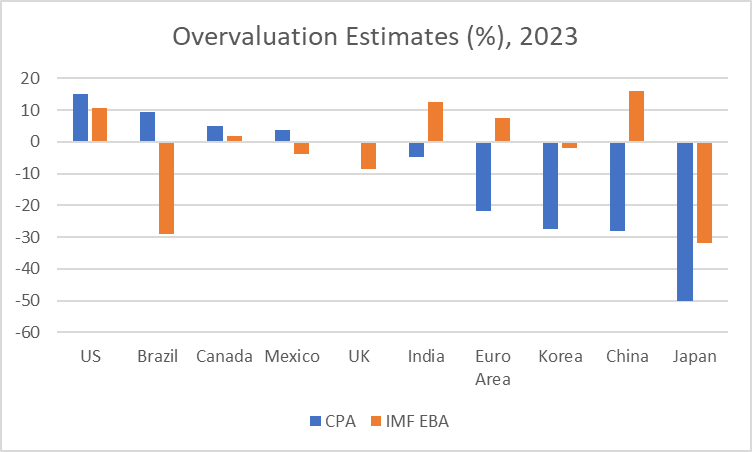

The Coalition for a Prosperous America and the Blue Collar Dollar Institute have developed a measure of currency misalignment, reported in their Currency Misalignment Monitor (August issue here). I thought it of interest to compare their estimates of currency overvaluation with those reported by the IMF in its External Sector Report (July). Here’s a chart for the currencies they focused in on in August.

Figure 1: Measures of currency misalignment from CPA/BCDI (blue bars), and from IMF EBA (tan bars), in %. Values greater(less) than zero are overvaluation(undervaluation). Source: CPA and IMF.

Why the large differences? The CPA/BCDI estimate is based on the approach adopted in William Cline’s (2008) SMIM. Using trade elasticities, the overvaluation is defined as the percent depreciation required to bring the current account to balance over time, requiring consistency across all other current account balances.

The IMF External Sector Report provides several estimates of misalignment. Here I report the one based on the External Balance Approach (EBA). The misalignment is the amount of exchange rate change needed to bring the current account to the level that is consistent with medium term balance (which is not necessarily zero).

In words, the EBA relies upon a saving-investment framework. This approach has a long history, both in and out of the IMF (my acquaintance starts with Chinn and Prasad (2000), published in JIE 2003, but for earlier, see Feldstein and Horioka (1979), published Economic Journal 1980 (over 4000 citations).

Cline’s approach did not assume zero balances were the targets; hence while the overall mathematical framework is the same (matrices, matrices!), the targets are quite different. In order to see how crazy this zero balance criterion is, this means that “fair” exchange rates are those that mean zero current account balances, which in turn means zero financial account balances. In other words, countries would be neither borrowers nor savers in the medium run.

See discussion of earlier CPA analyses of the dollar’s value, here. Discussion of measuring misalignment, here.

Addendum, 8/5 8:30am Pacific:

Here’s what the CPA/BCDI view of the fair exchange rate implies in a general equilibrium one good two period model, as I would teach in intro international economics.

So, I have admitted here on the blog, I have my little moments of stupidity (obtuse, absent-minded, choose your nice way to say dumb). You’re saying you think the CPA one is a little asinine and not a proper gauge??~~That to “zero out the reserves” is kinda arbitrary??

Check out who CPA represents.

And check out “no intertemporal trade”. Hoo boy! Reasonable as a thinking tool. Not reasonable for policy prescription.

The CPA/BCDI approach seems to be calling for massive appreciations of not only the Euro but also the currencies of China, South Korea, and Japan. The IMF approach seems to disagree except for the case of the yen.

The link to Feldstein and Horioka (1979) isn’t working but I suspect I know which paper this is.

@ Menzie

Thanks for the added/supplemental graph, I’m gonna try to look at it and mentally work through it. I am sure if I was at Follette I would be the last one in your class to “get” it.

@ pgl

Didn’t think I would find it. Here you go: https://www.nber.org/system/files/working_papers/w0310/w0310.pdf

Not sure if that was a Smith Corona, Underwood, or my personal favorite, Royal, typewriter.

https://www.nber.org/papers/w0310

Domestic Savings and International Capital Flows

Martin Feldstein & Charles Horioka

Nice touch linking to your take down of Representative Paul Ryan’s FY2012 “Path to Prosperity”. We saw a version of Ryan’s nonsense recently from JohnH. But I bet the ranch JohnH will have no clue with respect to how he is echoing Paul Ryan.

pgl’s automated, random insult generator is fabricating its usual, inane nonsense.

