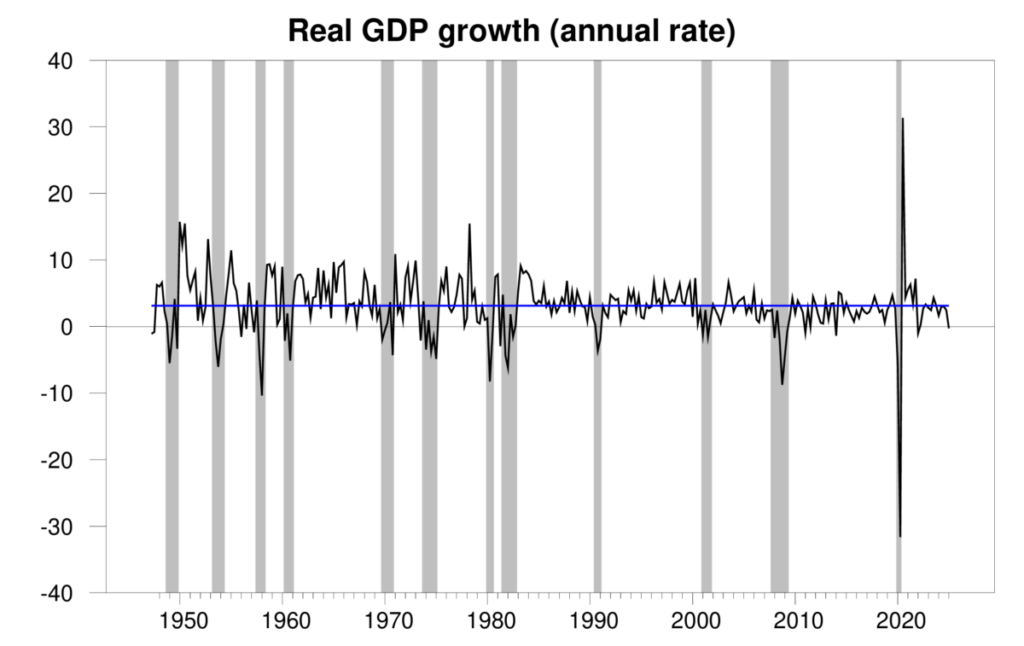

The Bureau of Economic Analysis announced today that seasonally adjusted U.S. real GDP fell at a 0.3% annual rate in the first quarter. One can make excuses for the number, but I’m not feeling optimistic.

Quarterly real GDP growth at an annual rate, 1947:Q2-2025:Q1, with the historical average since 1947 (3.1%) in blue. Calculated as 400 times the difference in the natural log of real GDP from the previous quarter.

