A picture (or two) is worth a thousand words:

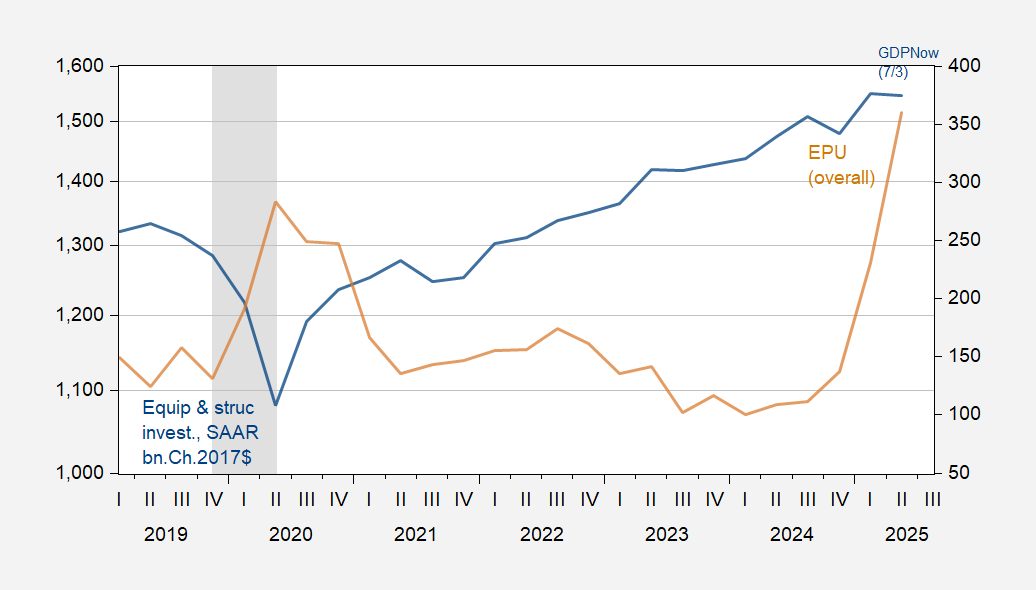

Figure 1: Sum of nonresidential equipment and structures investment, bn.Ch.2017$ SAAR (blue, left scale), and EPU (news). Q2 investment is GDPNow of 7/3. NBER defined peak-to-trough recession dates. Source: BEA, policyuncertainty.com, NBER, and author’s calculations.

Figure 2: Sum of nonresidential equipment and structures investment, bn.Ch.2017$ SAAR (blue, left scale), and EPU (legacy three component version). Q2 investment is GDPNow of 7/3. NBER defined peak-to-trough recession dates. Source: BEA, policyuncertainty.com, NBER, and author’s calculations.

I doubt that policy uncertainty will decline to pre-Trump 2.0 levels, given (in my opinion) Mr. Trump’s ongoing cognitive decline and inability to restrain his impulsiveness.

Okay, you have to see this with your own eyes. It’s the tariff letter that Trump sent to South Korea.

https://image.cnbcfm.com/api/v1/image/108168401-1751907230719-Japan.jpg

It’s supposed to be an official diplomatic document but looks like it was written by a 12-year-old on twitter. How are countries supposed to respond in good faith to a negotiator that is a toddler?

This embarrassing for our country.

Maybe only slightly off topic – trade policy and U.S. intellectual property:

https://www.project-syndicate.org/commentary/hidden-forces-driving-us-prosperity-at-risk-under-trump-by-ricardo-hausmann-2025-04?__readwiseLocation=

Hausmann identifies weakness in our data on foreign transactions as exaggerating the size of our current account deficit – also (implicitly) as stoking the felon-in-chief’s mistaken ideas about trade.

Hausmann’s view is founded on the claim that we are substantially underestimating our income from intellectual property. He invokes the now-familiar “dark matter” metaphor in labeling our undetected income – there just soooo much value not being counted, says Hausmann. He could be wrong, but it’s Hausmann, so he’s probably right.

A few things to note about this division of international labor in which we are top-of-the-value-heap. The Clinton administration pursued the idea, championed by Laura Tyson, among others, that the U.S. ought to aim at producing high value-added goods, with lots of imbedded intellectual property. Let lower-skilled and less capital-rich countries make toys and furniture. We’ll design high-tech equipment and provide sophisticated financial services. Draw your own conclusions about the wisdom of that policy in a culture with strong anti-intellectual components, limited upward mobility and educational opportunity and a weak system for sharing the gains from trade.

Anyhow, what Hausmann is describing is the success of Tyson’s idea; big money inflows from imbedded intellectual property. So Tyson got something right, even of the side effects are tearing us apart these days.

It’s also worth noting that much of the talk about China coming up in the world has to do with China producing homegrown intellectual property. Ok, most of the patents filed in China are economically and technologically irrelevant; when you reward people for filing patents, they file patents. Big surprise. But in among China’s innovative weeds, flowers abound. China is attempting to create an economy full of domestic innovation and domestically-produced imbedded intellectual property, and it’s working. If that were going to mean we and they would be contributing to a global stock of usefull ideas, that would be really nice. Seems more likely we will be living in a world of fenced-off ideas, some here, some there. In that world, I’m not sure our “dark matter” tech and knowledge advantage will age well.

If payments for good ideas won’t be enough to keep us prosperous in the future, what will? It won’t be our yokels, not by themselves. We probably need to craft an economy in which our smarty-pants types make more productive use of our yokels. That’s the claim made for their big pay packages. It’s the textbook explanation of what the managerial class is good for – putting resources to their most productive use.

Maybe it’s time to hold our smarty-pants managerial class to that idealized standard. China seems to do it pretty well. Parts of Europe, too, even if things aren’t so swell lately.

So now they have sent out a dozen or more literally identical tariff letters, apparently using Microsoft Word mail merge to just substitute names and tariff rates taken from a spreadsheet.

They sent one to President Zeljka Cvijanovic of Bosnia-Herzegovina with the greeting:

“Dear Mr. President.”

Then a few hours later they sent a second letter with the greeting:

“Dear Madam President”.

These folks are incompetent amateurs.

As for the tariff rates, they are the same as in the goofy April 2 table, except they are rounded to the nearest 5% because — well just because. They never made sense to begin with so why not.

I can’t wait to see the letter sent to the penguins on Heard Island.

The letters came from the office of the president, not USTR, which is odd. Presidents make nice. USTR is a bulldog.

Anyhow, looks like somebody in the White House actually dictated it. Pretty obvious who. Sad.

We keep hearing from other countries that the U.S. demands trade concessions, but never says what specific concessions we want. These letters, aside from being insulting, are unhelpful; we still aren’t telling the other side of the negotiation what we want from them.

“We’ve got you kid. Now give us what we want or you’ll never see her again!”

“I’ll give you anything. Just name it.”

“…Uh, we’ve got your kid…so give us…something…nice?”

You can’t make this stuff up. So today:

Reporter: “Is the August 1 deadline firm now?”

“No, I would say firm, but not 100 percent firm” Trump said with strategic uncertainty.

So we’ve had February, March, April, May, June, July and August deadlines — but maybe not.

TACO!

Apparently, Navarro got one on one time with the President this past week and see the results. Also, the President notice that the Texas flood disaster was crowding out his headline space in the various MSM Infotainment entities (Broadcast TV, cable news, newspapers, web pages, etc.) so time to bring on the second act of the “Tariff Show.”