“But I bet the ranch JohnH will have no clue with respect to how he is echoing Paul Ryan.”

Won that bet!

Yeah, right! pgl has no point to make…just more inane nonsense.

Dude – that was weak even for you. I guess Dr. Chinn’s take down of Paul Ryan was over your head. Everything else is.

Trump toadie Alan Dershowitz is all upset that the Martha’s Vineyard Book Fair refuses to carry his worthless trash:

https://www.msn.com/en-us/news/politics/martha-s-vineyard-blocks-sale-of-alan-dershowitz-s-books-defending-trump-i-ve-been-canceled/ar-AA1ePCBC?ocid=msedgntp&cvid=68e085ec7dbc4bfb99aafa49be6065f0

After all Alan teaches at HARVARD you know!

Dershowitz has saddled up with the people who’ve cancelled “The Bluest Eye”, “Heather has two Mommies” and large parts of history. Sauce for the goose…

pgl: As far as I can tell, from 2013 onward Dershowitz is emeritus at Harvard.

My favorite was when Dershowitz – who taught a criminal law procedures – pretended he was Harvard’s Constitutional Law expert. Harvard has a couple of real Constitutional Law experts and both of them strongly disagreed with Dershowitz. Good thing the law students at Harvard do not have to endure him anymore.

Are you certain Dershowitz expertise in law and developed cottage industry wasn’t pedophilia apologetics?? Something I read about his favorite clients had me thinking that. What was it that made me think that was his specialization?? Weird……..

Dershowitz never takes his undies off during a full body massage though. NEVER, NEVER, NEVER takes his Hanes undies off during a full body massage. Make a notation on that, OK??

If we “buy into” the idea that America and the world will de-globalize, I wonder if the de-globalization implies these currency questions become less important over time?? I’m guessing Menzie might concede less important, but still important.

I do think this could be one thing the Covid-19 has taught us (if we are willing to be taught), that dependence on foreign nations for things such as microchips/semiconducotrs etc is extremely dangerous for America. Whether that is due to broken supply chains, or other reasons, either way it’s an extremely dangerous logistics set-up for America. I stated it was dangerous for Germany and the rest of Europe to be overly dependent on natural gas from Russia many months</b< before the invasion in Ukraine started, and was scolded for stating that by many commenters here, and really, uh, no, let's shall we say, "moral support" from Menzie. You'd thought I was a freakazoid for saying it, judging by the response here. How did that one "play out" in the card deck, can anyone remind me??

Moses: “I stated it was dangerous for Germany and the rest of Europe to be overly dependent on natural gas from Russia…” and it’s not equally dangerous for Germany and the rest of Europe to be overly dependent on oil and natural gas “protected” by the United States?

Henry Kissinger: “Control oil and you control nations; control food and you control the people.”

No wonder China is intent on achieving energy independence. “In 2024, China will hit Peak Gasoline, with its Demand on a Downward Spiral ever After.” https://www.juancole.com/2023/08/gasoline-demand-downward.html

Did you have to give Putin a foot massage in order to get your dog food?

Gasoline? How about coal? Oh wait – China consumes 5.9 times as much as we do so yea they import a lot.

More pgl nonsense…I didn’t say that China doesn’t import energy…what I did say is that China is intent on becoming energy independent, which is understandable, given the US intention to “protect” global oil markets.

[Yet another example of how pgl constantly lies about what I say.]

pgl needs remedial reading lessons!

“China is intent on becoming energy independent”

BFD. Oh wait – does Jonny boy need me to translate for him?

Gee Jonny boy could not be bothered with the actual facts from his own link?

China is expected to import about 10.8 million barrels a day of petroleum in 2023, a 6% increase over last year when large cities such as Shanghai were still in lock down, according to Reuters. Its total petroleum demand this year is expected to be 14.86 million barrels a day. The country produces about 4.3 million barrels a day of its own oil.

For comparison, in 2022 the US imported about 8.2 million barrels a day of petroleum, though it exported 9.58 mn. b/d, so it was a net exporter by about a million and a quarter barrels a day. US production is expected to peak in 2023 and then to decline because some of the most productive fracking fields are shallow and becoming worked out.

Hey Jonny boy – given what you write is childish stupidity – could you once at least get the damn data right?

I could care less what Henry “peace is at hand” may have said but it seems Jonny boy is doing what he does best – LIE

https://www.reuters.com/article/factcheck-kissinger-control-idUSL1N34J1RD

There is no evidence a quote attributed to veteran U.S. diplomat Henry Kissinger on controlling the food supply to control people is true, and it appears to have first appeared on a satirical website. A spokesperson for Kissinger told Reuters the quote is untrue.

