What’s this guy smoking? From the article (originally Wash Examiner):

Many so-called experts predicted that President Trump’s economic agenda would usher in an inflationary Armageddon. This projection was so often repeated in the media that many Americans, especially Democrats, believed a depression was imminent. Yet the economy is thoroughly beating expectations and consumers’ expectations are becoming increasingly optimistic.

…

Just to remind Dr. Antoni, several key indicators are moving down:

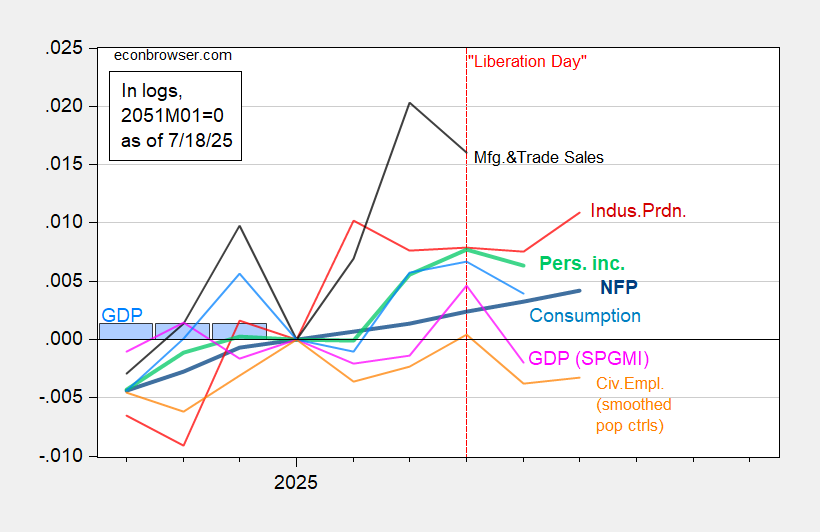

Figure 1: Nonfarm Payroll incl benchmark revision employment from CES (bold blue), civilian employment using smoothed population controls (orange), industrial production (red), personal income excluding current transfers in Ch.2017$ (bold light green), manufacturing and trade sales in Ch.2017$ (black), consumption in Ch.2017$ (light blue), and monthly GDP in Ch.2017$ (pink), GDP (blue bars), all log normalized to 2021M11=0. 2025Q1 GDP is third release. Source: BLS via FRED, Federal Reserve, BEA, S&P Global Market Insights (nee Macroeconomic Advisers, IHS Markit) (7/2/2025 release), and author’s calculations.

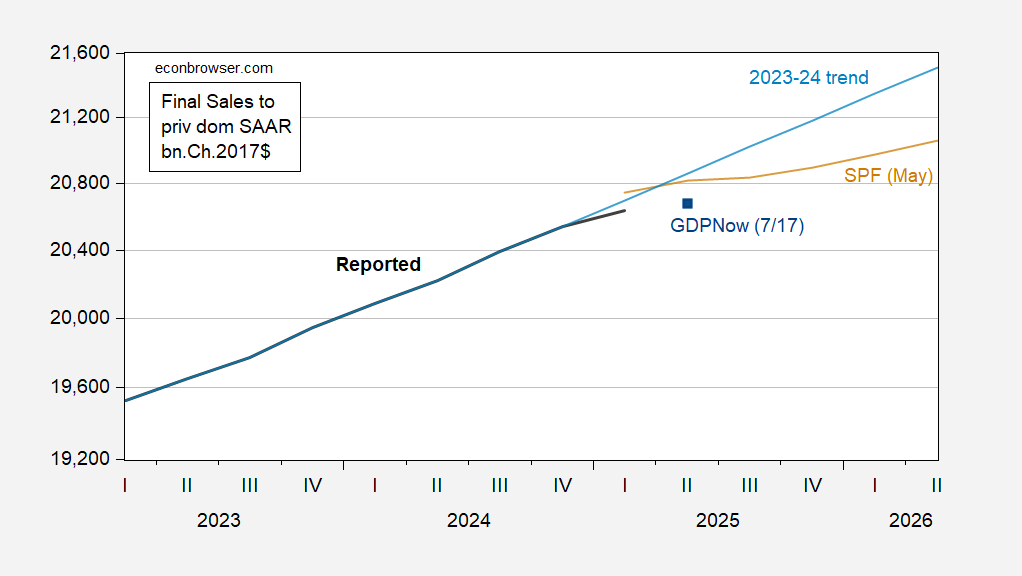

Dr. Antoni makes no mention of GDP (or GDO for that measure). Admittedly, GDP has experienced distortions due to the difficulties measuring the outcomes of tariff-frontrunning. However, “Core GDP” has slowed down as well.

