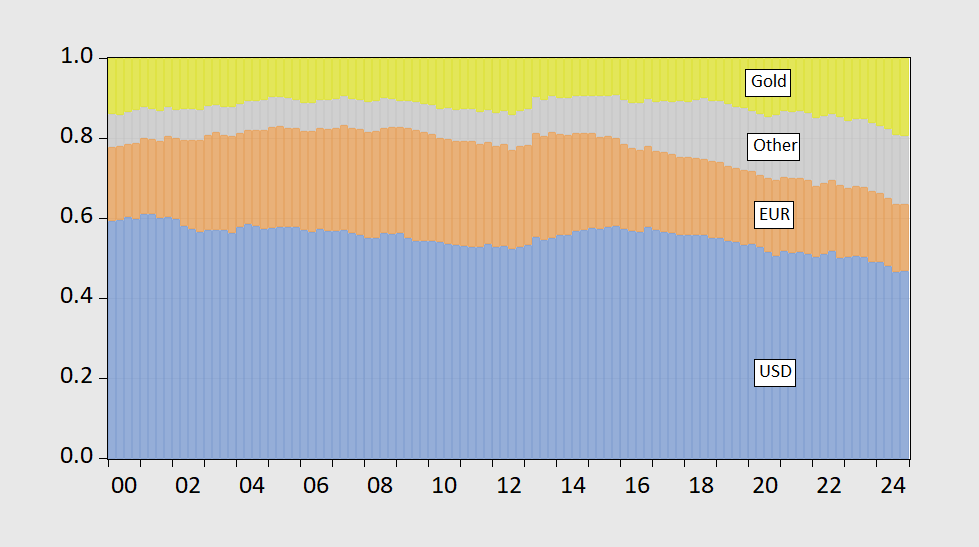

There’s not much data on individual central bank holdings of the dollar through 2023, but COFER goes through 2024Q4, and gold holdings through 2025Q1.

While there’s been some gain in EUR and other currencies in recent years, the biggest gainer in total reserves (fx reserves and gold) is … gold.

Figure 1: USD shares of fx and gold reserves (blue bar), EUR (tan), all other (gray), and gold (yellow). USD(EUR) share assumes 60%(35%) of unallocated reserves are in USD(EUR). Source: IMF COFER, World Gold Council, and author’s calculations.

The question is what happens to USD reserves in Q1, with bellicosity of US international economic policy and associated policy uncertainty.

