I’m coming up on lecturing on Fed independence and time consistency etc. President Trump continues to provide (depressingly) many episodes to discuss. No dearth of “current events” topics this term…

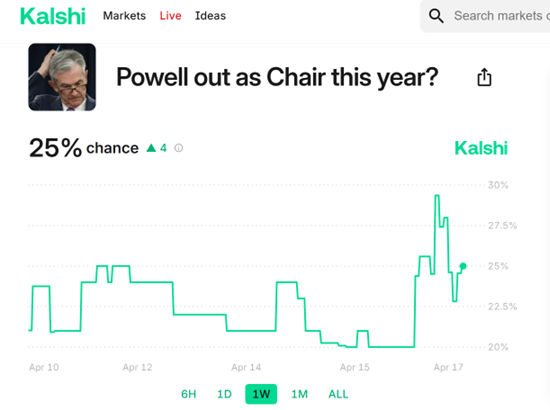

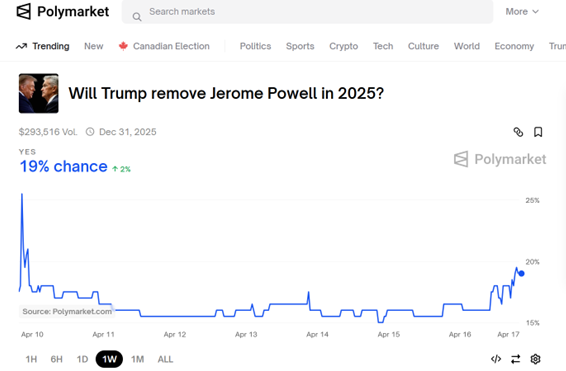

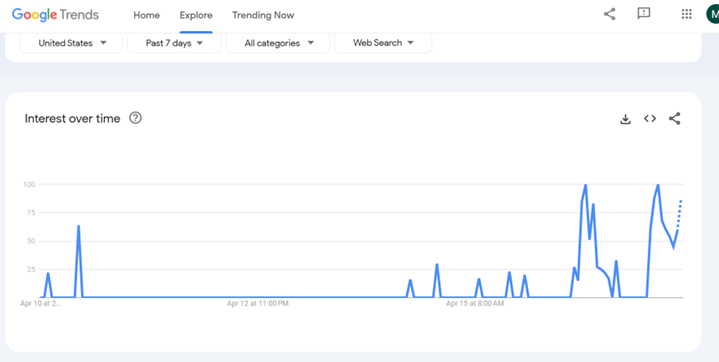

What happened when Trump uttered these words? The probability of Powell fired within the year rose by 3 ppts on both Kalshi and Polymarkets (the last week of data is shown in the three graphs below, all retrieved approx 2:40pm CT):

This shows how mad Trump is. Imagine the market machinations if Powell was replaced by a Trump guy. The bond market would go crazy and the $US plummet!

If, your prognostication “if Powell was replaced by a Trump guy. The bond market would go crazy and the $US plummet!”, reflects a widely held belief by market participants, then it is going to show up in the SP500 index and it will be starting to creep in between now and say in 6 months perhaps at the latest. But, once the market moves down meaningfully between now and 6 months from now, then the prognostication’s value for trading expires. Otherwise, will it be a wash (market makes sidewinder tracks)? The prognostication provides no value. If SP climbs then your prognostication wilts. If SP falls before Powell gets the axe, then maybe the tea leaves you are reading are somewhere between 0% and 100% correct (not much helpful feedback there). If SP500 does nothing definitive until it is beyond doubt Powell is replaced by another Trump ‘psychosickophant’ that tuned the AI precisely to resonate the Trump neural network pleasure centers with another made to order non-serious-peer reviewed paper, then, again the prognostication provides no value for investors since it failed send any signal soon enough to act on.

I’ve learned the hard way through experience and observation that prognostications usually do the most harm to their prognosticators for a myriad of reasons, often psychological. Seems fitting though. It’s probably the “Boomerang Effect”, not to be confused with “Karma”.

Would the fed board be able to resist, or would the nee chair have complete control over fed policy?

One thing for sure. If the King of Chaos Monkeys can’t resist the temptation to try and cover his larcenous tracks with more mayhem and disruption it will be because his legal demons from hades will have scoured,

https://www.federalreserve.gov/aboutthefed/section10.htm

for cracks in which to set their wedges.