproves of as being “woke” or DEI or gendered or Roosevelt’s New Deal. It’s all right there in Project 2025. All that stuff about fraud or inefficiency in Social Security is a lie. The real goal is the destruction of Social Security. He wants to privatize everything from the Post Office to the Weather Service to Air Traffic Control to Veterans Affairs. It has nothing to do with “efficiency.”

I’m quite aware that Trump’s real goal is to shutter the government and take revenge on the country. Hey, I spent a career as a civil servant!!! My point was that even on its own terms what Musk is doing is inefficient…even if you want to take him at his word that it’s all about efficiency. In Musk’s case I think a lot of his actions come from some perverse and immature glee that he gets from hurting people. You could almost see the dopamine when he was wielding that chainsaw.

BTW, Starlink is VERY expensive…much more expensive than fiber optic cable. And it’s quite slow and has never achieved its benchmark speed:

https://www.cnet.com/home/internet/starlink-doubled-its-users-in-2024/

And when it comes to that $42B infrastructure money, Musk is right there at the trough arguing for Starlink to get some of the money. As to government efficiency, laying fiber optic cable is a private sector thing, not the government. And that $36T debt wasn’t caused by government inefficiency; it was caused by politicians who couldn’t resist tax cuts for conservative voters who want lots of goodies but don’t want to pay for any of them.

Remember that the Starlink infrastructure is already in place. The additional cost is for the terminals for each user. If users chose cable, they would still have to rent/buy modems plus any installation costs and then would incur monthly fees as well. Cellular service is a nice alternative if you can get it. My T-Mobile downloads average about 500 Mbps dowloads and about 100 Mbps uploads which easily handles all my smart devices plus streaming services. My son’s fiber optic line is a little better, but no noticeable difference in performance.

Satellite service will be slower, but still sufficient for most users.

2023: https://www.pcmag.com/news/starlink-speed-tests-2023-vs-2022

2025: https://www.pcmag.com/articles/from-dc-to-doha-i-put-starlink-wi-fi-to-the-test-on-a-12-hour-flight

Most homes can get by with 30Mbps. Most corporations are not located in remote areas and if they are they can afford to pay for satellite service.

If you are in the middle of Alaska and willing to wait 10-20 years for cable services, then just use your carrier pigeon until then (or, ironically, your satellite phone).

If the government is willing to spend $42 billion for cable services to remote areas, then subsidizing some low-income users for Starlink would be much less costly and actually achieve some service before 2050. Otherwise, financially capable people can pay like everyone else. If you choose to live near Mt. McKinley, then don’t expect the level of services you receive in Seattle.

As for the recent rise in national debt, it is a combination of too little revenue for way too much spending. MIT Sloan Business School estimated that 40+% of 2021-22 inflation was caused by excessive government spending which then led to the Fed raising its funds rates which then led to interest service on the national debt exceeding the military budget which then led to higher national debt. See a pattern here?

The good news is that tariffs, basically a consumption tax, will put more revenue into the Treasury to help offset some of that excessive spending. Of course, nobody likes new taxes so this will be roundly panned. Better to have the top 1% of income earners pay 75% of total federal income taxes instead of the current 46% rather than a general consumption tax on inports.

We all like free internet and free stuff (paid for by others).

“Better to have the top 1% of income earners pay 75% of total federal income taxes instead of the current 46% rather than a general consumption tax on inports.”

Glad you agree with standard economics, for once:

https://www.sciencedirect.com/science/article/abs/pii/S0047272708000248

Given the declining marginal utility of income, downward redistribution of income increases utility. That is to say, taxing the rich and providing income support to the poor (along with services to everyone) absolutely improves welfare. Our government was formed “to promote the general welfare”, so I assume no true patriot would object to efforts to do so.

Taxing the top 1% at a 75% marginal rate would leave them with after-tax income above $200,000. Mercedes, yes. Yatch? Probably not, but the children of rich and poor alike could have enough food.

