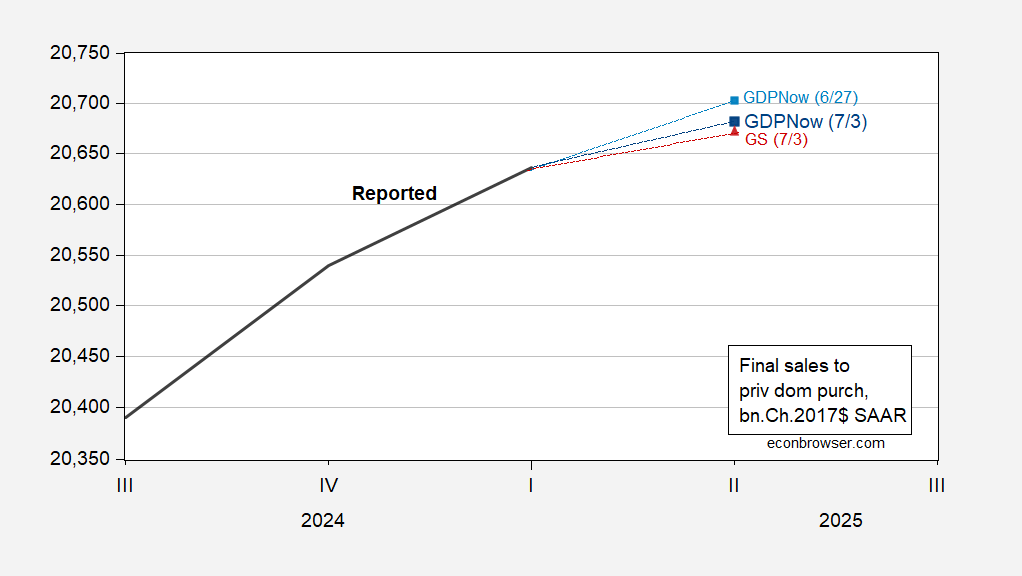

Atlanta Fed downgrades Q2 (GS ups from 0):

Figure 1: Final sales to private domestic purchasers (bold black), GDPNow of 6/27 (light blue square), of 7/3 (dark blue square), Goldman Sachs of 7/3 (red triangle), all in bn.Ch.2017$ SAAR. Source: BEA, Atlanta Fed, Goldman Sachs, and author’s calculations.

If final sales to domestic private purchasers (termed “core GDP by Furman) is a better measure of aggregate demand, then it sure likes deceleration. Combined with deceleration in monthly indicators followed by the NBER’s BCDC, it seems like a slowdown is in the offing.

Would have been nice if trump had not gutted the national weather service so those 23 missing summer camp girls could have been warned about the flash flood that swept them away in the middle of the night. Hope you sleep well tonight rick and bruce. Those cuts killed those girls. Cuts you supported.

Off topic – You guessed it, climate change:

I have been polluting this comments section for some time with warnings about climate change causing a systemic shock which runs from a withdrawal of insurance through a resultant withdrawal of credit to a collapse of economic activity. The FT’s Pilita Clark has published an article on just that subject:

https://www.ft.com/content/9e5df375-650d-492e-ba51-fb5a34e6ddd6?accessToken=zwAAAZhpUoR0kdOeXfN1ZQ1JLtO6UftaNObd1gE.MEUCIQCCASsNK56v42uCgt2pb7O-qLo_tds1jXblg058ZI9HPgIgcc0tbtcaqGVCElraGfLpb2DAYmef5cWze5mhBTnEGMQ&segmentId=9e5df375-650d-492e-ba51-fb5a34e6ddd6

About time, I say.

A point Clark makes which is well worth repeating is that when real assets lose value because of clmate change, the loss is likely to be permanent. In a standard balance-sheet recession, such as the one resulting from Japan’s Lost Decade or the Great Recession, healing of financial systems can restore the value of assets; just look at the gains made by the Fed on its MBS holdings. In the case of a climate-change-driven collapse in insurance, increased risk to the insured asset is the underlying problem. Not a liquidity shock. Not a speculative bubble. Nothing cyclical about it, so no cyclical recovery just around the corner. Timbuktu, not Las Vegas. The assets in question are the entire housing stock, infrastructure and productive capacity of whatever area becomes uninsurable.

Insurability is not the same issue as habitability, though the two are related and interact.

On topic – The U.S. economy is slowing down. Putting aside the likely further effects of the felon-in-chief’s trade, immigration and cronyism policies, what can we know about the future from the simple fact we’re slowing? I’ve speculated, based on staring at the quarterly data, that real GDP growth below about 1.5% usually leads to recession. Turns out, there’s a literature on that. Among the most recent papers is one by Ho and Yetman:

https://www.bis.org/publ/work407.htm

Their intro gives you a pretty good feel for the state of knowledge.

Among the works referenced by Ho and Yetman is Sheets and Sockin (2012). The FT kindly digs out the conclusions from S&S, among which are “They reckon 1.5 per cent growth is about the US’ stall speed threshold” (probably where my notion came from) and that “growth tends to fall by nearly 3 percentage points over the following four quarters”.

https://www.ft.com/content/cb7a9e6b-99f2-3ba4-8722-39471b85ed67

A couple of other things I pick up from S&S are that:

– they use year-over-year growth to identify stalls

– stall speeds don’t apply early in an expansion; slow growth accelerates to faster growth early in an expansion

Here’s U.S. real GDP growth, both q/q and y/y:

https://fred.stlouisfed.org/graph/?g=1K38K

As you’d guess, using y/y growth smooths the series out considerably, which is likely to reduce false positives.

Back in 2022, when recession cheerleaders were cheering, y/y growth bottomed out at 1.3% for a single quarter, and no recession has yet been declared for that period. Most recently, y/y growth was 2.0% in Q1. Using the latest GDPNow estimate for Q2 GDP gives another quarter of 2.0% y/y growth.

Both Q1 and Q2 data are distorted by efforts to avoid damage from the felon-in-chief’s trade policies. So, to get around that distortion, let’s get really casual about the S&S threshold and apply it to final sales. Eye-balling Figure 1, looks like the most recent GDPNow estimate for final sales in Q2 is up roughly 1% from a year ago. So reckless use of the S&S threshold and eye-balled numbers for the wrong data series, including a forecast, produces a recession warning. Take that for what it’s worth.