Survey results here, FT article . GDP level more optimistic than May SPF.

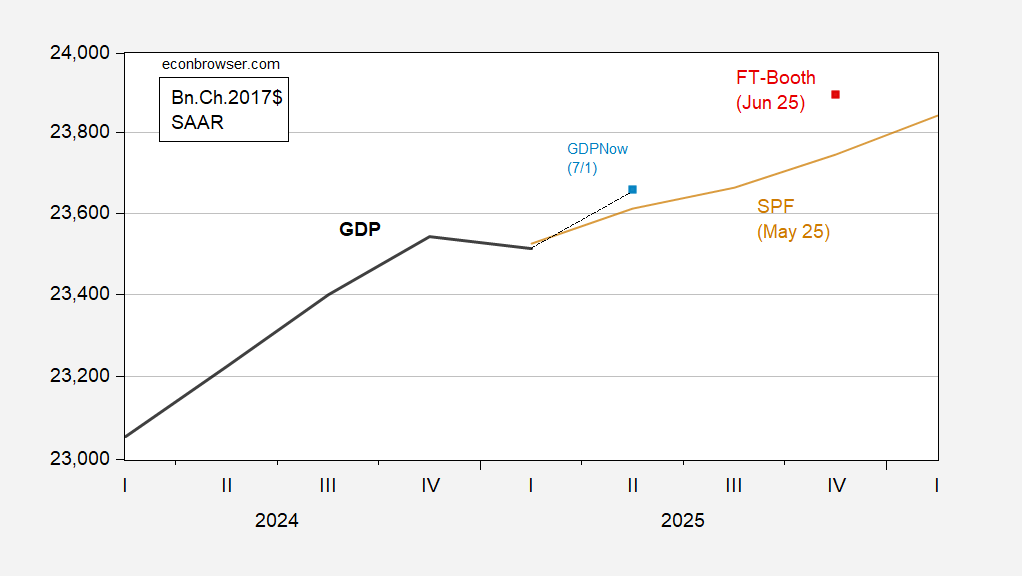

Figure 1: GDP (bold black), FT-Booth June 2025 survey median (red square), GDPNow of 7/1 (light blue square), Survey of Professional Forecasters May 2025 survey median (tan line), all in bn.Ch.2017$ SAAR. Source: BEA 2025Q1 3rd release, FT-Booth June survey, Atlanta Fed, Philadelphia Fed, and author’s calculations.

Note that the FT-Booth survey is considerably more optimistic regarding the level of GDP than the May SPF median.

