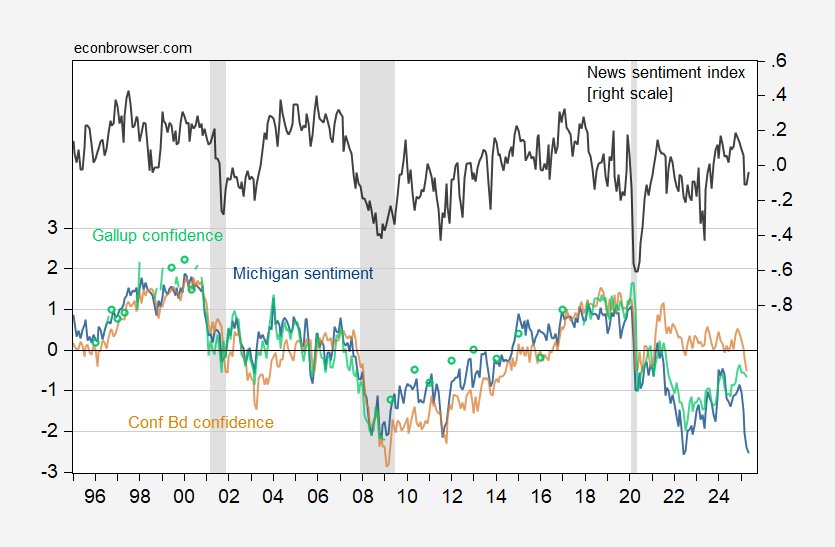

Note slight recovery in news sentiment (thru 5/18). Probably reflects some relief at the pause in higher US tariffs on Chinese goods.

Figure 1: University of Michigan Consumer Sentiment (blue, left scale), Conference Board Consumer Confidence (tan, left scale), Gallup Economic Confidence (light green, left scale), all demeaned and normalized by standard deviation (for the 1995-2024 sample period); and Shapiro, Sudhof and Wilson (2020) SF Daily News Sentiment Index (black, right scale). The U.Mich sentiment index for May is preliminary. The News Index observation for May is through 5/18/2025. NBER defined peak-to-trough recession dates shaded gray. Source: U.Mich via FRED, Conference Board via Investing.com, Gallup, SF Fed, NBER, and author’s calculations.

Confidence? We have a Cabinet member who doesn’t know what “habeus corpus” means:

https://abcnews.go.com/Politics/kristi-noem-fumbles-habeas-corpus-calls-citizenship-reality/story?id=122004790

When advised what the term actually does mean, she pretended to know that the felon-in-chief has the right to suspend habeus corpus; he does not.

But then, Noem is the same person who had a had a hillbilly-glam photo taken in front of a massive violation of habeas corpus. Is anyone really surprised she knows nothing about the Constitution she swore to uphold?

“Well, Senator, I see the Constitution as kind of like a puppy. An excitable, untrained puppy that’s starting to really get on my nerves.”

And she shot her son’s dog Cricket because he chased the chickens. And bragged about it in a book.

Article I, Section 9, which deals with the powers (or in this section, the lack of powers ) Congress had to legislate, not the Executive.

“The Privilege of the Writ of Habeas Corpus shall not be suspended, unless when in Cases of Rebellion or Invasion the public Safety may require it.”

Lincoln violated it provisionally in April 1861, but asked and eventually received from Congress’s retroactive legislation in 1862 suspending the “Great Writ” because, you know, there was a actual real rebellion going on across the Potomac River and lots of sympathizers to that Rebellion on the Maryland side, whose descendants now predominately vote MAGA.

A welder traveling to a job as Garcia was doing when ICE apprehended him is not an “invasion” or “Rebellion.”

Actually most of their descendents probably don’t vote ‘maga’ which is a phony term.

I’ve noticed that the right-wing economic cheerleaders on Fox News have moved on from short-term pain talking point (now that Trump’s top-down mercantilist policies will destroy our economy) to just wait the GOP tax cuts for billionaires will provide fiscal stimulus to the economy in the second half of the year. No – just like last time Trump did this – the tax cuts will cause greater wealth inequality and increase the national debt and budget deficits, potentially by trillions of dollars. Folks – never trust Republicans to practice responsible fiscal governance. Meanwhile, Republican Medicaid cuts will lead to severe consequences, especially in rural areas, including hospital closures, job losses, and decreased access to essential healthcare services.

There is some truth to the claim that fiscal expansion will boost growth. Some truth, but let’s consider how much…or little.

Fiscal stimulus works well when an economy is below full employment. The U.S. economy is pretty much at full employment, so we can’t expect a big boost from a tax cut. Stimulus when at full employment can be inflationary, especially in an already-inflationary environment…uh, oh.

The richest households have been the source of most growth in consumer spending in recent quarters, more than is usually the case, so stuffing diamonds on their pockets will keep spending growth distributed more or less as it has been recently – spending growth all goes to better-off households. That seems to be a big part of what got the felon-in-chief re-elected, but it’s been clear for some time now that working class Republicans vote against their own interests much of the time.