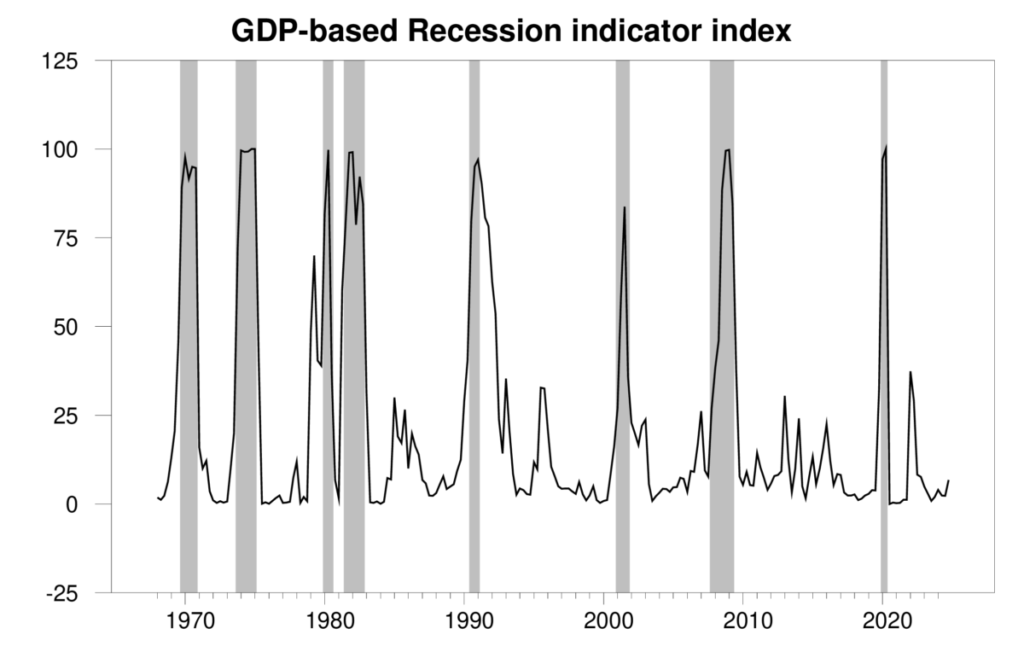

The new numbers bring the Econbrowser recession indicator index up modestly to 6.8%. Note this is an assessment of where the economy was in the previous quarter, namely 2024:Q4. Since we started reporting this in 2005, Econbrowser reports this measure with a one-quarter lag to allow for data revisions and to aid the algorithm in pattern recognition. A value of 6.8% by itself is not that alarming.

GDP-based recession indicator index. The plotted value for each date is based solely on the GDP numbers that were publicly available as of one quarter after the indicated date, with 2024:Q4 the last date shown on the graph. Shaded regions represent the NBER’s dates for recessions, which dates were not used in any way in constructing the index.

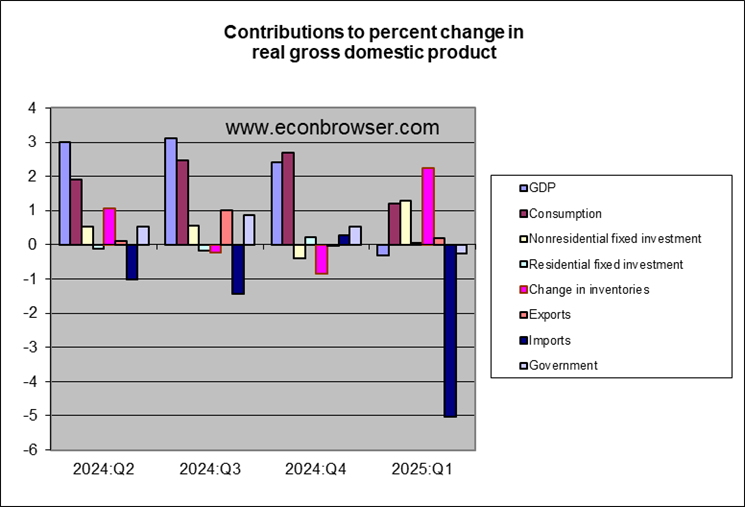

The fall in real GDP was caused by a huge surge in imports. These are subtracted from GDP and presumably reflected businesses trying to stockpile items before tariffs drive their prices up. We also see a surge in inventories, consistent with the stockpiling interpretation. Apart from this, one could take some solace in the strength of nonresidential fixed investment.

