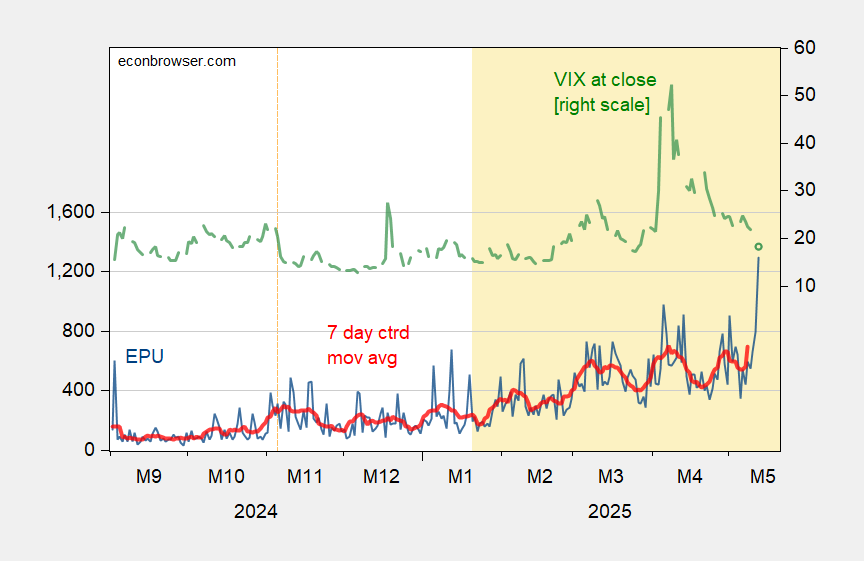

We should all be relieved that there’s been a 90 day pause in the tariffs on Chinese imports, but since they’re on tap in 90 days, and at unknown levels, don’t be surprised that uncertainty remains high…

Figure 1: EPU (blue, left scale), 7 day centered moving average of EPU (bold red, left scale), and VIX at close (green, right scale). Source: policyuncertainty.com, CBOE via FRED.

Secretary Bessent claims that Trump is a genius of “strategic uncertainty.”

Is “strategic uncertainty” the new administration catch phrase that replaces “alternative facts?”

Impacts of global, US, and domestic uncertainty shocks to inflation rates and monetary policy of BRICS countries: PSVAR estimations

Will be published soon via

International journal of economic perspectives

https://ijeponline.org/index.php/ijoep

The inflationary impact of 145% tariffs on imports from China was going to be, to a considerable extent, the from trade disruption rather than the pass-through of tariffs – very few imports would come in when prices more than double. There is no replacing of Chinese imports on a large scale, so the U.S. would have faced scarcity, and scarcity raises prices.

At (for now) 30%, tariffs will lead to some scarcity (as will the brief cessation of trade with China since April 1), but also price increases from direct pass-through of tariffs.

The Yale Budget Lab puts the effective tariff rate on U.S. imports 17.8%, while Fitch says 13.1%. Either way, there is still a big inflationary hit from tariffs. Yale puts the average cost per household at $2,800 per year, or about 3.5% of median household income – that’s before tax, by the way. So very roughly, that’s a 3.5% boost to the price level, on top of trend inflation?

Now, what happens to wages? Wages have recently outpaced inflation, on average. Firms faced with rising input costs, and probably with lost sales as a result, are likely to want to find cost savings. Wages are sticky downward, so firms can’t expect to claw back wage increases if things (tariffs and demand) go badly, making uncertainty (see Menzie’s point) another drag on wage gains. The logical thing to do is to resist raising wages.

Recently, job switchers are getting no better pay increases than job stayers, an historically odd situation. Job stayers are still getting better pay gains than prior to Covid, but job switchers mostly no longer are:

https://fred.stlouisfed.org/graph/?g=1J1Hj

Anyhow, the steam has pretty much gone out of the labor market, and the cost implications of tariffs look bad for wage gains.

The removal of workers from the work force by stopping inflow across the border and intimidating those here from going to work, is a bit of a wild card. Actual deportations are not any more than they were under Biden – but border crossings are way down.

Off topic – shut off Google AI:

Barry Ritholz has done the world a great favor. He has identified a way to shut off Google AI, and ads. Just add udm=14 to your query.

I’ve tried it. It works. Hallelujah!

By the way, despite the new deal that isn’t a deal with China, China is actually tightening its exports of critical minerals:

https://oilprice.com/Latest-Energy-News/World-News/China-Bolsters-Export-Controls-on-Critical-Minerals.html

So Xi got pretty much everything he wanted by not giving an inch, waiting for the felon-in-chief to cave. The felon caved. Then Xi tightened one of the controls meant to harm the U.S., inthe name of China’s “security” interests.

What might other countries decide to do, based on this example?

As you mentioned above, the remaining (low) tariffs are basically a sales tax on consumers in the country implementing them. US consumers (of final or intermediary products) will be taxes 3 times more than Chinas consumers (even more because we import more). So for China the current tariff situation is not a big deal and could become permanent without making much of a difference for them. The big freaking problem is the shut off of critical minerals, which could shut down large parts of our manufacturing. China will do fine by not selling that to us. My guess is that the next cave in from the Trump geniuses will be to lift all Biden’s restrictions on exporting cutting edge technology to China in return for them not shutting down our industries.

The Orange moron pushed China to play the “critical minerals” card before Biden’s plan to secure us against it had been implemented. I guess thinking just one step ahead was too much work for Trump.

the uncertainty should drop, in that we have now seen multiple cave ins by trump on the tariff issue. meaning the market now has some certainty that he will not drive us over the cliff. however, that does not mean he will not still drive us into a recession. personally, I think enough damage has been done that we will have a mild recession at a minimum. and to complicate matters, even with lower tariffs, I think they will work their way through to inflation. so this will be a tough spot for the fed to operate, again. stagflation seems to be the more likely outcome, as each day passes. I see the stock market on a dead cat bounce, and will drop again soon. I am starting to unload some of the stocks that recently rebounded, but have limited medium term returns.

and why does trump all of a sudden get special treatment with quick cases at the Supreme Court? just because he floods the system with unconstitutional executive orders, does not mean he should get preferential treatment by the court. stay the orders and let him work through the system like everybody else. this special treatment only encourages him to continue with unconstitutional orders, which have an effect even if only implemented for a few days. that should be punished, not rewarded.

The stock market is just responding to “Trump made a deal” WH press releases when he has not made a deal – the Trump tariffs on China are still around 40%. “Estimates by the Yale Budget Lab shows consumers face an overall average effective tariff rate of 17.8%, the highest since 1934.”

Also this is crushing small businesses – “We have only let go five people in the history of the company tied to changing economic times, and three of those have happened in the past few months,” Fry said. “It is definitely one of the most challenging times I have seen in this business in the last 30 years.” https://www.bloomberg.com/news/articles/2025-05-14/trump-s-china-tariff-pause-still-pressures-small-businesses-needing-cash

most stock trades are algorithmic these days. they follow headlines, but assume the headlines are accurate. the bump will fade in the longer term, once algorithms digest the fact that these “deals” are putting us in worse position that prior to liberation day. most Americans are going to lose a few thousand dollars in purchasing power over the next year. you can thank trump and his maga cronies for that. and interest rates will not be helpful.

notice how trump throws out the red meat of airplane bribe to distract from the fact that he basically lost the trade showdown with china. nothing to see over here…