EJ Antoni concludes we’re in a recession, and elsewhere, have been since 2022. On the other hand, he argues (rightly) that we shouldn’t take a face value GDPNow’s reading for Q1.

What’s Dr. Antoni’s basis for judging the US economy has been in recession since 2022? In basically irreproducible results (see this paper), he and Peter St Onge claim that US GDP properly deflated has been falling since 2022.

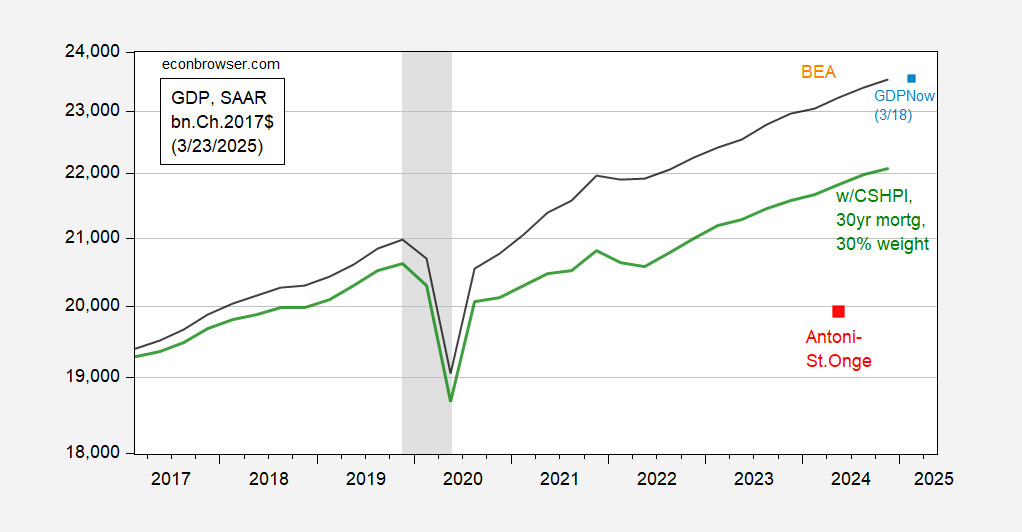

Figure 1: BEA GDP (black), GDP incorporating PCE using Case-Shiller House Price Index – national times mortgage rate factor index, using BEA weight of 30% (green), GDPNow as of 3/18 (light blue square), Antoni-St.Onge estimate for 2024Q2 (red square), all in bn.Ch.2017$ SAAR. NBER defined peak-to-trough recession dates shaded gray. Source: BEA, S&P Dow Jones, Fannie Mae via FRED, NBER, and author’s calculations.

I should note that elsewhere, Dr. Antoni has dated the recession to July or August 2024.

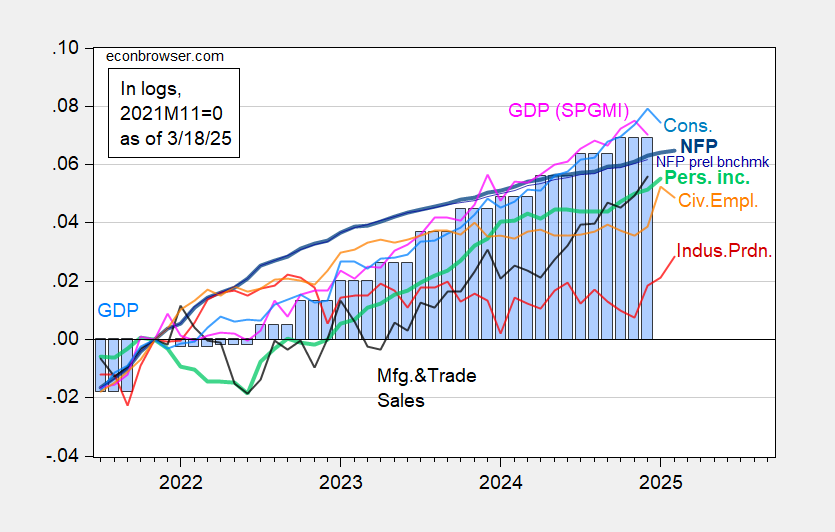

Recently, Dr. Antoni has taken to touting the industrial production surge as evidence of a coming resurgence — so my prediction is that he will soon call an end to the recession of 2022-2024. I’ll just note that industrial production is not one of the key indicators followed by the NBER Business Cycle Dating Committee (employment and personal income ex-transfers). For context, here’s a graph of the latest readings on those, along with industrial production and manufacturing and trade industry sales.

