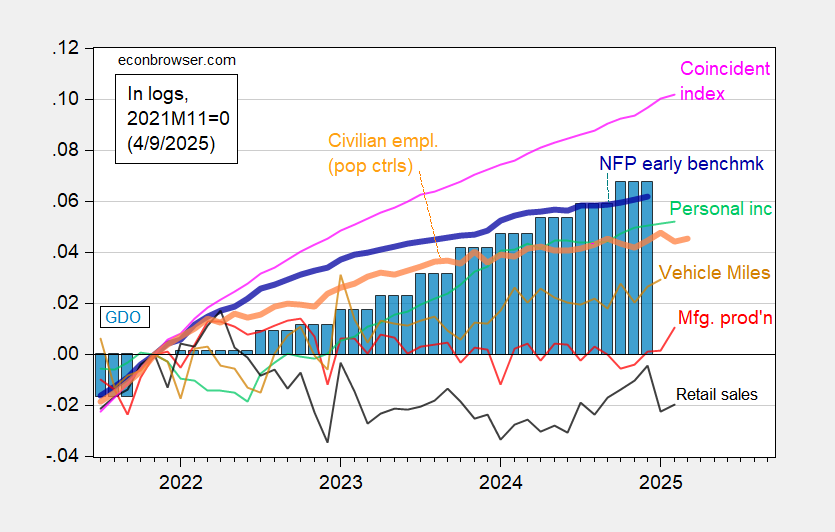

Coincident index growth slows from 4.1% m/m AR to 1.7% in February.

Figure 1: Implied Nonfarm Payroll early benchmark (NFP) (bold blue), civilian employment adjusted smoothed population controls (bold orange), manufacturing production (red), personal income excluding current transfers in Ch.2017$ (bold green), real retail sales (black), vehicle miles traveled (tan), and coincident index in Ch.2017$ (pink), GDO (blue bars), all log normalized to 2021M11=0. Source: Philadelphia Fed [1], Philadelphia Fed [2], Federal Reserve via FRED, BEA 2024Q4 3rd release, and author’s calculations.

No apparent recession start as of February preliminary data, but retail sales look somewhat pessimistic.

If grocery Ps continue to increase, consumers should continue paring back, shouldn’t they? Tomorrow’s CPI …

Ted Cruz is running for Presidet again. He’s arguing against the felon-in-chief’s trade policy as a way to gain prominence. That’s two strikes against him for the felon; bad-mouthing tariffs and not honoring the felon’s addled dream of a third term.

The good news is that, if he’s serious about running, Cruz will probably scrape that thing off his chin.