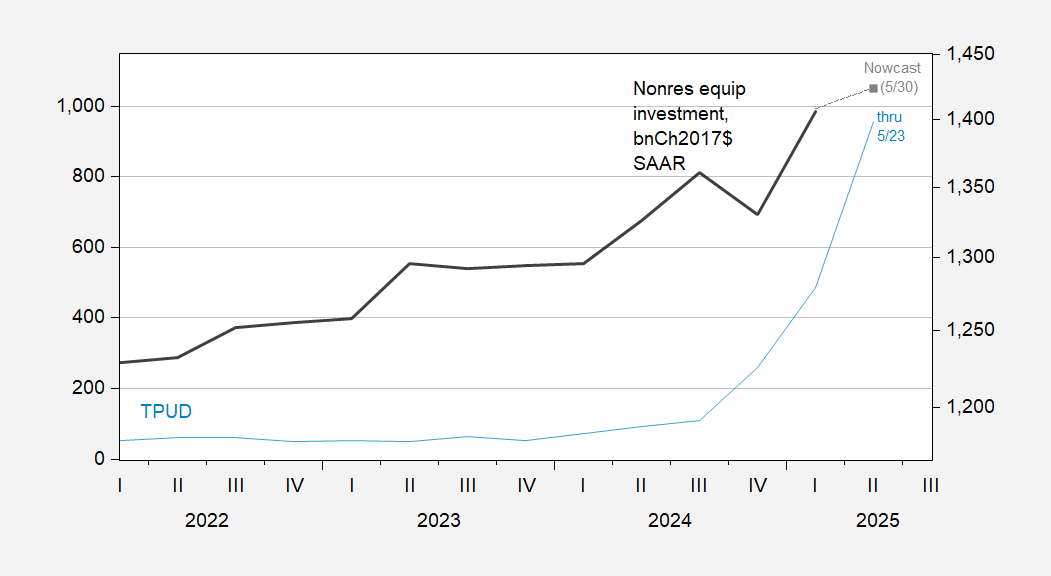

Why? Q2 equipment investment as implied by GDPNow of 5/30.

Figure 1: Caldara et al. Trade Policy Uncertainty index (blue, left scale), and nonresidential equipment investment (black, right log scale), and implied by GDPNow of 5/30 (gray square), both in bn.Ch.2017$ SAAR. Source: Iacoviello TPU, BEA 2025Q1 second release, and Atlanta Fed.

Note the spike in trade policy uncertainty (daily data shown here). The accompanying deceleration in equipment investment is consistent with the findings in Caldara, Iacoviello, Molligo, Prestipino, and Raffo “The Economic Effects of Trade Policy Uncertainty,” Journal of Monetary Economics (2020).

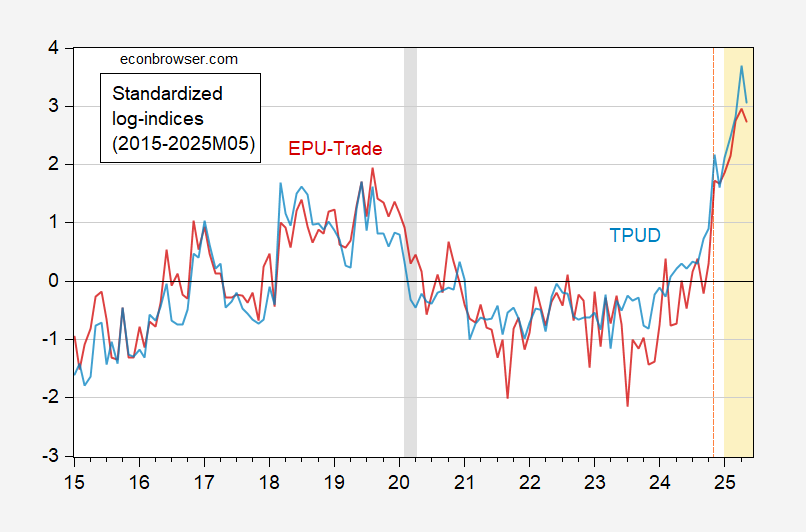

How does the Caldara et al. measure compare against the purely news based version of Baker, Bloom and Davis (the categorical component of EPU)? Here’s a graph of standardized (2015-2025M05) indices:

Figure 2: TPUD (light blue), and EPU-trade (red), both standardized over 2015M01-2025M05 period. NBER defined peak-to-trough recession dates shaded gray. Light orange denotes second Trump administration. Source: Iacoviello TPU, policyuncertainty.com, NBER, and author’s calculations.

Both series have shown similar increases since the election.

Construction of factories leads purchase of factory equipment. Here’s the picture of spending on factory construction against factory equipment:

https://fred.stlouisfed.org/graph/?g=1Jn9s

That surge in factory construction from 2022 appears to begin bearing fruit in new equipment spending as of last year. (Disaggregation of equipment spending data would help confirm that. Lazy me, maybe I’ll look into it.) If spending on factory equipment, more or less baked in by earlier factory construction, stalls, we need to look for a cause.

Timing, economic theory and intention clearly point to the CHIPS Act as the cause of the surge in factory construction; government investment works.

Timing and economic theory will clearly point to the uncertainty caused by tariff policy if spending on factory equipment doesn’t follow a trajectory similar to what we’ve seen in factory construction; that will constitute evidence that tariffs, as wielded by the felon-in-chief, don’t work to build factory capacity.

There is a generations-long history of Democratic governance producing faster growth and more jobs than does Republic governance. The Biden/Trump contrast looks set to add to that history. My pet theory is that Democrats actually look for ways to boost the economy, while Republicans serve the interests of the rich, claiming that enriching the rich is growth policy. The interests of the rich are simply not aligned with the overall health of the economy. Tax cuts don’t stimulate long-term growth. Reseach does. Deregulation doesn’t stimulate long-term growth. Education does. Cutting social spending doesn’t stimulate long-term growth. Government subsidy for spending on physical capital does. The list goes in and on.

Not everything is the felon-in-chief’s fault. Oil field capital spending is under pressure from declining oil prices. This is not just the result of natural market phenomena. OPEC is doing what cartels do, and it’s working:

https://archive.is/fWFZH

Smaller oil fields firms are cutting back on spending by 3.5% vs earlier plans, due to weak pricing.

Don’t worry, though. During the campaign, the felon promised a surge in oil output. He always delivers, right?

But didn’t Navarro tell us investment rose by 22% in 2025QI. It seems Hassett and Antoni have decided Navarro was right.