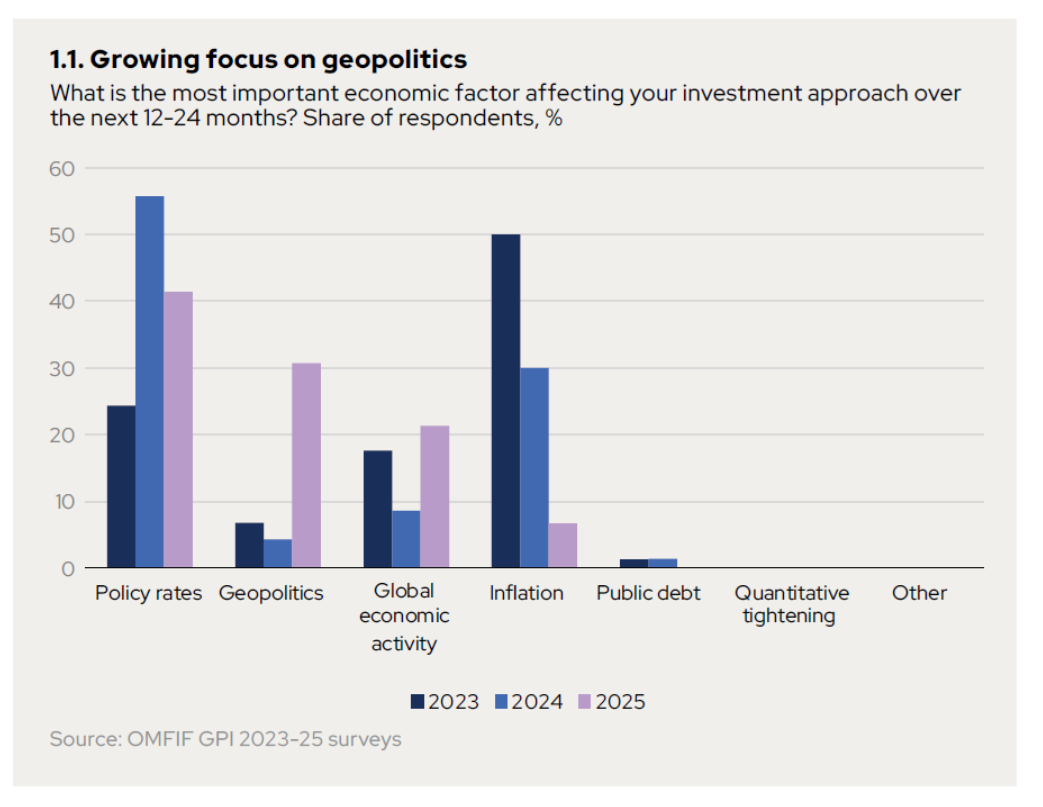

OMFIF’s Global Public Investor 2025 notes the rise in geopolitical concerns:

Source: OMFIF.

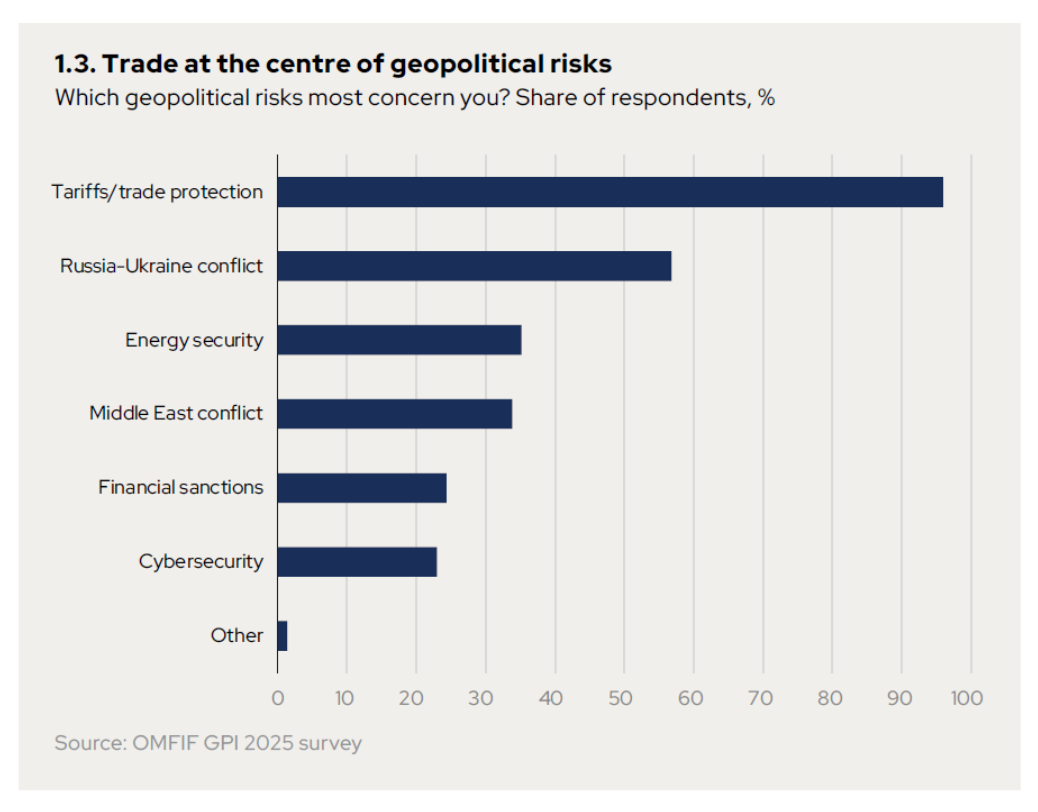

Of geopolitical concerns, tariffs and the trade war at the forefront:

Source: OMFIF.