Figure 2: Final sales to private domestic purchasers (black), 2023-2024 stochastic trend (light blue), SPF May survey median (tan), and Atlanta Fed nowcast of 7/17 (dark blue square), all in bn.Ch.2017$ SAAR. Source: BEA, Philadelphia Fed, Atlanta Fed, and author’s calculations.

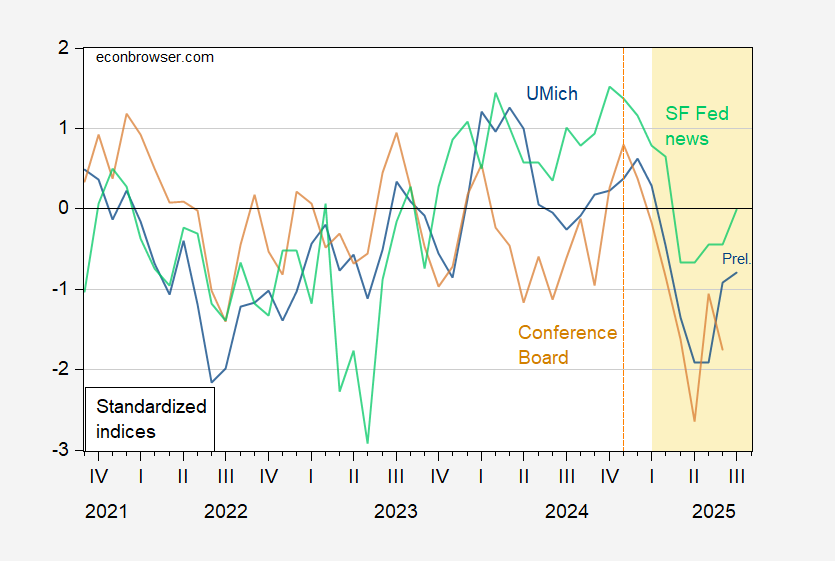

Finally, Dr. Antoni makes reference to the improvement in expectations. Expectations have indeed improved, but overall sentiment still remains far below levels at the beginning of the Trump administration (shadowed light orange in Figure 3).

Figure 3: U.Michigan Economic Sentiment (blue), Conference Board Confidence Index (brown), SF News Sentiment index (green), all demeaned and divided by standard deviation 2021M01-2025m02. Source: UMichigan, Conference Board, SF Fed, and author’s calculations.

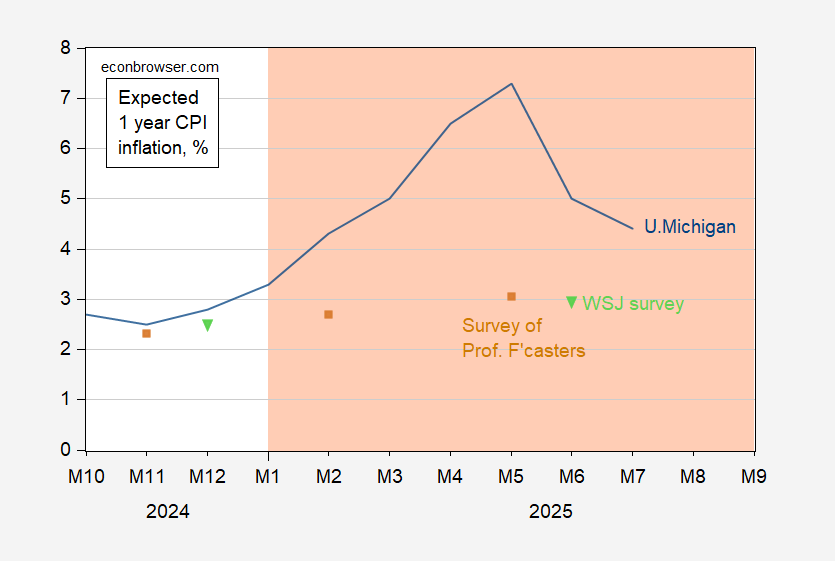

As for inflation, while it’s come down, expectations have risen since the Trump administration’s advent.