“I’m amused by those whose opinions of Musk have shifted 180º because he is now involved in trying to make government more efficient and less wasteful.”

Brucie, you mind-reader! In fact you’re playing mind-reader twice over. You pretend to know what Musk is trying to do so that you can pretend to know why people have changed their minds about him. Same old Brucie, makin’ stuff up.

Yes, Musk is involved in lots of businesses. And like any good sycophant, you give Musk credit for doing wonders with them. Let’s not ignore one very obvious reason that some folks have changed their minds about Musk: his businesses aren’t the wonders he pretends they are.

Oh, and about that “legal immigrant” thing – didn’t Musk violate his student visa status, thereby becoming an illegal immigrant, before he jumped the line to get legal status?

Your hero worship of racists and rapists is a thing to behold, Brucie.

Duckie, your envy is palpable. Musk was your hero until he went to the “Dark Side”, right? (Dark Side is defined as not supporting a progressive/socialist agenda).

“Palpable”? Keep your hands to yourself, Brucie!

You’re doubling down on mind reading with that “palpable “stuff, so thanks for proving my point. You don’t have a legitimate argument to make, so you’re leaning into to fake mind-reader stuff.

I’ve never had much use for Musk, contrary to your self-serving speculation. He got his pet Tesla board of directors to divert wealth from shareholders to his pockets. So, no, he was never a hero. And yes, I think less of him now that he has exposed his bigotry and his ineptitude as a manager.

bruce, while the others here have knocked down your response admirably, let me kick this dog while he is still down as well.

“True. NASA and Boeing left two astronauts stranded for months in their version of Gilligan’s Island. ” false. nasa did not strand anybody. or you should be honest and say it was nasa and space x that rescued the stranded astronaut. nevertheless, nasa is the adult in the room who made the safe decision to not board a leaky space capsule to return to earth. and lest us not forget, the only reason space x has these fun toys is because of the $billions of dollars in government and NASA money it received to develop them. I will repeat, space x exists because NASA FUNDED IT. let that sink it, dimwit.

and last I checked, those two astronauts were not dismayed one bit by being “stranded” in space for a few months. that was their dream experience. they trained for this time in space. there were adequate supplies and facilities. there was no suffering there. let me repeat, these were ASTRONAUTS. they have been dreaming of spending as much time in space as possible. so the idea they were “stranded” is simply absurd, you dimwit.

and a few comments on your other items. if starlink were to disappear today, the world would still spin. and don’t forget how musk randomly cut off starlilnk access for Ukraine, in attempts to facilitate Russian advances. as well as the Russian use of starlink in ukraine as well. the boring company? at best, it dug a tunnel in Las Vegas. not what I would call a successful and impactful company. there is more to underground construction than digging the dirt, bruce. musk has no handle on that aspect. and doge? musk is not working with the government for the greater good. he is targeting parts of the government for the benefit of his companies. tariffs on his competitors. gutting of government contracts that compete with spacex. and soon you will see neuralink try to capture the funds resulting from the decapitation of the formerly most advanced medical research program the world had ever seen, at NIH. bruce, I cannot believe one person could be so ignorant about musk and the world.

and I was a musk supporter until a couple of years ago, when I learned just how dysfunctional a personality he actually was. his disregard for employees is especially egregious. so this 180 was not a result of recent politics-although his recent actions provide ample evidence of why people should not be a supporter of him. he has displayed an unethical and immoral attitude, combined with selfish aspirations, that are not a positive for the world. which is unfortunate. at one time, I had high hopes for him.

Bruce: “Better to have the top 1% of income earners pay 75% of total federal income taxes instead of the current 46% rather than a general consumption tax on inports.”

Sounds good to me! Now you’ve got it.

Just the opposite, the Trump plan is to have both a consumption tax that falls most heavily on lower income households and couple that with lavish tax cuts for the rich. The billionaires are going to love it. Everyone else, not so much.