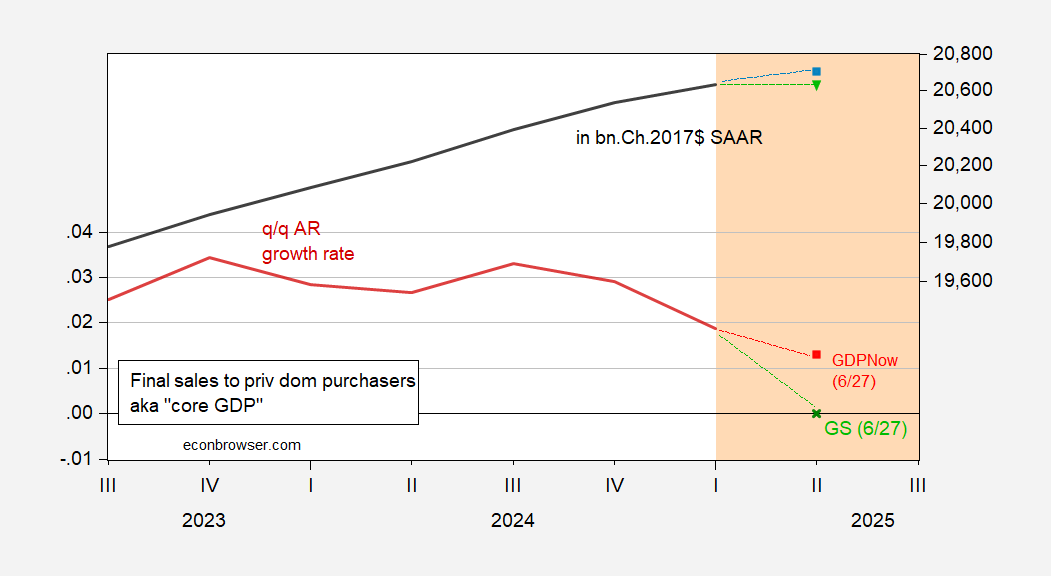

Various observers (e.g. Furman) have argued for final sales to private domestic purchasers as the best measure of economic momentum. Nowcasts and tracking estimates of this indicator cast into doubt prospects for rapid growth.

Figure 1: Growth rate q/q annualized for final sales to private domestic purchasers (dark red, left scale), GDPNow (red square, left scale), Goldman Sachs (green x, left scale); level of annualized final sales to private domestic purchasers (black, right log scale), GDPNow (blue square, right log scale), Goldman Sachs (inverted green triangle, right log scale), all in bn.Ch.2017$ SAAR. Source: BEA, Atlanta Fed (6/27), Goldman Sachs (6/27), and author’s calculations.

If Goldman Sachs turns out to be correct, then momentum will have stalled out.

PDFP as a measure of “core” GDP seems particularly flawed for this shock, since tariff frontrunning has intertemporal effects on aggregate spending (bringing forward consumption and investment) in addition to spatial (surge then withdrawal of foreign purchases). Seems like more is needed to tease the two effects apart.