Figure 4: Univ of Michigan Survey of Consumers mean expected one year ahead CPI inflation (blue), Survey of Professional Forecasters (brown squares), WSJ survey (green inverted triangle), all in %. Source: U.Michigan, Philadelphia Fed, WSJ.

The Michigan survey indicates a jump with “Liberation Day” announcements. It’s come down since, but should the August 1st deadline come and see higher tariffs implemented, expectations might well resurge.

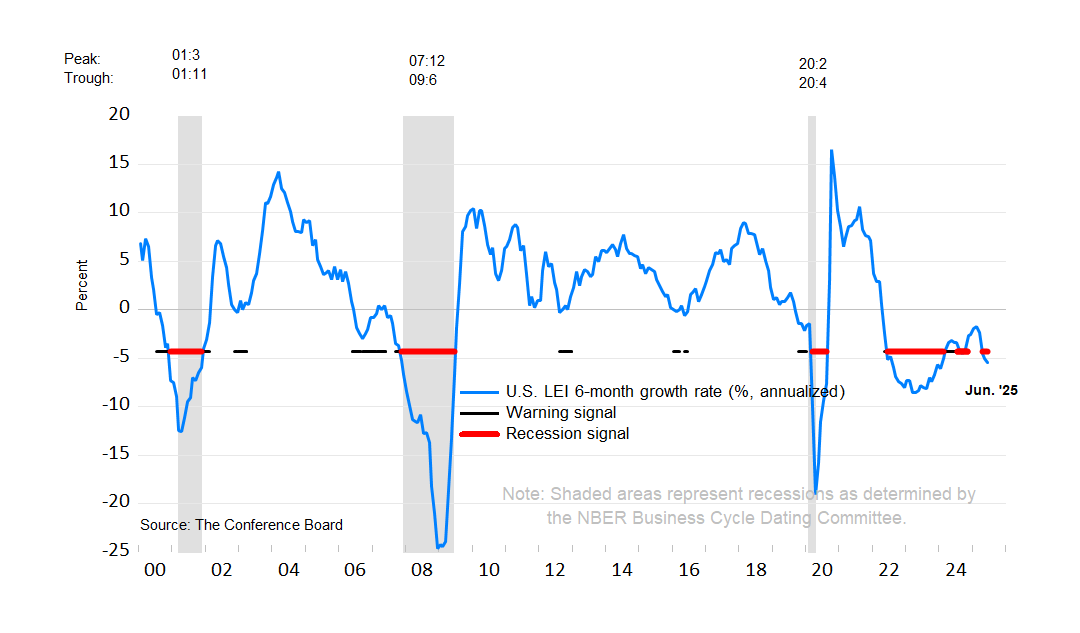

Addendum: Since the writing of Dr. Antoni’s piece, the Conference Board’s Leading Economic Index has declined again, signalling recession.

Source: Conference Board.

This bloke is a genius. A great example of your education system

Little Antoni is aping the White House (probably auditioning for a job). Here’s the White House:

“Core inflation beat market expectations…”

“Wholesale prices came in… below market expectations…”

“Industrial production bested market expectations…”

“Advance retail sales smashed expectations…”

“Consumer sentiment shot up in July, beating market expectations…”

https://www.whitehouse.gov/articles/2025/07/data-shows-u-s-economy-is-back-on-track-under-president-trump/

In every case, the standard of comparison is the expected result among whoever counts as “the market”. Worse than trend? Worse that what was forecast prior to the felon-in-chief taking office? Doesn’t matter. If forecasters were too pessimistic, everything is fine. Nothing to see here.

Here’s little Antoni:

“Yet the economy is thoroughly beating expectations…”

See? Cribbing off the White House.

When expectations are pretty bad because policy is pretty bad, beating expectations shouldn’t confer bragging rights. Remember when our local Putin apologist routinely harangued us about Russia doing better than some forecast, no mattet how badly Russia’s economy was performing? Same deal here, including shopping around for forecasts that were too pessimistic. It’s pathetic. And let’s not forget that consumer sentiment has improved because Trump Always Chickens Out. Even more pathetic.

I have mentioned before that beating expectations isn’t a sign of strength nor falling short a sign of weakness. Performance relative to forecast is a big deal for short-term traders and for forecasters. Kind of irrelevant for the rest of us – and I say that as someone who has spent probably thousands of hours on forecasts. The rest of us should care vastly more about actual performance than about performance relative to forecast.

How’s actual performance? See Menzie’s figures.