Steve Kamin in the FT, Goodman in the NYT, Krugman on substack, FT Editorial Board write on how Trump policy erraticism on erosion of the dollar as a safe asset/exorbitant privilege. Kamin deploys regressions to support his conclusions:

In the wake of President Trump’s initial salvo of broad-based tariffs, on 2 April, stock prices plunged, volatility as measured by the VIX index soared, and Treasury yields shot up substantially.

Ordinarily, these developments would be expected to buoy the value of the dollar, which is a “flight-to-safety” currency sought out by investors during times of crisis and acute uncertainty. Instead, the value of the dollar, too, plunged. In fact — relative to the predictions of a simple econometric model — the dollar fell by the greatest margin in the past four years.

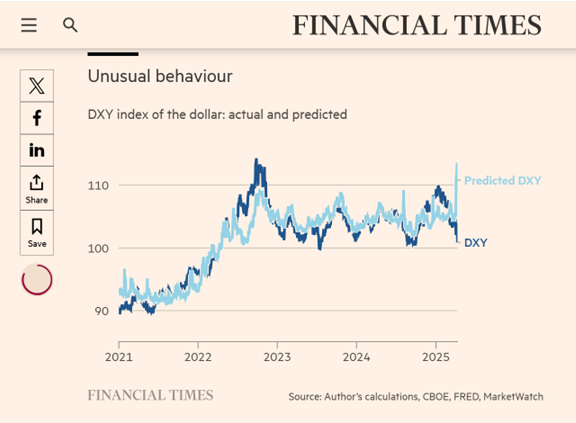

The anomalous behavior of the dollar (DXY index) is shown below:

The dollar index should have surged with the VIX. It declined instead. (It also declined with EPU, prompting me to admit in lecture yesterday I was wrong in my prediction of dollar appreciation in the wake of the Trump Tariff-Tantrum.

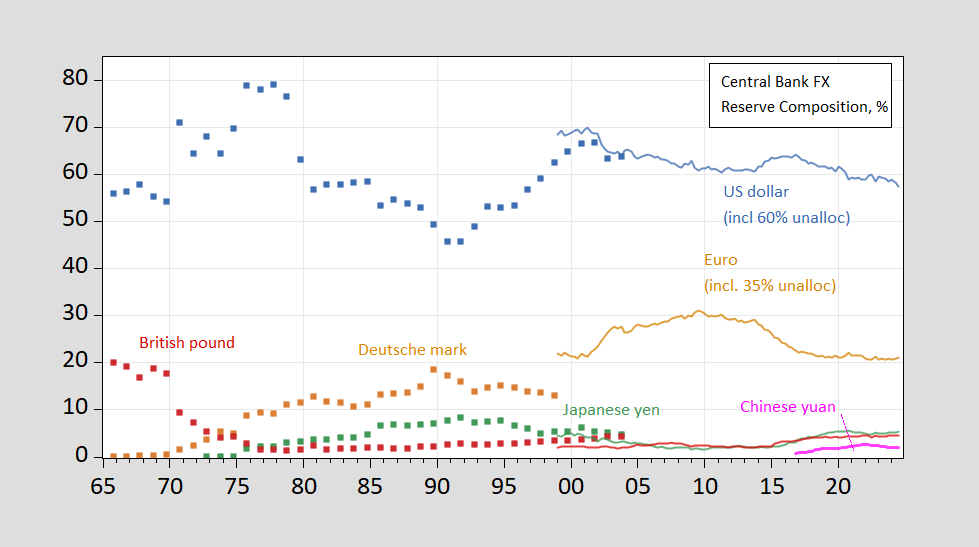

Do we know how central banks have changed their holdings? Not for a period encompassing Trump 2.0 and post-Liberation Day events. COFER data extends up to end-2024.

Figure 1: Share of foreign exchange reserves held by central banks, in USD (blue), EUR (orange), DEM (tan squares), JPY (green), GBP (sky blue), Swiss francs (purple), CNY (red). For 1999 data onward, estimates based on COFER data, and apportionment of unallocated reserves, described in text. Source: Chinn and Frankel (2007), IMF COFER accessed April 2025, and author’s estimates.

End-Q1 data will be released on June 30, 2025.

