From Paweł Skrzypczyński, “Average effective tariff rate in the U.S.”:

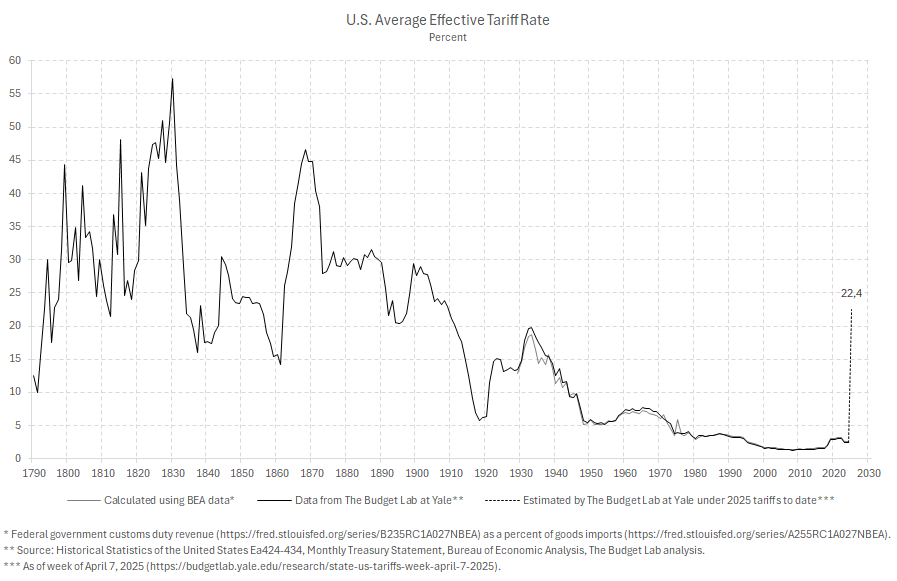

[This page] presents historical data on U.S. average effective tariff rate together with The Budget Lab at Yale estimate of this rate in 2025. The Budget Lab at Yale resources on trade policy issues are available at https://budgetlab.yale.edu/topic/trade. U.S. customs duty revenue data published in Monthly Treasury Statement releases, which is seasonally adjusted by me using X-13ARIMA-SEATS, is also presented on this page. …

Eye-popping, but nowadays, eye-popping is our daily fare.

Good resource to have. Thanks, Pawel.

Couple of thoughts on the felon-in-chief backing down on “some” tariffs.

Every school kid knows that you stand up to bullies, if you can. Canada, China, and eventually the EU all stood up to the bully. What have they learned? To stand up to this particular bully.

Stocks are better off, but the productive economy probably isn’t. In order to invest and hire with any confidence, businesses need to know that their particular circumstances are secure. It doesn’t help to know that you may or may not get a 90-day or permanent reprieve from some or all of your inputs, or that the economy is still at risk, but maybe a little less so.

Meanwhile, the felon has let it be known that he is open for business. Same old grifter.

Thx Macroduck!

On backing down Ernie Tedeschi writes on X: “ a 10% broad tariff on everything plus 125% on China, is a **25pp increase in the effective tariff rate**, even accounting for USMCA exemptions.

That’s almost exactly where 2025 tariff policy was this morning. It was just less concentrated on China & more weighted overseas.”

Repeating myself, I know, but the economic consequences, as opposed to financial market consequences, seem pretty bad. Yes, giving Canada and Mexico a break will surely help, but I have to think huge tariffs on China will mean that most factories will still have a hard time operating. Investment and hiring will remain off the table. The average tariff rate, as you note, remains nutso.

Now, if he backed down for some, won’t others have a motive to hold their ground? If so, uncertainty and risk continue.

trump will interpret the market rise yesterday as evidence of his good policy. but it was not. it was a massive short squeeze. so his decision making will be flawed going forward