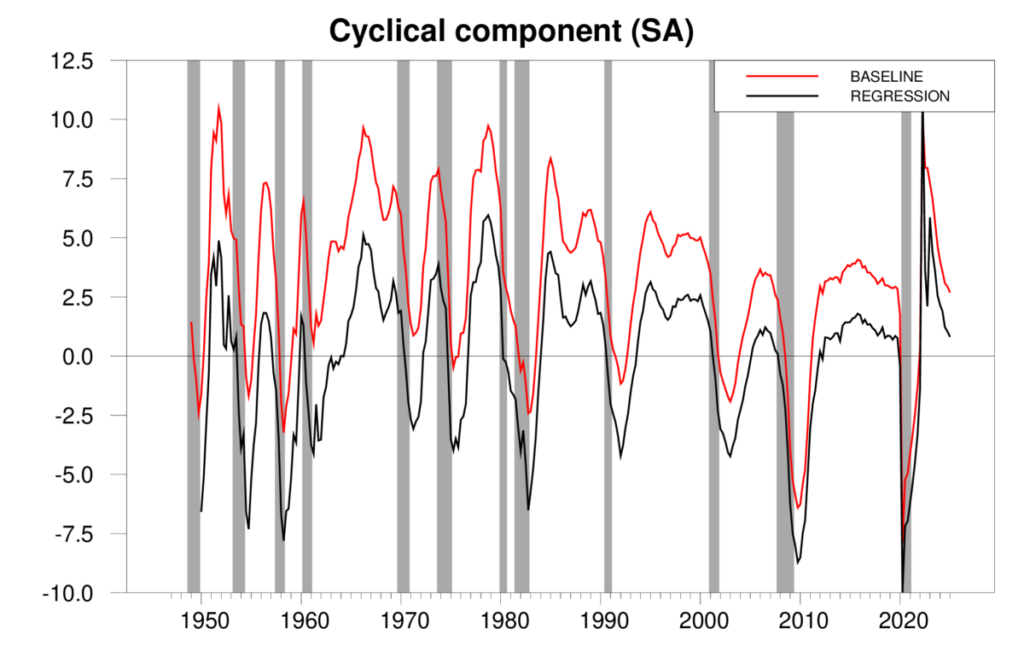

But I find it hard to see a positive in the fact that people are running to protect themselves from what’s coming around the bend. In a 2018 paper in the Review of Economics and Statistics, I noted that the two-year percentage change in the number of people on nonfarm payrolls often provides an early indication of an incipient business contraction. The 2-year growth rate has definitely slowed down, as it does as any expansion matures, though the sharp deceleration that often marks the months just before a recession has not yet set in.

Red line: 100 times the two-year change in the natural logarithm of end-of-quarter seasonally adjusted nonfarm payrolls, 1949:Q1 to 2025:Q1. Black line: two-year-ahead forecast error for predicting 100 times the log of end-of-quarter nonfarm payrolls, 1949:Q1 to 2025:Q1. Updates Figure 5 in Hamilton (2018).

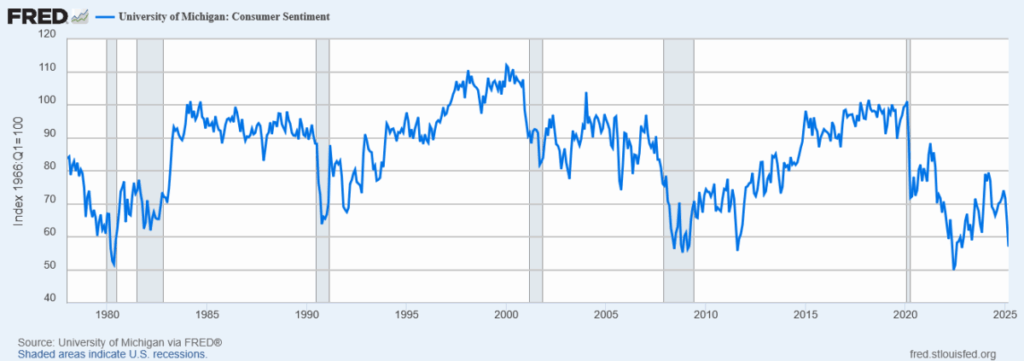

Consumer sentiment offers another warning sign.

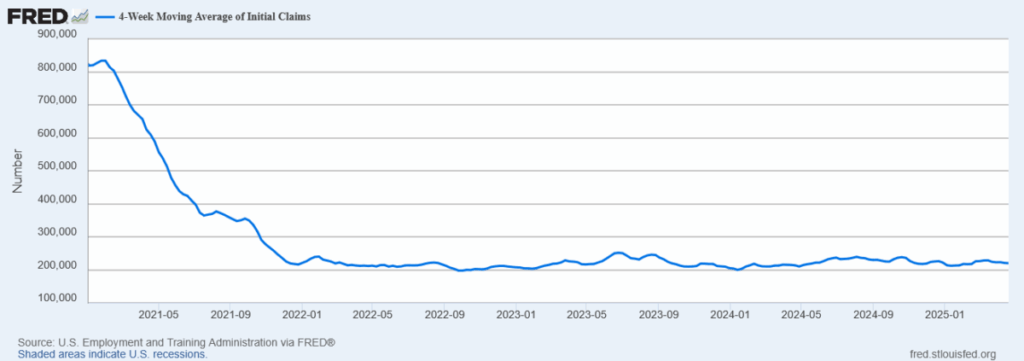

In my view, new initial claims for unemployment insurance are the single most reliable indicator of the early stages of a recession. These still look fine.

4-week average of initial claims, Jan 2, 2021 to Apr 19, 2025.

All this is not enough to ring the fire alarm. But it does bring a frown to our Little Econ Watcher.

In the words of Bob Dylan, it’s not dark yet, but it’s getting there.

“One can make excuses”

It was Biden’s fault? Oh wait – it was positive growth if you leave certain things off?

Just take out the negative things and the sum will be positive.

Trump told reporters he said there would be transition issues during the campaign. The press fact checked this claim and Trump never made any such claim before the election.

“Real final sales to private domestic purchasers” was up. Is that what Jason Furman calls core GDP?

