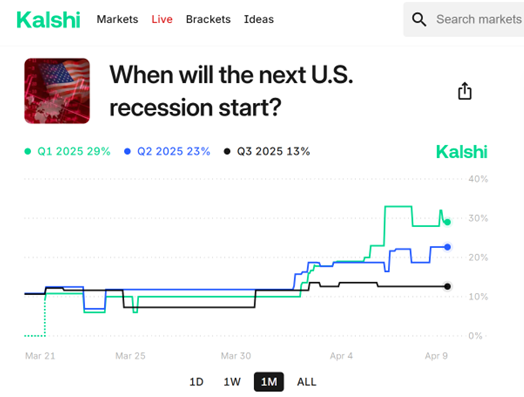

While the odds on a recession in 2025 have dropped from 69% to 54% in the wake of Trump’s 90 day pause, the predicted start of the recession has not changed much.

A 52% probability is ascribed to a recession starting in 2025H1.

The lack of a change with the announcement is perhaps less surprising when one considers that the combination of 10% broad tariffs and a 105% tariff on China yields effective tariff rates roughly the same as 10% tariffs with reciprocal tariffs.

I think it quite interesting that 29% odds on a recession having *last* quarter (as we’re in Q2).

Off topic – What the heck happened to Treasuries?

There are explanations in circulation for the behavior of Treasuries that rely on trading, rather than economic fundamentals. baffling has mentioned the “basis trade”. Margin calls are another factor. By the way, the two interact.

Don’t take my version of this stuff as gospel. I was only ever professionally adjacent to trading. Never a trader.

The basis trade is a form of arbitrage between cash Treasuries and futures. If there is a wide enough gap in pricing between the two that it will cover the cost of finance plus a little, you buy one and sell the other, typically on a leveraged basis. Since the two securities will respond similarly to directional changes in rates, you have hedged away much of the interest-rate risk. All you care about is picking up the little pricing difference, multiplied by whatever leverage you use.

However, big directional moves can blow up the trade. One or the other side can face margin calls, so you have to close that side of the trade. Closing one requires closing the other, because you now have a naked position – rate risk – in a volatile market. So, margin calls can drive a rapid unwinding of a basis trade – Sell, Mortimer! Sell!

Margin calls on stocks, which were mounting late last week, can lead to selling of securities other than stocks. You need cash to meet the margin call, and don’t care where you get it, so sell Treasuries. Which Treasuries? The ones with the most inherent risk, because you suddenly have way to much risk. The long end of the curve has the most inherent risk, so sell tens if you can, but sell.

So, margin calls on stocks can drive the unwinding of basis trades. In addition, unwinding of basis trades can lead to more margin calls on Treasuries, which then feed back into more Treasury selling. That’s another way in which margin calls and basis trades interact.

I have also heard the issue of of foreign countries selling treasuries as the source. my initial thought was china, and they may be a part of this. but I heard a lot of chatter that it was actually Japan who was the bigger seller. they offered to negotiate with trump while simultaneously selling off some of their treasuries. honestly, I think it was several foreign players, not acting in collaboration, who all took the same action to reduce exposure. and that impacted the basis trade as well. just a crazy world. and then you add in yesterday, in which the mother of all short squeezes drove the market excessively higher for a while. based on the continued drop in markets today, yesterday was simply a massive short squeeze brought on by trump and social media. what a crazy market to be in.

trump is now in a really bad situation with this trade war. he better hope that china, Japan and the eu choose not to gang up on him. because if they do, in his words, he is now holding the weak hand. the bond market is his weakness, and they feel it can be manipulated against him.

Speaking of recession, here are a couple of notions about recession tracking. New Deal democrat has elsewhere mentioned that leading indicators are forward looking, and we are right now focused on whether a recession is getting started as much as whether one is likely in the future. Knowing g whether recession is starting requires keep an eye on coincident indicators, which often don’t get much attention.

There’s another limit to leading indicators. They work because they track the internal workings of the economy. If I get an order today, I’m likely to fill that order in the future. I’ll order inputs and hire, or keep, workers to fill the order. If the curve inverts today, it’s in anticipation of rate cuts, lower inflation and reduced credit demand in the future.

When there’s an external shock, normal predictive relationships can break down. Oil embargoes, pandemics, stupid tariff policies and the Spanish Inquisition are not anticipated by leading indicators – nobody expected the Spanish Inquisition.

Now is a good time to rely on models, history and informed intuition, along with coincident indicators, rather than on leading indicators. That’s both because we’re dealing with an external shock and because we want to know where we are right now.