Did Jonny boy forget to read the end of his own link?

I suspect the South will get electrified faster than we now imagine. For one thing, BYD, NIO, Ford, Chevy, Toyota and other automobile companies are going to want to sell their electric cars in Afro-Asia and Latin America, and they will build out, or lobby their governments to build out, charging stations in the global South as a form of foreign aid and climate change amelioration. It is also likely that if we look out ten years, EVs will plummet in price as batteries get cheaper and new technology comes on line, so that Indians and Bolivians will increasingly be able to afford EVs. Some projections have their price falling to $6,000 in twenty years.

So, the upshot is that for China, peak gasoline is around the corner, and for the world as a whole it may be only seven or eight years off.

Huh – world demand will peak in a few years. Now Chinese companies are building EVs but so are companies like Ford, GM, and even Toyota. Jonny boy told us these companies would not be building EVs. Another Jonny boy special LIE!

“Electric car markets are seeing exponential growth as sales exceeded 10 million in 2022. A total of 14% of all new cars sold were electric in 2022, up from around 9% in 2021 and less than 5% in 2020. Three markets dominated global sales. China was the frontrunner once again, accounting for around 60% of global electric car sales…

In 2022, 35% of exported electric cars came from China, compared with 25% in 2021. Europe is China’s largest trade partner for both electric cars and their batteries. In 2022, the share of electric cars manufactured in China and sold in the European market increased to 16%, up from about 11% in 2021.”

https://www.iea.org/reports/global-ev-outlook-2023/executive-summary

There is almost no doubt that China will dominate the world EV market. Sure, Chevy and Ford will try to sell their own…but given they can’t compete without the protection of tariffs. How will they compete in global markets?

Of course, economists who were once staunch free trade fundamentalists are becoming as scarce as hens teeth, so you won’t hear them complaining about US protectionism!

OK – they do well in EV exports. You on the other hand tried to peddle the lie that China dominates the entire car market. Of course that was so easily rebutted – just like the rest of your stupid lies.

Perhaps, JH, China will also develop a mini fire extinguisher you can use when your pants burst into flame four or five times a day.

Correct me if I got what you said wrong but I doubt you were suggesting Europe rely exclusively on the US for natural gas (as JohnH just accused you of saying). You likely recall Dr. Chinn’s post on the possibility of sourcing natural gas from all sorts of places including the US, Canada, Qatar etc. But just in case here is production by country:

https://en.wikipedia.org/wiki/List_of_countries_by_natural_gas_production

Of course, Europe imports energy from lots of countries…all of the sources and routes under the watchful eye of the US navy…IOW it’s a protection racket. And Europe is dependent on US “protection” for its imported energy.

pgl needs remedial lessons…or to stop lying about what I write.

Stop the presses. Europe imports energy products? Who knew? Next Jonny boy will school on the fact that 2 + 2 = 4.

Dude – you have dumb downed the conversations here ever since you polluted EconomistView. Find another blog for your worthless trash.

Jonny did not want Moses talking about natural gas. Let’s talk oil. Oh we can’t talk about coal but we must talk about ships. Come on Jonny boy – make us your mind what the topic is. Like anyone else cares.

“Europe imports energy from lots of countries…all of the sources and routes under the watchful eye of the US navy”

I see – Jonny boy wants the Chinese navy to destroy all forms of commerce. If the US Navy is ensuring we can ships goods without being destroyed that would be a good thing. But no – little Jonny boy must hate all forms of international trade so let’s just destroy ships and watch their crews drown. Jonny boy is one sick dude.

Trump may have already ticked off the judge:

https://www.msn.com/en-gb/news/us/prosecutors-ask-judge-to-issue-protective-order-after-trump-post-appearing-to-promise-revenge/ar-AA1eOMsr

The Justice Department has asked a federal judge overseeing the criminal case against former President Donald Trump in Washington to step in after he released a post online that appeared to promise revenge on anyone who goes after him. Prosecutors on Friday requested that U.S. District Court Judge Tanya Chutkan issue a protective order concerning evidence in the case, a day after Trump pleaded not guilty to charges of trying to overturn his 2020 election loss and block the peaceful transition of power. The order, different from a “gag order,” would limit what information Trump and his legal team could share publicly about the case brought by special counsel Jack Smith. Chutkan on Saturday gave Trump’s legal team until 5 p.m. Monday to respond to the government’s request. Such protective orders are common in criminal cases, but prosecutors said it’s “particularly important in this case” because Trump has posted on social media about “witnesses, judges, attorneys, and others associated with legal matters pending against him.” Prosecutors pointed specifically to a post on Trump’s Truth Social platform from earlier Friday in which Trump wrote, in all capital letters, “If you go after me, I’m coming after you!”