Core GDP is such a dumb name for it, because it quite consciously has nothing to do with domestic production. It’s an attempt to gauge demand in the economy, but as we saw this month, demand can contribute to GDP or it can not (if it’s all in imports).

Inventory accumulation offsets only about half of the drag from trade. Where’d the rest go? The simplest answer is that it ended up in consumption. If half those extra imports ended up in consumption in Q1, demand for some categories of goods (durables, in particular) will probably slow in subsequent quarters. Crudely, that’ll match tariff-constricted supply, but not in a way that will make people, or economic data, happy.

Real investment grew 5.1% in the quarter, one of the highest rates in the past 25 years.

But real imports grew 9.0% (!!!), the highest rate in over 50 years except for one quarter during the pandemic:

https://fred.stlouisfed.org/graph/?g=1IEQy

Which suggests a huge amount of front-running potential tariffs.

So we’re looking at downward pressure on investment and consumption in coming quarters, because of prices (tariffs and immigration policy), supply (tariffs and immigration policy) and pulling spending forward (tariffs). We can also expect a bout of thrift in response to uncertainty (tariffs and immigration policy), a further drag on spending.

Here’s the kicker: If this prediction of weaker consumption and investment due to tariffs comes to pass, then this will all have been predictable. Hassett and Bessent and Lutnick and the felon-in-chief will all be proven wrong as wrong can be, without any real consequence to themselves. No accountability, except to themselves. Small wonder populism is popular.

Adding insult to injury there will be a lot of consumers who pull back because they used to be employed in research or other government funded activities.

and these workers are reasonably well paid. their pullback will be consequential to the economy.

Macroduck, re: “If half those extra imports ended up in consumption in Q1” that’s what i was figuring on too, given the big jump in March retail sales of autos, which was due to imports as per WardsAuto (the source of BEA data)….but the Q1 GDP report showed real durable goods were down at a 3.4% rate, with almost all of that due to an 11.1% drop in real sales of autos…other goods? modest increases in furnishings, durable household equipment, and recreational goods and vehicles, some of which could have been imported, while it’s unlikely that much of the increases in food, clothing or energy goods PCE were in any way imported to front run tariffs…most of the modest increase in Q1 PCE was services..

so where did the record imports end up? equipment investment, which increased at a 22.5% rate and added 106 basis points to GDP, is one thing i missed…the lion’s share of that was ‘data processing equipment’…according to the March durable goods report, the value of domestic shipments of nondefense capital goods less aircraft only rose 0.3%, after rising 0.7% in February and falling 0.2% in January, so it looks like most of the GDP increase in equipment was imported..

while wholesale inventories accounted for $243.4 billion of the big $250.6 billion NIPA basis inventory increase in March, the SAAR wholesale inventory increases of $84.9 billion in January and $38.6 billion in February did not come close to accounting for increased imports in those months…so it looks like about half the record 1st quarter imports will not show up in inventories until the second quarter, incorrectly inflating that quarter’s GDP growth after incorrectly being subtracted from Q1 GDP….watch for my coming response to Dr Hamilton below for a further discussion of that..

sources: https://www.bea.gov/sites/default/files/2025-04/gdp1q25-adv.pdf

https://www.bea.gov/sites/default/files/2025-04/gdpkeysource-1q25-adv.xlsx

Thanks. NDd seems to have similar thoughts.

“…U.S. real GDP fell at a 0.3% annual rate in the fourth quarter…”

I believe that should be “…U.S. real GDP fell at a 0.3% annual rate in the first quarter of 2025…”

Thanks! Fixed now.

Off topic – We need to cut the felon-in-chief some slack. Apparently, he has personally saved the life of 119 million Americans…no wait…258 million. That’s how many would have died if 22 million fentanyl pills had not been seized at the border since the felon’s inauguration:

https://nymag.com/intelligencer/article/pam-bondi-says-trump-just-saved-258-million-american-lives.html

And that’s just in the felon’s first 100 days, so in the 365 days of Biden’s final year on office, somewhere between 424 million and 943 million Americans must have died from fentanyl!!! Whichever number it was, out of a population of just 340 million, so that’s a lot of people who died from fentanyl.

Oh, and each of those pills kill 5 or 10? I gotta get me some of these.

a simple poll question to ask the readers. how many of you have made a decision to cut back on spending in anticipation of a chaotic future? we are no longer buying a new car. window purchase is on hold (although I will pull the trigger there). we eat out less and cut back on other discretionary spending-not eliminated but cut back. this is how a recession begins. my only issue is that this is a self inflicted recession. and I am not sure how it ends? it does not end in the usa until this tariff fiasco is constrained, and trump has backed himself and china into a corner. China appears willing to let the damage occur. their calculus is that in the long run, a tariff war damages the usa more than china.