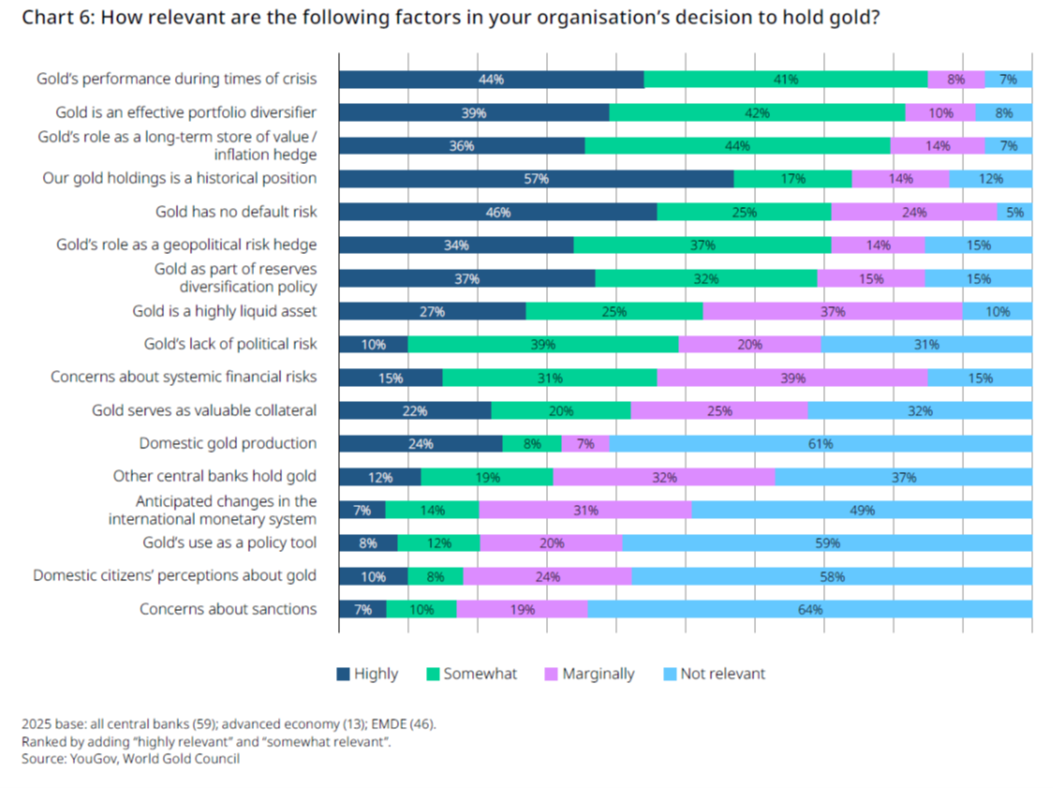

It’s also of interest to consider the central bank motivations for holding gold. From the World Gold Council’s Central Bank Gold Reserves Survey 2025:

Source: World Gold Council.

I find it interesting that the lack of default risk is highlighted as an important motivation for holding gold. While default risk on US Treasurys has come down recently, it is still high by historical standards.

Source: World of Government Bonds, accessed 6/28/2025.

COFER data through Q1 coming out in a few days.

As reported by CNBC, this appetite for gold can also be spun as a loss of place for the euro :

https://www.cnbc.com/2025/06/11/gold-overtakes-euro-as-second-biggest-global-reserve-asset.html

CNBC agrees that geopolitical issues are behind reserve demand for gold. I do wonder how much of the recent shift is due to changes in valuation.