Lock him up and take away his access to the Internet.

Paid for research (read as paid for answers) just isn’t what it used to be:

https://www.wsj.com/articles/does-facebook-polarize-users-meta-disagrees-with-partners-over-research-conclusions-24fde67a

I wonder how exactly people find Mark Zuckerberg to be a bully?? I saw Zuckerberg take the aluminum baseball bat to that old granny’s face and I really thought he did it in a gentle and loving way.

So Twitter wanted to pay $525 million for Instagram but Zuckerberg decided he would buy it for $1 billion. And we get Threads? I thought Threads was supposed to be the new Twitter but it strikes me as a junior version of Instagram.

BTW – a lot of people have stopped using Facebook. Oh well – these outfits are really good at evading income taxes.

The articles are extremely short. But maybe they are “concise”?? I haven’t read them yet, but hope to. They are free downloads as of the moment. I assume they are free because Facebook believed they were going to get the answers they were forcing.

https://www.science.org/toc/science/381/6656

A lot of milquetoast and “ride the fence” conclusions from “researchers” who apparently thought the road of making friends with Zuckerberg was paved with gold. If only the Chinese government was this good at “soft power” as Zuckerberg, they’d have full control of Taiwan by now.

For the record – China produced 4 million barrels of oil a day in 2022. But it consumed 16 million barrels a day so it had to import 12 million barrels a day in 2022, It is a good thing that this nation might (just might) reduce its oil consumption. Too bad Jonny boy does not know how to do his own research.

But can we talk about coal consumption? Oh no – that might make little Jonny boy upset. We can’t have that – can we?

The drive/incentives for university profs (once upon a time did they view themselves as classroom teachers??) to publish papers is strong. And, apparently, very few are immune to this university career path paradigm of publishing for the sake of publishing:

https://www.science.org/doi/epdf/10.1126/science.adj9568

Well…… maybe it was just a Reinhart and Rogoff brand of “Excel spreadsheet error”…… that “coincidentally” gave them the answer they needed for a book/paper to attract a mainstream audience?? Yes……. YES…… of course!!!!!…… that is what happened. These poor innocent PhD lambs got caught in the crosshairs of column 50 of the spreadsheet and column 51. No wait, I forgot….. I forgot AGAIN…….. I always forget this part…… it was “the RA’s error”. Damn I get so confused.

Furthermore, we can also think about the sustainability side. Zero-current current account balance are not required.

See Chinn and Prasad (2003) in the JIE. On page 50:

“However, since the current account is just the change in NFA, one apparent implication is that the current account should be zero for all countries in steady state, with interest payments (negative or positive) on NFA offsetting the trade balance. In other words, there would be no cross-country relationship between the current account (CA) and the stock of NFA in the long run. However, for growing economies, the existence of perpetual non-zero current account balances is consistent with a stable NFA/GDP ratio. The steady-state relationship is then given by CA = g*NFA, where g is the rate of growth of nominal GDP. During the transition to this ‘long run,’ various other factors could influence this relationship (see, e.g., Calderon et al., 2000). Furthermore, as noted by Debelle and Faruqee (1996), trends in real exchange rates could further complicate matters if there were differing valuation effects on NFA and GDP.”

“since the current account is just the change in NFA”

You are encouraging me to re-read their paper. I quoted the obvious as a plea to JohnH that he start reading actual economics. After all his latest babbling tells us he has no clue what net foreign assets or the current account even mean.

The JIE 2003 paper also notes:

“From an intertemporal perspective, the stock of net foreign assets (NFA) serves as an important initial condition, given that the current account is the sum of the trade balance and the return on a country’s stock of NFA (or payment on its net foreign liabilities”

So we could rewrite this as Change in NFA = trade balance + r*NFA where r represents the return on NFA.

A long-term stable state might be reached if the present value of future trade surpluses = the current net foreign debt. In terms of relative to GNP we could write:

TB/GNP/(r – g) = Debt/GNP.

Yea I’m thinking of good old fashion Domar dynamics with respect the government debt and deficits – something Krugman recently noted in his NYTimes oped.

I would raise the so-called Dark Matter paradox but when I recently did this it went so far over JohnH’s little brain he started hurling childish insults. Nonetheless an interesting issue for the adults here.