The real global contest is over capital not goods and Trump is figuratively cutting off our feet and tying US economy’s hands behind our backs with is tariffs on/tariffs off/carve outs for that/this sector/policy uncertainty. Meanwhile every other country on earth is seeing an opening for capital inflows – https://www.apollo.com/insights-news/insights/2025/04/the-real-global-contest-is-over-capital

in other news, the trump administration and rfk jr will now require placebo testing with vaccines. why? we already know the impact of virus on the unvaccinated. why put a particular group of people at risk in the study by giving them a placebo? seriously, how does placebo groups help in the study of an hiv vaccine? explain that to the person who ended up testing positive when they thought they had some protection? same with flu. this is not science. it is an attempt to create friction in the deployment of vaccines but a bunch of antiscience skeptics.

This policy serves as another distracting outrage against public welfare, and the felon is all about outrageous distraction. So, for that matter, is rfk. My first reaction was to think rfk wouldn’t willfully risk lives, but of course he would. It’s pretty clear that rfk has done his medical skeptic routine for money and it has cost lives. His kids are vaccinated (so is he?), but he tells the world that vaccines are bad.

It’s like he knows just enough about science to get it wrong. There is a pefectly good control treatment for new drugs intended to improve on existing drugs – the existing drug. We already have statistics on the untreated population. The placebo effect was already checked for when the first vaccine for a given disease was tested. By the transitive property of placebo, no need to do it for successor vaccines.

The felon-in-chief got an education in immunology during his first term, and it didn’t take; maybe this is his idea? It is “turn Gaza into a resort” level thinking. Or maybe that worm ate more of rfk’s brain than we thought.

From the World Health Organization: https://iris.who.int/bitstream/handle/10665/94056/9789241506250_eng.pdf?sequence=1

The medical ethics continue to be argued with regard to vaccines as it has for the use of off-label medication without clinical trials. There are those who argue that the risk of proceding without adequate clinical controls outweighs the possible benefits… and vice versa. This showed up during the COVID pandemic when vaccines were rushed to production with very abbreviated reviews on the basis that potential benefits probably outweighed the unknown risks of adverse reactions. However the judgment was exactly the opposite with regard to approving thoroughly tested and safe medications repurposed to fight COVID; the risk was considered too high.

And example of the latter is Ivermectin which was roundly derided as a “horse dewormer” by mainstream media, and physicians were threatened with the loss of their medical licenses if they prescribed it for treating COVID. Then it was discovered:

Meta-analyses based on 18 randomized controlled treatment trials of ivermectin in COVID-19 have found large, statistically significant reductions in mortality, time to clinical recovery, and time to viral clearance. Furthermore, results from numerous controlled prophylaxis trials report significantly reduced risks of contracting COVID-19 with the regular use of ivermectin. Finally, the many examples of ivermectin distribution campaigns leading to rapid population-wide decreases in morbidity and mortality indicate that an oral agent effective in all phases of COVID-19 has been identified.

https://pmc.ncbi.nlm.nih.gov/articles/PMC8088823/

Ironically, a new development has emerged with regard to Ivermectin:

Ivermectin has powerful antitumor effects, including the inhibition of proliferation, metastasis, and angiogenic activity, in a variety of cancer cells. This may be related to the regulation of multiple signaling pathways by ivermectin through PAK1 kinase. On the other hand, ivermectin promotes programmed cancer cell death, including apoptosis, autophagy and pyroptosis. Ivermectin induces apoptosis and autophagy is mutually regulated. Interestingly, ivermectin can also inhibit tumor stem cells and reverse multidrug resistance and exerts the optimal effect when used in combination with other chemotherapy drugs.

https://pmc.ncbi.nlm.nih.gov/articles/PMC7505114/

So the ethical debate rages on: should new vaccines be exempt from safety and efficacy testing if they hold the promise of benefit… and… should medicines approved for human use be withheld for off-label use without similar safety and efficacy testing even if they hold the promise of benefit?

How do you resolve that, baffling? There is patient risk in both scenarios; there is potential patient benefit in both scenarios.