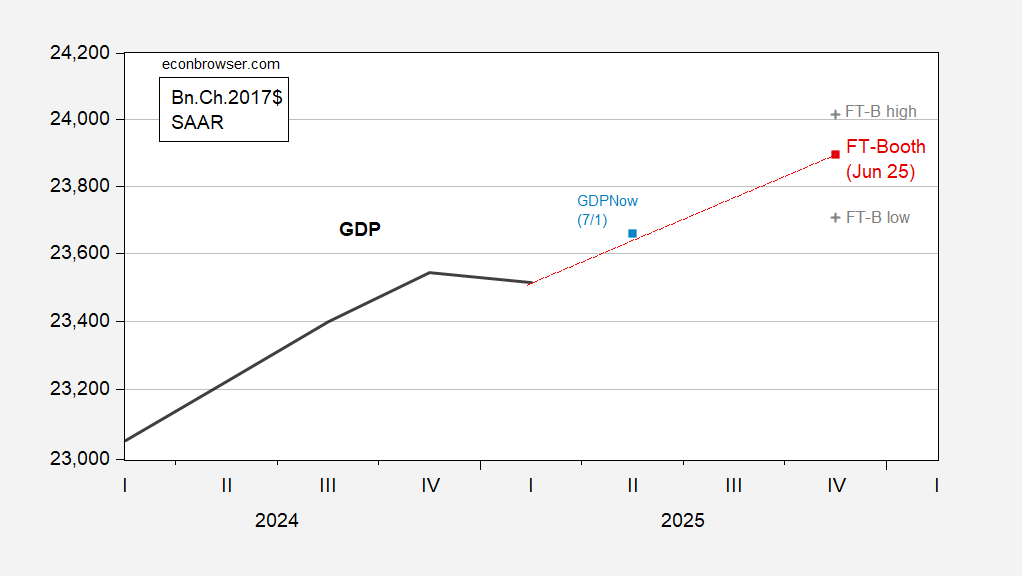

Figure 2: GDP (bold black), FT-Booth June 2025 survey median (red square), 10th percentile (gray +) 90th percentile (gray+), GDPNow of 7/1 (light blue square), all in bn.Ch.2017$ SAAR. Source: BEA 2025Q1 3rd release, FT-Booth June survey, Atlanta Fed,and author’s calculations.

While the FT-Booth median is above the May SPF median, the 10/90 percentile band encompasses the SPF.

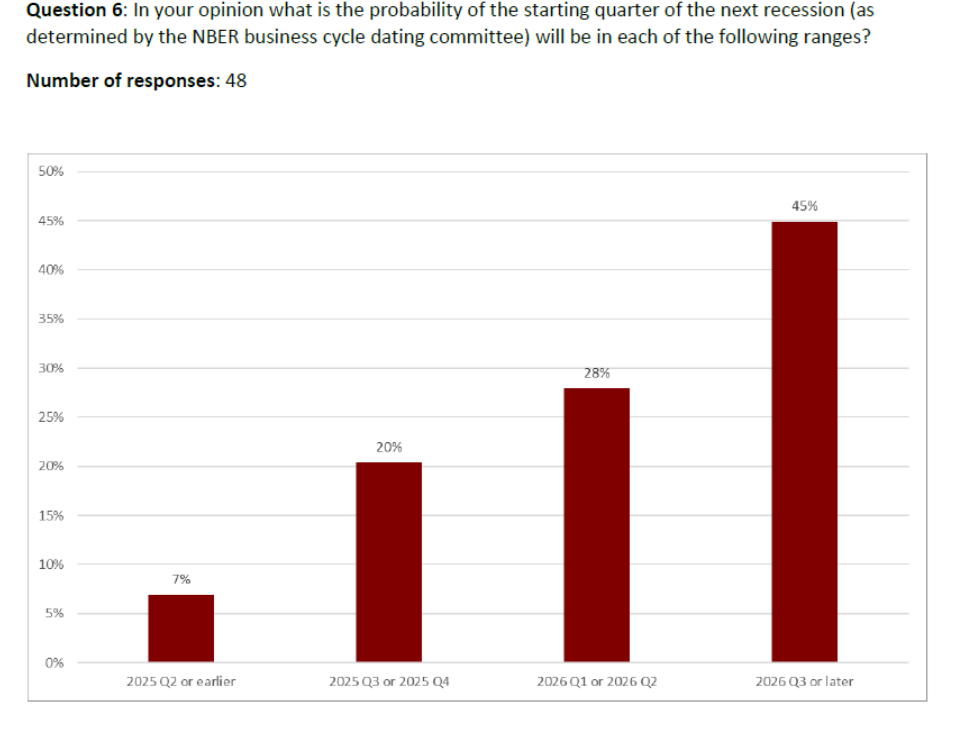

The FT-Booth survey respondents seem to think a recession has been moved back (2026q3 or later has risen from 39% in March to 45% in June.

My modal response was 2026Q1-Q2.

The macroeconomists were also queried about the prospects for the dollar’s safe haven aspect.

I’m one of the 32%.