Tax cuts end up going to the well-off, who tend to spend a smaller share of their income than do the poors. That means the multilplier for tax cuts tends to be smaller than for spending increases. Put that smaller multiplier together with full employment and we won’t see much lift from the tax cuts. On the other hand, we will see a drag on growth from spending cuts. Tax cuts are planned to be much larger than spending cuts, so may be able to fully offset spending cuts, in the aggregate. Not so much for the victims of the cuts, though.

Richies tend to buy services and services are where inflation has been stickiest, so the tax cut is probably more skewed toward inflation than it would seem at first glance.

Anyhow, that’s the way it looks to me.

To the extent that tax cuts might goose the economy a bit, that (along with a depreciating currency) will further deteriorate the balance of trade due to greater imports. Hmmm…I thought Trump was trying to reduce imports.

Oops. I meant along with an appreciating currency, which is what we would normally expect with tariffs. Why the dollar is currently depreciating is even more worrisome.

Yeah. When you understand how oddly markets are behaving, it can give you the shivers. So what if the stock market does what the stock market does? Currencies, bonds, spreads, term premium… Ugh.

Before the felon-in-chief returned, the weird thing about global markets was the divergence in P/Es between the U.S. and the rest. Was the rest of the world really that messed up? Now, the weird thing in is the reversal in safe-haven behavior. Shivers, I tell ya.

you guys are the experts here. so is it bond markets are causing currency to depreciate, or the other way around? are domestic and foreign bond holders selling in different patterns here? either way, tariffs will impact p/e ratios. i am wondering what is taking the equity market so long to address that issue. and can the fed drop rates if the 10 and 30 continue to increase yield? we are not in the storm, yet, but the clouds just seem to get darker and darker in the distance.

Most of that is European capital flight. Notice the dollar is back to precovid levels.

The outlook for inflation depends both on real-side shocks and on the response to those shocks. Here’s a bit of new, but not unexpected, news on the response to the tariff shock:

https://www.theguardian.com/us-news/2025/may/20/trump-tariffs-prices-allianz-report

Allianz surveyed 4,500 forms in 9 countries, including the U.S. about pricing plans and found thst 54% intend to increase prices in response to tariffs.

The thing to keep in mind when the felon-in-chief demands that firms absorb increased costs due to his tariffs (which he ssid would not increase costs to the U.S.) is that he cares less about reality than appearance. Walmart could have increased prices without so much as a whisper from the felon, if management hadn’t said price increases were the result of tariffs. Of course, withholding information from shareholders will get you sued, so keeping mum isn’t healthy, either.

The felon-emporor wants everybody to.stop pointing out his naked lies. He bellows every time it happens.

This is, as usual, an example of Trump’s incoherent thinking. If China et al. are going to pay the cost of the tariffs, there’s no need for U.S. companies to absorb higher (tariff-based) prices, and Trump should have said, “They aren’t going to see higher prices from their suppliers, so this is just price gouging!”

Walmart also doesn’t want its loyal customer base blaming it for price increases and consequently becoming less loyal, so it’s in Walmart’s interests, both from a customer and shareholder perspective, to make clear the impact of tariffs on prices.

The yield on Treasury bonds (30-year) us currently around 5.08%. That’s the highest on a closing basis since June 2007. Tens, meanwhile, are holding in the same range as in recent weeks – which also means at the highs since 2007.

Fred doesn’t carry term premium data for the bond, but here are term premia for tens and ones:

https://fred.stlouisfed.org/graph/?g=1JbR1

Recently, the ten-year premium has been high relative to all but the early quarters of the post-housing-crash recovery, and the spread between long and short term premia is wider than it has been over the period. Evidently, holding long-dated Treasuries is seen as riskier now than in the past 15 years or so.

Typically, term premium rises around the beginning of a Fed rate hiking cycle, then falls back. This latest rise in term premia has occurred while the Fed has been cutting rates. That mostly leaves the Fed out as the ultimate cause of the latest rise in term premia, though uncertainty about future Fed policy could be a proximate cause.

So if not the Fed, then what’s making Treasuries riskier? There’s a short list of possibilities, and they all start with “Trump…”

Confidence in the lying liar Republicans not just slashing Medicaid but also hiding 500 billion dollars of Medicare cuts in the cruelest bill ever to give tax breaks to billionaires? It was of course buried in the “big beautiful BS” but Rep. Boyle had the Congressional Budget Office do the math. Why do Republicans hate their constituents?

“Why do Republicans hate their constituents?”

‘Cause it works?

here is the odd thing. i would now be considered wealthy. and i have democratic leanings. and this bill, personally, is very appealing to me. makes spending cuts that will not impact me much at all, and provides tax cuts that will result in thousands (probably tens of thousands) in benefits in the next tax year. neither of these things are necessary for my existence. on the other hand, i have plenty of family in the republican party. most of them will be greatly harmed by this bill, personally. and yet they seem to actively support its existence, while i would be happy to terminate its existence. can somebody please explain this current political climate to me? crazy.