Just to repeat myself, reserves are only part of the picture when looking at a currency”s place in the world, as suggested by the OMFIF and Gold Council fugures above. As of December, 2024, official holdings accounted for 44% of overseas holdings of Treasuries, compared to 67% in December, 2004, according to TICS data. Official holdings of Treasuries have lost ground as a share of total overseas holdings.

That’s just Treasuries. As of last June, total overseas holdings of U.S. securities stood at $31 trillion, nearly half of which was equities, not generally held as reserves. Assets outweigh reserves. The dollar is involved in 88% of FX transactions and 54% of trade invoices. The dollar’s prominence goes deeper than reserves. To state the obvious, the dollar’s role in private transactions is the reason for its role as a reserve currency.

Can you imagine something as unstable as bitcoin being considered for a reserve currency?

My concern is the next Fed chairman. If we get a MAGA with the usual credentials, the world may wean itself from the dollar somehow and fairly rapidly. If that isn’t already happening. I don’t see pretty rocks and minerals as a viable reserve, though.

Not entirely off topic – Why is the GOP about to institute a budget-busting tax cut, partially paid for by denying food and medical care to the poor? Mostly, they’ve stopped offering excuses, but when they do, two are commonly waved about. One is that tax cuts boost growth. That’s baloney at tax rates as low as are found in the U.S.:

https://fred.stlouisfed.org/graph/?g=1JSzn

Economic growth has, in fact, slowed as marginal rates in the U.S. have been cut.

The other claim is that the rich simply don’t pay taxes, in part because they migrate away from tax increases. Here’s an example of that claim, as panicked as mainstream journalism usually gets:

https://www.yahoo.com/news/york-braces-billionaire-exodus-socialist-093000599.html

But it turns out, the rich almost never relocate to avoid taxes. Who’d have guessed?

Here’s an example of that claim, credulously repeated by CNN with regard to the UK:

https://www.cnn.com/2024/06/18/business/uk-millionaires-loss-record

That story relies on a migration advisor, Henley and Partners, as its only source. (No conflict of interest there.) Here’s a review of Henley and Partners’ claim, based in their own data:

https://taxjustice.net/press/millionaire-exodus-claim-backtracked-but-media-re-run-story-anyway/

Under 1% of UK millionaires have left the country since 2013. In fact, the data cited by Henley, asreviewed by the Tax Justice Network, shows that only 0.2% of global millionaires have migrated in any year but one since 2013; in 2018, 0.256% (barely rounds to 0.3%) migrated. So the “millionaire exodus” leaves more than 99.7% of millionaires firmly in place in any year.

If we put any faith in Henley’s claims, let’s note that Henley expects a record influx of millionaires to the U.S. this year, 7,500. To which I say “So what?” Turns out, the U.S. gained about 1,000 millionaires each day in 2024:

https://www.cnbc.com/2025/06/24/us-gained-1000-millionaires-a-day-on-average-in-2024.html

Henley’s estimate of net inward millionaire migration amounts to only about 2% of last year’s gain in millionaires.

So, y’all know that NYC is an urban hellscape, right? A big contributor to that satanic situation is high state and local income taxes and real estate taxes (and limited deductibility of state and local taxes in federal filing, thanks to the GOP). Again, relying on Henley, the tax hell that is NYC regularly has the single highest number of millionaire immigrants of any city in the world. The Bay Area, LA and Chicago are also among the global top ten, all run by Democrats, all relatively high tax, all hellscapes. And by the way, want to know who hasn’t fled NYC, despite its high taxes and infernal nature. Bill Ackman, so shut up, Bill.

We’re hearing that the rich will flee NYC if New Yorkers elect a mayor who looks to house, feed and transport the poor. That just doesn’t happen. And it won’t happen to the U.S. if the Big Bloated Budget fails to pass. Lies are a poor basis for policy, folks.

Considering that a president must choose a Fed Chairman from the sitting governors, there may not be a “Maga with the usual credentials”? Which, typically, are little or no credentials at all.