The study you quote uses data into December 2000, and at least one of the studies it was based on was retracted due to fraud. A later, larger, meta-study (https://www.sciencedirect.com/science/article/pii/S2405844024036788#appsec1) found the opposite:

“Our meta-analysis included thirty-three RCTs (n = 10,489), which comprehensively reviewed the evidence on IVM treatment of patients with COVID-19 up to June 22, 2023 and showed that IVM did not have an effect in reducing the risk of mortality in patients with COVID-19. However, IVM had an effect on reducing the risk of AEs and MV requirement. Additionally, IVM did not increase the risk of PCR negative conversion, LOS, viral clearance, admission to ICU, symptoms resolved, discharged from hospital, hospitalization due to progression, or SAEs. Subgroup analysis based on different controls showed that IVM did not have an effect on reducing all-cause mortality rates in patients with COVID-19. In addition, subgroup analysis by severity of COVID-19 patients, IVM showed no effect on all-cause mortality rate between IVM and SOC, either. Which was consistent with the overall analysis when excluded small sample size studies (n < 60) or studies with follow-up < 21 days."

With respect to your "ethical debate" – there isn't one, really, about either topic; w.r.t. your first topic; the answer is "no, except for patients who are going to die anyway and have been fully informed and agree to be test subjects." I mean, come on, *thalidomide*? And likewise for the second topic; doctors can freely prescribe drugs for off-label use and have been able to for a long time.

The confusion about the efficacy of ivermectin in reducing mortality from COVID seems to be due to regional differences in outcomes. Areas that reported significant reduction in mortality from COVID infected patients appears to be because of the prevalence of strongyloidiasis in those regions. However, that again demonstrates the danger of disregarding alternative approaches, not just for COVID, but for other diseases. Sometimes, one size does not fit all and a “finding” that “proves” or “disproves” a result under one set of conditions may be invalid under other conditions.

The ethical question is: should empirical results be ignored when the results are demonstrating positive results until clinical trials including placebo comparison trials are completed? It appears that hundreds of thousands of lives were potentially saved in areas of strongyloidiasis by using simple empirical approaches rather than relying on a pronouncement from the NIH or WHO.

https://jamanetwork.com/journals/jamanetworkopen/fullarticle/2790173#google_vignette

Results

Twelve trials17 -19,29-37 comprising 3901 patients were included in this analysis (Table 1). Ivermectin trials performed in areas of low regional strongyloidiasis prevalence18 ,19,29-32,35,37 were not associated with a statistically significant decreased risk of mortality (RR, 0.84 [95% CI, 0.60-1.18]; P = .31). By contrast, ivermectin trials that took place in areas of high regional strongyloidiasis prevalence17 ,33,34,36 were associated with a significant decreased risk of mortality (RR, 0.25 [95% CI, 0.09-0.70]; P = .008). Testing for subgroup differences revealed a significant difference between the results of groups with low and high strongyloidiasis prevalence (χ21 = 4.79; P = .03) (Figure 2). The estimate for τ2 (the variance of the study effect sizes) was 0 (95% CI, 0.000-0.9432), and the estimate for I2 (percentage of variability that is explained by between-study heterogeneity) was 0 (95% CI, 0-58.3%).

bruce, your ignorance is stunning. ivermectin treats strongyloidiasis, a disease that can compromise the immune system. what you are seeing in the data is not ivermectin treating covid. you are seeing ivermectin treating strongyloidiasis. and if treated, then that population has a better immune system to defend against a covid infection IF it occurs. this data does not say that ivermectin treats covid. in fact, the study basically states that fact. do you actually read the stuff you post?

Your link includes an expression of concern about the study, essentially warning against accepting its results. You ignore it. So even if you were ignorant of the study Ithaca cites, which se3ms likely, it was dishonest of you to imply that your favorite article is somehow legitimate. Evidence against it was right in front of you.

More to the point, though, you have pretended to address the point baffling made, but you haven’t come close to doing so. “Some question about accepted medical science, sometime” is not evidence that the use of placebos in tests of second-generation drugs is useful.

This is your most common rhetorical dodge: “Here’s a paper I’m going to pretend says something that I’m want it to says”. You bastardize science while pretending to honor it. That’s extraordinarily dishonest.

bruce

“So the ethical debate rages on: should new vaccines be exempt from safety and efficacy testing if they hold the promise of benefit… and… should medicines approved for human use be withheld for off-label use without similar safety and efficacy testing even if they hold the promise of benefit?”

this is an inaccurate statement, as usual. vaccines should not be exempt. but they also should not need to reproduce known results through a placebo test under many conditions. this is not a wild west. but you are advocating for creating friction when it negatively impacts safety. go tell that to the person who tested hiv positive after a placebo vaccine. you have that conversation, monster. and off-label use has always been available. so stop defending the monster in the white house and hhs who are simply trying to further their anti-fax agenda. it is simply immoral. you were protected from covid by the vaccine, for crying out loud.

