FEDS note published on Friday:

The role of the U.S. dollar has received renewed attention this year. A sharp rise in policy uncertainty has led some to question the strength and stability of the U.S. economy. In particular, increased attention has been paid to the U.S. fiscal outlook, as noted in the recent downgrade by Moody’s of the credit rating on U.S. government debt. And the U.S. has increased its level of tariffs and thereby somewhat reduced its openness to trade flows. Given that most data on international dollar usage is available with a lag, this note is not yet able to show any potential results of the change in the U.S. credit rating or changes to tariff rates in 2025. Rather, it provides a baseline for where the international role of the dollar stood before these announcements. In particular, we can examine the longer-run effects of U.S. sanctions on Russia that were imposed following its invasion of Ukraine in 2022.

From the Note:

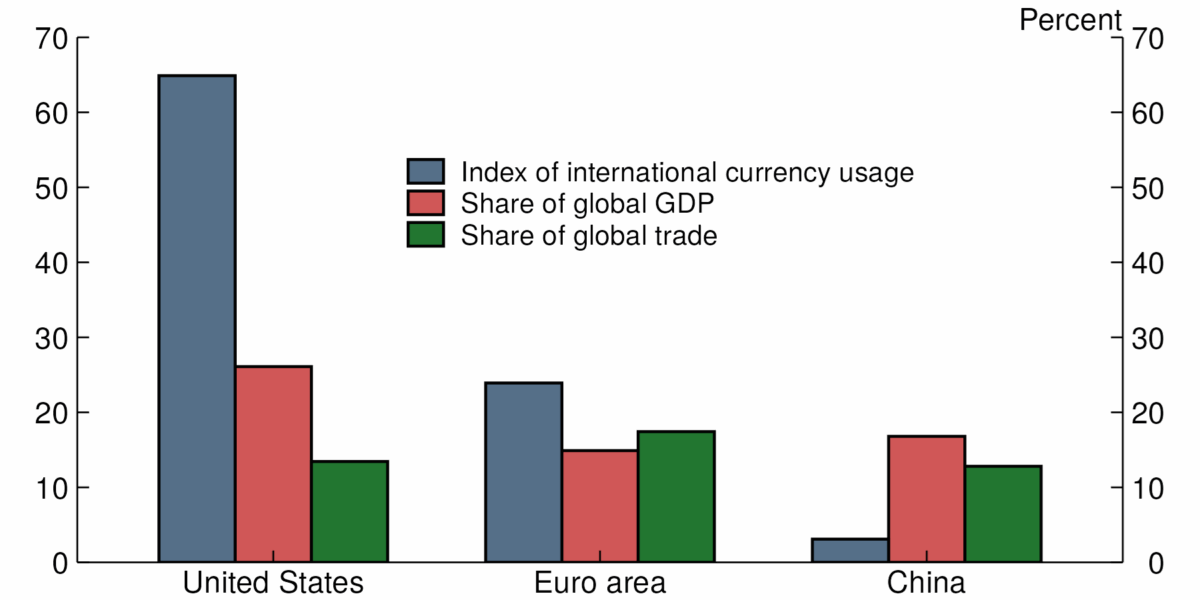

Source: Bertaut et al. (2025).Sc

I think there is a bit of understatement with respect to the potential impact of recent statements, including (1) “Liberation Day” and aftermath, (2) ongoing assaults on Fed independence by Trump et al.

In particular, Steven Kamin’s analysis of time-variation in the VIX-dollar correlation is noted in this recent Economist piece. Torsten Slok in today’s examination identify what correlates are necessary to explain the recent dollar-interest rate divergence (hint: includes tariffs but also a post-“Liberation Day” dummy, trade policy uncertainty measure, and cumulative mentions of “Mar-o-Lago accord”.

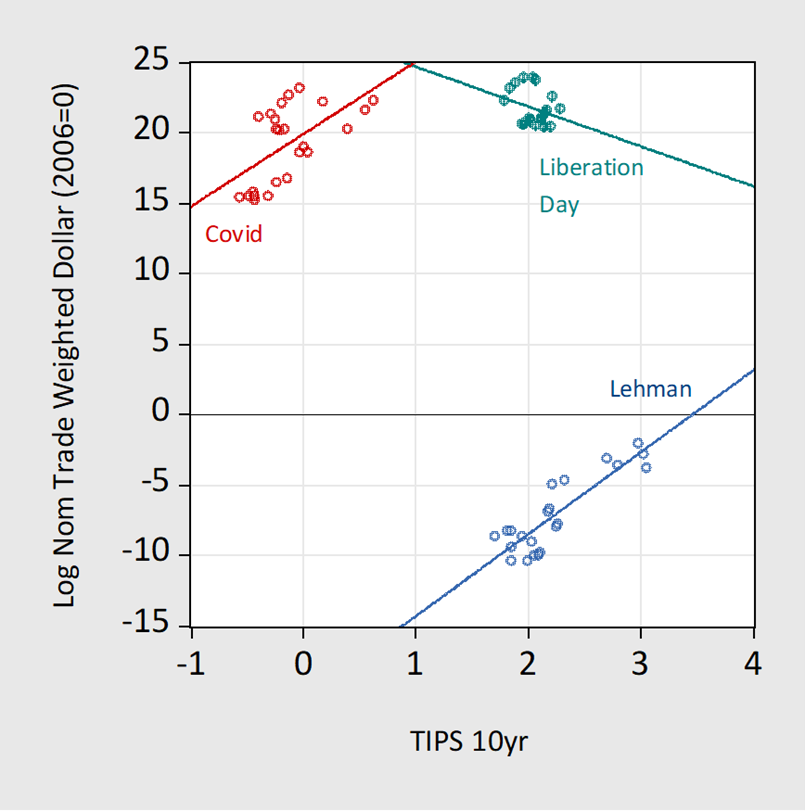

Personally, I like looking at the USD-10yr TIPS correlation over three “crisis” episodes:

Figure 1: Scatterplot of USD value against 10 year TIPS, around Lehman (blue), around Covid-19 (red), and around “Liberation Day” (green). Source: Federal Reserve Board and Treasury via FRED.

Currently working on a paper with Jeffrey Frankel and Hiro Ito, on assessing central bank holdings of reserves, including gold, and how those holdings have changed with the use of sanctions and in the presence of geopolitical factors. More on that soon.

Excellent. With all this talk of secondary sanctions (up to 500%), we desperately need analyses that make the arrogant, self-sabotaging nature of these policies evident.

In other news the justice department is sending its people to talk with Ghislaine Maxwell in jail. Maybe if they offer her a deal on a presidential pardon, they can get her to refuse to agree to letting certain information from the grand jury being released. She may also refuse to testify to congress – and in general hold back on information under the guise of not wanting to incriminate herself. I see a big beautiful deal in the making.