Figure 2: Nonfarm Payroll incl benchmark revision employment from CES (bold blue), implied NFP from preliminary benchmark through December (thin blue), civilian employment as reported (orange), industrial production (red), personal income excluding current transfers in Ch.2017$ (bold light green), manufacturing and trade sales in Ch.2017$ (black), consumption in Ch.2017$ (light blue), and monthly GDP in Ch.2017$ (pink), GDP (blue bars), all log normalized to 2021M11=0. Source: BLS via FRED, Federal Reserve, BEA 2024Q4 advance release, S&P Global Market Insights (nee Macroeconomic Advisers, IHS Markit) (3/3/2025 release), and author’s calculations.

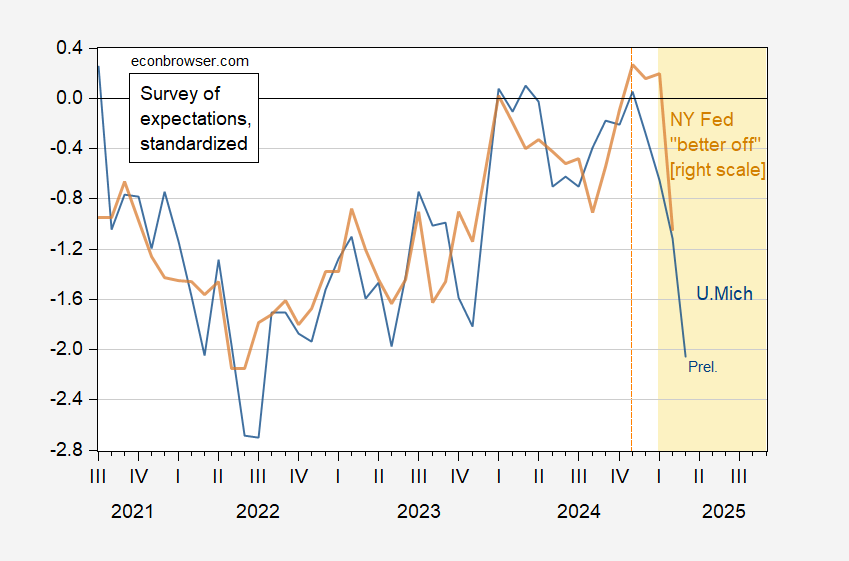

Interestingly, Dr. Antoni has made no mention of sentiment indices, even though in June he remarked on the MIchigan sentiment. For context, here are the latest readings on expectations.

Figure 3: U.Michigan expectations index (blue), and NY “better off” aggregate (tan), both demeaned and standardized (2013M06-2025M02). Source: U.Michigan, NY Fed, and author’s calculations.

Where you wrote “touting the industrial production surge”, I read “torturing “. Oh, well.

If we’re going to talk about “alternative” GDP calculations, let’s also discuss alternative GDP calculations, the ones without “bag of hammers” quotation marks:

https://digitaleconomy.stanford.edu/gdp-b/

For a good many years, there has been interest in the amount of consumer gain generated by stuff we don’t buy with money. That’s not to say we don’t pay for it; we put up with ads in exchange for music and movies, gardening, resume and make-up advice.

Anyhow, the authors have come up with a “GDP with benefits” to account for free stuff. They write that “We can also apply GDP-B to other areas of the economy, including household production, government services, and changes in health, environmental, and social indicators” which addresses issues that have been around longer than the internet.

There are conceptual problems with GDP-B, but there are conceptual problems with any effort to measure output, much less output, welfare and non-welfare conditions all in one number. Still, this is a real effort at seeing beyond a single definition, unlike what little Antoni has done.

My dictionary’s definition of 2 faced has a picture of Antoni next to it.

Please correct me if I am wrong, but the link below from FRED seems to be similar to Professor Hamilton’s recession probability postings.

The chart seems to say that there is a rather small probability that a recession has occurred since the 2020 recession.

https://fred.stlouisfed.org/graph/fredgraph.png?g=1EMaN&height=490

Here are the two, side by side:

https://fred.stlouisfed.org/graph/?g=3wqF

Looks like more people will be homeless as of next year:

https://calmatters.org/housing/2025/03/rental-assistance-hud-emergency-voucher/

Maybe sooner. A federal voucher program covering 60,000 to 70,000 recipients is delivering its last round of funding.

So little EJ’s lies have morphed into:

This is still hilarious that so many indicators point to a recession having started in ’22 but the gov’t wouldn’t acknowledge it; never before have standards of living declined so much w/o a recession:

It is on the Twitter where MAGA morons rule!

EJ Antoni needs to get caught up on his talking points – CEA Chairman, Stephen Miran and Treasury Sec. Bessent are now saying we have to have a recession to purge all those individuals with disabilities off their housing and SNAP benefits and then the GOP can give unfunded tax cuts to the top 1% – and blow up Federal interest rate payments with massive govt. debt. Also – when will the corporate media stop saying Republicans are good for the economy?