This is unethical according to the Helsinki Declaration – ” according to the Declaration of Helsinki in its most recent formulation, the use of placebo is acceptable under the condition that no proven treatment exists, but also ‘where for compelling and scientifically sound methodological reasons, [it] is necessary to determine the efficacy or safety of an intervention’, provided that ‘the patients who receive placebo or no treatment will not be subjected to any risk of serious or irreversible harm’ ” (https://pmc.ncbi.nlm.nih.gov/articles/PMC3894239/) I don’t imagine too many doctors will go along with this.

we have our first revisions to this GDP report with this morning’s construction spending report…to start with, annualized construction spending for February was revised $11.1 billion higher, from $2,195.8 billion to $2,206.9 billion, and annualized construction spending for January was revised $14.4 billion higher, from $2,179.9 billion to $2,194.3 billion…in reporting 1st quarter GDP, the BEA’s key source data and assumptions (xls) indicated that they had estimated March residential construction would be $3.4 billion more (at an annual rate) than that of the previously reported February figure, that annualized March nonresidential construction would be valued $0.6 billion more than that of the reported February figure, and that March public construction would decrease at a $0.9 billion rate from previously reported February levels…totaling those figures, the 1st quarter GDP report used figures showing March construction spending was at an $3.1 billion annual rate higher than previously reported February levels…since this morning’s report shows that March construction spending actually fell at an $10.8 billion annual rate from February figures that were revised $11.1 billion higher, that means the total annualized construction figure used for March in the GDP report was $3.1 billion too high….averaging that overstatement with the the understatements in the annual rates of construction spending used for January and February in the GDP report, we thus find that this morning’s report shows that construction spending was underestimated at an $7.5 billion annual rate in the 1st quarter GDP report, implying an upward revision to the related GDP components at a rate that would result in addition of about 0.14 percentage points to first quarter GDP when the 2nd estimate is released on May 26th…i should mention that since that estimate is based on the aggregate change in nominal spending, an imbalance of inflation adjustments among the revised construction components might also have a material impact on the final revision…

Annd…one day later, initial unemployment claims surge by 19k. Construction spending and the ISM manufacturing index are also down. That darkness is moving in pretty fast.

The FRED blog has a post about this issue:

https://fredblog.stlouisfed.org/2018/09/do-imports-subtract-from-gdp/

… and echoed here:

https://www.econlib.org/imports-as-a-drag-on-the-economy/

Presuming that tariffs are going to cause a sharp decline in imports (and a much smaller absolute decline in exports), should we expect a gain in GDP from the reduced level of imports? Statistically correct, but explain that to a confused freshman taking Econ 101. Perhaps that’s because most people think that buying a lot of imported goods reflects a strong economy and that GDP growth also reflects a strong economy.

bruce, clearly state what you think is going to happen with imports and gdp over the next quarter. put it in writing. and we can evaluate your prediction as right or wrong. be clear about what you are trying to say here.

A freshman being confused by GDP accounting is no surprise; they tend also to be confused by iambic pentameter and valence bond theory,too, until they apply themselves. That confusion reflects the condition that college education is meant to remedy.

When presumably educated adults misunderstand how economics (and the economy) works, that’s on them. They should not go unchallenged when they pollute discussion, or policy, with their errors.

We subtract imports from national output to avoid double counting – it’s an accounting thing. When imports trot along in normal fashion, they cause little wiggles in GDP accounting, as do inventories, and those import and inventory wiggles tend to be cancel each other out. When imports don’t trot along in normal fashion, they can cause swings in GDP large enough to cause misunderstanding. Same with inventories.

What caused inventories to behave oddly in Q1? Anticipation of stupid tariff policy did. Not only do we need to take the huge wobble in imports into account, but we also need to take the cause into account. Stupid tariff policy led to a surge in imports.

If this would confuse college freshmen, it should not confuse us. Stupid tariff policy led to a decline in GDP. Understanding that allows us to understand the economic damage that lies ahead if stupid tariff policy remains in place.

