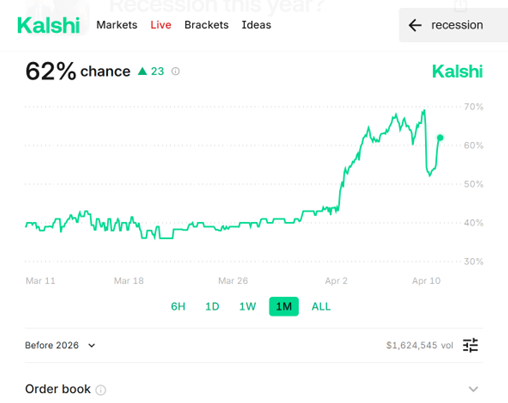

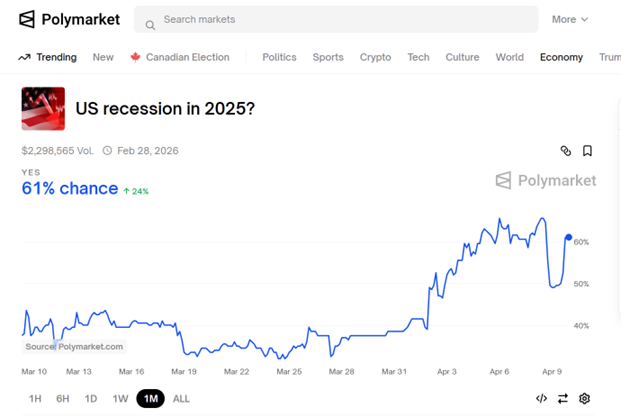

Two observations: (1) market odds of a downturn have rebounded today, and (2) the odds are very similar across two platforms (Kalshi, Polymarket), despite the fact the definitions of recession are different in the two markets.

Polymarket pays if either NBER declares a peak, or two consecutive quarters of negative growth in 2025, while Kalshi pays if there are two consecutive quarters of negative GDP growth in 2025.

If bettors are arbitraging between the two markets, I wonder if they understand the distinction between the two payout conditions.

The problem with recession forecasting right now is that it all boils down to the whims of the Idiot King. Normal long and short leading indicators are almost meaningless in the face of political force majeur.

Has he done enough to make a recession inevitable this year? Probably not yet.

Will he? Your mind reading is as good as mine.

But fwiw, the hard data, in the form of YoY jobless claims, real hourly wages, and real aggregate nonsupervisory payrolls, all of which have excellent records, all say “not yet.”

I looked up the fee schedule for the two markets… Polymarket has no fees of any kind (VC funded, operates at a loss), but Kalshi charges 2% to put your money into it and an additional 7*p*(1-p) percent per trade, where p is the probability of winning. For trades with somewhere near a 50% probability, this amounts to 3.75% total transaction fee. Whether or not this situation would be arbitragable depends on the probability that the NBER declares a recession w/o there being two consecutive quarters of negative growth in 2025.

Interesting! Maybe I’ll pay more attention to these markets (wouldn’t be hard, since this is the first time I ever did) in the future.

“U.S. egg prices increased again last month to reach a new record high of $6.23 per dozen despite President Donald Trump’s predictions, a drop in wholesale prices and no egg farms having bird flu outbreaks.”

The so-called ovum index speaks.