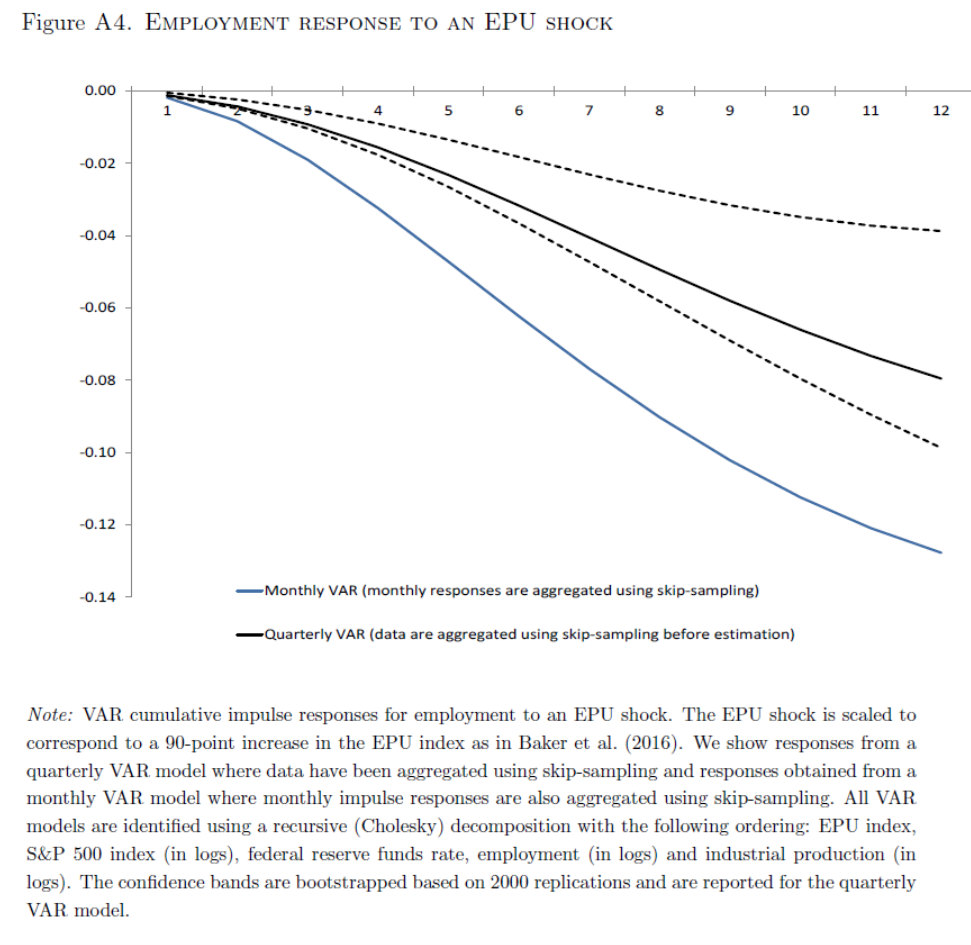

EPU has risen from a 2016-2024 level of 136 to a 2025 level of 430. Ferrara and Geurin (2018) find that a 90 pt increase results in a bit less than 2% decline in employment at the one year horizon.