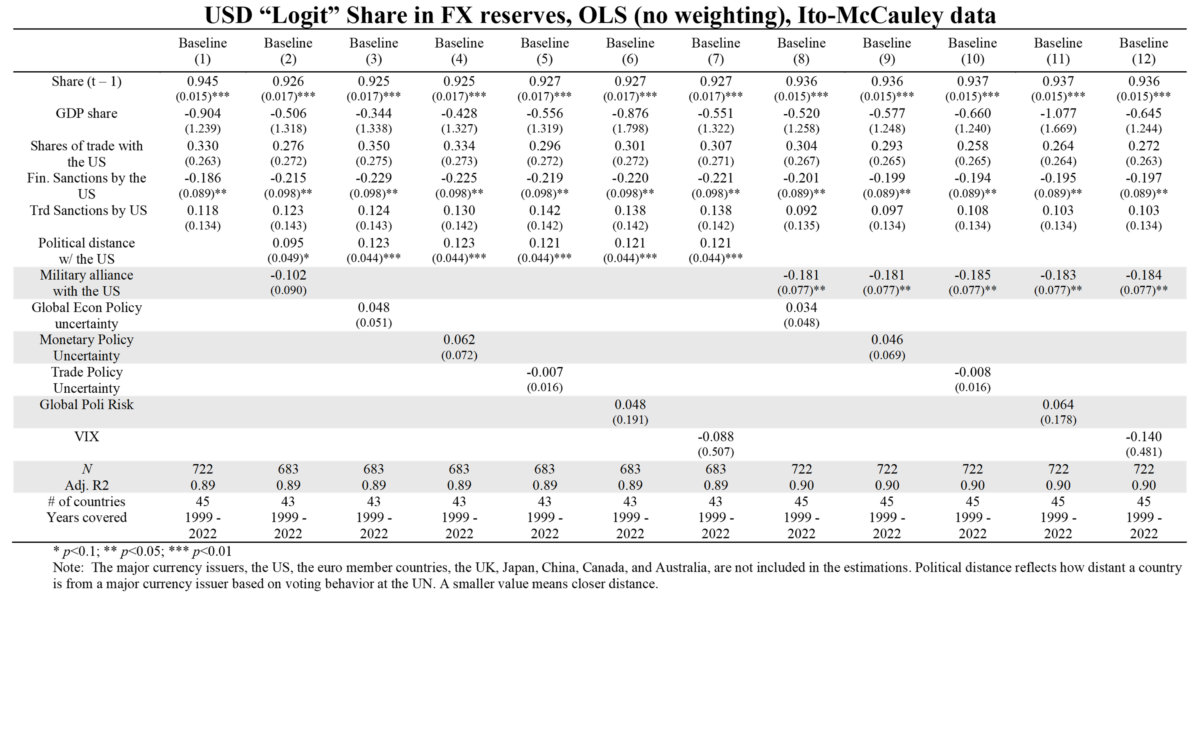

As for individual central bank holdings, which central banks are not required to publish, we only have voluntarily provided data through 2022 or 2023. Analysis of the determinants through 2022 is recounted here.

Results from regressions of logit transform of USD shares on various determinants of individual central bank holdings.

Source: Chinn, Frankel, Ito, “Geopolitical Risks and Central Bank Reserve Holdings,” presentation at “Global Shocks, Macroeconomic Spillovers and Geopolitical Risks: Policy Challenges” (ECFIN, Brussels, 7-8 April, 2025.

We won’t get a substantial number of results for 2025 for quite a while, so we’ll have to look elsewhere for evidence on central bank holdings.

US Treasury’s weren’t the only bonds that sold off last week. So did longer maturities in Canada, the UK, Japan, and Australia.

But two bonds conspicuously stood out, having sharp downtrends in yields. One was bonds in the Euro area. The other was Chinese bonds.

So on the global scale, US bonds as well of those of its closest trading partners sold off, while Euro area and Chinese bonds went entirely in the other direction.

Meanwhile, the Euro – along with the currency of every other major trading partner – appreciated against the US$. But not the Chinese renminbi, which stood out because it actually *depreciated* slightly.

If I am looking for the source of the “shot across the bow” of US$ and Treasury hegemony, I am going to look at the country which had every incentive to do so, the ability to restrict international trading in its own currency and bonds, and whose currency and bond yields moved in the opposite direction of the US.

There are a good many non-U.S. holders of dollar assets other than central banks, and those other holders are probably more sensitive to risk and faster to react than central bankers. Even if central banks have not changed their holdings much (see NDd’s comment for whether the PBOC might have), the drivers of recent dollar disinvestment are probably mostly private accounts.

Kamin’s math is certainly interesting. I would also want to consider sources of funding. Here are Interest rate spreads at 3-months for the U.S. against Switzerland, the Eurozone and Japan:

https://fred.stlouisfed.org/graph/?g=1IcvF

Those spreads suggest Switzerland and Japan as the place to borrow to fund trades, rather than Europe.

Here is the reaction of the Dollar vs Chf, Eur and Jpy to Liberation Day:

https://fred.stlouisfed.org/graph/?g=1Icy6

Notice that the match to interest rate spreads is not perfect. The Euro gained roughly as strongly as Swissy and more strongly than the Yen. (Again, see NDd’s comment.) Either something about the Eurozone makes it attractive, or the Eurozone was (is) particularly exposed to dollar assets. If memory serves, Eurozone investors are big into dollar assets.

Anyhow, high U.S. rates made dollar assets a target for investment, and unwinding of those investments would have gone through funding currencies, strengthening them. This has happened before, but as Kamin’s graph shows, the Dollar’s reaction to increased risk is uniquely bad in this instance.