Not really an issue. Jerome Powell is one of the seven sitting governors on the board and also the chairman of the board. When his term expires next summer, both his board seat and the chairman position become open. So the president can nominate whoever he likes to fill that seat on the board of governors and at the same time nominate them to be chairman.

You may recall that Larry Summers was considered by Obama to replace Ben Bernanke as Fed chair in 2014. He was not a member of the board of governors but could have been nominated simultaneously for a board seat and as Fed chair. As it turned out, he withdrew his nomination and Janet Yellin became Fed chair instead.

So its clear that Fed chair doesn’t have to be selected from currently sitting governors. But as you say, Trump’s nominee will be selected for absolute loyalty, not competence. Confirmation does require a majority vote of the Senate, but shouldn’t be a problem given the Republicans obeisance.

Trump appointments. Look for a Fox News economist!

Example: SecDef is Fox News talking head and his Chairman of Joint Chiefs was appointed for the retired rolls of the Maryland Air National Guard. His leap to 4 stars was approved by Senate. Who else could sell the Fordow, Iran bombing, without using Maverick as the B 2 pilot call sign.

Not entirely off topic – Why is the GOP about to institute a budget-busting tax cut, partially paid for by denying food and medical care to the poor? Mostly, they’ve stopped offering excuses, but when they do, two are commonly waved about. One is that tax cuts boost growth. That’s baloney at tax rates as low as are found in the U.S.:

https://fred.stlouisfed.org/graph/?g=1JSzn

Economic growth has, in fact, slowed as marginal rates in the U.S. have been cut.

The other claim is that the rich simply don’t pay taxes, in part because they migrate away from tax increases. Here’s an example of that claim, as panicked as mainstream journalism usually gets:

https://www.yahoo.com/news/york-braces-billionaire-exodus-socialist-093000599.html

But it turns out, the rich almost never relocate to avoid taxes. Who’d have guessed?

Here’s an example of that claim, credulously repeated by CNN with regard to the UK:

https://www.cnn.com/2024/06/18/business/uk-millionaires-loss-record

That story relies on a migration advisor, Henley and Partners, as its only source. (No conflict of interest there.) Here’s a review of Henley and Partners’ claim, based in their own data:

https://taxjustice.net/press/millionaire-exodus-claim-backtracked-but-media-re-run-story-anyway/

Under 1% of UK millionaires have left the country since 2013. In fact, the data cited by Henley, asreviewed by the Tax Justice Network, shows that only 0.2% of global millionaires have migrated in any year but one since 2013; in 2018, 0.256% (barely rounds to 0.3%) migrated. So the “millionaire exodus” leaves more than 99.7% of millionaires firmly in place in any year.

If we put any faith in Henley’s claims, let’s note that Henley expects a record influx of millionaires to the U.S. this year, 7,500. To which I say “So what?” Turns out, the U.S. gained about 1,000 millionaires each day in 2024:

https://www.cnbc.com/2025/06/24/us-gained-1000-millionaires-a-day-on-average-in-2024.html

Henley’s estimate of net inward millionaire migration amounts to only about 2% of last year’s gain in millionaires.

So, y’all know that NYC is an urban hellscape, right? A big contributor to that satanic situation is high state and local income taxes and real estate taxes (and limited deductibility of state and local taxes in federal filing, thanks to the GOP). Again, relying on Henley, the tax hell that is NYC regularly has the single highest number of millionaire immigrants of any city in the world. The Bay Area, LA and Chicago are also among the global top ten, all run by Democrats, all relatively high tax, all hellscapes. And by the way, want to know who hasn’t fled NYC, despite its high taxes and infernal nature. Bill Ackman, so shut up, Bill.

We’re hearing that the rich will flee NYC if New Yorkers elect a mayor who looks to house, feed and transport the poor. That just doesn’t happen. And it won’t happen to the U.S. if the Big Bloated Budget fails to pass. Lies are a poor basis for policy, folks.