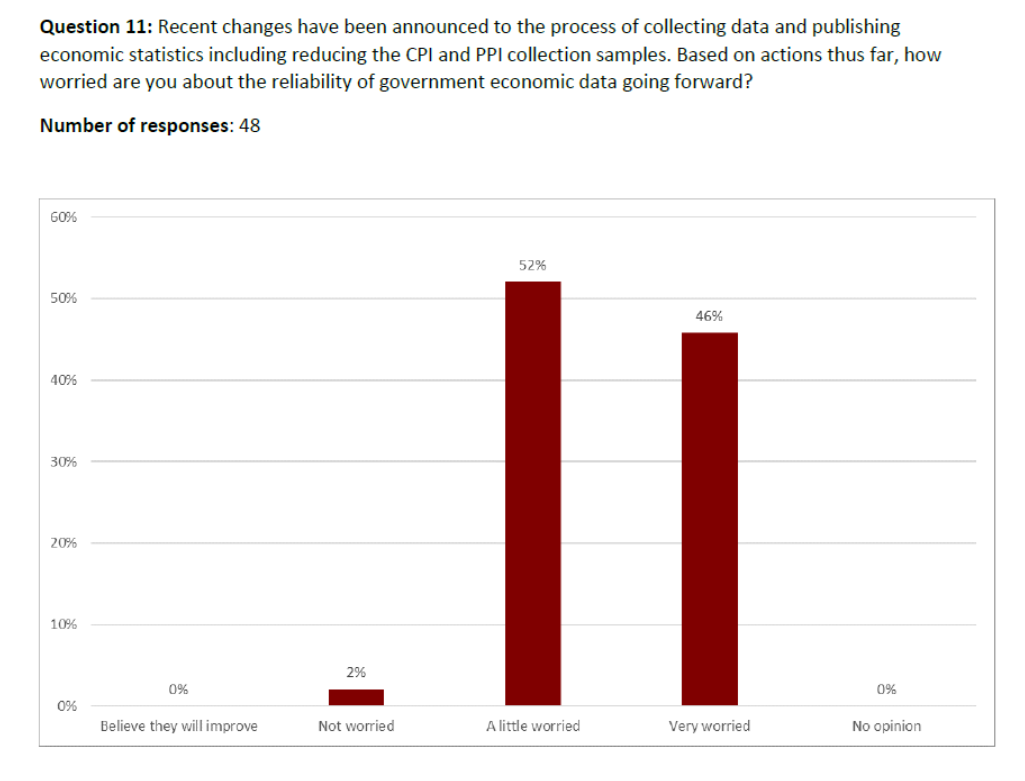

Finally, with respect to economic data collection.

Interestingly, a lot of macroeconomists are concerned about degradation of the series the BLS collects regarding prices. I would’ve thought the proportion would be higher for “very worried”, but at least nobody was delusional enough to “believe they will improve”. Given that the CPI enters into everything from Social Security benefit calculations to TIPS yields, we should all be concerned.

Off topic – climate change:

The observed effects of the increase in atmospheric greenhouse gasses have mostly run ahead of model estimates – things are getting bad faster than predicted.

At the root of climate change is a change in the Earth’s energe balance – how much energy in (sunlight, mostly) vs how much out (radiation of heat from the Earth into space). Turns out, we can measure energy in and out. Doing so allows us to score climate models for the accuracy of their prediction. Two recent tallies of energy in vs energy out find that the Earth’s energy budget – energy in minus energy out – has risen more than conventional models suggest:

https://agupubs.onlinelibrary.wiley.com/doi/10.1029/2024AV001636

https://www.science.org/doi/10.1126/science.adt0647

Actual measurement of our energy budget agrees with observation of effects – climate change is happening faster than predicted.

Think about the implications. All the Nordhaus-style actuarial recommendations as to trade-offs between the economy and climate – even using the New! Imroved! Nordhaus estimates, lean too far toward preserving economic activity. Insurance risks are being underestimated, so risks to the availability of insurance, and any activity which relies on insurance, are being underestimated. The need to build in resilience to weather events and to climate change is on a compressed schedule. Tipping points are nearer at hand than expected, which means every risk I’ve listed above will be supercharged sooner than expected.

Oh, and congratulations to climate-change deniers. You told us those models were wrong. Enjoy your future.