I see repeated references to this assertion. As Jason Furman points out, relative to “Liberation Day” announcement, he didn’t, insofar as the increase in tariffs on Chinese goods rose from 54% to 125% even as reciprocal tariffs were delayed 90 days, thus pushing up the effective tariff rate (with no quantity response) to essentially where it was going to.

I guess in the sense that Mr. Trump seems to want to add on additional tariffs on the merest of whims, he did blink. Kind of.

Here’s a picture of the effective tariff rate, assuming Chinese imports into the US are halved by the 125% tariffs.

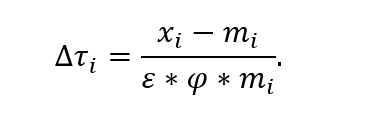

By the way, after looking at the USTR’s (?) formula ,

I gotta say the stupidity amazes even a jaded person like me. No wonder no one wants to take credit/blame for it.

Corinth and Veuger (AEI) have a concise takedown of the formula’s issues. Many have pointed out that bilateral zero balances make no sense. I want to go beyond that to say even an aggregate zero balance (on the current account, numerically roughly equal to the trade balance) makes no sense. Essentially that rules out intertemporal trade, which as shown below is Pareto inferior to free trade.

(This equilibrium is by the way the basis for the Coalition for a Prosperous America’s calculation of “fair exchange rates”, as discussed in this post.)

Finally, I am curious where CEA is. CEA’s role has been to “kill bad ideas”; and there have been plenty of bad ideas — trade-wise — floating around Washington DC for as long as I can remember. Maybe they’re fighting the good fight behind the scenes; if so, good for them.

It would appear that Trump wants to decimate (not quite annihilate) trade with China, especially in areas he deems dangerous to have dependency on China. He still kept the base 10% tariff elsewhere, but left the new 90-day window open as an opportunity to work on reciprocal or “free” trade agreements with other countries.

https://www.newsweek.com/countries-scramble-us-deals-trump-tariff-pause-2057915

The felon-in-chief has proven himself to be open to bribes. His daughter got special treatment from China, her husband from Saudi Arabia, in what Ocham would see as payoffs to the felon, during and after his first term. At the beginning of this term, the felon decriminalization the taking and giving of bribes in international commerce with a presidential order – probably an illegal order, but intent is clear.

Sane-washing of the felon’s behavior has become less common in the days since we were “Liberated” from free choice in the marketplace, but here’s Brucie, scrubbing away at the felon’s terrible economic decisions. Typical.

Well, pgl, nice to see you are back and commenting as usual. Nothing to say though, eh?

bruce, you are ok with decriminalizing bribes with international partners? seems like an odd priority the president made in his first days of office, don’t you think?

Let’s consider Brucie”s sane-washing claim that the felon-in-chief is limiting U.S. reliance on China by imposing tariffs of, who knows?, 104%, 124%, 145%. The Biden administration imposed targeted limits on exports to China, and by subsidizing construction of microchip factories, among other things, expanded U.S. capacity in a critical sector. These are targeted actions which make us more secure without causing a recession.

Does a 145% tariff on toys make the U.S. less vulnerable to China? On furniture? Clothing? Shoes? In some trivial sense, maybe you could make a tangled argument, but not in any serious way. The felon wants us to build our own factories, and is using the immediate near-shutdown of imports from China, along with big disruptions elsewhere, as a way to achieve that goal. Massive disruption of current production as an incentive? Biden, instead, used subsidies.There has been a huge increase in factory construction in response to Biden’s policies. There has been huge disruption in financial markets in response to the felon’s policies.

Oh, and in case Brucie gives us another “I choose to believe the serial liar over published data” as he did in discussion tariff levels, here’s the data on factory construction:

https://fred.stlouisfed.org/series/TLMFGCONS

This is what the felon claims to want, a giant increase in factories. Biden already did it, and the felon keeps talking about undoing what Biden did.

The U.S. was the best performing large economy in the world under Biden. Economic strength is a necessity for military strength – that’s what the South learned during g the Civil War, what Japan and Germany learned in WWII. Now, there is serious concern not only that the U.S. will fall into recession as a result of the felon’s actions, but that our growth will remain stunted in the future due to high tariffs. If strengthening ourselves against China is the felon’s goal, he’s going about it all wrong.

Brucie’s sane-washing of the felon’s policies doesn’t hold water. In fact, Brucie has once again done nothing but parrot White House talking points. The felon was a fan of tariffs decades ago. Biden came along and made the argument that we need to secure our access to strategic production, then went about doing so. The felon now uses Biden’s strategic production argument – which Brucie has aped – as just an excuse for the tariffs he has always loved. Brucie’s argument is nonsense because the felon’s policies are nonsense.

let me also remind bruce that trump promised a return to 2% mortgages. now i am not a greedy man. if you give me a 4% mortgage, i will be happy. but current trump economic policy is simply pushing rates up, not down. so bruce, when will i get that low mortgage? i can shave thousands off my monthly bill, if only the felon could follow through on that promise made to the country. of course, if those rates come as a result of a depression, will you still count it as a victory?

Corinth and Veuger deserve credit for getting this pass-through issue right and having the patience for putting up with these stupid lies from these White House clowns.

If “blink” is an absolute reversal of tariff policy, then no, the felon-in-chief didn’t blink. If “blink” means to realize that he had to appear to soften his stance in order to head off a catastrophic financial collapse, well maybe.

The fact that interest rates rose rather than falling as stocks plunged was drawing a good bit of attention around the time of the felon’s announcement. If Bessent is good for anything, he should have been warning of the risk of irreparable harm if the pressure wasn’t eased.

Problem is, the relief trade appears not to have stuck. Market participants have had another look today, and seem to realize what you are pointing out, that most of the economic harm is still in place. It’s probably not the case that a somewhat less massive tariff increase is a linear improvement over the full “Liberation Day” mistake. The baseline 10% tariff is a huge problem. The difference between 104% and 124% tariffs on Chinese goods probably doesn’t matter to a lot of purchasers.

The dollar index is having a worse day today than any in the Orange Crisis ™ other than last Thursday, and today ain’t over yet. The tens year yield started the day lower, but is rising again, while stocks fall. Tha suggests more selling to cover margin calls on stocks. Reuters reports that private credit holdings are being sold to raise cash:

https://www.reuters.com/markets/private-credit-secondary-sales-set-rise-market-turmoil-spurs-hunt-cash-2025-04-10/

This is the less-regulated part of lending, existing to get around bank capital requirements. Selling here is just another symptom, showing that slow money has joined fast money in freaking out. That’s another opportunity to break parts of the system.