Bruce Hall:

The contributions to GDP growth represent the answer to the following counterfactual question: suppose that the indicated component of Y = C + I + G + X – M had had changed by the amount actually observed in the first quarter with all other components unchanged, what would we have observed the change in Y to be? The sum of the attributed components exactly equals the observed change in GDP. The implication is that much of the observed growth in C + I came from higher M, and that the volume of domestically produced goods contracted. Greg Ip (citing Brad Setser) speculates that some of the increased inventory of imported goods was not counted in measured inventory change.

i can’t get to the Ip article, but i agree that some of the increased inventory of imported goods was not counted in measured inventory change, nor not much anywhere else in PCE or investment, and hence should not have been subtracted from first quarter GDP….that’s clear if one looks at the BEA’s key source data and assumptions (xls) that accompanied the report; we had record real imports in January, 0.1% short of a record in February, and up ~5% to a new record in March…those imports did not appreciably start accumulating in wholesale inventories until March, so it’s possible less than half of them were accounted for in the GDP report..

there is nothing inherent in a boatload of goods arriving at a port in So Cal that reduces the output of goods and services produced domestically…if your intention is to get an accurate read on 1st quarter domestic output, imports should only be subtracted from GDP when they’ve been incorrectly added to another GDP component, ie, represented by imported PCE, equipment, or inventories…BEA does not help our understanding of what’s being done by including imports under a GDP entry with exports… the formula Y = C + I + G + X – M is crude, and in this case yielded a seriously incorrect Y…..if you were to write it correctly, your formula would look some like Y = (C -MC)+ (I -MI)+ G + X i don’t know if we have data to do that…a similarly crude adjustment, which would get us closer to the real change in GDP, would be to lag the import subtraction by a month, ie, subtract December, January and February imports from 1st quarter GDP, and then subtract March imports from the second quarter….i know that’s heresy, but it would come close to what’s happening in the real world..

“…BEA does not help our understanding of what’s being done by including imports under a GDP entry with exports… the formula Y = C + I + G + X – M is crude, and in this case yielded a seriously incorrect Y…”

Not sure I understand. Y is C + I + G + X – M by definition. It can’t be “incorrect” if it is calculated according to that definition, other than because of estimation errors. If there is an undercounting of inventories, that will presumably be remedied in revisions.

If you have some concept in mind other than Y, such as domestic consumption, we have data for that.

On the one hand, the felon administration has been lying its backside off about trade deals and negotiations, in particular with China. On the other hand, it apoears that the felon administration has been requesting trade talks with China and that China is open to the idea:

https://www.thetimes.com/business-money/companies/article/chinas-state-media-says-no-harm-in-holding-trade-talks-with-us-8tds5cfxm

The S&P is up about 1%, DXY up about 0.8%, 10-year yield up 6 basis points.

China continues to contradict the felon’s claim that negotiations are underway, but has reduced tariffs on various U.S. imports. As it happens, most of the tariffs which have been reduced apply to imports necessary for Chinese production; unlike the U.S., China isn’t cutting off its nose to spite its face. This will undoubtedly be cited by the felon as China bending to his will.

Meh, those tariffs didn’t change, nor were they lowered. Macro, please source your info. It offers nothing new. They won’t lower tariffs until a recession/financial downturn begins. Then they will be stopped to stop a full blown crisis. You still don’t get it.

My link is less than a day old. Your claim of “nothing new” is obviously wrong on that point. You asked for links to evidence and then simply assumed there is no evidence. That’s dishonest.

By the way, since you asked so nicely, let’s start with ethane, pharmaceutical, aerospace and semiconductor products:

https://uk.finance.yahoo.com/news/exclusive-china-waives-tariffs-us-135419268.html?guccounter=1&guce_referrer=aHR0cHM6Ly93d3cubmFrZWRjYXBpdGFsaXNtLmNvbS8&guce_referrer_sig=AQAAAEU9Ew88Vi2ky46Q1P9Epxz0APN86y7NsablmbCoxrBDTXP4GL3C-RWFq0zBcufMVaqIRGzhP0gpR0Nnw6aVKXAUnd6UQzF0Yw7IQzfLRBt5vwwcQpWABdqfxQOoXivgjK5YWcCmGgam8T6SLU0cqN8d-MscDEJ8wOMptg4fyYTj

Maybe check the internet before you run your mouth next time.

And if you demand evidence, maybe you should provide some. I mean really, what’s this nonsense?:

“They won’t lower tariffs until a recession/financial downturn begins. Then they will be stopped to stop a full blown crisis.”

I’m curious whether “they” is meant to be China or the U.S. but either way, you’re simply inflating your unsupported opinion to the level of fact. Grow up a little.