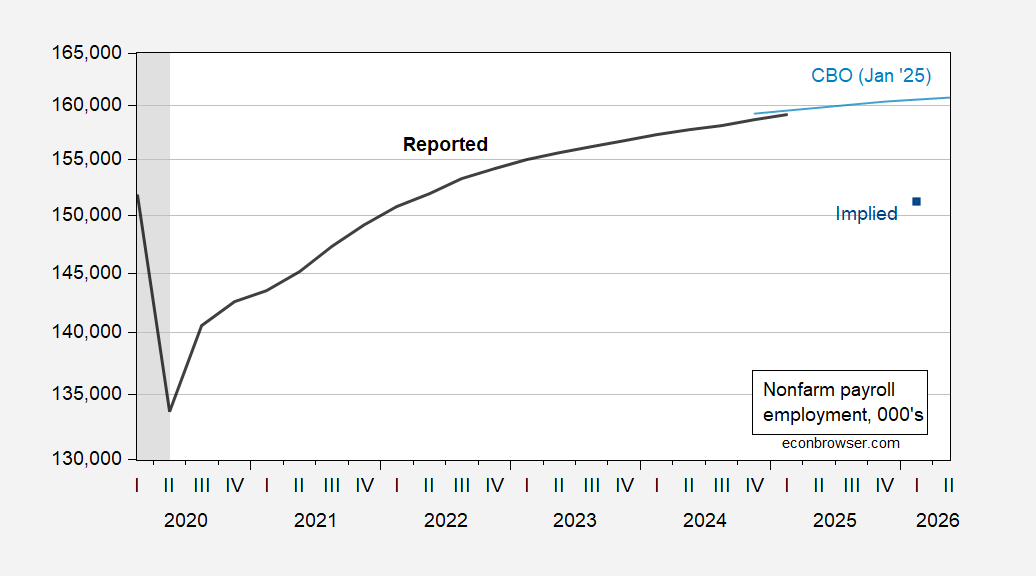

Assuming linearity in the impacts, this means that at a one year horizon, employment might be down by as much as 6 ppts. This is shown in the figure below.

Figure 1: Nonfarm payroll employment (black), CBO January 2025 baseline (light blue), and implied by 3.3 std deviation shock to EPU (blue square), all in 000’s, s.a. Source BEA, CBO (January 2025), and author’s calculations.

Note that this calculation is based upon linearity-in-effects. There have been no comparable increases in EPU, save the Covid-19 associated spike, and the Q2 value is yet higher. It could be that after a certain level, EPU does not have any further negative impact on employment.

Taking Economic Policy Uncertainty Seriously?

Treasury Secretary Bessent certainly does. He says that Trump is a genius of “strategic uncertainty.”

Trump says about his TACO strategy “It’s called negotiation.” Trump said, that as part of the negotiation, he intentionally “sets an outrageously high number” and then “adjusts it slightly downward.”

So there you have it. It’s not uncertainty. It’s brilliant negotiation.

NYTPitchbot: “Trump’s outrageous claim that Biden was executed in 2020 and replaced with a clone is a negotiating tactic to get America to accept the slightly milder conspiracy theory that Barack Obama was born in Kenya.”

Yes, he did this.

Our fake Treas. Sec. went onto Face the Nation was his mansplaing the female host and his usual lying. At least he said the pass-through coefficient for tariffs was not as low at 25%. Now it is 35%! Never mind that the AER paper they cited on 4/2 said it was 94%.

A 6% drop would mean the loss of 9.8 million jobs. During the housing-crash recession, we lost roughly 8.6 million. Of course, the workforce is larger today, but that’s still a bunch of people out of work, a bunch of mortgage defaults, a big loss in government revenue at all levels. More hungry kids.

On the other hand…

The EPU seems designed to reflect uncertainty about future monetary policy; “Federal Reserve” is among the search terms used to construct the index. Uncertainty about Fed policy reflects uncertainty about the economy in general, so introduces a cyclical component to the EPU. Pol8cy decisions invving taxes, spending, regulation and stupidity are all secular, for the most part. Given the very large effect of cyclical swings on employment, the job loss estimate attached to increases in the EPU may exaggerate the effect of pure policy uncertainty. An ex-Fed EPU would be interesting.

Macroduck: The Ferrara-Guerin estimates are from a (Cholesky decomp) VAR using EPU, SP500, IP, NFP. One could re-aggregate up the components of the EPU excluding monetary policy uncertainty, haven’t seen it done yet. There are also categorical monetary policy uncertainty indices as well, that one could test to see how much is explained by this component, e.g. https://www.sciencedirect.com/science/article/pii/S0304393218301661

Of course, we face a great deal of uncertainty about the economy now, as reflected in the Monetary Policy Uncertainty index. Here it is, against the overall EPU index:

https://fred.stlouisfed.org/graph/?g=1JnTk

Much bigger swings in MPU vs EPU in recent years vs in the past. Perhaps because of a greater public, and journalistic, awareness of Fed policy.